Alex Potemkin/iStock via Getty Images

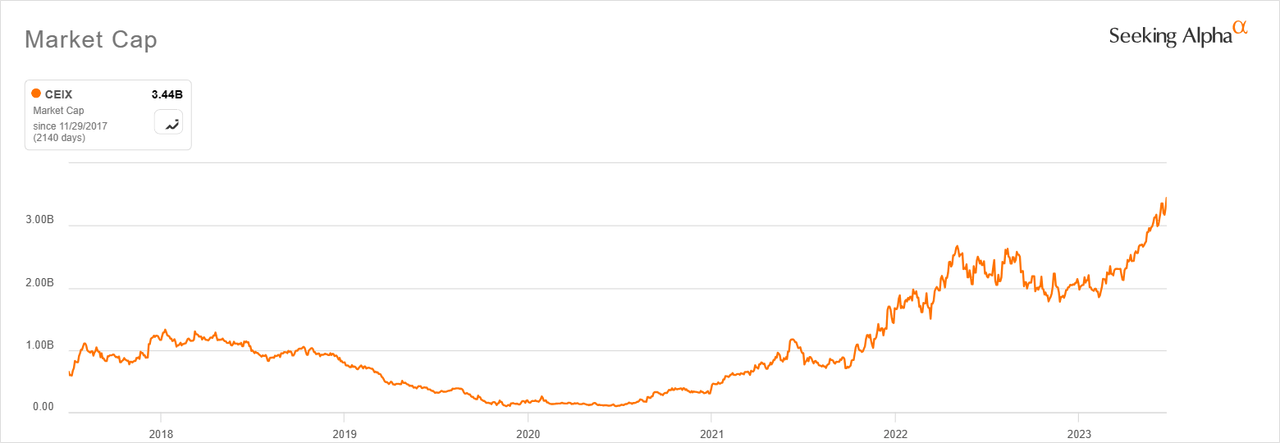

CONSOL Energy (NYSE:CEIX) is on a multi-year uptrend, having gained 366% since the beginning of 2022 and 85% YTD. The US coal miner’s market cap has over this time ballooned to $3.4 billion. CEIX has never been this valuable in its history as a publicly traded company, highlighting the need for bullish investors to carefully consider the risks of buying the stock or adding to their existing positions at current prices.

CEIX market cap at record high (Seeking Alpha)

It’s a generally accepted truth in investing that the riskiest time to buy a stock is when it is approaching its peak valuation. I consider this to currently be the case with CEIX and would advise bulls to proceed cautiously at current prices. Before going into the reasons why I believe CEIX’s stock price has limited room to expand further, it would be useful to briefly recount the main reason for its impressive rally over the past 2 years.

