US non-public funding agency AE Industrial Companions is buying Israeli cyberattack firm Paragon Options, sources near the matter inform “Globes.” Paragon was based by the previous commander of the IDF 8200 intelligence unit Brig. Gen. (res.) Ehud Schneorson, along with former Prime Minister Ehud Barak. AE pays an estimated $900 million – half in money and half in future milestone funds.

The fast cost of $450 million will likely be divided between Paragon’s 400 workers (20%), and the corporate 5 founders (30%). Schneorson, who serves as chairman, CEO Idan Nurick, and Igor Bogudlov, Liad Avraham, and Liran Elkayam. The opposite half of the quantity will go to buyers US enterprise capital fund Battery Ventures and Israeli enterprise capital fund Crimson Dot, which final week noticed one other portfolio firm – cybersecurity firm Notion Level – acquired for an estimated $100-200 million.

Ehud Barak is estimated to personal a number of % of Paragon price $10-15 million pre-tax. His involvement within the firm as one of many entrepreneurs had raised issues with the patrons that Israel’s ruling echelon wouldn’t approve the deal for political causes resulting from its hostility to Barak. Paragon works underneath shut supervision of Israel’s Ministry of Protection, which up to now opposed the sale of cyberattack firm NSO Group to US protection firm L3 for safety causes. So far as is thought, the Paragon deal was not even checked out by the political echelon and was permitted by senior Ministry of Protection officers a number of weeks in the past.

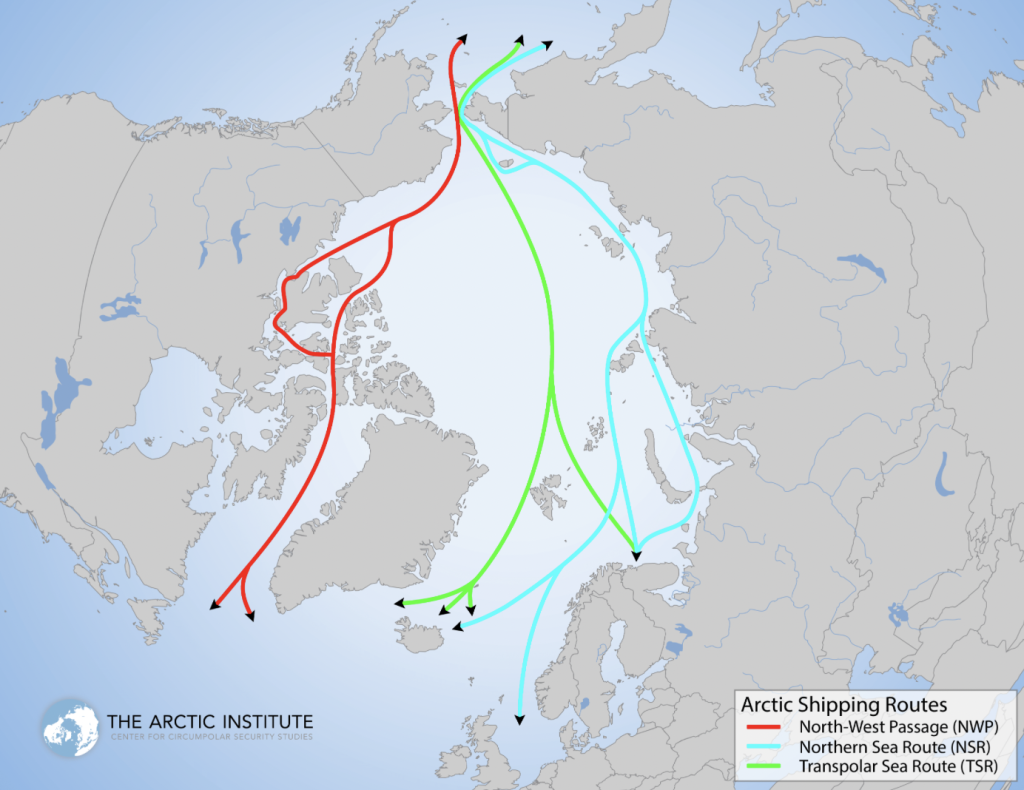

AE, “Globes” has discovered, will merge the Israeli firm into its portfolio cyber firm REDLattice – a protection integrator, which establishes custom-made tasks for the US Division of Protection and English-speaking international locations. The deal will permit Paragon to broaden its market footprint in international locations just like the UK and Eire, Australia, New Zealand and Canada in addition to the US. Sources inform “Globes” that Paragon will proceed to function in Israel as an Israeli firm however the deal features a clause permitting it to export cyberattack know-how to the US.

Eran Gorev, a associate at Francisco Companions and former NSO CEO, invested in Paragon when the corporate was based. Nonetheless, Gorev won’t profit from the exit, if the deal is accomplished, as a result of he bought his shares some years in the past.

