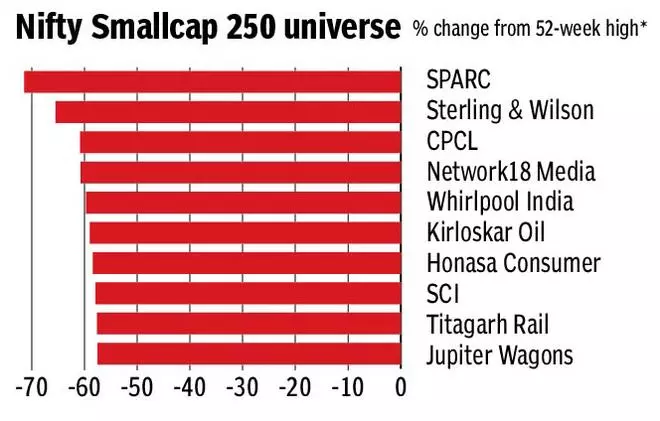

Within the ongoing rout within the small- and mid-cap area that has drained portfolios, traders have been suggested by consultants to take refuge in large-caps. However are all large-cap shares protected?

Leaping out of the frying pan into the hearth — that is the state of affairs that traders would have discovered themselves in, had they chosen the large-cap index ‘Nifty Subsequent 50’ or its constituent shares.

The index, also called Nifty Junior, includes these large-cap shares that aren’t a part of the Nifty 50 index.

No totally different vs small caps

Nifty Subsequent 50 index has misplaced 22.3 per cent for the reason that fag finish of September 2024, when the market entered a correction section.

This additionally occurs to be the time when many indices — Nifty 50, Nifty Subsequent 50, Nifty Midcap 150 and Nifty Smallcap 250 —hit their all-time highs.

- Learn: Mid- and small-cap funds: Is the stress decrease after the current correction?

Though the Nifty Subsequent 50 index is assessed as a large-cap index, its 22.3 per cent decline surpasses even the small-cap index’s 20.2 per cent drop. In distinction, the Nifty 50 corrected by simply 12.9 per cent throughout this era.

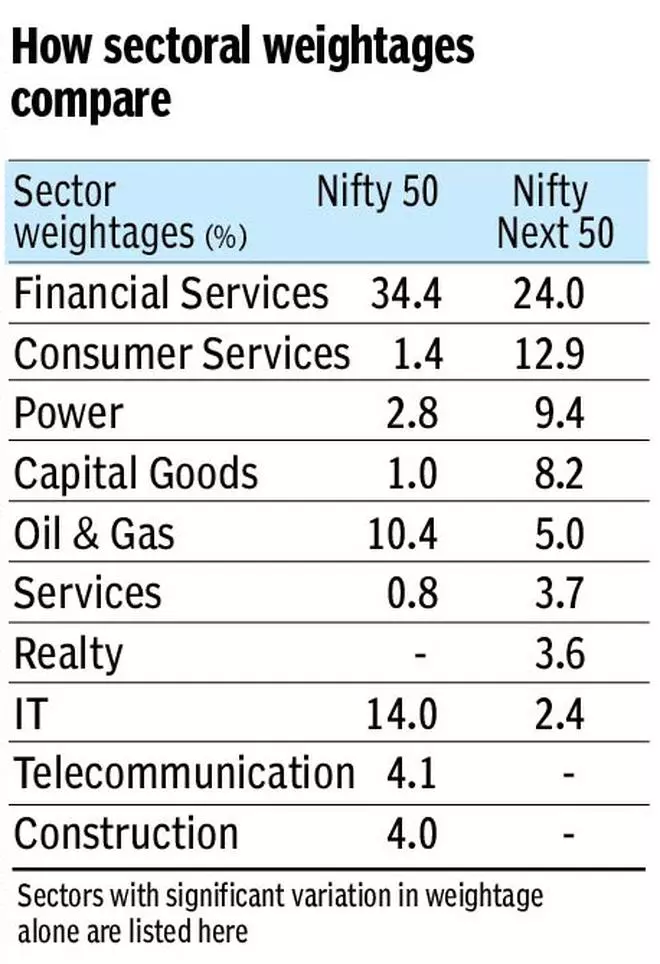

This distinction truly is sensible when the sectoral composition of Nifty Junior is in contrast with that of Nifty 50.

- Learn: Volatility is the center identify of small-cap mutual funds. Listed here are the methods to navigate it

Whereas weightage to sectors reminiscent of FMCG, healthcare, auto and metals are largely equal to that of Nifty 50, there’s a stark distinction within the weightage of sectors reminiscent of monetary providers, client providers, energy, IT and capital items.