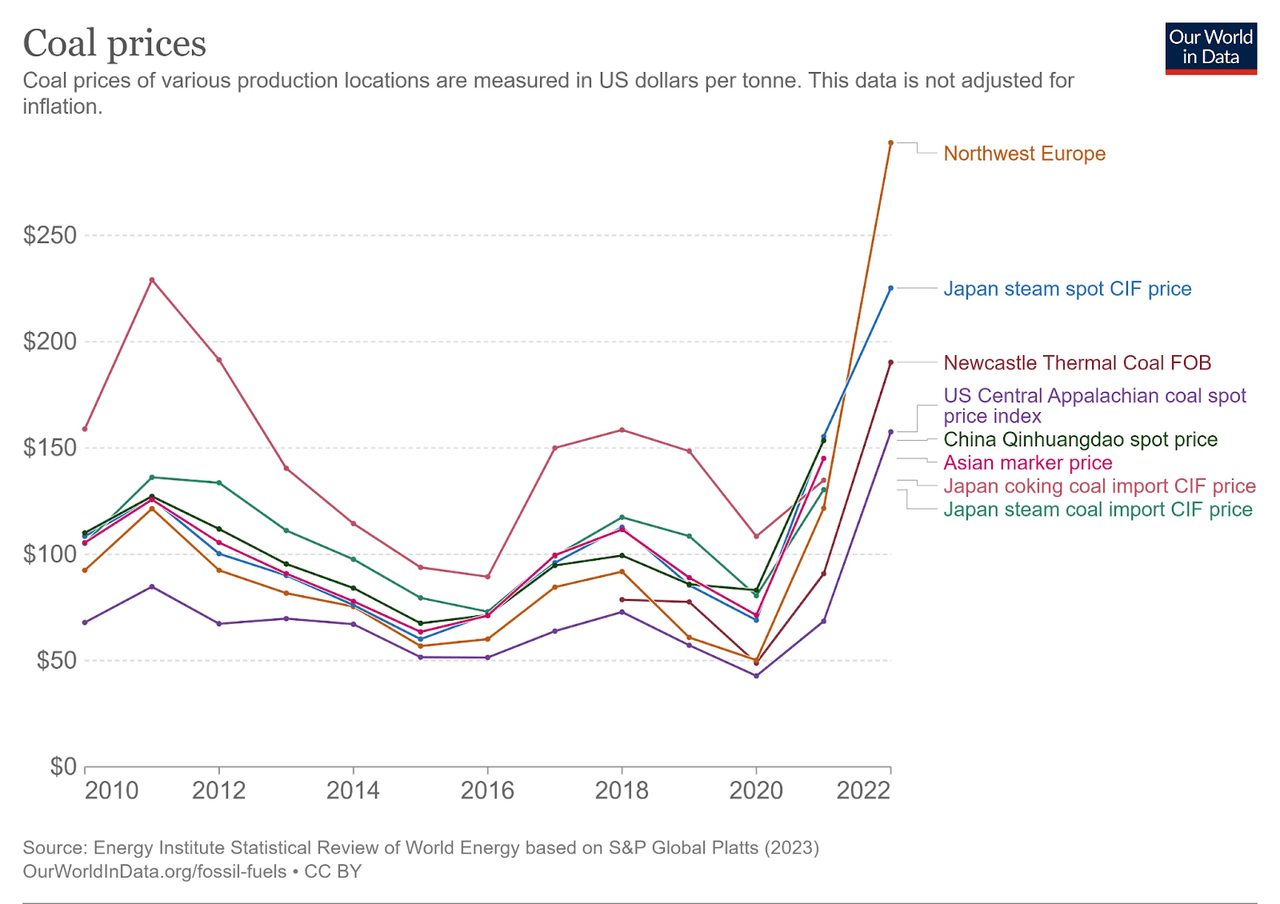

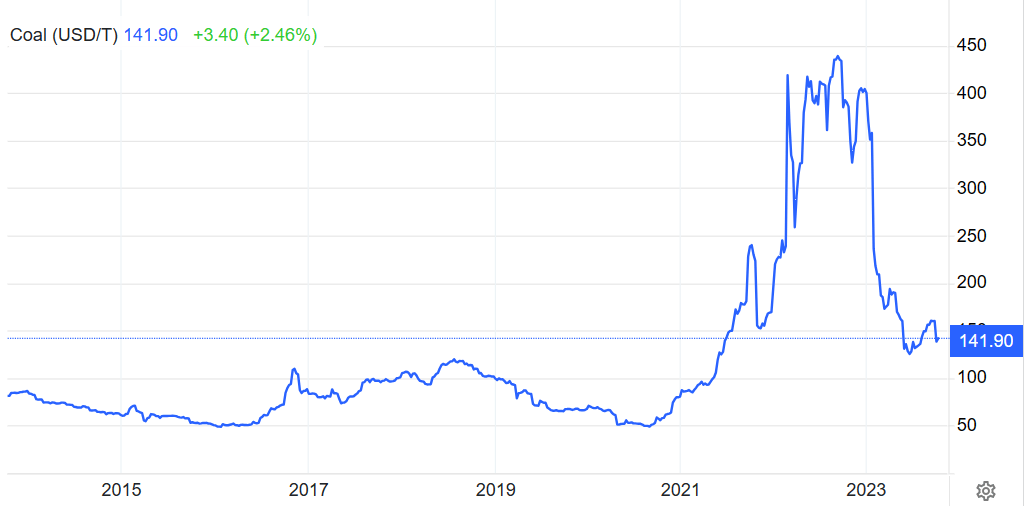

CEIX’s bullish run has largely been fueled by elevated coal prices, which surged in 2021 and 2022 amid broader inflationary pressures in the global economy. High coal prices resulted in windfall profits and record cash generation for CEIX, helping to push the stock higher.

Coal prices surged in 2021 and 2022 (Our World In Data)

When I last covered CEIX in December 2022, I argued that it would sustain its uptrend in 2023 as my expectation at the time was that coal prices would stay elevated on curtailed supply and strong demand. This has come to pass. While the stock is up 48% since my last article vs the S&P 500’s 14%, I’m now less enthusiastic about future returns given the current high valuation and the overlooked macroeconomic risks.

CEIX is not a bargain

Looking at CEIX’s current P/E relative to historical P/E ratios creates the misleading impression that the stock is a bargain. Its FWD P/E of 5.05 is almost 66% lower than its 5-year average of 15.23, according to SA valuation data. The challenge with using P/E, however, is that CEIX is in a highly cyclical industry so looking at the company’s P/E at two different phases of the coal price cycle isn’t practical. Companies in cyclical industries will typically leverage on windfall profits to reduce debt and buyback shares, effectively boosting EPS and affecting the comparability of P/E over different phases of the price cycle.

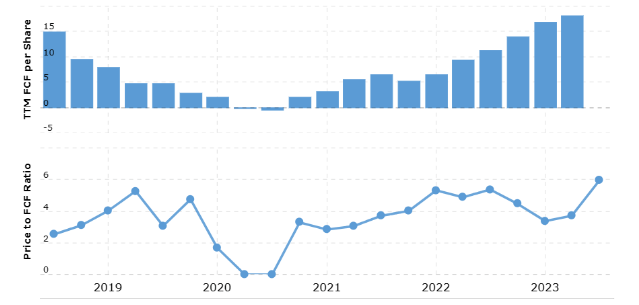

A more reliable valuation metric for a cyclical business is price to free cash flow ratio, as this shows how much the stock is in relation to the free cash the business generates, regardless of fluctuations in earnings.

