Yves right here. This can be a helpful overview of the Trump tariffs and tax scheme. Word that this publish forecasts, as nearly any economically literate look does, that new tariffs will decrease progress compared to present circumstances.

This text doesn’t deal with the probably improve in inflation. A purpose for the dearth of a lot in the way in which of estimates is the affect is difficult to work out. For example, from CNBC:

Precisely how a lot larger costs would go is difficult to say. The connection actually isn’t as easy and direct as some Democrats have prompt by contending that tariffs would perform as a “20% gross sales tax,” says Clark Bellin, chief funding officer at Bellwether Wealth.

“Particularly if you throw the inflation we’ve been having into the combination, it’s exhausting to give you a line merchandise like, ‘That is how a lot issues have gone up due to tariffs,’” he says.

Vox raises the query of whether or not Republicans on Supreme Court docket would block these measures. I assume that the Democrats are usually not anticipated to joing per the abstract of Napoleon’s recommendation: “Don’t get in your enemy’s manner when he’s making a mistake.”

Word that Vox additionally discovered consultants that aren’t deterred from estimating the affect of Trump tariffs however their determine differ broadly. From Vox:

Although Trump inherits a robust financial system and low inflation, he’s proposed a ten to twenty p.c tariff on all imports, and a 60 p.c tariff on all imports from China. The Price range Lab at Yale estimates that this coverage alone might increase client costs by as a lot as 5.1 p.c and will diminish US financial progress by as much as 1.4 p.c. An evaluation by the assume tank Peterson Institute for Worldwide Economics, finds that Trump’s tariffs, when mixed with a few of his different proposals corresponding to mass deportation, would result in inflation rising between 6 and 9.3 p.c…..

If Trump pushes by means of his proposed tariffs, they are going to undoubtedly be challenged in court docket — and, most certainly, within the Supreme Court docket…

Will this Supreme Court docket allow Trump to enact insurance policies that would sabotage his presidency, and with it, the Republican Social gathering’s hopes of a political realignment that would doom Democrats to the wilderness?

The authorized arguments in favor of permitting Trump to unilaterally impose excessive tariffs are surprisingly robust. A number of federal legal guidelines give the president exceedingly broad energy to impose tariffs, and the boundaries imposed by these statutes are fairly obscure.A presidential proclamation imposing such tariffs wouldn’t be unprecedented. In 1971, President Richard Nixon imposed a ten p.c tariff on practically all overseas items, which a federal appeals court docket upheld. Congress has since amended a few of the legal guidelines Nixon relied on, however a key provision permitting the president to manage importation of “any property through which any overseas nation or any nationwide thereof has or has had any curiosity” stays on the books.

The judiciary does have a technique it would constrain Trump’s tariffs: The Supreme Court docket’s Republican majority has given itself an unchecked veto energy over any coverage choice by the manager department that these justices deem to be too formidable. In Biden v. Nebraska (2023), for instance, the Republican justices struck down the Biden administration’s major scholar loans forgiveness program, even if this system is unambiguously approved by a federal statute.

Nebraska suggests a Nixon-style tariff needs to be struck down — at the very least if the Republican justices need to use their self-given energy to veto government department actions persistently. Nebraska claimed that the Court docket’s veto energy is at an apex when the manager enacts a coverage of “huge ‘financial and political significance.” A presidential proclamation that would carry again 2022 inflation ranges actually appear to suit inside this framework.

The Vox piece has extra element on potential authorized jousting.

By Invoice Haskell. Initially printed at Offended Bear

Since now we have a brand new president who favors Tariffs, we must always begin speaking about how these Tariffs will affect the US Financial system and Residents. The Tax Basis provides up a quick rationalization which needs to be readily comprehensible for Offended Bear readers. If Trump is ready to pull this off and get it out of Congress, I don’t see a lot favoring it when it comes to financial progress. Then there’s additionally protecting the prices of the 2017 Tax Cuts and Jobs Act (TCJA) which has but to pay for itself in financial progress.

The TCJA was purported to die underneath a Biden Admin. Biden eliminated himself as a candidate and Democrats misplaced an election by not turning out. Which is similar to what occurred in 2016 with Clinton v Trump. Should be that Dems don’t favor ladies because the Presidents? Extra of that later once I can study the numbers.

There are a number of sources to this commentary on Trumps Tariffs and Tariffs in gemeral. I’ve linked to every if you want extra info or examine my feedback additional.

