Roman Tiraspolsky

Overview

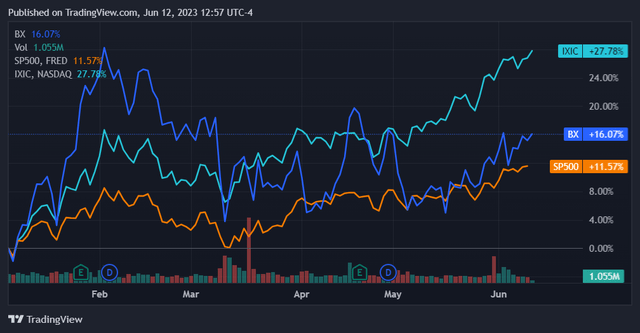

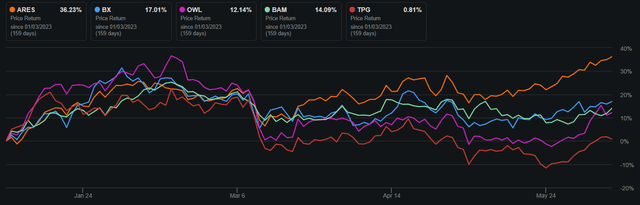

Blackstone (NYSE:BX) stock has done fairly well this year, marginally outperforming the S&P on price return and by 4.5% on total return. It has still trailed the NASDAQ Composite, in line with most other firms that are not megacap technology entities.

Seeking Alpha

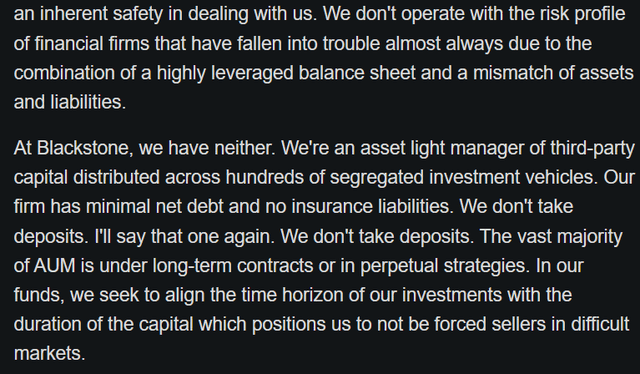

As an asset-light alternative asset manager Blackstone is in an interesting economic position at the moment. While higher rates have created significant turmoil across the financial sector and even brought down several banks, Blackstone’s management has made clear that their firm is of a different sort when it comes to their risk profile.

Seeking Alpha

Reiterating these comments, Blackstone does not have a highly leveraged balance sheet and is not subject to duration risk in a material way. They do not take customer deposits and also aim to line up capital commitments such that reflect the investment horizon of a given fund’s target asset class. All things considered this looks to be an operating modality that is well-aligned to our current context.

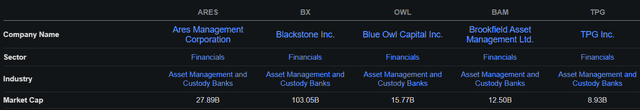

With that being said, Blackstone isn’t the only game in town. It competes against a set of other alternative asset managers that leverage the same framework. In this article I’ll compare Blackstone against its peer competitors, considering salient fundamental metrics in addition to valuation. Through this we can determine its relative value and decide if the stock is a buy at current prices.

The five scale players in asset-light alternative asset management are as follows. Blackstone is by far the biggest of the bunch and has notched the second-highest price return YTD.

Seeking Alpha

Seeking Alpha

Comparative Financials

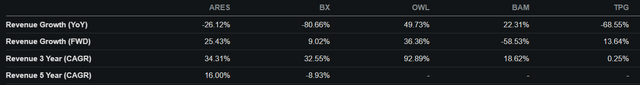

Revenue growth is highly variable in this space. Blackstone, as well as Ares (NYSE:ARES) and TPG (NASDAQ:TPG) all saw significant revenue declines y/y. Blackstone’s revenue decline was the most precipitous. Given the very high y/y volatility that is inherent in this business, we can’t read too far into that.

The forward metrics are also highly spread out. On a one-year forward basis Blackstone is expected to have the 2nd-worst revenue growth in the space, albeit one that is still positive. As to long-term forward compound annual growth expectations, Blackstone falls in the middle of the pack. It is expected to grow revenues at a 32.6% compound rate over the next 3 years, which would be an excellent showing for any company.

Seeking Alpha

The takeaway here is that Blackstone continues to be one of the higher-growth players in its market, even though it is by far the largest firm within it. That’s a good combination to have.

