Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) has been faring well relative to other tech stocks. It is currently traded at $126.36, down by just 27% from $172.17 in the past 12 months. Apple is a great company that has created tremendous value for its shareholders. However, a great company might not necessarily be a great stock to own at this point. This article mainly focuses on some main concerns from investors and explains why those might not be as much concerning.

Apple’s Revenue Growth

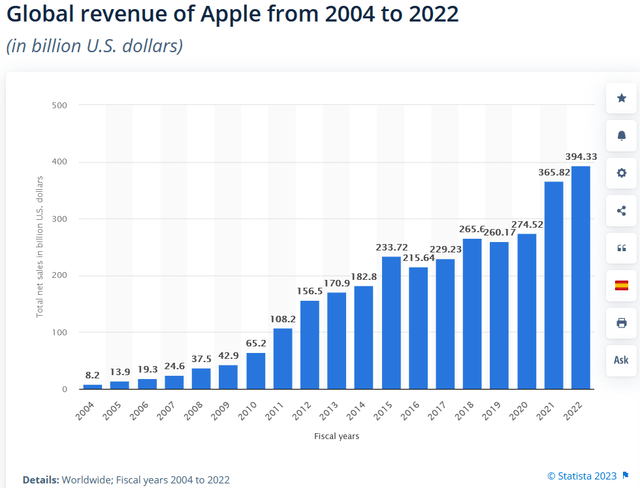

The following figure shows Apple’s revenue since 2004. The business has grown from $8B to $394B in less than two decades. However, investors might have started questioning its single-digit growth (8%) in FY22 vs. 33% in FY21. And the ultimate question is “what could be a fair trading multiple for a business with single-digit growth”?

Apple Revenue, Statista

I don’t think this is a major concern, and there are three things we should be aware of.

1. Growth rates vary by business as well as what stage the business is at.

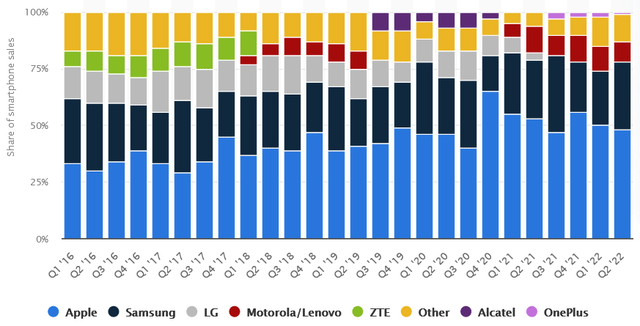

Apple produces durable products (~3-year product life cycle) with 48% market share in US (92% of total smartphone penetration in US according to Statista). At this level of saturation, growth rates would be different from when Apple was going after a greenfield in its early days. Low growth rate is not necessarily a problem as long as it can hold or increase its market share, and is ramping up other revenue streams out of its existing ecosystem.

2. Apple has been making efforts in diversifying revenue, and more growth will come from less saturated markets, such as wearables.

In Q4-22 earnings call, the company mentioned that among consumers buying Apple watches, two-thirds came from people who purchased Apple watches for the first time. Smartwatches penetration worldwide is less than 3% according to Statista. This is where Apple will be able to accelerate its revenue growth.

3. Apple’s revenue mix is shifting more to Services, which has 2x Gross margin of Apple Products.

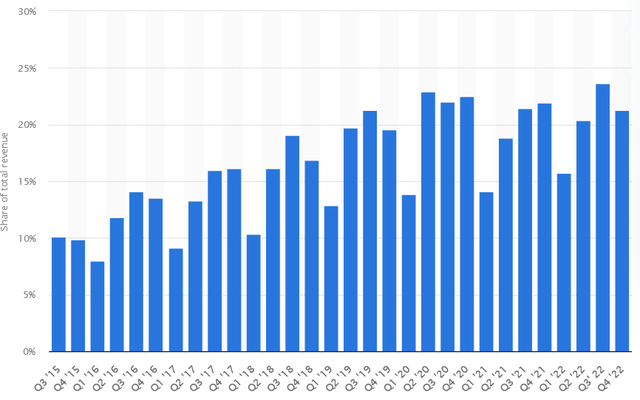

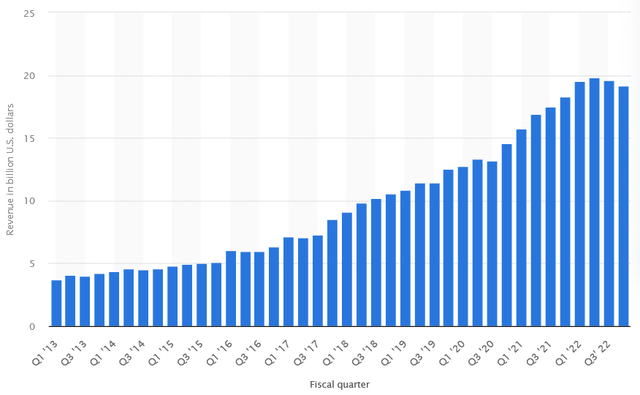

We can also look at the revenue components, especially the mix between Products and Services. Apple’s Services revenue has grown from 10% to over 20% since 2015, and Services also have 72% Gross margin vs 36% for Products. Also, just note, Services revenue is not impacted by most of the supply chain constraints. Generally, Apple takes a standard 30 percent commission rate for App Store transactions and regular subscriptions.

