blackred

Pricey Companions,

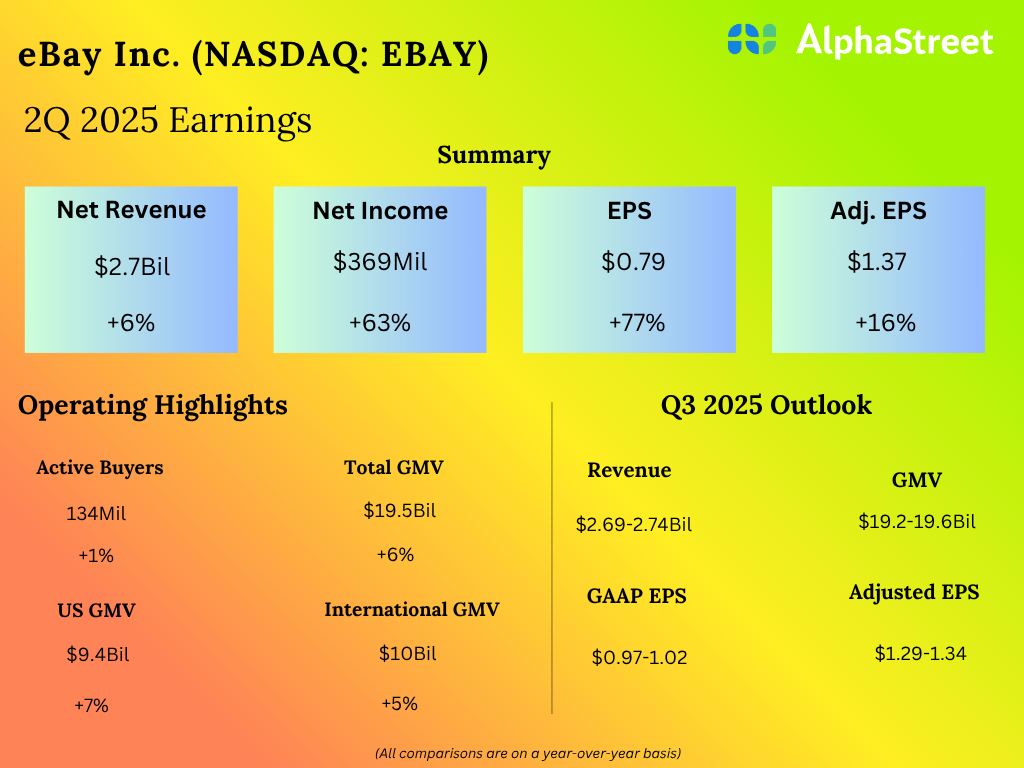

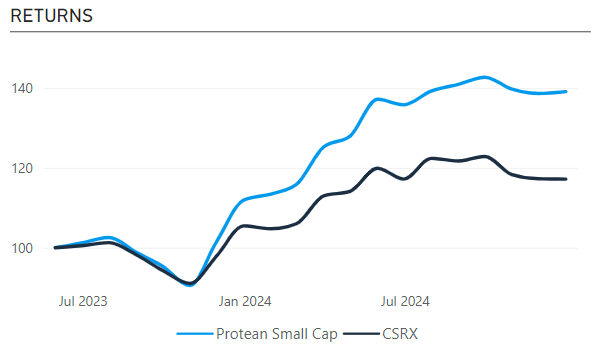

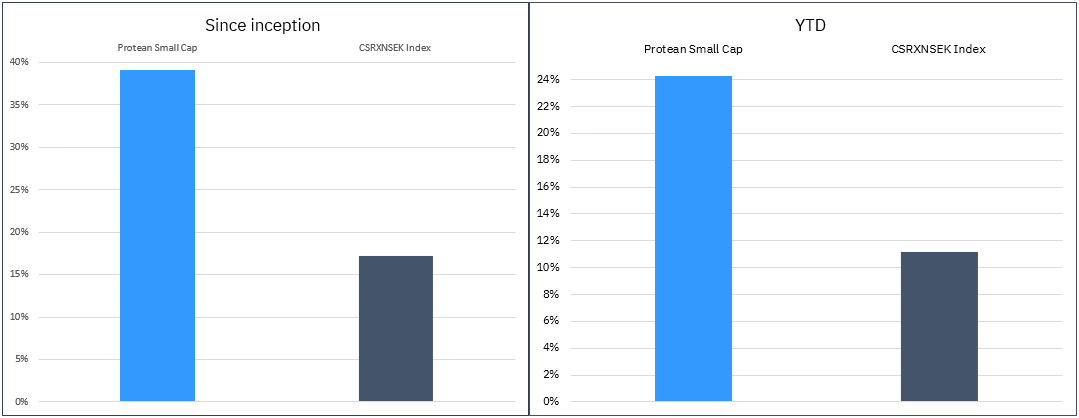

Protean Small Cap beat its benchmark in December. It returned 0.3%, whereas the index retracted by -0.1%. The complete yr 2024 return was 24.3%, 13.2% forward of benchmark. Since launch June 2023 it has gained 39.1%, which is 21.9% forward of the Carnegie Nordic Small Cap Index. A lot happy.

