At the GST Council’s meeting last month, the Government of India said it would soon clear the pending balance to states — Rs 16,982 crore for June 2022, the last tranche — even though the compensation fund was empty. GST collections are back on track. The revenue mopped up last month — Rs 1,49,577 crore— was a 12% jump y-o-y. For the April-February period of the current fiscal year, the monthly GST collection did not slip below Rs 1.4 lakh crore even once, a significant threshold considering that it nosedived to a paltry Rs 32,172 crore in the lockdown-hit month of April 2020 before rebounding to Rs 1 lakh crore in October, after six months.

As the GST collection turns robust — an outcome of widening tax base and plugging of leakages — this is the right time to usher in the next phase of India’s most ambitious tax reform. So, what kind of reforms should be part of GST 2.0?

Pratik Jain, Price Waterhouse & Co’s tax partner, says “rate rationalisation (reducing the current four tax slabs of 5%, 12%, 18% and 28% to just three) and bringing petroleum products under the ambit of GST rate structure” should be prioritised to take the reform to the next level. On petroleum products, he says, if a consensus on passenger fuel would take more time, the GST Council should start by including aviation turbine fuel (ATF) and natural gas. Now, petroleum products and select items such as electricity and alcohol are kept outside the purview of GST.

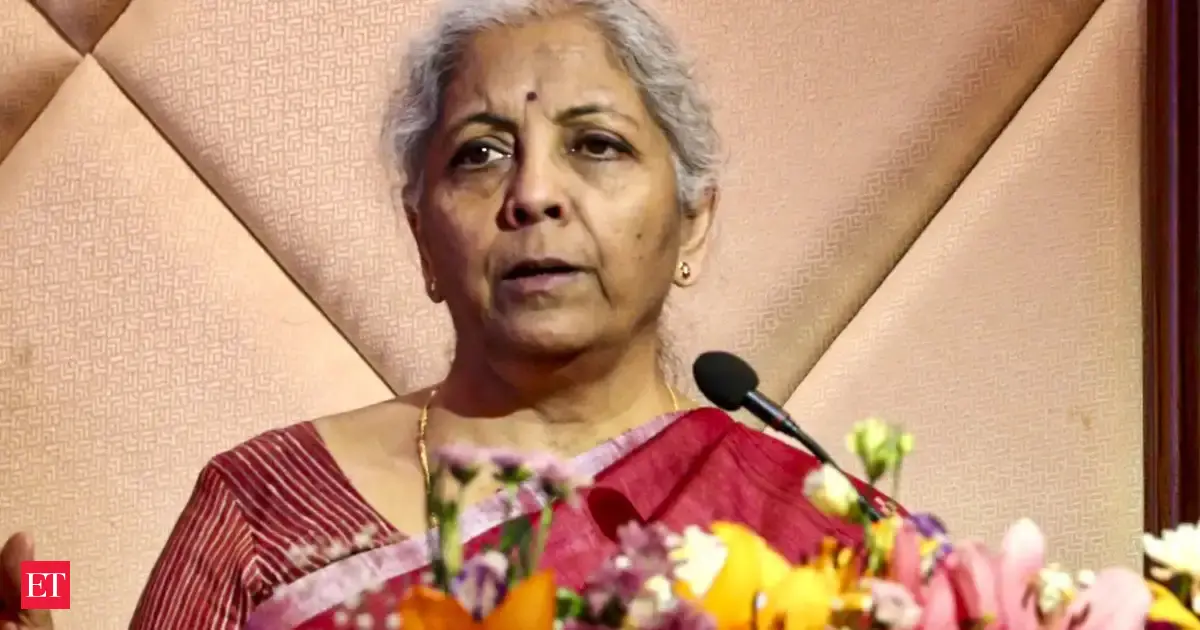

According to Jain, two areas require the Council’s immediate attention — formation of a GST appellate tribunal and closer coordination between Central and state GST authorities for audit. The Council, chaired by the Union finance Minister with her counterparts from states as other members, is the apex decision-making body on indirect tax in India. The Council, for its part, has started deliberations on new reform measures. Its 49th meeting held in New Delhi last month took up the issue of setting up an appellate tribunal. It adopted the report of a group of ministers with some modifications. “The final draft amendments to the GST laws shall be circulated to Members for their comments. The Chairperson has been authorised to finalise the same,” says the official statement released after the meeting.

According to EY India’s tax partner Saurabh Agarwal, the GST appellate tribunal might be headquartered in Delhi with regional benches in Mumbai, Kolkata, Chennai, Bengaluru, Ahmedabad, Prayagraj, Chandigarh and Hyderabad, as “it may not be possible to set it up in all states in the initial phase”.