To forecast Apple’s future growth, the primary driver would be revenue from App Store. In my opinion, growth of this business can go wild if we believe technology advancement (e.g. IoT, AI, Metaverse, etc.) will trigger a lot of new use cases for human lives in the future.

| Gross margin | 2022 | 2021 | 2020 |

| Products | 36.3% | 35.3% | 31.5% |

| Services | 71.7% | 69.7% | 66.0% |

| Total | 43.3% | 41.8% | 38.2% |

Service Revenue % of Total, Apple

Apple Service Revenue, Statista

Apple’s Market Share

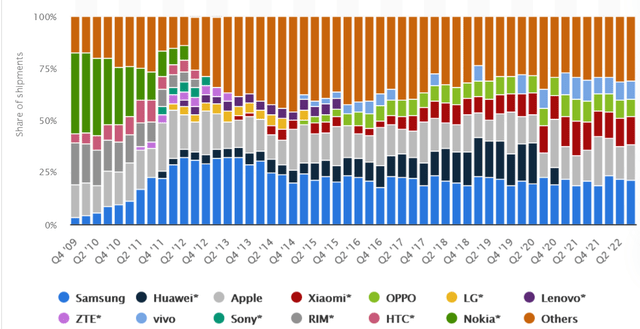

Apple’s market share is 48% (No.1) in the US, and 17% (No.2) worldwide. Like many other US companies, Apple is doing better in US than in international markets.

But I would not be concerned about its global market share for two reasons. First, the market share in international countries is largely a result of different targeted market segments, as Apple’s products are priced higher than most other smartphone products. Second, comparing with other tech companies in US, Apple is already doing very well in international countries, America (40%), EU (23%), Greater China (15%), Japan (6%), Other APAC (6%).

As mentioned in Q4-22 earnings call, “Customer satisfaction for the iPhone remains very, very strong at 98%.” As most liked products, I do not see any threat like shrinking shares for Apple.

Worldwide Smart Phone Share% by Vendor, Statista

US Smart Phone Share% by Vendor, Statista

Apple TV+, what’s Apple’s strategy?

Apple launched its streaming service with 100% original content in 2019, and since then Apple has been investing in a number of contents. Apple so far is estimated to have around 25 million paid subscribers, and additionally 50 million users with free 1-year access to the SVOD platform via promotion. Spend on original content is expected at $6.5B, as compared to Netflix’s $17B.

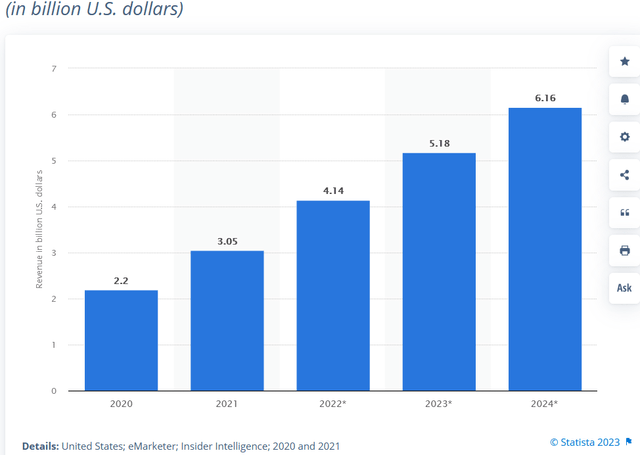

Investors might be concerned about Apple TV+’s future. $6.5B content spend is not a trivial number, but there is zero chance that Apple TV+ competes with Netflix or Disney at this stage. The following figure shows Apple’s Advertising revenue in past years. $6B is a significant number but appears nascent relative to other Ad Tech players.

Apple Advertising Revenue, Statista

I am actually glad that Apple is not rushing into the money-burning streaming business. There are three points I want to make in this article.

1. Apple is a unique company pursuing perfecting as opposed to compromising for near-term financial results.

Apple defines itself through its long history. Apple has been a long-standing champion of customer experience and customer privacy. The way it remains very selective for the Apple TV+ contents is similar to how it builds iPhones.

I think two things will always come first rather than diversifying monetization. One is building most liked Smartphones, Smart Wearable, and Computers, and the other is growing their ecosystem. And Apple is doing so.

2. There are many ways for Apple to create more revenue streams out of its ecosystem. Apple Store Search Ads, Apple TV+ Ads, Apple Pay, etc. Just to name a few.

Apple has not yet done aggressively in Advertising and Payments. But opportunities will be out there, and it’s just a matter of when. I am positive that whenever Apple wants to drive its new business lines at full speed, it will be able to gain material shares from the market.

3. Apple has a unique culture of keeping confidentiality (as opposed to some other companies that tend to market out loud for what’s coming). I would not be surprised when Apple announces about new businesses. It did not highlight anything, but it might not mean the work is not in progress.