By Leika Kihara

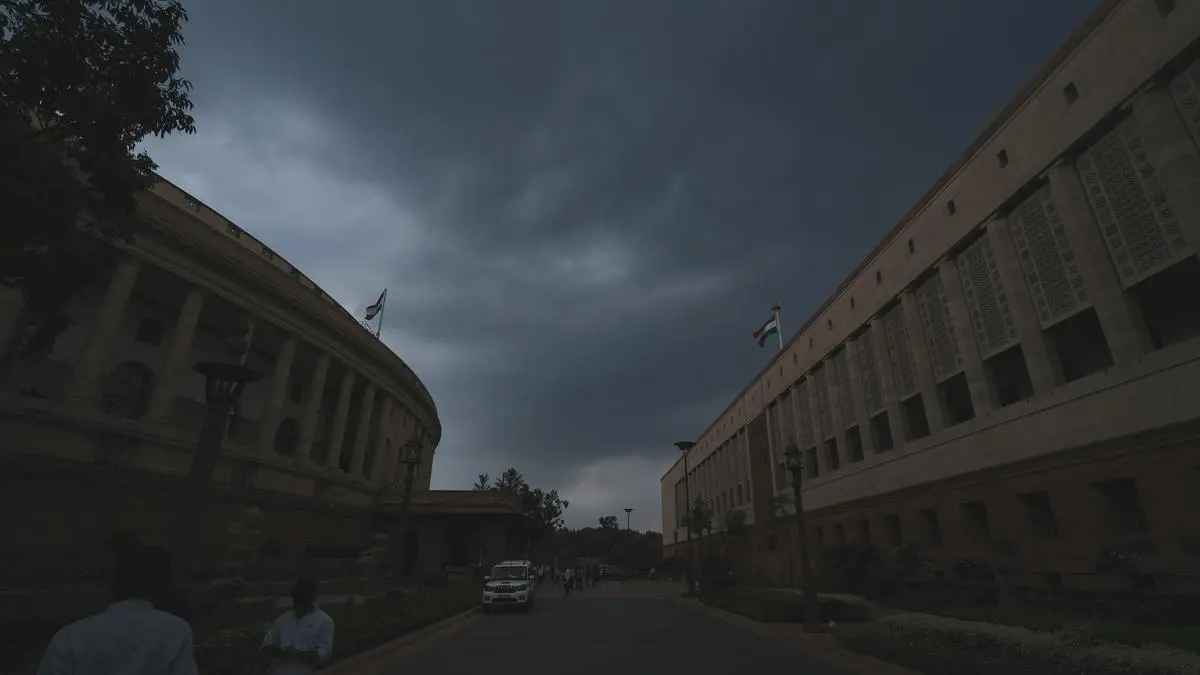

TOKYO (Reuters) -Japan’s ruling get together management race, which can decide who turns into subsequent prime minister, may complicate the central financial institution’s plan to normalise ultra-loose financial coverage.

Listed below are some particulars on how the end result of the LDP management election, to be held on Sept. 27, may have an effect on the timing and tempo of the Financial institution of Japan’s (BOJ) future rate of interest hikes.

WHO ARE THE FRONT-RUNNERS?

Among the many 9 candidates, three are seen as front-runners who may make it to the run-off: former defence minister Shigeru Ishiba, former surroundings minister Shinjiro Koizumi and Sanae Takaichi, minister answerable for financial safety.

WHAT ARE THEIR VIEWS ON MONETARY POLICY?

Most candidates, together with Ishiba and Koizumi, seem to endorse the thought of rates of interest rising steadily.

Koizumi mentioned he would respect the BOJ’s independence in setting financial coverage. Ishiba has mentioned the BOJ was on the “proper coverage observe” by ending detrimental rates of interest, although he lately mentioned Japan should prioritise making a full exit from deflation.

Probably the most vocal opponent of coverage normalisation is Takaichi, who mentioned the BOJ hiked charges too early, and that borrowing prices have to be stored low to keep away from hurting client sentiment.

HOW COULD THE RACE OUTCOME AFFECT BOJ POLICY, MARKETS?

The BOJ could also be compelled to delay the timing of fee hikes if Takaichi turns into prime minister, or takes up key posts similar to finance minister, given her desire of low borrowing prices.

A Takaichi victory may subsequently push down bond yields and weaken the yen – an unwelcome prospect for policymakers wanting to have markets in tune with its plans to exit unfastened financial situations. Nevertheless, bond yields could rise within the longer run if she vows to compile a giant spending package deal that would result in elevated debt issuance.

Takaichi has known as for “strategic” spending with out providing particulars. Koizumi additionally pledged emergency payouts to small companies and low-income households hit by rising dwelling prices. Neither has elaborated on the scale of spending, or how it is going to be funded. Often called a fiscal hawk, Ishiba has known as for getting Japan’s fiscal home so as.

HOW WOULD THE POLITICAL CALENDAR AFFECT BOJ POLICY?

The winner of the Liberal Democratic Get together’s (LDP) management race is about to develop into subsequent prime minister because of the get together’s dominance in parliament, and is more likely to name a snap election that may very well be held as early as Oct. 27.

The BOJ could want to keep away from drawing undesirable political consideration by mountain climbing charges across the time of the election, which implies policymakers could wait at the very least till December to hike charges once more.

After the Sept. 19-20 assembly, the BOJ subsequent holds a coverage overview on Oct. 30-31 when it is going to additionally problem contemporary quarterly development and worth estimates.

A majority of economists polled by Reuters anticipate the BOJ to boost charges once more this yr, following its shock July hike, with greater than three-quarters of them betting on a hike on the Dec. 18-19 assembly.