In our final piece, we examined simply how lengthy US shares can go underperforming US bonds. The reply was, quite a bit longer than most might deal with.

However what a few extra comparable asset – shares outdoors the US?

US shares have trounced international shares for so long as anybody can recall. Although as podcast alum Edward McQuarrie has identified, which may simply be a case of “proper hand chart bias“. That’s when an asset has carried out properly not too long ago it appears to be like prefer it has ALWAYS outperformed, regardless that there could possibly be many intervals of underperformance too.

Right here’s his instance of US shares vs. bonds:

What’s any of this should do with US vs. international shares? Nicely, For the reason that GFC in 2009, it’s felt like U.S. shares might do no fallacious, and also you’ve remodeled 900%. For international shares a measly 300%.

America has been the belle of the worldwide fairness ball. However historical past has a humorous approach of humbling those that extrapolate latest tendencies endlessly.

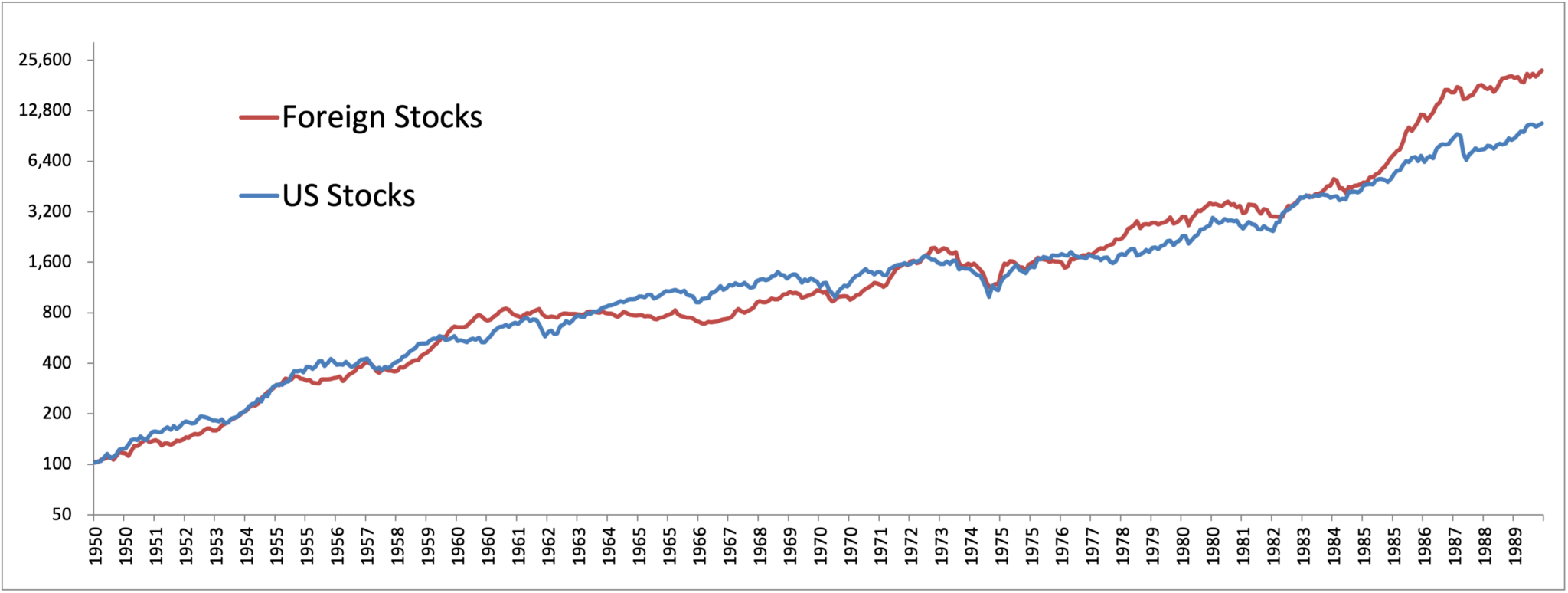

Right here’s the kicker: U.S. shares can—and have—underperformed international shares for many years.

Let’s rewind the tape. Many can recall the latest 2000 to 2010 decade, dubbed the “misplaced decade” for U.S. shares, the place the S&P 500 truly misplaced cash. In the meantime, international developed markets (suppose Europe, Japan, and so on.) and particularly rising markets (hey, BRICs!) posted strong positive factors. It was the basic case of timber not rising to the sky.

The connected chart hammers this dwelling. In case you had been sitting within the U.S.-only camp for the whole lot of sure intervals, you’ll’ve trailed globally diversified portfolios by a mile. And it’s not simply cherry-picking—we’re speaking decades-long stretches.

That was 4 a long time from the Fifties by the Eighties. In case you return to the 1800s, international shares outperformed the USA for 60 years at one level.

What if the outperformance lasted yr after yr? Attempt to think about 5 or 6 years in a row?! Might by no means occur, proper? It actually occurred about 20 years in the past, lol, and in addition within the Eighties. Traders typically are inclined to extrapolate from the latest previous, with US shares outperforming international markets in 12 of the final 15 years. With vital international outperformance this yr, is the Bear Market in Diversification ending?

The important thing lesson? Diversification isn’t only a cute slogan—it’s a survival tactic.

Our dwelling nation bias blinds us.In case you’re loading up on U.S. shares after a 15-year run as a result of it “feels proper,” that’s your lizard mind speaking. Historical past says beware. Valuations matter. And when U.S. CAPE ratios are touching the stratosphere whereas international markets are lounging within the basement, future returns are inclined to comply with the inverse path.

The answer? Personal the haystack, not simply the American needle. A worldwide worth tilt, rebalanced periodically, offers you a shot at collaborating when management modifications—because it at all times does.

In case your portfolio is a 100% U.S. allocation, it is perhaps time to zoom out. There’s a complete world on the market, actually.