Getty Images/Getty Images News

Investment Thesis

The Apple Inc. (NASDAQ:AAPL) outlook is far from sparkling strong. However, given that the rest of the economy is also far from stable, anything that isn’t bad news is being viewed by investors in a very positive light.

Apple is a contentious stock. Bulls view it as a business that never disappoints, extremely well managed, with unparalleled dominance. While, on the other hand, the bears question its valuation and whether paying more than slightly more than 25x next year’s earnings leaves new investors with any upside potential.

Apple to Plow Further into Fintech?

Apple’s Service segment continues to deliver plenty of excitement. At its core, the Service segment has something for everyone, from health and fitness to music.

But the core of the bull case is the understanding that this very high-margin business can continue to deliver steady, diversified gross profit margins that now reach 71%.

In other words, even if Apple’s digital advertising and mobile gaming are not shining brightly at present, there’s always something in this segment that can push through and support the overall segment.

For instance, in the more recent quarter, Apple was able to highlight that it now has 2 billion active devices. With this size of an active user base, Apple only needs to deliver products that match inflation, for the Services segment to continue delivering positive incremental gross margins to the overall business.

During the earnings call, we saw Apple declaring that it has taken the first steps into Buy Now and Pay Later (“BNPL”) and that Apple is pleased with the initial progress made in offering customers a savings account.

In fact, the one thing that Apple is renowned for is conservatism. Apple progresses very slowly in ensuring that its products are a very strong fit for the market. Moreover, I strongly believe that in the coming few quarters we will be hearing a lot more positive highlights on this avenue.

We’ll now talk about one significant drawback to this investment thesis.

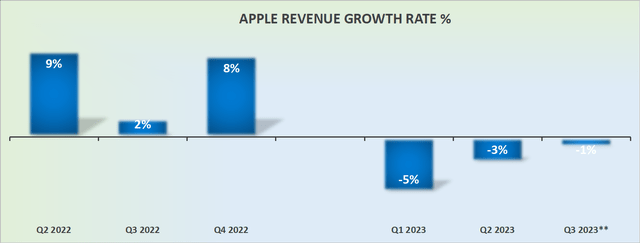

Revenue Growth Rates Mature

AAPL revenue growth rates

Apple’s fiscal Q3 2023 is up against easy comparables and yet its guidance is far from alluring. What’s more, as we look further on to Q4 2023, Apple will be up against even more challenging comparables.

One way or another, Apple is unlikely to grow its revenues by more than 2% (adjusted for FX), if that, over the next 6 months.

Meaning that even as investors look to Apple as a ”safe haven” to park their cash, they are being exposed to a very high multiple on its stock.

On yet the other hand, there’s no question in anyone’s mind that parking cash in mega-caps over the past 2 years has been the absolute right choice. That being said, when investing, it’s always about what’s the next 12 months, as there’s very little point in reminiscing what the recent past has delivered.

Profitability Profile Set to Improve

Apple’s fiscal Q2 2022 reported gross profit margins of 43.7%, while its guidance for Q3 of this year points to somewhere between 44% and 44.5%. Indeed, given that Apple has a tendency to be conservative with its guidance, we should expect to see around 700 basis point expansion in gross margins y/y.

Going forward, Apple reaffirms its intention to continue raising its dividend, in line with what it has done in recent years. However, share repurchases are still expected to take up the majority of the capital budget.

Keep in mind that in the past 6 months, Apple has repurchased just over $43 billion worth of stock. Hence, when Apple states that it seeks to repurchase a further $90 billion worth of stock as it continues to progress towards a net neutral balance sheet, we can assume that the pace of share repurchases will continue in line with the past 6 months.

More concretely, at current prices, Apple’s share repurchases amount to about 3.3% capital return, on top of its 0.6% dividend yield. Meaning that without much else happening, shareholders will get a 4% combined total yield.

The Bottom Line

With Apple Inc., the bear thesis has to be around the fact that it’s barely reporting any revenue growth rates.

On the other hand, there’s enough innovation under its hood that investors are unlikely to be too quick to give up one of the only stocks in the market that is still holding up.

After all, as I’ve discussed throughout, Apple prides itself on innovation. And with more than 2 billion active devices, Apple has enough reach to continue launching new products, such as its recent push into payments, that it should be able to outpace inflation.

I would counter this yet again, by noting that while Apple’s valuation is clearly stretched, given that so many hedge funds and financial institutions need somewhere to park their cash if they want to match the market, I don’t believe that Apple Inc. stock is left too exposed to any meaningful selloff, either.