INFLATION DOMINATES the American standard psyche to an extent not seen because the Nineteen Eighties, when costs had been final rising on the present tempo. Very like complaining concerning the climate or final night time’s basketball playoffs, moaning about increased costs has grow to be a dialog starter. Figures printed on Might eleventh are anticipated to indicate that client costs rose by greater than 8% in April, in contrast with the earlier yr. Newspapers are publishing 4 occasions as many tales mentioning inflation as they did a yr in the past. And, in accordance with a number of polls, People consider inflation is an even bigger drawback for his or her nation than Russia’s invasion of Ukraine. However America will not be alone. Inflation can also be turning into baked into on a regular basis life in different elements of the world.

The Economist has gathered information on 5 indicators—“core” inflation, which excludes meals and power costs; the dispersion in inflation charges for the sub-components of the consumer-price index; labour prices; inflation expectations; and Google searches for inflation—throughout ten huge economies. To gauge the place inflation has grow to be most pervasive, we rank every nation in accordance with the way it fares on every measure, after which mix these ranks to kind an “inflation entrenchment” rating.

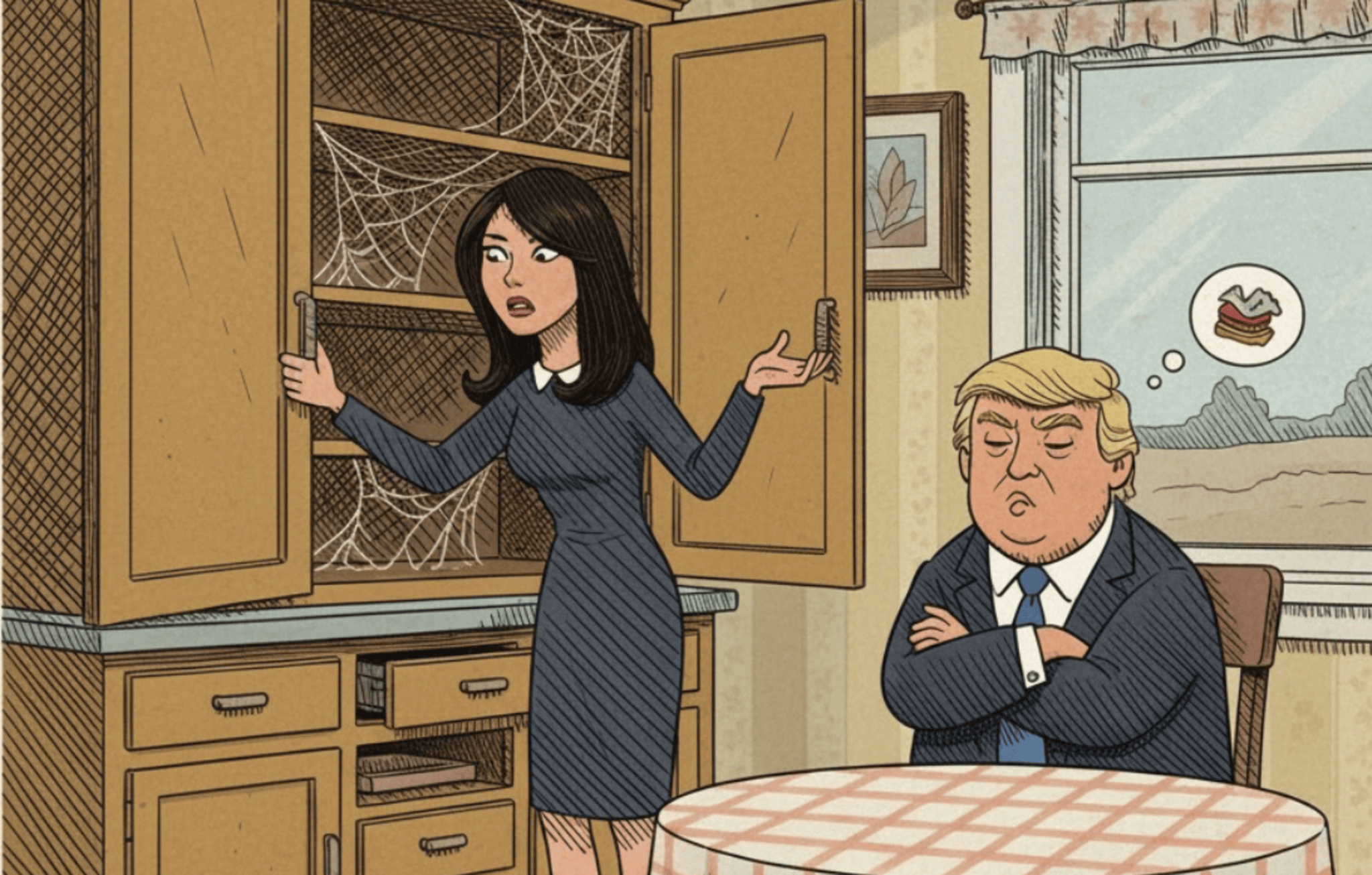

Continental Europe, to this point no less than, appears to have escaped the worst of the scourge. Inflation is leaving barely a hint on Japan. However it’s entwining itself round Anglophone economies. Canada is now faring barely worse even than America. Britain has an enormous drawback on its fingers.

A number of elements clarify what’s going on. Whole fiscal stimulus throughout Anglophone nations in 2020-21 was about 40% extra beneficiant than in different wealthy locations, in accordance with our estimates. It was additionally extra targeted on handouts to households (comparable to stimulus cheques). That will have stoked demand to a better extent. Financial coverage within the euro space and Japan was already ultra-loose earlier than the pandemic, limiting the quantity of additional stimulus central banks might present. Britain’s pervasive inflation may additionally replicate an idiosyncratic issue: Brexit. It seems that breaking along with your largest buying and selling associate may cause prices to rise.

The only element of our rating is the speed of “core” inflation. This measure provides a greater sense of underlying value stress. Amongst our ten nations, America leads the pack (although core inflation is above common just about all over the place).