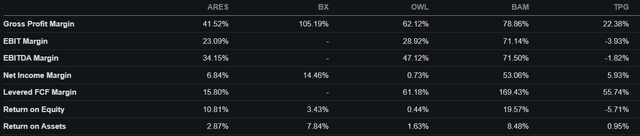

The profitability picture is also quite variable across these 5 firms. Here, Blackstone has the best gross margin in the business – a remarkable 105.19%. That’s the kind of showing you can only see in the financial sector. Net margin comes in as being the 2nd-highest in the space, although at 14.46% it is more than double that of the remaining 3.

Seeking Alpha

Return on equity for Blackstone is right in the middle of the bunch at 3.43%. Return on assets looks superior on a relative basis, being 2nd-highest and only 0.64% below that of the leading player.

Blackstone has a good relative position when it comes to profitability.

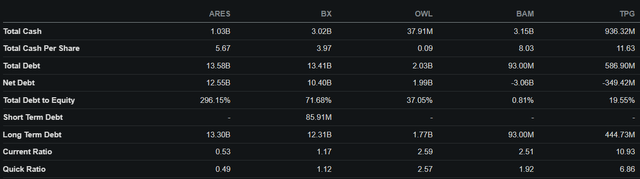

Continuing to the balance sheet, we can see that Blackstone operates with relatively high leverage. While not as highly leveraged as Ares, which has a current ratio of 0.53, Blackstone’s current ratio of 1.17 is still much lower than the other 3 firms. Its overall debt-to-equity of 71.68% is much higher than that of the lower leverage players.

Seeking Alpha

The conclusion we can come to from comparing these balance sheets is that Blackstone is the 2nd most leveraged company in the space. While not readily comparable to Ares in terms of leverage it is still levered far beyond the other 3 firms. Since its debt to equity ratio is still well below 100%, however, this should not present too much concern.

While this balance sheet overall may not be quite as good as what you would assume from listening to Blackstone’s latest conference call, it still looks fine. Given that Blackstone is already one of the more leveraged players, I think it will be important to watch how this metric progresses going forward.

Valuation

We can now look at how these financials are reflected in Blackstone’s valuation. While we have extensive non-GAAP metrics for these companies these are not readily comparable because they involve idiosyncratic calculation methodologies for each. TPG had a GAAP net loss last year and doesn’t have a number as a result.

For trailing twelve months GAAP P/E Blackstone comes in as fairly expensive, although the range of valuations here is exceptionally wide. Forward GAAP P/E looks more amenable to comparison. Here Blackstone is trading at a discount to both ARES and Brookfield (NYSE:BAM). The disparity in forward GAAP P/E valuation is fairly significant; Ares’ valuation is 21.2% higher and Brookfield’s is 17.8% higher than Blackstone’s.

Seeking Alpha

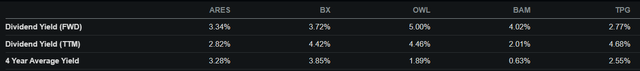

Considering Blackstone’s competitive levels of profitability, I’m not so sure that this forward discount is warranted. While both Ares and Brookfield readily exceed Blackstone on ROE, this is not the case when it comes to net income. Here Ares has about half the margin that Blackstone does while Brookfield has more than triple. Additionally, Ares and Brookfield have a slew of additional differences between them, including widely distinct balance sheets and disparate growth prospects. Since these two companies are so different from each other there is not a clear rationale for them to both be trading at elevated valuations while Blackstone is not. Essentially, there is not an immediate fundamental factor that implies this discounted forward valuation for Blackstone is warranted. Dividend yields are also not that different.

Seeking Alpha

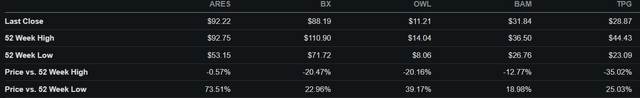

Blackstone’s current fundamental metrics and relative pricing indicate a potential buying opportunity. The stock price is well-situated as per its recent history, trading at a 20.47% discount to its 52-week high.

Seeking Alpha

Conclusion

Blackstone looks like a buy at these prices. Simply put, I don’t see why this company should be trading at a material forward discount as compared to two of its peers. While there are material differences across these companies, Blackstone’s profitability and growth profile appear to warrant a valuation closer to Ares and Brookfield on a forward basis. The company is a leader in its space but is not trading at a forward premium that reflects that. All of this considered I would call it a good buy at this price, with an investment horizon of 1 year.