At any time when the Israel matter comes up, we attempt to tread frivolously. As famed American thinker Louis C.Ok. as soon as mentioned, “Jew” is the one phrase that may be derogatory or descriptive, simply based mostly on tonal inflections. Most individuals’s data of Jews in all probability extends to the funny-looking individuals seen strolling round New York airports. These are Hasidic Jews who make up about 5% of the Jewish inhabitants. Then you’ve got Ashkenazis who’re the vast majority of Jews, and occur to be among the smartest individuals on this planet – research have proven. However that breaches the subject of genetic intelligence, and now that everybody’s beginning to squirm of their seats, we’ll shortly change the topic.

Jews apart, Israel is remarkably profitable for a rustic with simply 9 million individuals. With greater than 85 firms buying and selling in the uswith a mixed market cap of $300 billion, solely China and – in fact – America – have extra firms buying and selling within the States than Israel. One Israeli success story we’re going to have a look at in the present day is SolarEdge (SEDG).

Looking for Photo voltaic Shares

The photo voltaic investing thesis has been robust to navigate over time. Should you invested in the one photo voltaic ETF on the market – the Invesco Photo voltaic ETF (TAN) – when it debuted on Might first 2008, you’ll be holding that place at a 78% loss proper now. Should you invested in TAN 10 years in the past, you’ll have solely realized a +191% return in comparison with a Nasdaq return of +332% over the identical time-frame. However an funding in TAN 5 years in the past would have netted you a achieve of +268% vs a Nasdaq return of +118%. It’s one of many uncommon instances the place the outdated saying, “it’s about time out there, not timing the market” doesn’t seem to carry true.

We’re at the moment holding TAN and seeking to exit the place for no different cause than we don’t need to maintain any ETFs in our disruptive tech inventory portfolio. Given photo voltaic is predicted to develop at a sooner clip than some other renewable power, we vetted The ten Largest Photo voltaic Shares within the World and shortlisted two shares – Enphase and SolarEdge. The previous isn’t a inventory we’d take into account holding based mostly on dangers we outlined in our current piece on The Huge Photo voltaic Debate: SolarEdge Inventory Vs Enphase Inventory. That leaves us with SolarEdge.

About SolarEdge Inventory

Let’s begin with among the threat components we’ve recognized to this point.

- SolarEdge says 30.9% of 2021 revenues come from two distributors – Consolidated Electrical Distributors (CED) and Sunrun (RUN).

- The corporate doesn’t present any coloration on their publicity to utility photo voltaic vs. residential photo voltaic. In line with a bit by Morningstar, SolarEdge is claimed to be evenly cut up between residential and industrial.

- SolarEdge has an opaque enterprise mannequin with doesn’t mirror the kind of recurring revenues we wish to see when demand for {hardware} dries up.

Beginning with the primary bullet level, finish prospects and distributors symbolize two varieties of threat. A distributor disseminates merchandise to a large number of finish prospects who drive demand for these merchandise. Consolidated Electrical Distributors (CED) is likely one of the largest privately owned electrical distributors in the USA with 700 places, whereas Sunrun is “an American supplier of residential photo voltaic panels and residential batteries” and the most important residential photo voltaic installer in the USA since their acquisition of Vivint. From our perspective, CED can be thought of a distributor, whereas Sunrun wouldn’t. This implies our buyer focus threat considerations lie primarily with Sunrun. If we assume they represent half of that focus at 15% then that’s not overly problematic. Presumably that can decline over time as SolarEdge expands globally.

Relating to utility vs. industrial vs. residential, try the beneath slide from a current SolarEdge investor deck.

