Podcast: Play in new window | Obtain

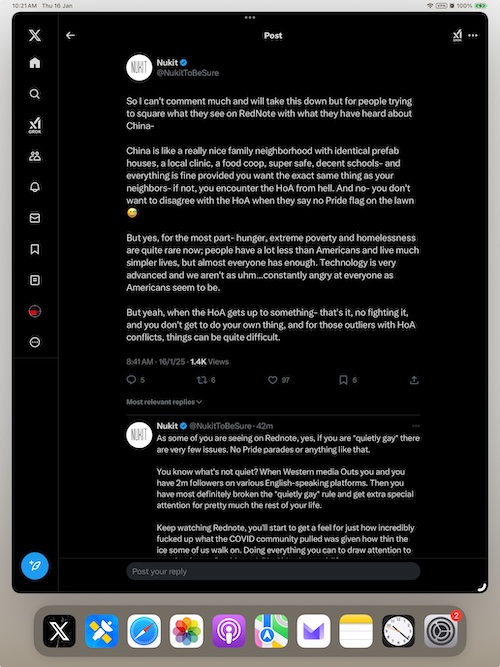

NOTE: We initially revealed this weblog submit in 2021. At the moment, Ohio Nationwide Introduced it plans to demutualize and dramatically modified its dividend calculation for entire life insurance coverage coverage holders. Since then, the newly acquired firm modified its title to AuguStar Life. The policyholder whose coverage we used on this evaluation determined to cancel this coverage and transfer his cash into a distinct entire life coverage at a distinct firm. In the event you personal an previous Ohio Nationwide entire life or common life coverage and you might be questioning about your choices, you’ll be able to at all times attain out to us for assist.

Subsequent up in our sequence of reviewing real-life outcomes from entire life insurance coverage insurance policies, we glance this week at Ohio Nationwide. Like different insurance policies reviewed, we took knowledge from an Ohio Nationwide entire life coverage bought round 10 years in the past. We’ve got the unique illustration and used that to match towards present coverage values.

We additionally used this knowledge to take a look at the dividends at present payable to the Ohio Nationwide policyholder in comparison with initially projected dividends.

Ohio Nationwide Complete Life Coverage Precise Money Worth Efficiency

We’re an Ohio Nationwide entire life coverage that used all of the essential components of a coverage designed to optimize money worth progress. It is blended with nearly all of the premium comprised of paid-up additions.

We used the interior price of return (IRR) to judge how this coverage carried out in comparison with its unique projections. Here is what we discovered:

Initially, the coverage projected a 3.14% annualized price of return at this level within the coverage. This implies the coverage proprietor anticipated incomes 3.14% compounding yearly on the premiums paid to the coverage. The coverage buy happened about 10 years in the past. The dividend price at Ohio Nationwide declined significantly for the reason that unique coverage buy. Essentially the most dramatic change happened simply this previous 12 months. The true IRR achieved on this coverage is from inception is 2.26%%.

Precise Historic Dividends Paid By Ohio Nationwide

Whereas I haven’t got an in depth breakdown of every annual dividend cost from the coverage outset, I can see the present dividend paid in comparison with the projected payable dividend from the unique illustration. They aren’t surprisingly totally different.

The present dividend paid is 46% decrease than the initially projected dividend payable at this level.

We will see that this decrease dividend definitely drives down money worth efficiency from what the policyholder initially anticipated. It is also price noting that whereas the change in dividends is not as substantial as we noticed in reviewing different firms, the change in money worth IRR is barely extra pronounced than within the case of a number of the different comparisons. This level helps our long-standing declare that entire life insurance coverage is a broad title used for a sort of life insurance coverage that may differ significantly from firm to firm in relation to particular performance.

Causes The Coverage Carried out As It Did

The usage of paid-up additions locations much less significance on the dividend cost for the event of money worth. That is very true for the primary a number of years of a complete life coverage’s existence. The assured curiosity paid on money worth, which applies to money worth created by PUA’s, drives a substantial quantity of coverage progress throughout this time. So the change in money worth progress as a result of dividend modifications is much less when wanting on the total efficiency of the coverage.

Had this entire life coverage used a extra conventional design and method to entire life insurance coverage, the change in IRR would probably be considerably extra.

The Timing Of Dividend Adjustments Issues

Whereas this Ohio Nationwide entire life coverage barely underperformed its unique projections, the dividend efficiency shifting ahead may result in a wildly totally different story over the subsequent 10 years.

If the dividend stays largely the identical, then the unfold between precise and projected values will develop. That is merely the mathematical actuality of the distinction between the preliminary accumulation assumption and present realities. If, then again, the dividend will increase over this time, precise outcomes will pull nearer to projected values. What’s straightforward to miss in a life insurance coverage ledger is the function the timing of dividend modifications performs on money worth efficiency. When the coverage has additional cash worth, modifications within the dividend will likely be extra impactful.

This knife cuts each methods, nevertheless. A complete life coverage with a bigger money worth stability will get a substantial increase when the dividend goes up, however it is going to additionally miss out on a whole lot of progress when the dividend goes down.

Probably problematic for this coverage is the brand new calculation Ohio Nationwide introduced when it introduced its de-mutualization plans. The dividend cost projected for subsequent 12 months is considerably decrease than the payable dividend for this coverage 12 months. This development seems to proceed when wanting on the ledger. It will lead to a rising hole between precise and initially projected money worth except ONL modifications this dividend upward sooner or later.

The Ohio Nationwide dividend did change considerably since coverage inception, and this ends in a coverage with a decrease than deliberate price of return. There are about $5,500 fewer {dollars} within the coverage than initially assumed.

That mentioned, this coverage nonetheless carried out higher than a number of the different insurance policies we reviewed–even some that carried out a lot nearer to their projected values.