An increasing number of states now require financial literacy coursework as a graduation prerequisite for high school students. This recognition underscores the importance of imparting core life skills related to budgeting, savings, investing, and debt management. While schools strive to incorporate this coursework, financial institutions are equally enthusiastic about enhancing financial proficiency among their clients’ families. Goalsetter is a B2B financial literacy platform for financial institutions, wealth managers, and credit unions that allows K-12 students and their families to learn more about personal finance in an engaging and age-appropriate way. The platform’s award-winning curriculum combines elements of gaming, GIFs, and pop culture references to foster meaningful engagement. Goalsetter has forged strategic partnerships with major financial service providers to offer their clients a white-label turnkey youth banking solution. The company presently offers savings account and spend management tools with plans to integrate more live banking capabilities into the platform, leveraging its strong relationships with financial institutions and credit unions.

AlleyWatch caught up with Goalsetter Founder and CEO Tanya Van Court to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding raised to $39.7M, and much, much more…

Who were your investors and how much did you raise?

This newest round for Goalsetter was a Series A extension and was led by an affiliate of Edward Jones and MassMutual through its MM Catalyst Fund. Series A investors Fiserv, Webster Bank, Seae Ventures, Astia Fund, and Partnership Fund for New York City also participated in the round along with new investors Reseda Group and InTouchCU.

Tell us about the product or service that Goalsetter offers.

Goalsetter offers financial institutions, credit unions, and wealth management providers with an award-winning, education-first family finance and technology platform that is centered around fun and engaging financial literacy tools that empower K-12 students and their families. In 2022, Goalsetter was recognized by Fast Company as one of the “Brands That Matter,” underscoring its cultural and social impact and the innovative value it brings to the financial education space.

What inspired the start of Goalsetter?

I was inspired to start the company after my 8-year-old daughter asked for an investment account and a bike for her ninth birthday. I realized the potential impact of equipping every child in America with the tools to save and invest, thus changing their roles from consumers to savers and investors.

How is Goalsetter different?

