Boy Wirat

Funding overview

I wrote about Semrush Holdings (NYSE:SEMR) beforehand (29 Could 2024) with a maintain ranking, as I felt that the valuation was now not engaging when in comparison with friends. SEMR 2Q24 outcomes have been stuffed with positives and have made me really feel extra optimistic concerning the potential for extra development acceleration over the medium time period. Nonetheless, I need to see extra proof that the methods employed right this moment can proceed to work. As such, contemplating that the near-term upside has been priced in, I stay hold-rated.

One other spherical of stable efficiency

Complete 2Q24 income (introduced on August fifth) noticed $91 million, with a $1 million contribution from the Brand24 acquisition. This efficiency was barely above consensus estimates of $89.7 million. On a y/y foundation, whole income grew 21.8% in 2Q24, a 70bps acceleration from 1Q24. Adj gross margin additionally expanded by 60bps y/y. Sturdy development and an expanded gross margin led to adj EBIT enlargement from 3.1% in 2Q23 to 13.4% in 2Q24.

The notable level is that annual recurring income [ARR] confirmed stronger power. Complete ARR grew 23% (reported 25%, however 2% was from inorganic contribution) in 2Q24, representing a 200bps natural y/y development acceleration from 1Q24 (noticed 21% y/y). Internet new ARR addition, on an natural foundation, was additionally sustained at ~$16 million (much like 1Q24 of $17.1 million).

Progress potential from up/cross-sell obtained higher

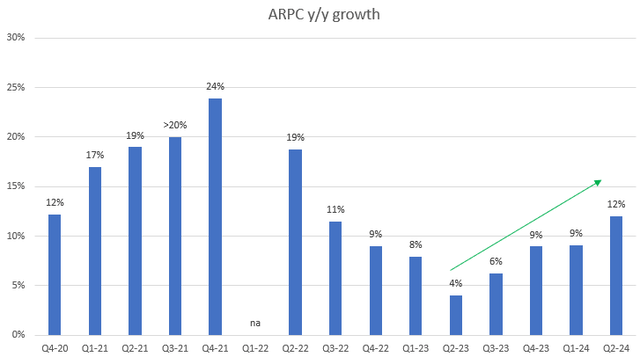

The important thing spotlight from the 2Q24 result’s that the potential development contribution from up- and cross-selling obtained loads higher. Based mostly on the ARR development reported and that SEMR solely added ~4.1 internet new paying prospects in 2Q24 (which is a 12% y/y development), this means {that a} sizeable quantity of ARR development was pushed by a rise in ARPC (common income per paying buyer)—about 12%.

Could Investing Concepts

This marks the primary quarter of ARPC development within the >10% vary since 3Q22, supporting the truth that SEMR is seeing a variety of success in executing on its cross-sell and up-sell technique. With the acquisition of Brand24 and Ryte, I see a stable path for SEMR to march in the direction of mid-to-high-teen ARPC development. Based mostly on my evaluation, SEMR will be capable of develop its footprint throughout the mid-market and enterprise prospects (these are upmarket prospects) as each of those belongings match strategically into the SEMR product ecosystem (Brand24 expands SEMR capabilities in social media and model advertising; Ryte permits SEMR to increase its capabilities in technical search engine optimisation). Right here is crucial factor for traders to notice: Ryte might doubtlessly drive one other 5x ARPC uplift (for SEMR’s core enterprise answer) from the beforehand guided 10 to 15x to fifteen to 20x to 15x-20x.

We consider Ryte permits us to develop our Enterprise portfolio footprint past search engine optimisation and content material advertising by partaking web site builders inside our present and potential buyer base. It’s our expectation that over time, these further options will additional enhance our common ARR per paying buyer. We talked beforehand about our Enterprise search engine optimisation product rising our common ARR for enterprise accounts by 10 to fifteen occasions and we estimate Ryte might additional prolong that enhance by 15 to twenty occasions. Firm 2Q24 earnings

That mentioned, the timing of those uplift contributions is unlikely to occur within the close to time period. Particularly for Brand24 and Ryte, that are guided to develop at an identical fee to the SEMR common over the close to time period, till the cross-selling efforts take maintain.

That can assist you together with your modeling, I would make just a few further feedback. We count on that the mixed whole of Brand24 and Ryte may have a income development fee much like our company common over the near-term, earlier than our cross-selling efforts kick-in. Firm 2Q24 earnings

Stable traction in penetrating upmarket

Recalling my prior submit, through which I famous SEMR ought to begin to see advantages from its Enterprise GO product (which went into basic availability within the earlier quarter), certainly, the outcomes have proven up very properly in 2Q24. The overall variety of prospects with >$10k ARR grew by 37% within the quarter, a 500bps acceleration from 1Q24, and this marked the threerd consecutive quarter of acceleration. Therefore, I’m optimistic concerning the potential right here, because the cross-selling efforts from Brand24 and Ryte haven’t even began but.

Valuation

Could Investing Concepts

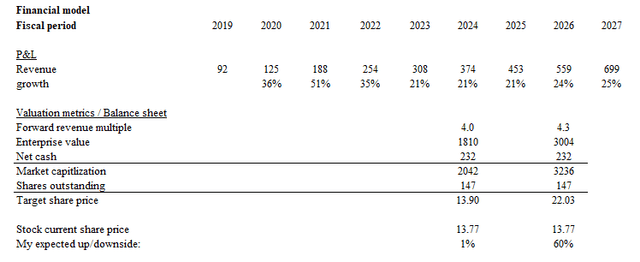

The near-term upside isn’t that engaging if we’re simply specializing in FY25 numbers, because the upsides from cross-selling Brand24 and Ryte merchandise aren’t going to materialize within the close to time period (as administration talked about). Any advantages from a macro restoration will solely get extra materials, in all probability in 2H25 (even after just a few fee cuts within the coming quarters, charges are nonetheless significantly excessive vs. pre-covid ranges). With development not anticipated to speed up in FY25, I consider valuation will commerce at 4x ahead income (because the market comps SEMR towards DoubleVerify Holdings (DV), which is anticipated to develop at low teenagers, has the next adj EBITDA margin, and trades at 4x ahead income).

Nonetheless, if an investor is ready to make investments for the medium time period, the upside could also be engaging as SEMR ought to begin to see development acceleration (from all of the contributing components talked about above), and at that time, the market ought to begin to connect the next a number of to the inventory (I assumed SEMR will be capable of commerce at the place it’s buying and selling right this moment, 4.3x ahead income, a premium to the place DV is buying and selling right this moment).

For myself, I like to observe for just a few extra quarters to see if SEMR is ready to proceed penetrating the upmarket (metrics to observe: ARPC development and variety of prospects with >$10k ARR development) and whether or not the cross-selling technique will proceed to work (metric to observe: ARPC development, and any qualitative feedback about this, particularly relating to the Brand24 and Ryte merchandise, might be drastically appreciated). With this mindset and the near-term upside being priced in (per my mannequin), I’m nonetheless sticking to my maintain ranking.

Conclusion

I give a maintain ranking for SEMR. Whereas 2Q24 efficiency was nice, marked by robust income development, expanded margins, and accelerated ARR development, and the strategic concentrate on upselling and cross-selling has yielded constructive outcomes, the near-term upside seems to be largely priced in. I choose to observe for just a few extra quarters if the underlying power is sustainable, which can give me extra confidence within the timing of development acceleration; therefore, I maintained my maintain ranking.