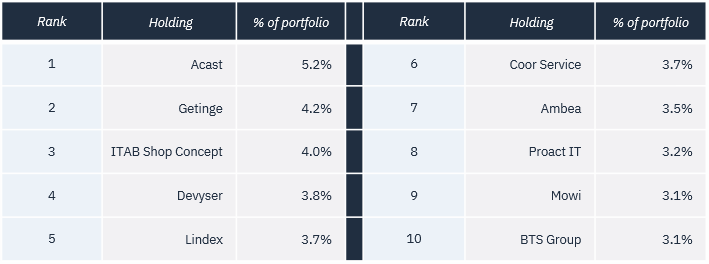

High contributors had been Acast (OTCPK:ACASF), Getinge (OTCPK:GNGBF) and Intea. Detractors embrace Devyser, Proact and ITAB.

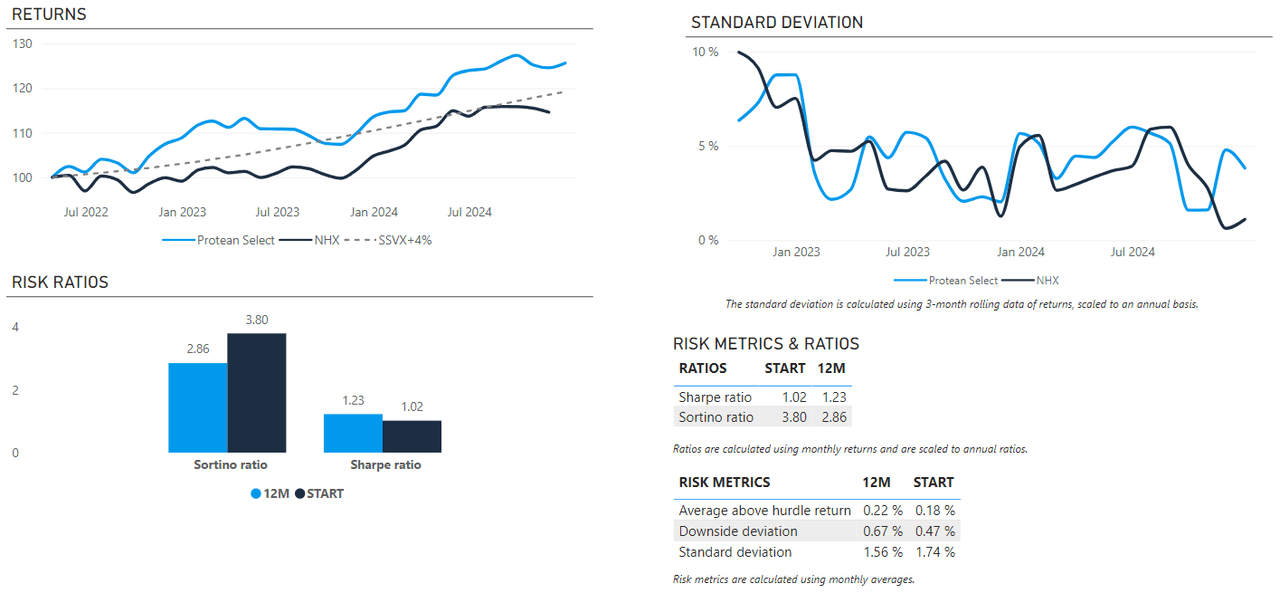

The hedge fund Protean Choose returned 0.8% in December. Full yr 2024 return ends at 10.6% and 25.6% since launch in Might 2022. Volatility for the yr, calculated on day by day returns, was 5.5%, producing a Sharpe ratio of 1.35.

