JLGutierrez

By Michiel Tukker, Benjamin Schroeder, Padhraic Garvey, CFA

Upside shock to US CPI, however doesn’t distract from deal with jobs

Just a few economists had predicted a 0.3% month-on-month core CPI studying in August, and thus, markets have been stunned by this determine. The pricing of a September lower is now 28bp, so a 25bp lower clearly has choice. However, markets weren’t utterly spooked by the uptick, which exhibits that the deterioration of the labour market is the brand new focus. The yield curve remained disinverted, albeit barely, with the 2Y10Y flattening to simply 2bp.

PPI knowledge on Thursday is the subsequent enter in shaping inflation expectations, however the weekly jobless claims numbers may find yourself drawing extra consideration. The final studying was effectively according to consensus, and this time expectations are for the quantity to stay secure. With lingering issues about a pointy deterioration of the roles market, a major draw back shock may persuade markets {that a} 50bp lower in September remains to be a chance.

ECB will lower once more, however a consecutive October lower appears unlikely

All economists on Bloomberg predict a 25bp lower by the ECB, and right here markets will definitely not be caught unexpectedly. Extra attention-grabbing stands out as the ahead steering with which the lower is delivered, though we don’t have excessive expectations about this. As an alternative, the ECB is more likely to simply reiterate the data-dependent method and depart the trail ahead utterly open.

Wanting forward, markets are nonetheless pricing in round a 40% probability of one other lower for October, which, in our eyes, is very unlikely. If Christine Lagarde emphasises the significance of quarterly projections in the course of the communications, then that proportion may diminish significantly. Solely a extreme deterioration of the financial system would warrant an October lower, however given the restricted quantity of further knowledge out there by then, this opportunity appears negligible.

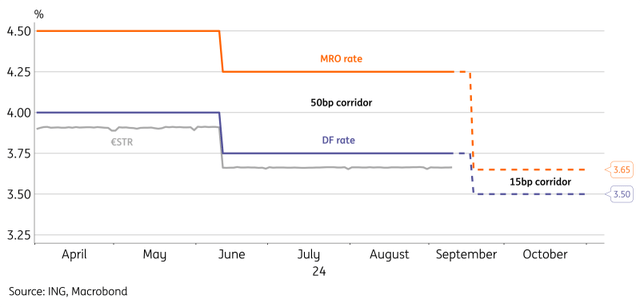

The ECB will even slim the hall between the principle refinancing charge and the deposit facility charge from 50bp to 15bp, as a part of the broader assessment of the operational framework. This needs to be seen as a technical adjustment and never a loosening of financial coverage. With loads of extra liquidity within the system, the deposit charge is the essential coverage charge for now, and thus, market charges (i.e. ESTR) shouldn’t be impacted by this tweak.

ECB will tweak the principle refinancing charge, however this should not influence market charges

Thursday’s occasions and market views

Apart from the ECB’s coverage charge determination, we’ve US PPI numbers. The PPI excluding meals, power and commerce is anticipated to return in at 0.2% MoM, which ought to assist inflation converge in direction of the goal.

Provide consists of 3Y & 7Y BTP auctions from Italy (totalling €6.5bn), and Eire with a 7y inexperienced bond and a 10y bond, for a complete of €1bn. Later within the day, we’ve the US with a 30Y Bond for $22bn.

Content material Disclaimer

This publication has been ready by ING solely for info functions regardless of a selected person’s means, monetary scenario or funding aims. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Unique Submit