AI algorithms are only as good as the big data you feed them. ARK Invest’s fearless leader, Cathie Wood, told Bloomberg today that software companies will be the true beneficiaries of the AI explosion. UiPath (PATH) is learning about how knowledge workers work, and this allows them to perform more advanced automations, perhaps even with industry specializations. Teladoc (TDOC) uses their telehealth offering to generate lots of healthcare data which can potentially be used to build new products. Both firms may utilize AI hardware to train algorithms on, but the real value is in their data.

ARK’s point is that software is where the real value is realized for disruptive tech themes, a belief mimicked in the adage, “software eats the world.” It’s why we’re particularly suspicious of hardware-only business models. Recurring revenue streams should be developed concurrently with growth so investors can see the potential unfolding. It’s like companies that sell consumables. If you’re selling hardware, and consumables aren’t becoming an increasingly important component of revenues over time, then something is wrong with your razor-blade model. And if you’re selling a high-margin hardware product, you better be developing a software/services component to fill the margin gap when pricing pressures drive down your gross margins.

Pure Storage-as-a-Service

Our previous piece on Investing in Data Storage Hardware Stocks discussed the excitement behind “flash native” storage technology and Pure Storage (PSTG), a company that built their hardware and software from scratch to create an efficient economically competitive solution to flash drives. Remember hard disks vs. random access memory (RAM)? Now, laptops like the one this article is being typed on use RAM hard drives (also called solid-state drives or SSDs) which increase performance. Everyone prefers RAM because it’s quicker, but it’s not cost effective. Pure Storage changes that.

Oftentimes, highly competitive hardware products come with dismal gross margins. This means you’re unable to compete with the Teslas of the world who will bait you into a price war because they can (cough, Xpeng, cough). So, when Pure Storage offers investors gross margins of (checks notes) 70%, it seems nothing short of remarkable. This begs the question as to how software vs hardware gross margins compare, and the answer might surprise you – both are floating around 70%. Think about how much pricing flexibility that provides Pure Storage on the hardware side.

Another thing to consider here might be the uplift customers can get from just buying hardware (on premise) to utilizing the storage-as-a-service solution from PSTG (also called Pure Fusion). Clients may be able to cut costs by switching while PSTG’s revenue streams become more stable and predictable. Over time, software is slowly growing more significantly, clocking in at 35% of total revenues last year. In last year’s piece on Pure Storage Stock: A Big Data Pure Play, we talked about how we like the company, but needed to consider opportunity costs. Are there better ways to invest in the growth of big data? It’s a good segue into some concerns we have around the company.

Pure Storage Concerns

We like Pure Storage, but we’re not here to force-feed you the bull thesis. Today, we want to address some concerns we have prior to going long this stock (if ever).

- Competition – where there are juicy gross margins, sharks will eventually come

- Low forecasted growth – “mid to high single digit growth” this year

- Survivability – cash on hand, burn rate, debt

Let’s start at the top.

Pure Storage Competition

Pure Storage isn’t selling into a blue ocean, they’re displacing legacy hardware providers such as IBM and Dell. They’re growing at the expense of others, but they’re hardly a leader. While the company claims to be consistently growing market share more than all other competitors, they’re still a small fish in a big data storage ocean.

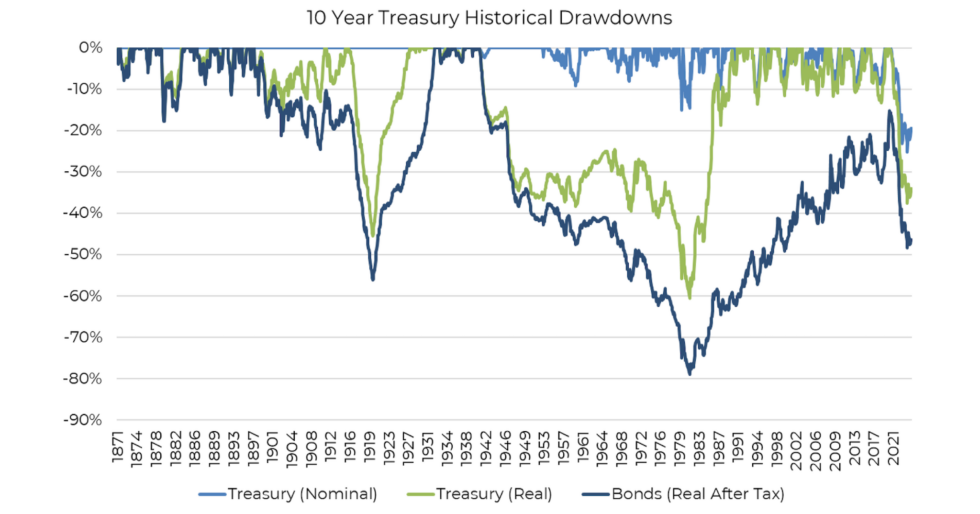

The above chart reflects most the players Gartner lists in their leaders quadrant (only missing Infinidat and Huawei). An analysis by Blocks & Files shows that Pure Storage only commanded a 4% market share for enterprise storage systems. While the data is several years old, it isn’t likely to have changed that much.

