JHVEPhoto

Values are in CAD unless noted otherwise. Convertible Debenture Issues trade solely on TSX.

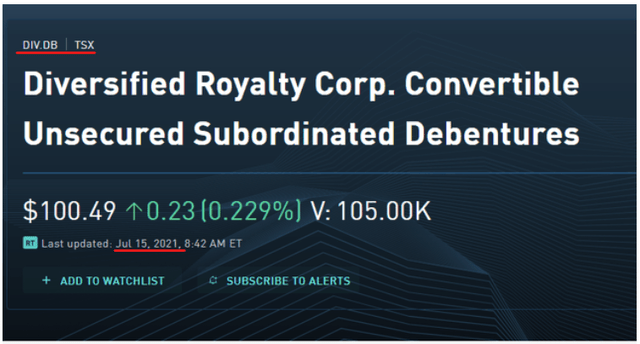

We advocated the debentures each time we have covered Diversified Royalty Corp. (OTCPK:BEVFF) (TSX:DIV:CA) on this platform. We liked the company but wanted to give its debt load a wider berth back in July 2021. Rating the common shares a hold, we recommended buying the outstanding debenture issue at the time, DIV.DB.

Seeking Alpha Article

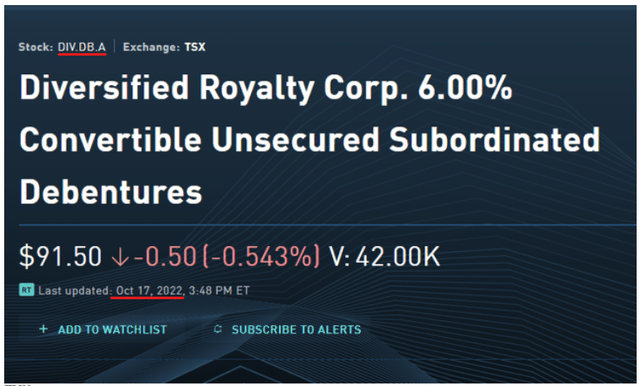

Wholly redeemed in December 2022, investors made a 7% total return from the initial recommendation. In October 2022, we revisited the company and highlighted its newer debenture issuance that was trading at a decent discount. The yield to maturity or YTM was 8.47% at the time.

Seeking Alpha Article

Investors are already up by that amount due to the price appreciation and income to date. Of course, the redemption is scheduled for 2027 and the price will fluctuate in the interim. The YTM will keep delivering the 8+% for those that got in at the time.

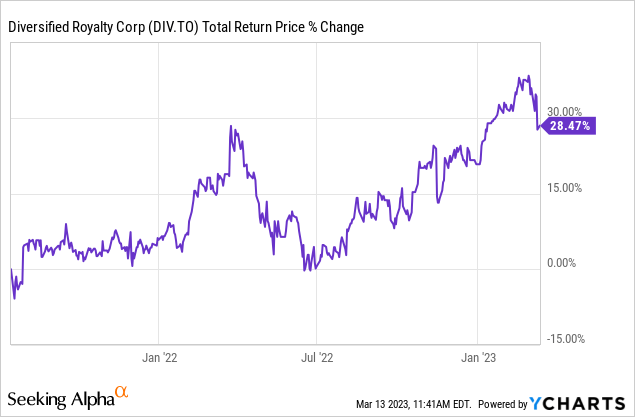

While the two debentures have delivered decent returns, the commons have surpassed them comfortably.

The debentures though met our investment goals of being low risk plays and we reiterated our stance on the DIV.DB.A in on the last day of 2022.

The current balance sheet looks great with about $160 million in net debt serviced by about $40 million of EBITDA. This is before the impact of the share issuance and new Stratus transaction funded solely by equity. Considering that Diversified has a strong positive correlation with inflation with almost none of its downside, we see the 9.0% yield to maturity as a low risk play.

Source: Diversified Royalty: 9.0% Yield With Low Risk

Today we go over the developments since our last review of this company and lay out our current thinking.

Company Overview

DIV earns royalties and to a smaller extent management fees from varied and multi-location businesses in North America.

Company Website

Be it tutoring services with Oxford Learning, residential real estate with Sutton, automotive maintenance with Mr. Lube, home care services with Nurse Next Door, casual dining with Mr. Mikes and cleaning services with Stratus, DIV has it covered. The AIR MILES segment has run into issues recently but that had not impacted the incoming royalties at the time of the press release.

All of the royalties are either based on top line numbers or a fixed rate with built in annual increases. Like other royalty companies we have covered, this one too aims to pass most of its net income to shareholders after setting aside a reasonable reserve. Prior to the pandemic, the dividend payout comfortably breached 100%, while in the last couple of years it has been closer to 90%.

