We’re beginning a brand new sequence right here that can ultimately be a brief paper, however thought we’d drip these articles out each week over the course of the summer season….take pleasure in!

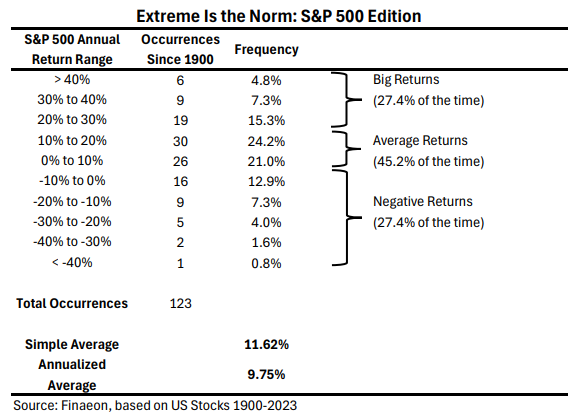

#1 – Regular inventory market returns are excessive

Most buyers perceive that shares return about 10% per 12 months over time.

Nonetheless, many buyers might not respect the risky path that shares usually take to realize this 10% return. It’s not a gradual 10%, 10%, 10%.

Over the previous 125 years, the common up 12 months in markets was 21%!

The common down 12 months is -14%.

There are about thrice as many up years as down years. In reality, there are extra 25% or extra up years than down years.

However the down years nonetheless occur, and after they do, they’re scary. The extra risky small caps common close to a bear market decline yearly.

Staying the course could be robust on the trail to 10%.

Because of our intern Ava for the chart and to Ken Fisher for the inspiration!