CEIX Price to FCF ratio at record high (macrotrends)

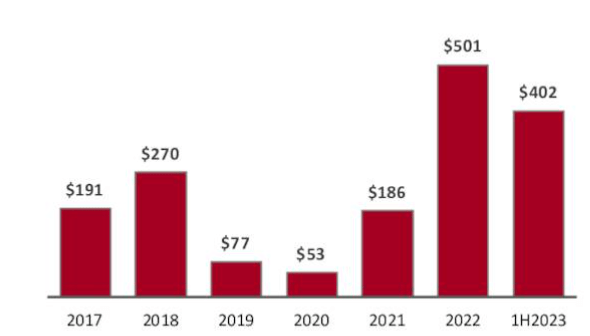

CEIX’s price to FCF ratio is currently at an all-time high despite its FCF reaching record levels. This means that the market has likely already priced in the company’s improved cash position, including the fact that it generated $402 million in H1 2023, an impressive 80% of the total free cash flow generated in the whole of 2022.

CEIX Free Cash Flow Generation (Consol Energy)

It’s also noteworthy that compared with coal mining peers, CEIX’s valuation is highest on the basis of Price/Book, Price/Sales and Price/FCF. Peers selected for this comparison include Peabody Energy Corporation (BTU), Alliance Resource Partners (ARLP), Alpha Metallurgical Resources (AMR), and Arch Resources (ARCH). The data is sourced from Seeking Alpha.

|

CEIX |

BTU |

ARLP |

AMR |

ARCH |

|

|

Price/FCF |

4.41 |

1.78 |

2.74 |

2.91 |

2.98 |

|

Price/Book |

2.64 |

1.01 |

1.64 |

2.22 |

2.03 |

|

Price/Sales |

1.49 |

0.66 |

1.10 |

1.13 |

0.87 |

The possibility of a global recession in 2024 could also lead to a sell-off in CEIX. According to the International Monetary Fund, the global economy is expected to slow down in 2024. This could lower demand for commodities like coal, affecting sale volumes for coal miners and offsetting any benefits from elevated coal prices.

China’s weak economic recovery is further likely to dampen demand for coal, considering it’s the world’s largest consumer of coal. This could lead to prices falling, leading to a deceleration in revenue and earnings growth for CEIX in coming quarters.

Coal prices have moderated in 2023 (Trading Economics)

Coal prices have already moderated significantly in 2023– even though they are still elevated compared to 5 years ago. If prices fall or stay at current levels, CEIX will likely return to a more normal range of revenue and profitability, potentially leading to a decline in its stock price.

Giving credit where it’s due

While I’m not bullish on CEIX’s stock at current prices, I admire how the company’s management team has handled success and the decisions they have made to enhance shareholder value.

CEIX has taken advantage of the windfall profits and record cash it generated in recent quarters to cut its debt by more than half. Total debt levels have declined from $657 million in 2021 to $228 million in 2Q23, its latest earnings presentation shows. As a result, S&P Global Ratings has upgraded CEIX’s corporate credit rating to B+ with a stable outlook, according to statements by CEIX’s President and CFO Mitesh Thakkar in the Q2 earnings call.

CEIX’s management has also demonstrated strong cost discipline, with average cost of coal per ton sold increasing by only $1.52 from $34.81 in 2Q22 to $36.33 in 2Q23. This is against the backdrop of a $9.09 increase in average realized coal revenue per ton sold from $72.18 in 2Q22 to $81.27 in 2Q23. This enabled it to enjoy higher margins and profitability despite fairly flat volumes at 6.4 million tons in 2Q23 vs 6.2 million tons in 2Q22.

CEIX’s strategy to reduce reliance on the domestic US power generation market and instead focus on exports is also timely given the stricter environment standards in the US. Sales to domestic power generation accounted for 23% of total revenue in H1 2023 vs 61% in 2017. “This portfolio optimization of shifting a significant portion of our tons into the export market to offset weakness in the domestic market is a true differentiator for us and reduces our dependence on the shrinking domestic power generation market,” said Mitesh Thakkar on the Q2 earnings call.

Conclusion

CEIX is a well-run business and has historically been a great buy-and-hold investment that has tripled in value in less than 2 years. However, the expression “past performance does not indicate future results” aptly captures my sentiments when it comes to CEIX’s potential future returns. I believe that the current valuation doesn’t leave room for meaningful future returns, especially considering that coal prices are cyclical and have already reduced moderately in 2023 amid a weaker macroeconomic outlook. It may be time for bulls to reduce their exposure or risk learning firsthand the painful truth behind the adage “the market giveth and the market taketh away.”