At the mid-year renewals, US primary insurance giant Allstate has shrunk its Florida reinsurance tower, and shifted all of its catastrophe bond coverage to the upper-layers of it.

A year ago, Allstate had significantly increased the size of its Florida focused reinsurance tower that covers its Castle Key insurer subsidiaries in the state.

In fact, at the mid-year 2022 renewals, Allstate extended the top of its Florida excess-of-loss catastrophe reinsurance tower by almost $600 million.

As a result, Allstate’s Florida catastrophe reinsurance tower for 2022 provided coverage up to $1.8312 billion of losses, which was roughly $592 million more than the prior year’s $1.2391 billion tower.

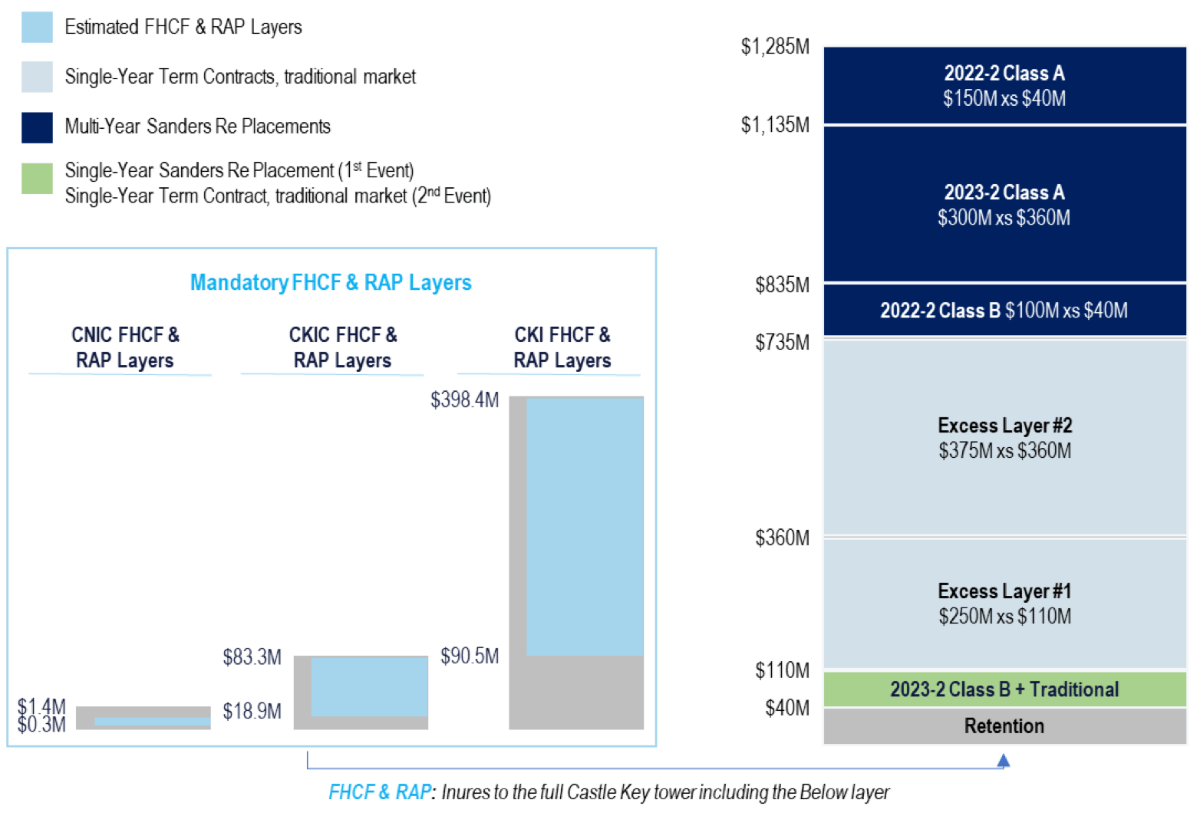

At the June 2023 renewals, Allstate’s appetite to buy as much protection diminished, it seems, with the catastrophe excess of loss reinsurance tower for Florida now topping out at a much lower $1.285 billion.

The insurer has managed to keep its retention for its main Florida excess catastrophe reinsurance tower at just $40 million, the same as the prior year.

The layer above again features a one-year zero-coupon catastrophe bond, the $70 million Class B tranche of notes from the most recent Sanders Re III Ltd. (Series 2023-2) issuance that Allstate sponsored in May this year.

That risky cat bond layer occupies a share of the layer alongside traditional reinsurance, attaching after the $40 million retention and exhausting at $110 million of losses.

Above that, traditional reinsurance layers occupy the tower from the $110 million attachment right the way up to $735 million, above which the rest of Allstate’s Florida cat bonds dominate the tower.

Above the $735 million level in Allstate’s Florida reinsurance tower sits three cat bond tranches, two from the Sanders Re III Ltd. (Series 2022-2) cat bond and one from the Sanders Re III Ltd. (Series 2023-2) issuance.

You can see Allstate’s 2023 Florida catastrophe reinsurance tower below. The 2022 tower can be viewed for comparison in this article from last year.

Alongside the main excess of loss layers, Allstate has this year participated in the Reinsurance to Assist Policyholders, or RAP program in Florida.

This has helped it pull down the protection from the state slightly, with it having a lower attachment than a year earlier.

But the overall picture is one of less reinsurance protection in Florida for 2023, likely driven both by a moderated appetite for risk there, as well as the much higher costs of reinsurance in the state.

Reinsurance costs have risen considerably for Allstate in 2023, with the company reporting that, for the first-half, its property catastrophe reinsurance programs, excluding reinstatement premiums, cost $242 million for the second-quarter and $461 million for the first-half.

That’s significantly higher than the $173 million and $317 million cost in the second quarter and first six months of 2022, respectively.

There have been some other changes and renewals in Allstate’s reinsurance program at the mid-year, with a range of nationwide and other reinsurance treaties renewed at June and July 1.

There haven’t been any significant changes to the Nationwide excess catastrophe reinsurance tower of any note, just a few layers renewed around the middle of it, with the coverage it provides the same as after the April renewal date, see our previous article here.

At the mid-year renewals, Allstate also secured reinsurance for its National General Lender Services Standalone Program, with a little more limit procured, but at much higher retention levels.

While, for Allstate’s National General Reciprocal Excess Catastrophe Reinsurance Contracts, and Kentucky Earthquake Excess Catastrophe Reinsurance Contract, there was no change to the expiring coverage at June 1st.

It’s clear Allstate’s Sanders Re catastrophe bond program has become even more important this year, filling out more of both the Nationwide and Florida reinsurance towers and with the multi-year coverage helping the company to moderate the cost increases it faced.

Finally, as we’d reported a few weeks ago, Allstate’s aggregate catastrophe losses for the second-quarter, which is the first quarter of its annual aggregate risk period for some of the Sanders Re cat bonds, had reached $2.7 billion.

This year, the lowest attaching Sanders aggregate cat bond sits at $3.4 billion in the tower, but with this contract featuring a $50 million per-event deductible, it is hard to know how much of the $2.7 billion has qualified to-date.

But, one thing is certain, these aggregate cat bonds of Allstate’s could come under pressure later this year, if the run-rate of catastrophe losses remains high for the carrier. You can see where those aggregate cat bonds sit in the Nationwide tower in this article.

View details of every catastrophe bond ever sponsored by Allstate here.