High contributors had been lengthy positions in Getinge and Hexagon (OTCPK:HXGCF), and quick positions in index futures. Notable detractors had been longs in Devyser, Tryg (OTCPK:TGVSF) and a brief place in a basket of small caps.

This month’s letter elaborates on what’s occurred since launch in 2022, what we take into consideration the business construction of the financial savings market, how we plan to handle a market failure with a brand new fund, particulars on efficiency and some holdings, and an extended write-up on current IPO Intea by our new Accomplice and Funding Supervisor Richard Bråse.

Thanks for being an investor!

// Workforce Protean

À la recherche du temps perdu

Protean was shaped in January 2022 and the primary fund launched on Might 2nd of the identical yr. We’ve come a good distance in three years. As we enter 2025, we do it with a workforce of 5, over 200m USD in belongings beneath administration and a 3rd fund about to launch. However most significantly: our efficiency since beginning out is superb within the case of the hedge fund Protean Choose – and glorious, within the case of the Protean Small Cap fund.

After we began the agency, we promised each ourselves and traders that with out cheap returns with cheap danger, we might shut down after three years.

In 2024 Protean Small Cap returned 24.3%. Beating the index by 13.2%. Protean Choose rose 10.6%, with a volatility of 5.5% and a 1.35 Sharpe ratio.

Protean Choose has overwhelmed all Nordic indices since inception, regardless of working a median web publicity of round 35% and common volatility of 6%. We run a diversified guide, with low leverage. This implies we, with virtually mathematical certainty, are unlikely to be on the high of efficiency league tables in any given yr. However then again, we’re more likely to be on the higher half, and crucially: to not be within the backside. Compounding capital at a gradual price, with out catastrophic drawdowns, is the way you get wealthy. Slowly and steadily.

Protean Small Cap is the higher-risk little sister. Small caps are inherently extra risky but additionally holds extra return potential. The drawdowns will be extreme however the upside can be substantial over an extended time period. Since inception in June 2023, it has returned 39% and overwhelmed its benchmark by 22%.

We’re not shutting up store simply but.

It’s miles too straightforward when writing issues like this to finish up sounding like a company drone, glossing over weaknesses and exaggerating efficiency. We see reviews from friends which are so bland and nondescript that one can surprise why even trouble producing them. As Protean grows and ages, we actively stay rebels. Efficiency has been good to this point, however we focus extra on the issues we now have accomplished poorly. Belief me, there are tons of selections the place we in hindsight scratch our heads and surprise what the **** we had been considering.

Why diversify?

Investing is a recreation of decision-making with incomplete info, the place the principles change on a regular basis. For those who as well as sprinkle sketchy info, biases, flows, macro and sentiment on high, there’s ample room for error. For this reason sizing and portfolio construction is essential. A diversified liquid portfolio leaves room for error, because it permits us to course appropriate with out an excessive amount of trouble and market impression.

Diversification is an insurance coverage coverage in opposition to hubris. A self-confidence bordering on delusion is a prerequisite for considering you may beat the market. Subsequently, it’s straightforward to see why including to shedding positions (or the inverse – not masking shorts going within the fallacious route) is such an alluring proposition: “it’s not me that’s fallacious, it’s THE MARKET!”. The irritating factor with markets is that generally doubling down is the fitting factor to do. On common, and over time, we consider diversification serves us nicely. To succeed, you need to first survive. Therefore a disproportionate draw back can’t be tolerated, no matter conviction.

Fiercely impartial

Protean’s raison d’être is to handle our personal financial savings in an optimum manner. This implies proscribing the dimensions of the funds to stay versatile and nimble, to limit investing and promoting the fund to month-to-month and quarterly, and to keep away from pointless restrictions like kinds, sectors and ESG-branding. We’re not optimizing for dimension or making an attempt to please everybody. We’re fiercely impartial and can stay so.

Trade construction creates alternative

The inertia of the financial savings market is feeding an entire herd of rent-seeking asset managers and advisors. Among the main gamers on the market look extra like a slow-motion day-light theft than a well-meaning fiduciary. I get it although, investing is difficult, not everybody cares or has the time to become involved within the particulars of assorted charges, methods and what not. Generally I believe each advisor ought to be obliged to indicate precisely how she or he has invested their very own financial savings or pension. That might be enjoyable.

