Germany has seized control of three oil refineries run by Russian firm Rosneft in its latest effort to shore up energy supplies.

The country’s energy regulator will take control of stakes in oil refineries in Schwedt, Karlsruhe and Vohburg, equivalent to around 12pc of Germany’s oil processing capacity.

The move mirrors Berlin’s decision to seize control of Gazprom Germania earlier this year.

Chancellor Olaf Scholz’s Government is also weighing up nationalisation of energy giant Uniper, which already requires more funding after burning through a €19bn support package it received in July. Ministers are also eyeing a stake in energy firm VNG.

The move is an escalation in the stand-off between Europe and the Kremlin, and highlights efforts by countries to secure their energy supplies.

Shell, which holds a 37.5pc stake in the PCK Schwedt oil refinery, said it was unaffected by Germany’s decision.

03:22 PM

Uber hacked in cyber attack

Uber has been hacked in a cybersecurity attack that threatens to compromise the personal and financial details of the ride hailing app’s 118m users.

Gareth Corfield has more:

Screenshots posted to social media showed the hacker, who claimed to be an 18-year-old, appeared to have gained admin access to major web services used by the taxi and food delivery business.

It comes as a former head of security for Uber stands trial in the US, accused of paying hush money to cover up a previous hacking incident that exposed the details of 57m Uber users.

Services illicitly accessed in the small hours of Friday morning included Uber’s email and file storage provider Google, Amazon Web Services – used for the software that powers Uber’s app – internal chat app Slack; other websites Uber uses for tracking employee expenses; and even an account on cyber security incident reporting website HackerOne.

Marten Mickos, chief executive of HackerOne, said on Twitter that he had disabled the affected account.

02:54 PM

EDF contractors relax radiation exposure limits to speed up repairs

Some contractors helping EDF to inspect and repair its corrosion-hit nuclear reactors are planning to relax their rules on radiation exposure limits so that their workers can spend more time on the job.

The French energy giant, which is rushing to get its fleet of nuclear power stations ready for the winter, said the new threshold was in line with its own standards and remained well below French legal limits.

The company told Reuters: “We have been informed by some of our partners that they expect to increase the radiation exposure limit for some of their staff.

“The activities currently underway at our plants lead to a higher number of hours worked in the nuclear part of our sites. This additional activity had not been foreseen by our partners when they set their radiation limits.”

According to the report, at least one EDF contractor –French company Monteiro – had already increased the maximum exposure its workers could be subject to, adding this posed no health risk.

02:36 PM

Wall Street sinks as FedEx sparks slowdown fears

Wall Street’s main indices have opened sharply lower after a profit warning from FedEx spooked investors already worried about aggressive rate hikes from the Federal Reserve tipping the economy into a recession.

FedEx plunged 23pc at the opening bell after the company said a global demand slowdown accelerated at the end of August and predicted that it would worsen in the November quarter.

The benchmark S&P 500, Dow Jones and Nasdaq all slumped 1.3pc.

01:50 PM

National Express shares rise on takeover rumours

Shares in National Express have jumped 7pc amid rumours of a possible takeover approach.

The coach operator was mentioned in a so-called ‘uncooked’ Betaville report, which said it had attracted interest from a financial buyer such as a private equity firm or infrastructure fund.

‘Uncooked’ reports on the Betaville blog tend to refer to market gossip.

01:23 PM

Scholz: Rosneft swoop brings independence

Chancellor Olaf Scholz has said the move to take over Rosneft’s oil refineries ffrees Germany from dependence on Moscow.

He told reporters: “We are making ourselves independent of Russia, and any decisions that are taken there.”

The German government has earmarked about €1bn (£880m) for Schwedt, including aid for the region. It’s a broad package to be disbursed over several years.

Mr Scholz added that said the country was prepared in case Russia retaliates to the move by cutting oil deliveries to Germany.

One refiner has already warned it’s preparing for such a reaction from Moscow.

12:22 PM

EU’s €140bn energy plan isn’t enough, warns industry

Industry groups have warned the EU’s package of emergency measures to bring down energy costs does not go far enough as they urged Brussels to do more to tame gas prices.

The European Commission this week proposed cuts in electricity use and applying windfall taxes on energy firms, which it said would raise €140bn (£122bn) for governments to rechannel into helping businesses and citizens with soaring energy bills.