A second measure, of dispersion, helps seize how broadly primarily based value pressures are. A rustic the place headline inflation is being pushed by one or two gadgets—say, the price of a restaurant meal—is in much less bother than a rustic the place the worth of all the things goes up rapidly. To measure this we divide every nation’s consumer-goods basket into as many as 16 parts, then calculate the share the place the inflation price exceeds 2%. In Japan only a quarter cross that threshold. However in Australia greater than two-thirds do. A current report by JPMorgan Chase, a financial institution, breaks down Britain’s consumer-price index into 85 sub-components, and finds that inflation charges for 69% of them are operating above their 1997-2019 averages.

Inflation might additionally spiral if staff demand increased wages to compensate them for rising costs (and corporations increase their costs in flip). Unit labour prices, which measure the connection between what staff are paid and the worth of what they produce, are rising far sooner than their long-run common in lots of nations. On Might fifth America’s statisticians revealed that these rose by 7% within the first quarter, in contrast with a yr in the past, up from a pre-pandemic common of round 2%. Michael Saunders of the Financial institution of England not too long ago famous that with pay offers being struck at as much as 5% a yr, however productiveness development of solely round 1%, Britain’s unit-labour-cost development might be “effectively above the tempo in step with the inflation goal [of 2%].”

Our final two measures assess households’ expectations. One proprietary information set, offered to The Economist by researchers on the Federal Reserve Financial institution of Cleveland, Morning Seek the advice of, a consultancy, and Raphael Schoenle of Brandeis College, is a uncommon dependable cross-country gauge of public inflation expectations. In Might 2021 a respondent within the median wealthy nation thought inflation over the following 12 months can be 2.3%. Now they count on a price of 4.5%; Canadians, a good increased 6%. A measure of Google searches for inflation reaches an analogous conclusion. Britons now search extra steadily for “inflation” than they do for Taylor Swift.

For extra skilled evaluation of the most important tales in economics, enterprise and markets, signal as much as Cash Talks, our weekly publication.