Beginning a enterprise to problem this business construction is tough. The regulatory burden is substantial. Each fraud or drawback that has ever occurred in historical past, has been adopted by new regulation geared toward combating the earlier conflict. Leading to a patchwork of legal guidelines that collide and accumulate in exponential trend. On high of that comes the EU (and don’t even take into consideration what occurs when you have a US-based investor and the SEC-regulations begin making use of). Simply within the final yr we now have the substantial DORA-regulation coming into impact, aiming to enhance the resilience of the IT infrastructure within the EU. For us, 5 guys in a room with computer systems, this has resulted in numerous hours in conferences with inner audit, compliance, and consultants.

The end result? New insurance policies and documentation. Modifications to what we already had been doing each day? None. Improved IT-resilience? Unlikely. Price? Within the tens of 1000’s of {dollars}. Profit to whom? Unclear.

The regulatory pressures and related prices, and the rent-seeking advisor/platform neighborhood, is what’s driving the numerous consolidation of the Nordic asset administration business. This raises terrific limitations to entry.

Plus, after all, the elephant within the room: passive investing. Sweden’s inventory market has for many years been the envy of the world. The supply of development fairness for smaller corporations has helped create a vibrant eco system of a number of gamers and lively managers which are capable of worth and fund a plethora of ventures. However with fewer and fewer impartial asset managers, outflows from lively funds, and extra voluntary (marketing-driven) restrictions like ESG, we danger slicing off the department we’re sitting on. Heck, even the CEO of one of the aggressive consolidators is out within the press complaining in regards to the destructive penalties of consolidation!

Asset supervisor > asset gatherer

Asset administration is a really scalable enterprise. The prices are excessive, however largely mounted. Once you attain a sure threshold, the incremental charges come at near 100% margins. For this reason asset managers usually flip into asset gatherers quite than efficiency optimizers.

We don’t do this. Just lately we participated in one in all Sweden’s greatest Finance podcasts, and the host was aggressively questioning us alongside the strains of “absolutely you’ll launch further comparable merchandise to get round that when you get there?”. It was like unfathomable that our strategy is real and a vital a part of technique. We consider (and educational analysis backs up) {that a} smaller fund has higher possibilities of producing engaging returns. We began Protean to handle our personal financial savings. We want a little bit of scale to have the ability to entry all of the instruments we’d like, that’s why we’re taking outdoors cash. We would like cheap returns at an inexpensive danger. That’s it.

The third fund… It’s getting nearer

The third fund we’re about to launch has a unique rationale: it goals to handle the market inefficiency the place just one in ten lively managers outperforms the index over any given 10-year interval. We are going to supply a product we predict is lacking for a lot of traders: a wise actively managed long-term Nordic fairness fund with a Very Low Payment that may beat the index. The kicker is: the larger the fund will get, the decrease the price. Our start line might be at lower than half the typical price for actively managed Nordic funds. And we minimize the price additional at each 10bn SEK in belongings beneath administration. If (when!) the fund reaches 50bn SEK in AuM it will likely be on par with index-fund charges on web platforms. Scale benefits shared!

The fund might be managed by our current rent Richard Bråse, one of the attention-grabbing investment-thinkers I’ve ever come throughout. His capability for impartial thought and integrity is strictly what’s wanted to type the wheat from the chaff among the many Nordic large- and mid-caps. Faraway from the bustle of Stockholm, he has the best set-up for long-term considering and persistence required for a fund that in lots of situations has extra in frequent with funding corporations than different funds. For what’s an funding firm? An extended-term considerate proprietor of first rate companies, at a low price. We tip our hat and goal to copy simply that in a low-priced fund construction that will get cheaper because it grows.

The fund might be a day by day traded UCITS fund. It should maintain 40-50 shares and have an funding horizon in extra of 10 years. Mathematically, this implies 4-5 shares are modified in a given yr. Stylized, after all, however simply as an example. With restricted turnover, transaction prices are minimized. The fund will keep away from over-indebtedness, low returns on invested capital and fads.

Who does it match?

We predict the fund might be nicely suited to all kinds of traders. – These which are searching for a broad and common sense pushed publicity to cheap corporations at a aggressive worth however assume index funds are boring (and probably dangerous for market functioning). – People who assume it’s price making an attempt to really BEAT the market and simply not get the market return. – World traders that assume the Nordics are an underappreciated funding alternative and are searching for a pleasant and tidy approach to get publicity by way of a well-run, regulated and low cost car. – People who assume you may possible beat the index over time for those who simply handle to keep away from the stupidest stuff that’s included within the index.