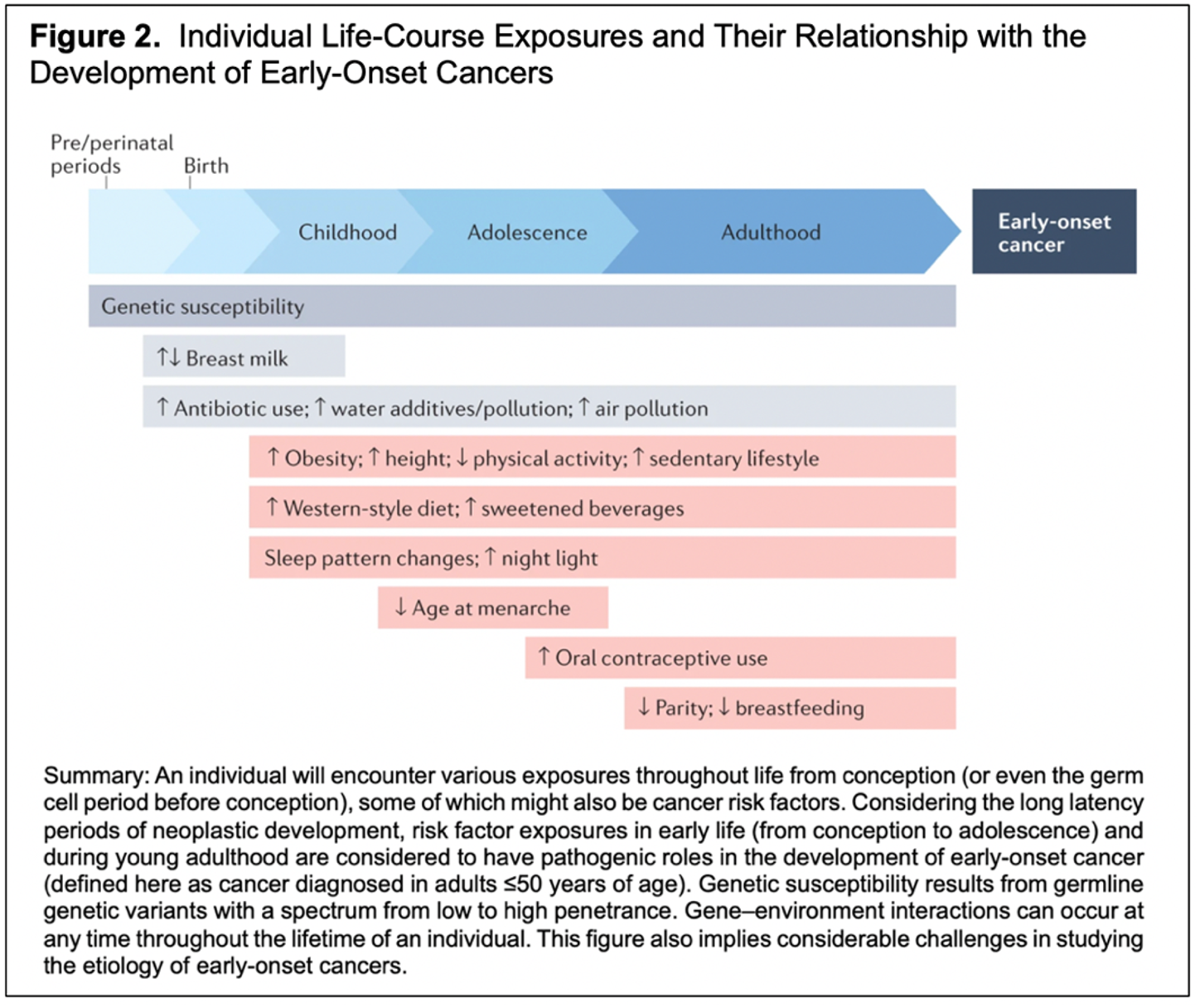

The corporate’s technique is to scale back their reliance on residential – a product portfolio that they understand as full – and concentrate on rising industrial and utility. This aligns with our need to carry a photo voltaic firm that’s diversified past simply residential. Now, let’s discuss our most essential level of competition – the necessity for recurring revenues as soon as the photo voltaic funding growth subsides.

A Photo voltaic Gold Rush

In photo voltaic as an funding thesis, our greatest concern lies in what occurs to photo voltaic {hardware} producers when the infrastructure growth ends and demand dries up. In line with an estimate supplied by SolarEdge, solar energy will symbolize 38% of all energy technology globally by 2050 (adopted by wind at 20%).

Given the anticipated 25-year lifespan of the inverters and optimizers offered by the corporate, this works out fairly properly. Since SolarEdge offered $1.656 billion value of inverters and optimizers in 2021, we will anticipate replacements to be ordered in 2046 which – adjusting for inflation – ought to present one other rising income channel over time. In an ideal world, the photo voltaic infrastructure growth will tail off proper when demand for substitute {hardware} begins selecting up. Since SolarEdge gives free monitoring software program to their purchasers for 25 years, the timing is nearly proper.