This is a “skate to where the puck will be” situation, one that Pure Storage believes they can win because they’re able to capture market share more effectively than legacy vendors who may be simply cannibalizing their own hardware when selling new data storage technologies. From a technology standpoint, Pure Storage is the leader – or so they say. Compared to the competition, they claim to be 10x more reliable, 2X to 5X more power and space efficient, and “require 5 to 10x less manual labor to operate, resulting overall in at least 50% lower total cost of ownership (TCO).” It’s that lower TCO that can help insulate Pure Storage against having to compete on price. Then, there’s this little gem Gartner drops which points to the growth potential for Pure’s SaaS offering:

By 2025, more than 75% of corporate, enterprise-grade storage capacity will be deployed as consumption-based offerings, which is an increase from less than 40% in 2022.

Credit: Gartner

Sounds great for Pure Storage’s storage-as-a-service offering, so why are they only expecting “mid to high single digit growth” this year?

Pure Storage Growth

Says the company, “annual revenue guidance assumes that macro conditions will continue to be challenging and will be consistent with what we have seen over the last couple of quarters.” Next quarter’s guidance – flat year-over-year growth – implies “continued strong subscription revenue growth and a slight year-over-year decline in product revenue.” Strengthening subscription revenue alongside weakening product revenue makes sense if we assume that companies want to reduce total cost of ownership by moving to storage-as-service instead of on-premise. Subscription also seems to be consistently growing over time, though the trend is slowly being eroded.

In Pure’s most recent earnings call, there was a common theme throughout the accompanying Q&A session. No, it wasn’t that analysts kept bringing up AI for whatever reason, just showing how hype is permeating Wall Street at all levels. It was that analysts seemed to be pushing Pure’s management hard on their guidance suggesting possible upsides which hinted at impatience around the 5-9% growth they expect to see this year. Pure’s response stuck to the talking points and spoke about their sales team having a better understanding of the sales cycle (confidence in their guidance) and that there could be a return to better growth end of this year or beginning of next.

Balance Sheet Bits and Bobs

With $1.2 billion in cash and positive operating cash flow of $173 million last quarter, Pure Storage should be able to not just survive but thrive. That’s the cash balance after they paid off $575 million of convertible senior notes which largely retired their debt obligations. Other uses of cash include buying back shares, though shares outstanding have been gradually increasing over time – from 264 million in 2020 to 304 million in 2023, an increase of 15% over three years. That’s meaningful, but nothing to be overly concerned about. Overall, Pure Storage has a solid balance sheet that looks much better since the last time we checked in.

Valuing Pure Storage

Our simple valuation ratio (SVR) uses annualized revenues for a reason, mainly so that it can be responsive to companies that are growing very quickly (or stop growing quickly). In the case of firms with cyclical revenues – like Pure Storage – it will be deceptively low for larger quarters and higher for smaller quarters. So, a current SVR of 4 for Pure Storage is higher than what we’ll see in the fourth quarter of this fiscal year, all things being equal. Compare this to our catalog average of 6 and PSTG looks to be undervalued, though one might argue only double-digit growth ought to accompany rich valuations. Ultimately, we still haven’t answered the question. If Pure Storage decreases total cost of ownership by 50%, and companies look to cut costs in the face of macroeconomic headwinds, then why aren’t these solutions selling like hotcakes? Are revenues dropping because of pricing pressures or something else? Or are these the normal “it takes longer to get signatures” macroeconomic headwinds that all SaaS vendors are experiencing?

Conclusion

Would we go long Pure Storage? Adding some exposure to the growth of big data is appealing, which is why we went long Snowflake (SNOW). There are other stocks we’re eyeballing, so maybe it’s a matter of taking the best opportunity that comes along. Bargain hunting this year has been slim pickings though, with the Nasdaq up +30% year-to-date, and AI hype driving many tech names upwards. PSTG jumped that much in the past five days alone, leading us to think it’s a bit overheated.

While Pure Storage may not look like a leader when it comes to market share, their superior product offering makes up for that. We just can’t figure out why their growth appears stunted this year. Is management playing a conservative hand and preparing for a year-end surprise, or are the TCO numbers just not compelling enough when it comes time to sign on the dotted line?

Tech investing is extremely risky. Minimize your risk with our stock research, investment tools, and portfolios, and find out which tech stocks you should avoid. Become a Nanalyze Premium member and find out today!