Q4-2022 Results

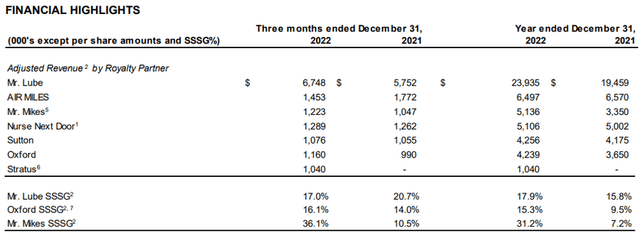

Save for AIR MILES and the recent addition to the portfolio, Stratus, the royalty partners came through with higher year over year numbers.

Q4-2022 MD&A

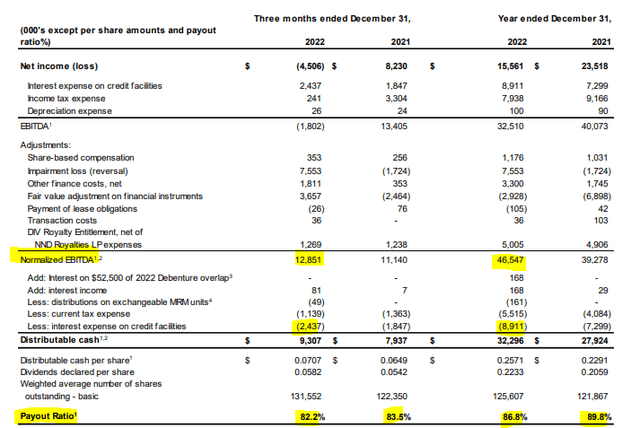

Price increases, resumption of business as usual, store reopenings and growth contributed to the year over year outperformance by Mr. Lube, Oxford, and Mr. Mikes. The latter’s 2022 numbers include a $1.3 million payment of deferred royalties from the prior year. Sutton and Nurse Next Door have built in 2% contractual increases which were reflected in their 2022 numbers. Overall the results were extremely strong and the payout ratio which was already sub 90%, reached 82.2%.

Q4-2022 MD&A

We also want to highlight the EBITDA to interest expense ratio, something we as debt holders are particularly interested in. For the quarter the ratio was over 5.27X. For the year a bit lower, but still comfortably over 5.0X.

Outlook

The big elephant in the room is the situation with AIR MILES.

In 2021, LoyaltyOne saw the non-renewal and loss of two sponsors from the AIR MILES Program, and the emergence of the COVID-19 Omicron variant in November 2021, which negatively impacted results. Based on the assessments performed, the Company concluded that the carrying amount for the AIR MILES Rights exceeded the recoverable amount. As a result, the Company recorded an impairment loss of $5.2 million in connection with the AIR MILES Rights for the year ended December 31, 2021. In 2022, LoyaltyOne saw the loss of a significant AIR MILES sponsor Sobeys, which negatively impacted results in the fourth quarter of 2022. Based on the assessments performed, the Company concluded that the carrying amount for the AIR MILES Rights exceeded the recoverable amount and as a result, the Company recorded an impairment loss of $14.4 million in connection with the AIR MILES Rights for the year ended December 31, 2022.

Source: Q4-2022 MD&A

Things got worse after the year end as Loyalty One declared bankruptcy. There remains some murkiness as to what will happen next but it appears as though one of the big 5 banks of Canada may be coming to the rescue.

According to Bloomberg News, Loyalty Ventures Inc., the company that owns Air Miles, filed for bankruptcy and announced a plan to be bought out by the Bank of Montreal (BMO).

And in a press release from March 10, BMO confirmed that they are indeed in the process of acquiring the brand.

However, the deal is not completely final yet. Its success is still dependent on approval from the courts, regulatory approval and “other customary conditions.”

“If our acquisition of the AIR MILES business is successful, we will bring the ownership of AIR MILES home to Canada,” said Ernie Johannson, an executive at BMO. This means that Air Miles ownership will shift from Houston, Texas, to the Great White North.

Source: Narcity

Assuming this goes through as planned, it will likely improve Diversified’ s position. On the other hand if it does not, it could crimp the company’s position just as we head into a recession.

Verdict

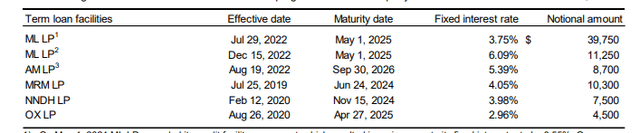

Diversified offers a solid 7.66% yield at the current price and growth is likely to come via inflation. The company has some exposure to interest rate increases but more than half of the debt has interest rate swaps protecting it.

Q4-2022 MD&A

With the current payout ratio and the likelihood of BMO taking over Air Miles, we see the company continuing with steady payments, even through a likely recession. That said, the debentures are still the safest and the best bet. The yield to maturity is at about 7.83% and that is for the debentures maturing in about 4.25 years. We think that is where we will continue to make our stand and escape the volatility of the common shares.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.