Merchants work on the New York Inventory Alternate on Dec. 17, 2024.

NYSE

This report is from in the present day’s CNBC Every day Open, our worldwide markets e-newsletter. CNBC Every day Open brings buyers on top of things on the whole lot they should know, irrespective of the place they’re. Like what you see? You possibly can subscribe right here.

What you could know in the present day

Dow drops for the ninth day

On Tuesday, the Dow Jones Industrial Common misplaced 0.61%, marking a nine-day shedding streak. The S&P 500 slipped 0.39% and Nasdaq Composite retreated 0.32%. Europe’s regional Stoxx 600 index dropped 0.42%, weighed down by a 1.4% decline in banking shares. Europe’s tech shares, nonetheless, managed to defy the stoop so as to add 0.61%.

What to anticipate from Fed

The U.S. Federal Reserve concludes its two-day rate-setting assembly later this Wednesday. Regardless of sticky inflation and a resilient labor market, the Fed is broadly anticipated to decrease charges by 25 foundation factors. However a CNBC survey of 27 respondents, comprising economists, strategists and fund managers, confirmed that solely 63% assume it is the fitting transfer for the Fed.

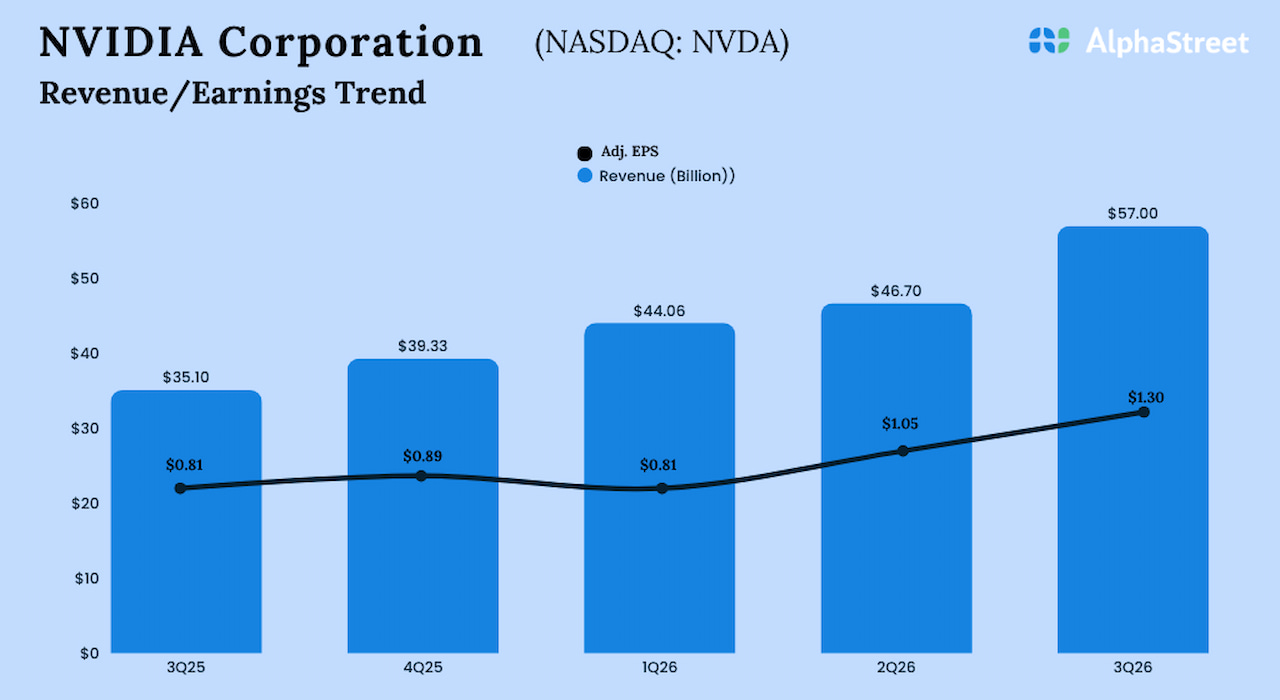

Nvidia and Broadcom fall in tandem

Nvidia shares fell 1.2% on Tuesday, discovering itself deeper in correction territory, sometimes understood as a ten% (or extra) stoop from an all-time excessive shut. Broadcom’s rally additionally misplaced steam, with its shares shedding 3.9%.

Automakers, mix

Japanese automakers Nissan Motor and Honda Motor are contemplating a merger, in accordance with a Tuesday report by The Nikkei. Each corporations are additionally planning to carry Mitsubishi Motors — during which Nissan owns 24%, making it the highest shareholder — beneath the holding firm finally. Each Honda and Nissan neither confirmed nor denied the report.

[PRO] Santa Rally, hurry to the market tonight

The Santa Rally is a phenomenon during which inventory costs rise on the final 5 buying and selling days of the yr and the primary two in January. As soon as the Fed assembly concludes in the present day — and barring any unwelcome shock — markets are poised to welcome Santa Claus and ring within the holidays, stated Financial institution of America.

The underside line

In February 1978, the Bee Gees’ tune “Stayin’ Alive” was the highest Billboard tune of the month. It was additionally the anthem for the Dow Jones Industrial Common, which was combating 9 straight days of losses.

Nearly fifty years forward, the Dow is mired in nine-day shedding streak once more. To take one other cue from the Billboards chart, all buyers need for Christmas is the Dow to cease bleeding pink.

That stated, it isn’t a serious wound for the 30-stock index, regardless of the scary numbers.

The heaviest drag on the Dow is UnitedHealth, which has contributed to greater than half of the index’s decline over the previous eight classes, famous CNBC’s Yun Li. The medical insurance firm was rocked by a deadly capturing of its CEO Brian Thompson in addition to a broader sell-off within the trade.

Exterior the Dow, the inventory market continues to be cheery. Regardless of the S&P and the Nasdaq additionally slipping of their final buying and selling session, each indexes are hovering close to their file closes. This means that it is largely the Dow constituents — “old-economy” shares like industrials, financials and client discretionary — which can be flailing.

“Wall Avenue is waking as much as the truth that a Trump presidency may not be as nice for shares as some individuals hoped,” stated David Russell, world head of market technique at TradeStation. “Financials and industrials jumped on his win however now could must face greater charges and commerce uncertainties, and healthcare faces its best political dangers in current reminiscence.”

Furthermore, the losses for the Dow could be consecutive, however the incline is not that steep. The index is simply 3.6% off its file excessive, and its 50-day shifting common continues to be trending upward.

Although it isn’t as if the inventory market is giving buyers cash for nothing, we nonetheless aren’t fairly in dire straits.

— CNBC’s Yun Li, Michelle Fox, Fred Imbert, Alex Harring, Adrian van Hauwermeiren, Brian Evans and Samantha Subin contributed to this report.