Industry group European Aluminium said: “These measures are not enough and will not save the energy-intensive aluminium industry from further production cuts, job losses, and possibly a complete breakdown.”

The energy intensive sector urged EU energy ministers to take “additional measures” when they meet later this month to negotiate the plans – in particular, to tackle high gas prices, which are the main driver of rocketing electricity costs.

Jacob Hansen, director general of Fertilizers Europe, said: “We need a physical supply of competitively priced gas for the European fertiliser producers to restart production.”

12:11 PM

US futures slide as dollar keeps climbing

US futures extended their declines this morning as the dollar kept climbing on expectations of further Federal Reserve interest rate rises.

Futures tracking the S&P 500 fell 0.8pc, while the Dow Jones was down 0.7pc. The tech-heavy Nasdaq slumped 1.1pc.

12:08 PM

Russia makes smallest interest rate cut this year

Russia’s central bank has announced its smallest interest rate cut since it started easing monetary policy in the wake of the Ukraine invasion amid fresh inflation risks.

Policy makers led by governor Elvira Nabiullina lowered rates to 7.5pc from 8pc. In a statement with the decision, the central bank left it unclear what path it will take with future rates.

Russia’s urgency to revive the economy following the shock of western sanctions is giving way to concerns that inflation could be harder to contain in the months ahead.

11:56 AM

LNER suspends ticket sales due to strikes

David Horne, boss of LNER, says the operator has suspended ticket sales for October 1 and 5 due to the latest strike action.

LNER serves the East Coast Main Line, with trains from London serving stations including Leeds, York, Newcastle and Edinburgh.

11:40 AM

Train drivers plot fresh strike action

Train drivers at 12 rail companies are planning two more days of strike action in a long-running dispute over pay.

The industrial action will take place on October 1 and October 5, PA reports.

11:07 AM

Price stability is priority before growth, says ECB’s Lagarde

The ECB’s actions may weigh on growth but price stability is the main priority, President Christine Lagarde has said.

Speaking to high school students at the French central bank, Ms Lagarde said that in setting its monetary policy the ECB had to take into account all elements affecting inflation, as well as the risks weighing on growth.

She said: “Will that weigh on growth? It’s possible, but it’s a risk we have to take… because price stability is a fundamental and principal dimension.”

10:58 AM

London Metal Exchange faces lawsuit from hedge funds

The London Metal Exchange faces a potential lawsuit by a group of hedge funds over its handling of the nickel crisis earlier this year.

AQR Capital Management, DRW Commodities, Flow Traders, Capstone Investment Advisors and Winton Capital Management filed a commercial court claim in London against the LME, according to court records.

So far the claim relates only to pre-action disclosure.

The move ramps up the pressure on the LME, which has been widely criticised for its handling of the nickel crisis, when it suspended the market and controversially cancelled $3.9bn (£3.4bn) of traders following a huge short squeeze.

It is also facing lawsuits from Jane Street and Paul Singer’s Elliott Investment Management, collectively claiming nearly $500m in damages arising from its handling of the incident.

10:36 AM

Chinese economy shows signs of recovery

China’s economy showed signs of recovery in August as Beijing rolled out stimulus measures.

Industrial production, retail sales and fixed asset investment all grew faster than expected last month. The urban jobless rate fell to 5.3pc, while youth unemployment eased back from a record high.

Despite signs of improvement, China’s recovery remains fragile amid more outbreaks of Covid across the country and continued stringent lockdowns.

A property market slump also shows no sign of easing, with data showing house prices have now declined every month in the last year.

10:22 AM

John Lewis hopes for Christmas advert miracle

As the cost of living crisis sends the high street plunging towards a harrowing winter, spending millions of pounds on a Christmas advert might seem like an extravagance, write Matt Oliver and Laura Onita.

But for John Lewis, this year’s annual TV spot is more than just a way of showing off its status.

After plunging to a near-£100m loss, the company needs a festive miracle to stave off disaster – so much so that one executive warned cutting the ad budget would be a “terrible idea”.

“No one could have predicted the scale of the cost-of-living crisis that has materialised, with energy prices and inflation rising ahead of anyone’s expectations,” the mutual’s chairman Dame Sharon White said on Thursday.

