By Graham Summers, MBA

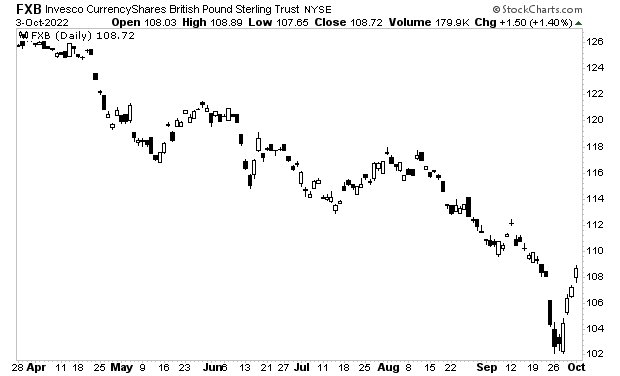

Yesterday I asked, “is the Fed about to hit the PANIC! button like the Bank of England?”

The markets certainly acted like it: stocks, Treasuries, oil, and gold erupted higher yesterday, fueled by the announcement that the Fed had scheduled an emergency meeting for 11:30AM EST.

It was only a matter of time before Fed Chair Powell would appear and tell the markets that the Fed was reintroducing Quantitative Easing (QE), just as the Bank of England (BoE) had done last week.

Except… Chair Powell didn’t appear. The Fed didn’t make any announcements of any kind except that it was updating its rule regarding debit card transactions.

Debit. Card. Transactions.

Not the reintroduction of QE. Not a slowing or potential end to rate hikes. And certainly not a Fed pivot of any kind.

This is not to say that Fed officials didn’t refrain from making any public appearances yesterday. John Williams, the President of the New York Fed (the branch in charge of market operations) gave a speech in Phoenix Arizona in which he stated:

1) Inflation is far too high.

2) Our job [cooling demand and reducing inflationary pressures] is not yet done.

3) The drop in commodities prices is “not enough” to “bring down” the “broad-based inflation” caused by goods demand as well as labor and services demand.

So… no sign of a pivot there.

If anything, the market’s action yesterday makes a Fed pivot less likely any time soon. With both Treasuries yields AND the $USD falling yesterday, rate and liquidity pressures are much lower than they were last week.

The $USD reversal in particular is a welcome relief as it allowed the British Pound and other currency that were under pressure to rally hard… But this again erases any need for the Fed to pivot.

Bottomline: the Fed will no doubt pivot at some point… but it’s not doing so now. And the market’s action has made the likelihood of a pivot MUCH lower.

So enjoy the relief rally… but don’t plan on it lasting for long. Because the Great Crisis… the one to which 2008 was a warm-up, has finally arrived.

In 2008 entire banks went bust. In 2022, entire countries will do so.

And it is inflation that triggered it!