The distinction to an index fund is price dwelling on. They’ve two important drawbacks: it can’t, by definition, beat the index. And it should additionally personal, by rule, the silliest issues which are included within the index.

Tips on how to beat an index

We consider there are two methods for a long-only fund to beat the index:1. Be small, work exhausting and be hyperactive. That is Protean Small Cap. 2. Personal good companies for a very long time, pay as little as attainable in charges and transaction prices and keep away from silly issues. That is the brand new fund.

However for a low-fee fund to work, it wants belongings. To get belongings it wants distribution. Distribution on this context means being obtainable on varied platforms. Platforms are on-line brokers, insurance coverage corporations, banks and pension suppliers. Most distributors make their cash by taking a major a part of the fund price. This implies the upper the price, the higher. For a Very Low Payment fund, it is a battle of curiosity. And a problem for us. And for individuals who need to make investments.

We want your assist

However hey, inertia, oligopolies and consolidation be damned. Market inefficiencies are there to be challenged. Let’s go!

Protean Small Cap

– Carl’s replace for December

Protean Small Cap returned +0.3% in December. That’s 0.4% forward of the CSXRN (SEK) benchmark index for the month. This places the fund 21.9% forward of our index (CSRXN SEK) since inception and 13.2% forward throughout 2024. The fund now manages SEK485m. Thanks on your belief.

Notable performers in December had been Acast, Getinge and Intea,

We’ve initiated a mid-sized place in Bavarian Nordic (OTCPK:BVNKF). This Danish vaccine producer is generally recognized for its Jynneos franchise, vaccines for smallpox and monkeypox. Uncommon ailments these, however the latter of the 2 has develop into a scorching matter for the inventory in recent times, and it usually spikes (and subsequent declines) as outbreaks come and go together with various frequency. That provides an optionality to the story however is clearly tough to construct a case on. What attracts us is the robust efficiency Bavarian has proven in its journey vaccine franchise, the place merchandise in opposition to rabies and TBE are displaying robust progress.

TBE – which has a sure ‘ick’ issue hooked up to it as it’s unfold by ticks – is getting extra consideration because it advantages from a hotter, wetter local weather. To us, journey vaccine seems to be a horny enterprise for Bavarian to develop, additionally by way of acquisitions. It’s usually a really small portion of the gross sales in large pharma corporations, more likely to be barely uncared for. Generic competitors isn’t a difficulty. By way of this, Bavarian has began to construct a bread-and-butter enterprise which reduces the general danger degree within the share. The corporate just lately introduced that its venture to consolidate vaccine manufacturing goes as deliberate, and this may enhance margins in 2025.

We additionally participated within the IPO of Intea which we’ll write extra about later on this letter.

We’ve offered out of some smaller positions, amongst them Humble (OTCPK:HMBAF) and CINT. We’ve additionally offered Cargotec (OTCPK:CYJBF), which has been a really robust performer for us for the reason that inception of the fund. The reasoning? The divestment of MacGregor introduced much less proceeds than we had anticipated. Nonetheless, a really robust stability sheet and a scarcity of M&A in the newest years for HIAB would counsel a flurry of offers in 2025. Nevertheless, current feedback from administration point out {that a} backlog of IT integration tasks implies that this is not going to be the case, which shocked us sufficient to half with the inventory.

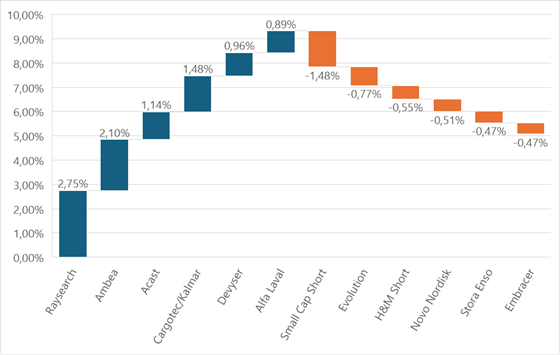

Reflecting on 2024, we see a yr the place our high performers have been with us since inception, resembling Raysearch (OTCPK:RSLBF), Ambea and Acast. Out of our high ten performers, we nonetheless maintain seven. Out of our high ten detractors, we personal 4. Maybe we’re getting higher at sticking with the winners?