According to a recent Press Trust of India report which quotes an unnamed official, a four member appellate tribunal with two technical members (one officer each from the Centre and states) and two judicial members is proposed to be set up in each state. Establishing an appellate tribunal will reduce court litigation and bring down legal cost for litigants.

“From a short- to mid-term perspective, the next stage of GST reforms should aim at early resolution of disputes and reduction of ongoing litigation,” says Vikas Vasal, national managing partner — tax, Grant Thornton Bharat.

“The focus should be on the establishment of appellate tribunals, introduction of faceless assessments similar to those in the income tax regime, and an amnesty scheme to resolve existing disputes many of which have arisen due to interpretation issues or minor non-compliances during the initial years of GST,” he says, adding that from a long-term perspective, the focus should be on expanding the ambit of GST and bringing all goods and services within its ambit.

However, Sushil Modi, former deputy chief minister of Bihar and the politician who headed the empowered committee of GST before the implementation of the tax regime, argues that GST does not need any more big bang reforms. “What it needs is a little tweaking. As there is good revenue growth and with inflation under control, this is the right time to reduce the number of GST slabs to three. There should be one slab between 12% and 18%, and another between 5% and 12%,” he says, adding that the highest slab (28%) should remain as it is.

An EY report published last year, “GST Transformation: The Road Ahead”, suggests rate rationalisation according to the following formula: “Shifting to a three-tier rate structure of 8 (merit rate), 15 (standard rate), 30 (demerit rate) percent by merging 12 percent and 18 percent into 15 percent slab and increasing demerit rate from current 28 percent to 30 percent.” The report also says the 30% slab can be raised to 40% after the abolition of compensation cess.

GST, which subsumed 17 large taxes and 13 cesses, has four slabs plus an exempt list (eggs, curd, vegetables etc., attract no tax). Luxury and sin items attract the maximum tax of 28%. An additional cess is levied on items such as tobacco, aerated water, caffeinated beverages and some motor vehicles, over and above the tax slab of 28%, to fund the compensation corpus needed to support states that failed to mop up GST at a yearly growth of 14% and above. The compensation was meant only for the transition period between July 2017 and June 2022.

NO COMPENSATION BUT CESS GOES ON

While states no longer receive compensation, the cess collection continues, and will go on till March 2026. Levying of cess has been extended to meet the revenue gap arising out of the pandemic, when the Centre resorted to borrowings (Rs 1.1 lakh crore in 2020-21 and Rs 1.59 lakh crore in 2021-22). The cess varies from item to item — for example, pan masala attracts a 60% cess and pan masala containing tobacco a whopping 204% cess.

According to an RBI report on state finances released in January, the top 10 recipients of GST compensation during the five-year transition period were Maharashtra, Karnataka, Gujarat, Tamil Nadu, Punjab, Uttar Pradesh, Delhi, Kerala, West Bengal and Madhya Pradesh. The report says that the states and Union territories that are likely to be impacted the most after the withdrawal of compensation are Puducherry, Punjab, Delhi, Himachal Pradesh, Goa and Uttarakhand, in that order, as the share of GST compensation in their tax revenue was 10% or more on average.

However, after analysing the revenue numbers for a 10-month period from April to January of FY22 and FY23, Jain concludes differently, “Uttarakhand, Himachal Pradesh, Karnataka and Gujarat have been able to sustain a growth rate of more than 14% despite discontinuation of GST compensation. States such as Delhi, Uttar Pradesh and West Bengal appear to be the most adversely affected by the discontinuation of compensation.”

The very concept of compensation was weaved into the GST regime to woo recalcitrant, producing states such as Maharashtra and Gujarat. Several of these producing states used to enjoy higher revenue because of the origin-based tax regime that was in place prior to GST. With the compensation gone, how will the states adapt to the new regime and reform themselves to mop up a robust revenue? After all, it was clear from Day 1 that GST compensation was only a temporary measure.

“Ultimately, the states must become self-sustainable. To augment the revenues, the states should try to plug tax leakages and have stricter monitoring on compliances,” says Jain.

Economist and former chief statistician of India Pronab Sen adds that the loss incurred by states due to the withdrawal of GST compensation is something that “needs to be looked at by the Finance Commission”. A new set of reforms needs to be initiated to make GST simple and seamless.

Deloitte India’s tax partner MS Mani, however, argues that it is essential to stabilise GST with minimal changes during the year because each change necessitates modification in IT systems, product pricing, business plans, et al. “It would be good if all changes discussed and approved during a fiscal year are introduced from April 1 of the next fiscal year in order to give time for businesses to prepare and be ready for the same,” he says.

Maybe a series of changes could be clubbed together and introduced at one go. GST 2.0 is indispensable but it should be rolled out with minimum disruptions.