“As a business, we have faced unprecedented cost inflation across grocery and general merchandise.

“A successful Christmas is key for the business, given the first half.”

Read the full story here

10:06 AM

Teesside Airport workers to vote on strike action

Workers at Teesside Airport have begun voting in a ballot on strike action today, raising the threat of more disruption for passengers.

Staff including air traffic controllers and fire fighters at the Darlington travel hub turned down a pay offer from bosses, according to the GMB union.

The ballot closes on September 28, with any industrial action likely to take place next month.

09:54 AM

Naked Wines brings back founder as adviser

Naked Wines has called back founder and former boss Rowan Gormley has an adviser amid concerns about the company’s finances.

The position is unpaid and is expected to last for a period of two to three months. Mr Gormley holds a 2.9pc stake in Naked Wines.

It comes a day after the online wine merchant lost a third of its value following the abrupt departure of a non-executive director after just three weeks.

Naked has said it’s reviewing its finances for the next 18 months and has announced talks with lenders over its credit facility.

Read more on this story: Fears ‘something awry’ at Naked Wines as director leaves after just three weeks

09:37 AM

The misheard word that directed public to mourn late Queen in Yosemite

Snaking through London, the queue to see Queen Elizabeth II lying in state ran for 4.4 miles on Thursday, stretching from Westminster to Tower Bridge and beyond.

However, those looking to join the back of the line might have been forgiven for thinking it began 5,300 miles away in Fresno, California.

The reason for the confusion was a choice by the Department for Digital, Culture, Media and Sport to use a British app to help mourners find the end of the queue.

The app, called What3words, uses a combination of three words to pinpoint a grid address anywhere in the world. Its map is broken up into 57 trillion three metre squares, each with a unique identifier made up of three words.

Matthew Field and Gareth Corfield report. Read their full story here.

09:16 AM

Liz Truss to lobby SoftBank to list Arm in London

Prime Minister Liz Truss and Chancellor Kwasi Kwarteng are said to be preparing a last-ditch effort to persuade SoftBank to list British tech firm Arm in London.

The Government will push for high-level talks with SoftBank bosses once the official mourning period ends next week, the Financial Times reports.

SoftBank had previously indicated it wanted to list Arm in New York, but there have been talks over a potential dual listing.

Such a deal would be a significant show of confidence in the London Stock Exchange at a time when it’s struggling to attract initial public offerings.

08:47 AM

Pound drops to $1.1400 for first time since 1985

Sterling has extended its losses this morning following dire retail sales figures for August.

The pound dropped almost 1pc to fall below $1.1400 for the first time since 1985, when Ronald Reagan’s tax cuts sparked a huge rally for the dollar.

08:44 AM

Royal Mail shares slump after FedEx warning

Royal Mail is the biggest FTSE faller this morning as it felt the impact of a wire profit warning from US rival FedEx.

The package delivery giant pointed to weakness in Asia and challenges in Europe as it withdrew its previous forecasts and reported quarterly results that fell well short of expectations.

It also warned trading could deteriorate in the current quarter, adding it would take immediate steps to cut costs.

The glum update sparked jitters across the sector. Royal Mail slumped as much as 11pc.

08:37 AM

FTSE risers and fallers

The FTSE 100 looks set to end the week in negative territory after retail sales fell more than expected in August.

The blue-chip index was down 0.4pc, with traders responding to the latest gloomy outlook for the economy.

Retailers were in the red on fresh signs of trouble for the high street after Asos, Primark owner Associated British Foods and Ocado all warned on profits this month.

InterContinental Hotels Group was the biggest faller, sliding 4pc after analysts at Citi downgraded the stock amid warnings of “muted” demand.

AstraZeneca bucked the trend, rising 1.6pc after its Evusheld Covid drug got the green light from EU regulators.

The domestically-focused FTSE 250 slumped 0.7pc. Royal Mail dropped 11pc after US rival FedEx issued a profit warning.

08:28 AM

Energy firms hauled in for price cap meetings

The Government has called in some of the country’s biggest energy companies for a meeting next week to discuss a measure that would cap wholesale electricity prices.

Business Secretary Jacob Rees-Mogg is pushing for a deal that would see low-carbon energy producers sell power at fixed prices on long-term contracts.