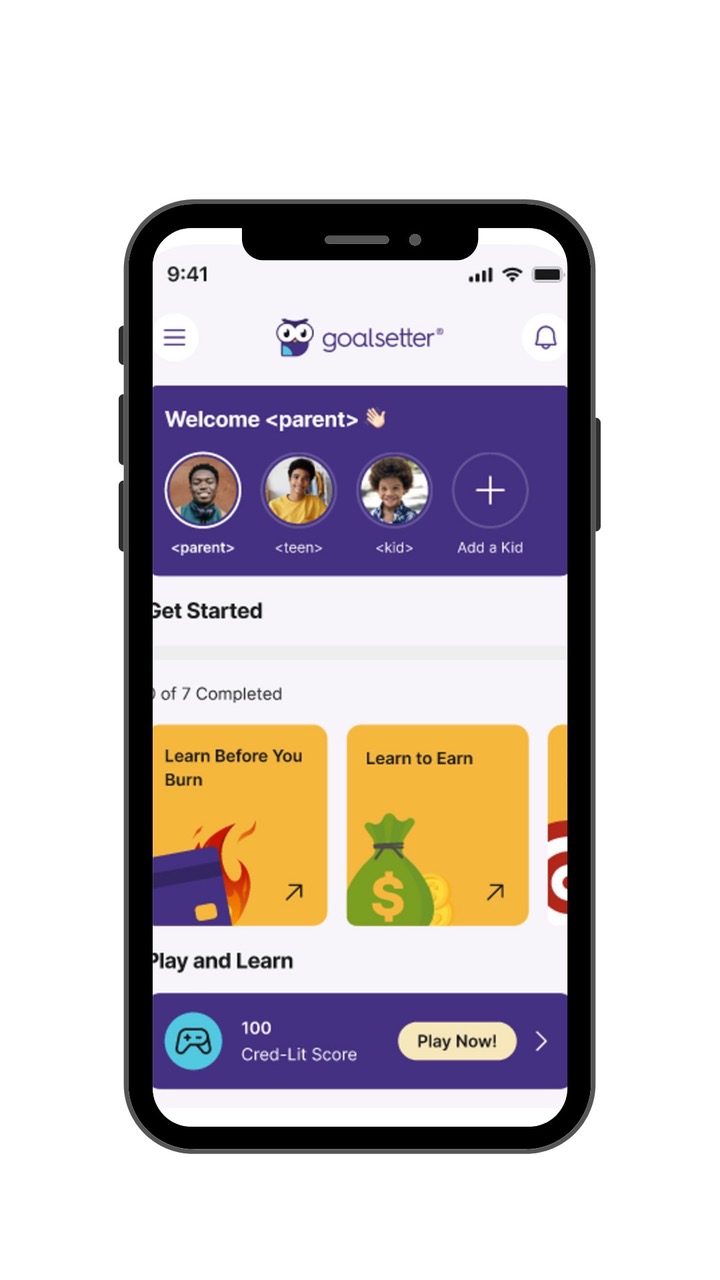

Goalsetter is different in that it focuses on educational-first financial solutions, aiming to teach kids and teens the language of money in a relatable and engaging way through games, GIFs, and pop culture references. It offers a full suite of financial tools including FDIC-Insured Savings Accounts, investment platforms, and parental control features like “Learn to Earn,” which allows kids to earn money by answering financial quiz questions, and “Learn Before You Burn,” which freezes their debit cards if they don’t take weekly quizzes. This approach targets building generational knowledge and wealth from kindergarten to graduation and beyond.

What market does Goalsetter target and how big is it?

Goalsetter primarily seeks to work with financial institutions, credit unions and wealth management companies to engage the K-12 youth market and their families. This demographic is digitally native, highly diverse, and is estimated to be about 68 million strong in the U.S., representing 25% of the population and holding $140B in spending power. It’s a significant market with a substantial influence on current and future financial trends.

What’s your business model?

Goalsetter’s business model includes partnering with financial institutions, credit unions, wealth management companies, and school systems to white-label its platform. These partnerships and the B2B model allow Goalsetter to distribute its educational tools and financial services more broadly, transforming access to financial education in America.

How are you preparing for a potential economic slowdown?

Diversifying revenue streams, managing burn alongside growth opportunities, doubling down on efforts to achieve profitability and growing as revenue comes in.

What was the funding process like?

We have a robust business model, strong traction, and a strong pipeline, and that’s what funders want to see. Funders appreciate pivots when the economy changes, but are wary of purported pivots without strong plans. Goalsetter has been a B2B-focused fintech since we secured our initial Series A round 2 years ago, and have executed on that strategy to serve credit unions, banks, wealth management firms, and school systems with a platform that helps them both secure and financially prepare the next generation of their customers. Our investors saw the value prop we bring to the table for our enterprise customers and were excited to join the journey with us. This resulted in a fairly straightforward raise process, since we have a proven B2B business model and sought capital from strategic partners who recognize the need for Goalsetter’s solution in the ecosystem.

What are the biggest challenges that you faced while raising capital?

The biggest challenge we faced was people confusing Goalsetter with the B2C teen banking platforms in the market. Once they understood both how different our product is and how differentiated our business model is, things fell into place. We are a market leader in B2B financial services offerings, and are 100% aligned with financial institutions and their needs. We are not a B2C fintech play that is trying to disrupt the ecosystem – we are actually bolstering the financial services ecosystem. That means our model, our customers, our partners, and our future market opportunities are significantly different than the teen challenger banks.

What factors about your business led your investors to write the check?

Goalsetter’s investors recognized that we are a market leader in B2B financial services offerings, and are 100% aligned with financial institutions and their needs. We are not a B2C fintech play that is trying to disrupt the ecosystem – we are actually bolstering the financial services ecosystem. The successful execution of our enterprise go-to market strategy that reaches credit unions, banks, wealth management firms, and school systems tells the story for us.

What are the milestones you plan to achieve in the next six months?

In the next six months, we will continue to enhance our product suite, and sign and launch new partners. We will use our additional capital to grow our human resources and our technology resources at a measured pace, ensuring that we are growing where our partners need us most and where the greatest opportunities for extension and expansion are in the financial services and educational ecosystems.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

The advice that we give to those companies is that during lean times, you have to sit down and do a strategy session focused on the 3 P’s: Pivot, Profit, and Partnerships. Can you pivot to make your business stronger in the existing economy – is there something different you can do to position yourself for success? Can you achieve profitability by diversifying your revenue stream or taking advantage of short-term opportunities that can help you to weather the storm and prepare yourself for long-term growth? Partnerships: What partners do you have on your team or in your ecosystem who are essential and can fuel your growth? How can you deliver outsized value to them, enabling them to also deliver outsized value to you?

Where do you see the company going now over the near term?

Goalsetter has already paved the way for what family finance should look like, and we are powering more and more financial institutions that realize that the future of finance is family finance. We are going to continue to help credit unions, community banks and wealth management firms to be relevant to the next generation, and our product will allow them to move as quickly as the next generation moves with respect to their ever-changing technology tastes and interests.

Our nation has seen entire industries upended by technology disruptors who target the next generation of customers and peel them away when they are 16 and 17, and the financial services industry is no different. They are in danger of disruption, and our constant evolution is helping them to remain with a viable suite of offerings as the country’s financial landscape – and financial services users – evolve.

What’s your favorite restaurant in the city?

Tatiana in Brooklyn. The crispy okra is fantastic, and my 8-year old tells me there is no shrimp quite like Mom Dukes shrimp.