- SolarEdge: Appears like your 25-year free trial is coming to an finish and it additionally seems to be like your {hardware} is sort of outdated. How about we exchange all that outdated gear for you and prolong that free software program trial one other 25 years?

- Buyer: Seems like a plan

Rising revenues with substitute {hardware} is one state of affairs for development past the photo voltaic gold rush, however there’s no want to attend till then. SolarEdge has outlined a variety of segments they plan to broaden into which they at the moment ball up right into a class known as “All different” which incorporates the design, improvement, manufacturing and gross sales of power storage merchandise, e-Mobility merchandise, UPS merchandise, and automatic machines. Ultimately one would anticipate these extra segments to be damaged out as soon as they obtain significant development which appears to be coming. The “All Different” phase grew by 71% in 2021 reaching simply over 10% of complete revenues in 2021 (it’s known as “non-solar” within the beneath chart).

Buyers will need to maintain an in depth eye on how this phase grows over time because it gives a lot wanted income diversification for the corporate.

Shopping for SolarEdge Inventory

Somebody as soon as requested if it’s greatest to purchase earlier than earnings calls or after and we imagine the latter is the suitable alternative. That’s as a result of in the present day’s tech investor is more and more demanding. Usually we’ll see a agency report instantly in keeping with their steerage whereas shares get punished. Right this moment’s development hungry investor calls for that expectations are at all times surpassed and this angle – accompanied by a short-term horizon – signifies that earnings calls hardly ever shock to the upside. After they do, shares normally revert again to the imply over time.

SolarEdge has an earnings name subsequent week which – we will solely hope – disappoints the YOLO FOMO traders on the market. Should you’re somebody who’s bullish on SolarEdge, you higher hope and pray all these provide chain points the corporate confronted in late 2021 affected revenues and the share value will get completely decimated. Regardless of what Jim Cramer says, there’s nothing higher than a top quality firm with a falling share value. If we resolve to tug the set off on some SolarEdge shares, Nanalyze Premium subscribers will likely be receiving an e-mail alert.

Lastly, we have to discuss valuation and volatility. You don’t want to grasp the idea of beta to see that SolarEdge is a unstable inventory that’s appreciated quickly over the previous 5 years – a rise of +1,470% in comparison with a Nasdaq return of +115%. When the U.S. sneezes, photo voltaic traders catch a chilly, and NextEra Power (NEE) – the most important renewable power firm on the earth – was not too long ago complaining a couple of determination by U.S. Division of Commerce to provoke an anti-circumvention investigation into the importation of photo voltaic panels from choose Asian international locations which may create issues for NEE’s photo voltaic development plans. Luckily, SolarEdge has simply 40% publicity to the land of the free.

Geopolitical occasions will inevitably whipsaw the value of SolarEdge inventory round like a yoyo, so that you’re greatest served slowly accumulating a place versus attempting to time the market. As for valuation, the inventory value may simply half or double and nonetheless be inline with its photo voltaic friends. Beneath you may see our easy valuation ratio calculated for a handful of photo voltaic names in our tech inventory catalog.

| Firm | Market Cap (USD tens of millions) |

Final Quarter Income (USD tens of millions) |

Nanalyze Valuation Ratio |

| ENPHASE | 20,734 | 413 | 13 |

| SOLAREDGE | 14,008 | 552 | 6 |

| ARRAY TECHNOLOGIES | 1,071 | 192 | 1 |

| SUNNOVA ENERGY | 1,814 | 65 | 7 |

| SUNRUN | 4,408 | 435 | 3 |

| FIRST SOLAR | 7,933 | 907 | 2 |

Conclusion

If photo voltaic can understand the expansion that’s being predicted, and develop into the dominant supply of power throughout the globe, then we’d wish to have a canine in that race. Sadly, investing in photo voltaic hasn’t been so simple as shopping for an ETF and ready. SolarEdge appears to be rising as a worldwide chief in photo voltaic infrastructure with plans to diversify into complimentary areas that may present development when the photo voltaic infrastructure growth subsides. Whereas the inventory experiences quite a lot of volatility, it looks as if a promising option to get international publicity to the expansion of photo voltaic.

Tech investing is extraordinarily dangerous. Reduce your threat with our inventory analysis, funding instruments, and portfolios, and discover out which tech shares you must keep away from. Develop into a Nanalyze Premium member and discover out in the present day!