Ministers reportedly want to get the measure set up as soon as possible, to ensure prices are fixed for winter.

08:20 AM

Germany takes control of Putin’s oil refineries

Germany has taken another bold step to shore up its energy supplies by seizing control of three oil refineries run by Russian firm Rosneft.

The country’s energy regulator will take control of stakes in oil refineries in Schwedt, Karlsruhe and Vohburg, equivalent to around 12pc of Germany’s oil processing capacity.

The move mirrors Berlin’s decision to seize control of Gazprom Germania earlier this year.

Chancellor Olaf Scholz’s Government is also weighing up nationalisation of energy giant Uniper, which already requires more funding after burning through a €19bn support package it received in July.

Ministers are also eyeing a stake in energy firm VNG.

The move is an escalation in the stand-off between Europe and the Kremlin, and highlights efforts by countries to secure their energy supplies.

08:15 AM

1,000 flights cancelled in French air traffic control strike

More than 1,000 flights have been cancelled ahead of a walkout by French air traffic controllers today.

France’s aviation authority DGAC has warned of “severe” disruption and asked airlines to halve their flight schedules.

The strikes, which are due to run from 6am today until 6am tomorrow, could also disrupt flights passing over French airspace.

It’s the latest blow for passengers, who have suffered from widespread delays and cancellations throughout the summer.

08:01 AM

FTSE 100 opens lower

The FTSE 100 has lost ground at the open after retail sales figures added to bleak signs about the state of the economy.

The blue-chip index fell 0.4pc to 7,250 points.

07:56 AM

Pound sinks further as retail sales slump

Sterling has extended its losses after retail sales dropped more than expecting, highlighting the grim economic outlook ahead of the Bank of England meeting next week.

The pound fell 0.6pc against the dollar to $1.1414, testing its recent 37-year lows.

The currency has dropped 15pc against the dollar so far this year and is near its lowest since 1985. Incidentally, today is the anniversary of Black Wednesday, when the UK crashed out of the Exchange Rate Mechanism.

07:48 AM

Brits spending more to buy less

Consumers are spending more to buy less, writes my colleague Eir Nolsoe.

The cost-of-living crisis meant Britons spent 5.4pc more on retail in August than a year earlier, but bought 5.4pc less in terms of quantity.

The highest increase in spending was on fuel, with households spending 21pc more than in August last year while buying 9pc less. Spending on groceries also rose by 6pc, despite volumes being 4.5pc lower.

On a monthly basis, sales volumes fell by 1.6pc in August, while value fell 1.7pc. Consumers have been buying fewer retail goods since last summer when Covid restrictions on hospitality ended, with many swapping cooking at home for eating out more often. Food store sales are 1.4pc below their pre-pandemic levels.

Online shopping remains much more prominent than before Covid, however. Households bought around a quarter of retail online in August, compared with a fifth in February 2020.

07:46 AM

Reaction: Bank of England will have to raise rates further

Olivia Cross, assistant economist at Capital Economics, predicts that the Bank of England will have to raise interest rates even further.

The 1.6pc drop in retail sales volumes in August supports our view that the economy is already in recession.

Retail sales will probably continue to struggle as the cost of living crisis hits harder in the coming months. But nonetheless the Bank of England will still have to raise interest rates aggressively.

The fall in retail sales in August more than reverses the upwardly revised 0.4pc rise in July. Sales volumes fell in every major category and the ONS reported that high prices were prompting households to reign in their spending.

And this sits comfortably with the fall in consumer confidence to its lowest level on record in August. For example, fuel sales fell 1.7pc despite a sharp 6.2pc decline in fuel prices in August.

With CPI inflation yet to peak, it will continue to squeeze real incomes and weigh on consumer spending in the coming months. That said, the potentially huge fiscal expansion from the government’s Energy Price Guarantee will offer substantial support to households and consumer spending further ahead.

We now expect that the recession will be smaller and shorter than we did before, which is one reason why we expect that the Bank of England will need to raise interest rates further than we had been expecting to a peak of 4pc.

07:39 AM

Reaction: Retailers face winter of discontent

Lynda Petherick, retail lead at Accenture, says the latest sales figures will be worrying for retailers.

