The newest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics exhibits the entire variety of job openings within the financial system decreased to 10.698 million in June, down from 11.303 million in Could; openings have been a record-high 11.855 million in March.

The variety of open positions within the non-public sector decreased to 9.766 million in June, down from 10.275 million in Could and a record-high 10.812 million in March. June was additionally the primary month under 10 million since November 2021 and the bottom degree since September 2021 (see first chart).

The full job openings price, openings divided by the sum of jobs plus openings, fell to six.6 p.c in June from 6.9 p.c in Could whereas the private-sector job-openings price fell to 7.0 p.c from 7.4 p.c within the earlier month (see first chart). The June consequence for the non-public sector is the bottom since June 2021.

Two business classes nonetheless have greater than 2.0 million openings every: schooling and well being care (2.246 million) {and professional} and enterprise providers (2.009 million). Commerce, transportation, and utilities (1.651 million) and leisure and hospitality (1.451 million) are above 1 million.

The best openings charges have been in leisure and hospitality (8.5 p.c), schooling and well being care (8.4 p.c), skilled and enterprise providers (8.3 p.c). Manufacturing (5.8 p.c) together with commerce, transportation, and utilities (5.4 p.c) additionally stay elevated.

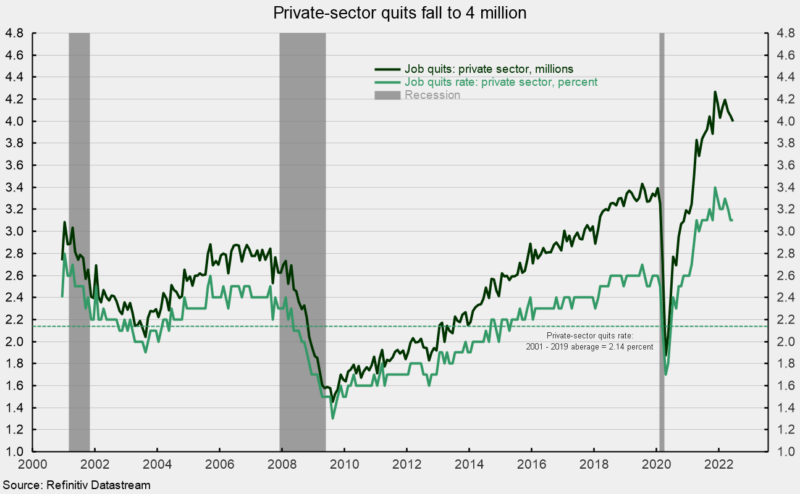

The variety of private-sector quits fell in June, coming in at 3.999 million, down from 4.048 million in Could (see second chart). Commerce, transportation, and utilities led with 950,000 quits, adopted by leisure and hospitality with 848,000 quits, {and professional} and enterprise providers with 738,000.

The full quits price was unchanged at 2.8 p.c for the month whereas the private-sector quits price held at 3.1 p.c. The present private-sector quits price is the bottom since October 2021 and 0.3 share factors under the report excessive 3.4 p.c in November 2021 (see second chart).

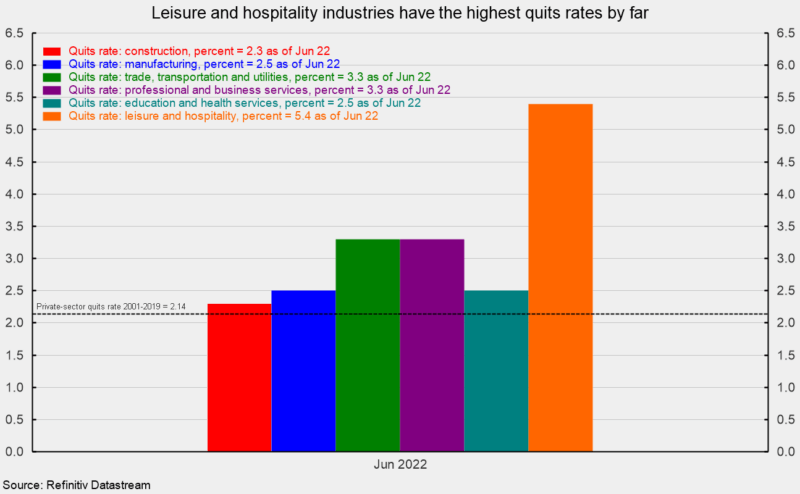

The quits charges among the many private-sector business teams are nonetheless dominated by leisure and hospitality with a price of 5.4 p.c, properly forward {of professional} and enterprise providers and commerce transportation, and utilities, each with a 3.3 p.c quits price (see third chart).

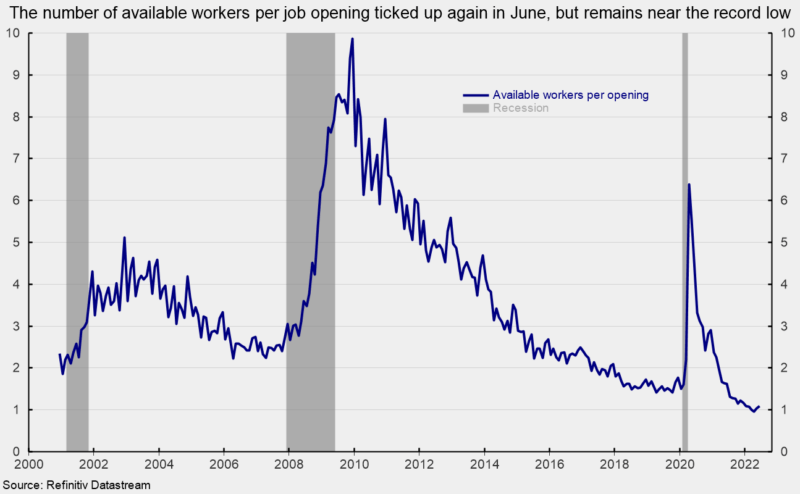

The variety of job seekers (unemployed plus these not within the labor drive however who desire a job) per opening ticked up barely once more in June, rising to 1.092 in June from 1.028 in Could and a report low 0.957 in April. Earlier than the lockdown recession, the low was 1.409 in October 2019 (see fourth chart).

As we speak’s job openings knowledge add to the numerous vary of proof that counsel the financial system is weakening. Whereas the still-large variety of openings counsel the labor market stays tight, the deterioration on the margin is a warning signal. Warning is warranted.