In accordance with IVC Analysis, $30 million was invested in Paragon Options within the early 2020s.

RELATED ARTICLES

US non-public fairness agency in talks to purchase cyberattack co Paragon

Paragon has developed software program able to extracting knowledge from encrypted apps

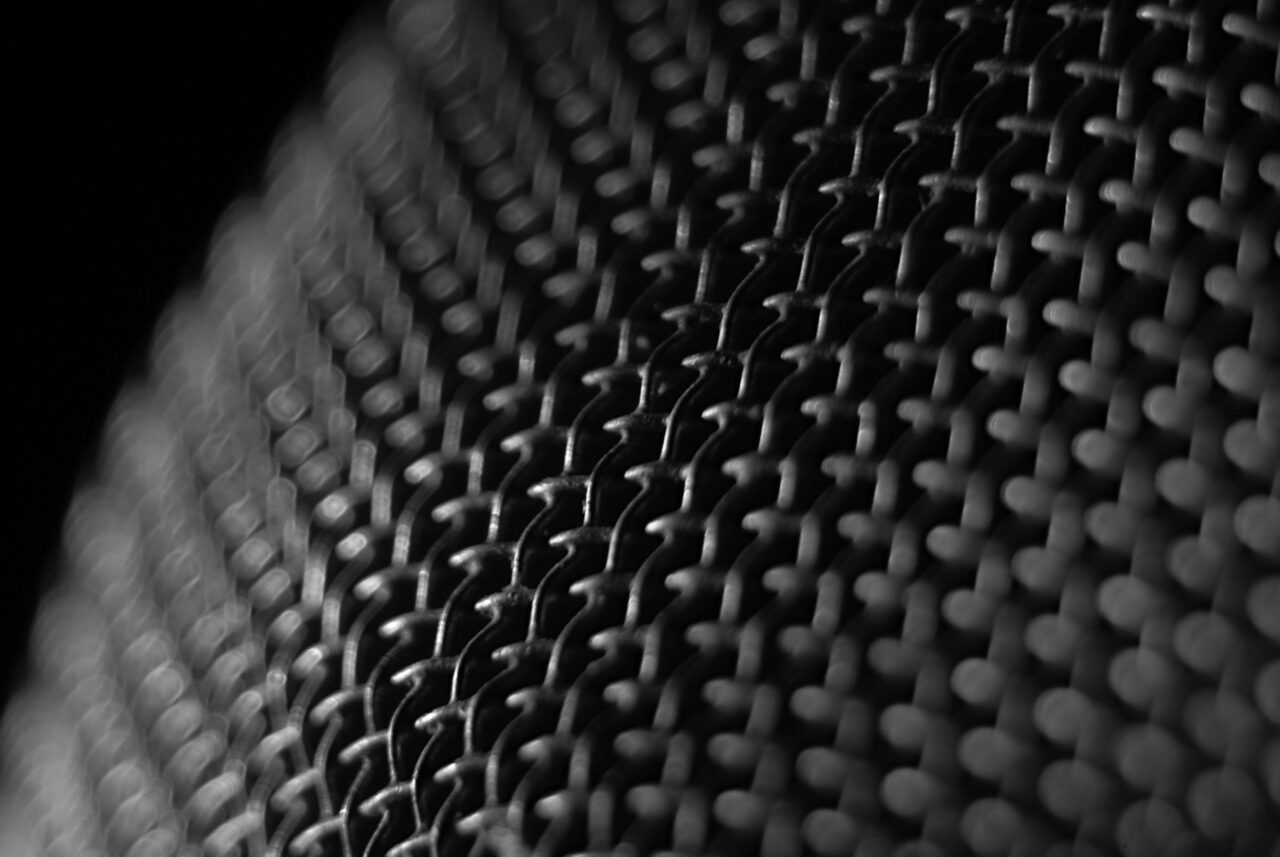

Paragon has developed Malicious program software program referred to as Graphite that may extract knowledge from encrypted messaging apps like WhatsApp, Fb Messenger, Sign and Telegram. Not like different Israeli cyberattack corporations like NSO and Candiru, Paragon Options was based with US funding for the outset to be able to function solely in 34 international locations outlined as democratic in coordination with the safety authorities and native authorized techniques with minimal use of invasion of privateness.

In distinction to NSO’s Pegasus software program, Paragon’s software program doesn’t take photos of the person with their cellphone’s digicam, and so far as is thought, doesn’t use the cellphone’s microphone, however solely information voice conversations within the chat functions. The corporate started promoting its merchandise within the US about two years in the past and its prospects embrace the US Drug Enforcement Administration (DEA) and safety authorities in Singapore, the place, based on a report on the Intelligence On-line web site, it has changed applied sciences of Israeli corporations blacklisted within the US.

Printed by Globes, Israel enterprise information – en.globes.co.il – on December 16, 2024

© Copyright of Globes Writer Itonut (1983) Ltd., 2024