With a difficult winter to come, it will come as a worry to retailers that shoppers have already reigned in their spending despite the hot summer.

The sombre atmosphere in the UK this week and news of slow economic growth will be adding to the sense of concern among retailers as the weather gets colder.

Rising costs remain front of mind, and brands will be doing all they can to minimise outgoings and protect their margins for the months ahead.

To avoid a winter of discontent and beyond, technology will be crucial to helping retailers find a careful balance between product, price and experience to keep customers coming back for more.

07:36 AM

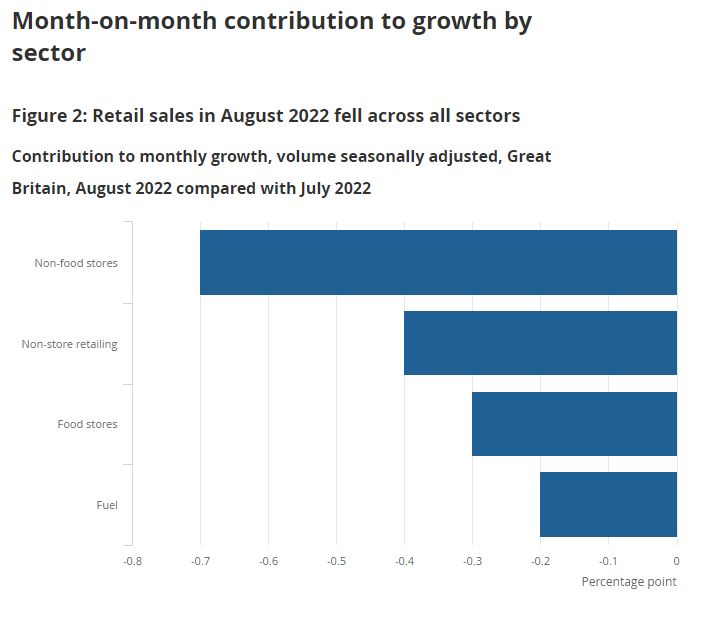

Sales slump across all sectors

There were declines across the board in August, with retail sales tumbling in all categories.

It’s the first time that’s happened since July 2021, when all Covid restrictions on hospitality were lifted.

07:31 AM

Retail sales slump

Good morning.

There’s more dire economic data this morning, as retail sales dropped at the fastest pace in eight months in August.

The quantity of goods sold in-store and online fell 1.6pc from July, according to the ONS. That fall was three times bigger than forecast.

Sales declined across all categories – the first time this has happened since July 2021, when the reopening of hospitality venues following Covid restrictions drove punters to restaurants and bars.

The figures are the latest sign of how soaring inflation and a big squeeze on living standards is hitting consumers. It also highlights the challenge facing retailers heading into the key Christmas trading period.

5 things to start your day

1) Why Waitrose’s claim to have held down prices doesn’t add up Prices for everyday staples have gone up by more than 30pc in some cases

2) British Airways cancels one in seven flights during Queen Elizabeth II’s funeral 100 flights axed to keep skies clear as Heathrow restricts arrivals and departures on Monday

3) We don’t know how much Liz Truss’s energy bills freeze will cost, admits Treasury PM’s fiscal statement, due next week, is set to reverse tax rises but costings for policies to ease bills will only cover first few months

4) Louis Vuitton owner tells staff to take the stairs and turns down store thermostats Even French luxury retailer is cutting back in the face of skyrocketing energy costs

5) Billionaire founder of Patagonia gives the outdoors brand away Company will split between two organisations and pay dividends to ‘protect the planet’

What happened overnight

Asian markets were weaker this morning as investors braced for a US rate hike next week amid growing concerns of a global recession following warnings from the World Bank and the International Monetary Fund.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.3pc on Friday, after US stocks ended the previous session with mild losses. The index is down 4.1pc so far this month.

Australian shares were down 0.9pc on Friday, while Japan’s Nikkei stock index slipped 1.2pc.

Hong Kong’s Hang Seng Index was down 1.1pc while China’s CSI300 Index was 0.9pc lower.

Coming up today

-

Economics: Inflation (EU), retail sales (UK, US, China), industrial production (China), Michigan consumer sentiment index (US)

-

Corporate: No major scheduled updates