Introduction

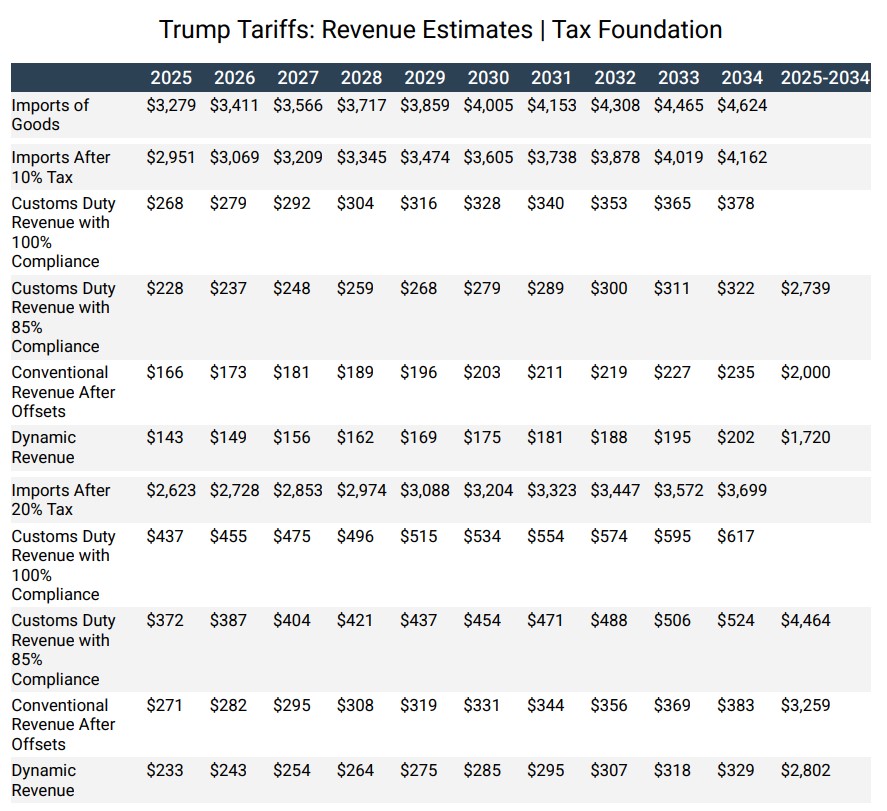

President-elect Donald Trump has proposed to implement a common baseline tariff on imports when he takes workplace. We estimate a ten p.c common tariff would increase $2 trillion and a 20 p.c common tariff would increase $3.3 trillion from 2025 by means of 2034, earlier than factoring in how the taxes would shrink the US financial system.

In 2025, a ten p.c common tariff would improve taxes on US households by $1,253 on common and a 20 p.c common tariff would improve taxes on US households by $2,045 on common.

Income raised by tariffs would fall quick of what’s wanted to completely offset the income losses of constructing the expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA) everlasting.

Income Estimates of Trump’s Common Baseline Tariffs (Billions)

Course of to Estimate the Income Affect of a Tariff

To estimate how a lot income a common tariff raises? We begin with a baseline projection of products imports over the subsequent decade. Imposing a tax on imports would scale back purchases of foreign-produced items, leading to fewer imports. We apply an import elasticity of -1 to venture how imports would fall in response to a ten p.c tariff and a 20 p.c tariff. How a lot imports shrink thus varies with the utilized tariff fee, implying that doubling the speed doesn’t double the income.

From there, we multiply the import tax base by the inclusive tariff fee (the speed divided by one plus the speed) to estimate preliminary customs responsibility income raised underneath good compliance earlier than making an adjustment to mirror an 85 p.c compliance fee, which represents the typical tax hole.

After the compliance changes and earlier than accounting for revenue and payroll tax offsets; we estimate a ten p.c common tariff would generate $2.7 trillion of customs responsibility revenues and a 20 p.c common tariff would generate $4.5 trillion of customs responsibility revenues.

The Whole Income Raised

The whole income raised can be lower than the customs responsibility income generated by the tariff as a result of tariffs cut back incomes (taxes paid as talked about above), lowering revenue and payroll tax collections. Accounting for revenue and payroll tax offsets, our standard income estimate finds that the ten p.c tariff would generate $2 trillion of elevated income, whereas the 20 p.c tariff would generate $3.3 trillion over a decade.

And The Financial system?

Each taxes (Tariffs) would shrink the dimensions of the US financial system. The dynamic scores are smaller: $1.7 trillion for the ten p.c tariff and $2.8 trillion for the 20 p.c tariff. If overseas international locations retaliate, even partially, to the US-imposed tariffs, income will fall additional because the financial system shrinks much more. For instance, we estimate a ten p.c tariff on all US exports would shrink tax revenues on a dynamic foundation by greater than $190 billion over 10 years.

Tariffs Tried?

Second Time period President Trump as soon as stated throughout his first time period. Certainly one of his major overseas coverage objectives was to rein in world adversaries like China and take U.S. commerce companions to activity for rising commerce deficits (outlined as U.S. imports exceeding exports). Trump’s method to reaching this objective was enacting tariffs, particularly specializing in China. These tariffs have negatively impacted commerce between the U.S. and China, main importers to shift towards Mexico’s west coast as a substitute of delivery on to the USA. In consequence, commerce between Mexico and China has grown by 60% in a single 12 months. And . . . product was being trucked north to the U.S. The tariffs have been circumvented with a further step. Mexico gained and the US? Nothing . . .

The tariffs had been supposed to profit the typical American citizen, who would then purchase cheaper merchandise made at residence. One other instance and this time with Metal. The US tried to cease the sale ofa metal firm. In a single politically charged instance, U.S. Metal made the primary strikes to promote the corporate to the Japan-based Nippon Metal Company regardless of a long time of presidency subsidies. Strategically, this is able to have been a good suggestion if the plant was trendy. It wasn’t. Likelihood are, China will lose on this sale.

That didn’t develop into the fact. The coverage objective of making and safeguarding American jobs failed. A 2021 examine by the U.S.-China Enterprise Council discovered the Trump tariffs resulted in an estimated 245,000 American jobs misplaced.