The ten largest positions in Protean Small Cap as we enter January are:

Protean Choose

– Pontus’ replace for December

| *We illustrate our efficiency by displaying a comparability with the NHX Equities index. That is an index constructed from the efficiency of 54 Nordic hedge funds specializing in fairness methods. NHX is revealed after our Accomplice Letter, so updates with one-month lag within the chart above. We goal to have constructive returns whatever the market, however no return is created in a vacuum, and a net-long technique will correlate. Our hurdle price is 6.9% annualized (4% + 90-day Swedish T-bills). All figures are web of charges and ratios within the above charts are calculated utilizing month-to-month returns. |

Protean Choose returned 0.8% in December. Full yr 2024 return ends at 10.6% and 25.6% since launch in Might 2022. Volatility for the yr, calculated on day by day returns, was 5.5%, producing a Sharpe ratio of 1.35.

High contributors had been lengthy positions in Getinge and Hexagon, and quick positions in index futures. Notable detractors had been longs in Devyser, Tryg and a brief place in a basket of small caps.

We exit December with 37% beta-adjusted web lengthy publicity and 108% gross publicity. The portfolio stays diversified, with the largest place 4% of belongings.

Novo Nordisk (NVO)

The most important drama within the Nordics in December was undoubtedly the a lot awaited learn out of Novo Nordisk’s section III-study on Cagrisema. If we printed out and laid all of the emails and analysis reviews generated by the funding banks aspect by aspect, they might simply attain throughout the English Channel. When markets are navel gazing to this extent, and positioning is prolonged to the Nth diploma due to Novo being a multi-year winner, regular guidelines don’t apply. Our intestine feeling going into the occasion was merely that it was not price taking part in.

We aren’t within the enterprise of making an attempt to outguess these with probably the most intimate information of trial designs, organic mechanisms and statistical evaluation. Therefore, we determined to take a seat out the read-out. Half luck, half expertise meant we prevented the 20% drop within the greatest inventory in Scandinavia in December.

It would look myopic and like an overreaction for Novo to drop 20% on what appears to be like like a slight miss to expectations in a single examine however do not forget that pharma shares commerce in a different way than others. They’re priced on development potential 5+ years out sooner or later, as growth occasions are lengthy and visibility is affordable. Subsequently, Novo’s flagship next-generation product not exceeding its closest competitor is an enormous occasion. Naturally, there are tons of particulars to be debated. Was the examine design flawed? Why didn’t greater than 57% of members proceed to most dosage? Would the outcomes look totally different (higher) if extra had accomplished so? Is that this examine actually that essential? And many others and many others. We’re nonetheless enamored by Novo’s valuation and cash-flows, and historical past of innovation and execution mixed with shareholder-friendliness within the type of buybacks and dividends. We’ve actively traded the inventory on this volatility and contemplating it was virtually -15% on the yr and -40% from the intra-year highs, we’re happy with “solely” ending up shedding a web 0.5% on the inventory for the complete yr.

2024 full yr particulars

This is a break-down of our full-year greatest winners and losers in Protean Choose. Notable is that our long-held core small cap positions are those driving the majority of the outperformance. This solidifies our perception that small and mid-caps are our dwelling turf and that we profit from being a small fund.

Protean Choose 2024 Winners and losers

The ”Small Cap Quick” is a basket of >80 shares we use to hedge our small cap publicity. We tried our luck in Evolution (OTCPK:EVVTY), seeing a horny valuation, however lined our losses (and was even quick for some time) after we realized the narrative of unregulated Asian revenues was more likely to proceed weighing on the inventory. In H&M our thesis finally performed out, however our timing (and endurance) was poor. We had been too early in Stora Enso (OTCQX:SEOJF) on the lengthy aspect as a second wave of “it’s not time for a cyclical restoration simply but” mixed with continued poor execution knocked the wind out of its sail, and Embracer (OTCPK:THQQF) simply stored on being its good outdated risky self.

All advised, 10.6% return for the fund was higher than most (all? I haven’t checked all of them) Nordic long-only indices. To generate that return with 5.5% volatility, at a 1.35 Sharpe ratio, is an efficient yr.

We look ahead to repeating it once more, hopefully just a little higher, in 2025.

