- The 13 years ending 2021 are among the best for stock market returns.

- This year could be the beginning of the bursting of a superbubble that inflated over the previous 13 years.

- Baby boomers cannot afford to bet against the bursting of bubbles at this time in their lives.

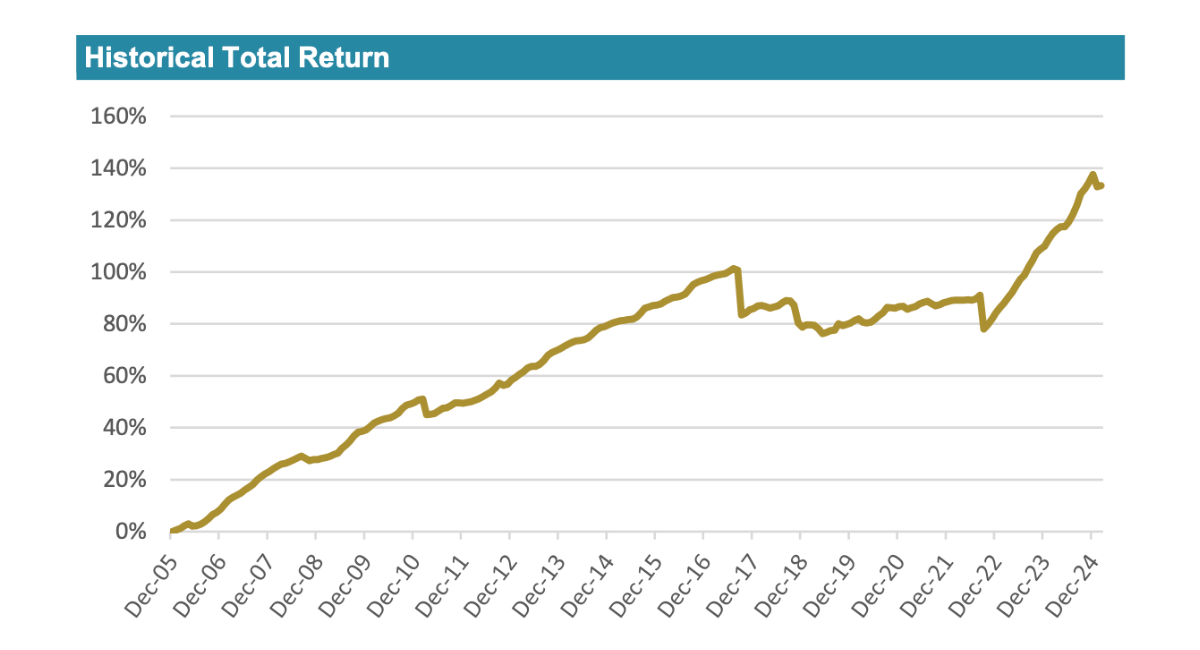

In January of this year, I wrote Lucky 13. History of 13-Year Investment Returns that shows that the 13 years ending 12/31/21 is one of the best on record, so I postulated that the next 13 years might not be so good. The “Roaring 2010s” might have set the stage for the “Depressing 2020s.”

The inflation of a superbubble

The last 13 years are unique in their persistence of good positive investment returns year after year. There was no risk.

The only “volatility” was up, leading to many articles about the length and magnitude of the recovery from the 2008 crash.

As of the end of 2021, the recovery was the longest on record. By historic standards, a correction was 7.5 years overdue.

And the magnitude of the rise brought it to superbubble levels, where a superbubble is defined as a market that rises more than 3 standard deviations from trend. Many measures of expensiveness had risen to this level, like P/E ratio and the Buffett Indicator.

The deflation of a superbubble

So far 2022 has delivered corrections in both stocks and bonds. It’s interesting to note that recent commentators use the word “volatility” to mean losses because it softens the bad news. We now have downside volatility, something we haven’t seen since 2008.

There are many explanations for the declines, including investor behavior. Crestmont Research documents that investor fear takes hold when inflation is extreme – either high or low.

Price/Earnings ratios are a manifestation of investor fear or greed. Investor euphoria leads investors to pay a premium for earnings, while fear makes them frugal.

The question on everyone’s mind is how low will prices go. Many, including Jeremy Grantham, believe the US stock market is bursting a superbubble that according to this article. Some examples of previous modern superbubbles in the financial markets are the 1929 stock market crash, the 1970s, and the 2000 dot-com bubble. These events are extreme in historical nature and can see drops in prices of 50% to 90%.

If the ultimate decline is between 50% and 90%, the stock market has another 34%-88% drop ahead. The worst may be yet to come.

Conclusion

As is the usual case in bear markets, Wall Street advises “buy the dip” and “stay the course.” That will work if Grantham and others are wrong, and this is not the bursting of a superbubble.

But 78 million baby boomers cannot afford to risk their lifetime savings at this time because most are in the “Risk Zone” during which losses can irreparably spoil the rest of their lives. We each get only get one passage through the Risk Zone, and this zone is currently extremely risky. Baby boomers need to move to safety which means Treasury bills and intermediate term TIPS.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.