Not your ordinary property inventory– Richard’s Reflections

The actual property firm Intea refused to comply with the PR consultants’ playbook through the IPO course of. As an alternative of displaying up in all places to inform us all about how nice they’re, about its rosy outlook and tempting monetary targets, they selected to maintain a low profile with few media appearances.

After spending the final 15 years at Sweden’s enterprise day by day Dagens Industri, masking quite a few IPOs, there’s one conclusion: like with any pushy salesperson, it’s not those most desirous to see their names in print that symbolize the most effective enterprise alternatives. And it’s all the time higher to let the numbers do the speaking, quite than speaking about numbers that by no means materialize.

Intea stored a low profile as a result of they might. As an alternative of compacting the final penny out of probably the most price-insensitive traders ( you AMF), the homeowners accepted a considerably cheaper price to easily inject 2 billion SEK of recent fairness into the enterprise. The capital will generate greater than sufficient to offset the dilution.

Intea’s portfolio consists of high-quality specialised properties, primarily leased to public tenants on long-term leases. These embrace police stations, school services, and prisons. The operational danger is as little as it will get, with low emptiness charges and longstanding, secure counterparties.

To date, it seems like an inexpensive defensive possibility in a sector the place workplace homeowners are struggling resulting from each a weak financial cycle and structural components. In the meantime, perceived low-risk condominium corporations do not generate sufficient money stream to impress anybody with their low-yielding asset base. Secure money stream isn’t a lot enjoyable if it’s secure at a low degree.

Intea presents greater yields than the workplace section, however with out the headwinds. And it’s greater than only a cheap defensive possibility resulting from its excessive venture exercise, with 3.7 billion SEK in ongoing developments. This offers our firm a transparent development trajectory, with the venture developments serving as the worth driver.

Primarily based on firm steering, the two billion SEK might be deployed at a yield on price of about 6.5 %, in a enterprise that values its properties at 5.2 %. That hole interprets into income.

And there’s extra to return. The Swedish Jail and Probation Service expects to extend the variety of locations in detention facilities and prisons from 9000 in 2024 to 27,000 by 2033. “Such speedy and intense enlargement might be difficult,” because the Swedish Jail and Probation Service states in its capability report.

State-owned Specialfastigheter is the primary participant in terms of prisons, and other than Intea, Erik Selin’s Skandrenting is the one non-public jail proprietor.

For property homeowners typically, the glory days of the sub-zero rate of interest period are gone. The Swedish 10-year yield is now a tad greater than when the Riksbank began decreasing rates of interest again in Might. The US 10-year yield is up near 100 foundation factors for the reason that Fed’s first minimize in September. This implies you shouldn’t count on yield compression to do the trick – actual property corporations should take the worth creation into their very own fingers. Simply appropriately.

Over the approaching three years, Intea might be among the many few listed Swedish actual property corporations posting double-digit compound annual development charges in each NAV and money earnings, adjusted for dividends.

IPOs are tightly managed spectacles, however regardless of the extremely orchestrated nature of those occasions, there hasn’t been a lot daylight for individuals who subscribed to the earlier two actual property IPOs. Sveafastigheter, SBB’s rental condominium enterprise, has but to shut above the problem worth and is down 9 % so far. Prisma Properties, an organization with a give attention to low cost retailers and fast-food eating places, stayed afloat on its first day in June however is down 12 % since then.

After two damaged IPOs within the sector, the funding banks acquired a cheerful ending. Intea has gained a wholesome, however not overwhelming, 10 % since its IPO in mid-December. The shares nonetheless commerce with a reduction to NAV and an implicit yield of 5,3 % primarily based on subsequent yr’s numbers.

Each the CEO and CFO have purchased extra shares after the IPO. They know that Intea’s development trajectory relative to its worth bodes nicely relative to the sector.

The month-to-month reminder

We optimize for efficiency, not for comfort, dimension, or advertising and marketing.You’ll be able to withdraw cash solely quarterly (month-to-month in Small Cap).We are going to let you know little or no about our holdings.Our technique is hard to explain as we goal to be versatile.A hedge fund can lose cash even when markets are up.We cost a efficiency price if we do nicely.You don’t get a reduction when you have a bigger sum to speculate.We should not have an extended observe document.

Thanks for being an investor.

Pontus Dackmo

CEO & Funding Supervisor

Protean Funds Scandinavia AB

| DISCLAIMER: Investments in a fund can each improve and reduce in worth. You aren’t assured preservation of invested capital. |

Authentic Submit

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.