Realty sector, which has a 3.6 per cent allocation in Nifty Junior, has zero weightage in Nifty 50.

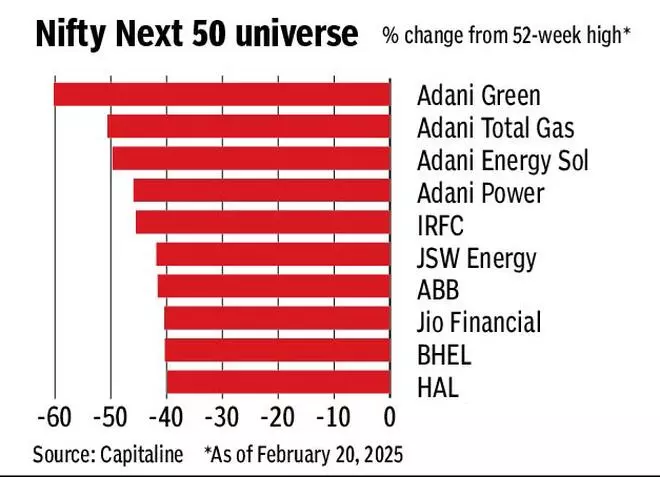

Nifty Junior shares within the monetary providers sector reminiscent of IRFC, REC and Jio Monetary are down anyplace between 37 per cent and 46 per cent from their 52-week highs. Equally, IRCTC, Avenue Supermarts and Zomato from the patron providers area are down between 23 per cent and 35 per cent.

Capital items shares reminiscent of ABB, BHEL, HAL and Siemens have misplaced near 40 per cent.

The three Adani Group shares from the facility sector (see infographic), JSW Power and NHPC have misplaced 33 per cent to 60 per cent. Such deep cuts can effectively be in comparison with the correction within the constituent shares of the small-cap index.

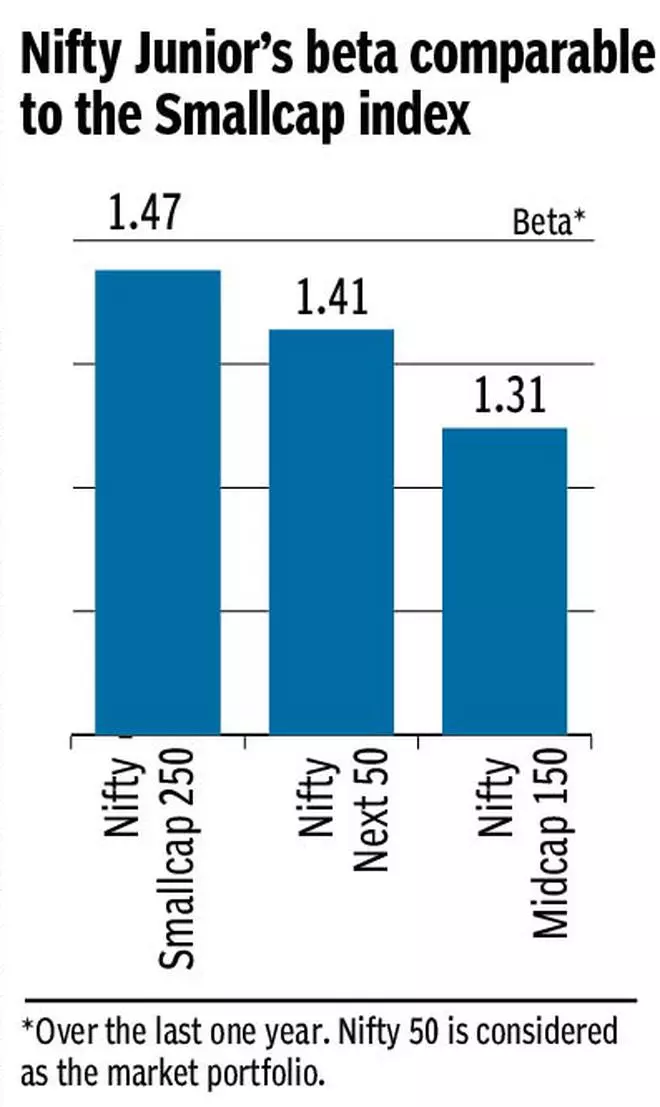

Excessive beta

Additionally, the beta (calculated with knowledge of the trailing yr) of Nifty Subsequent 50 index in relation to Nifty 50 (Nifty 50 is taken into account because the market portfolio) is kind of excessive at 1.41.

- Learn: Sensex, Nifty 50 long-term outlook: Is the bull run over?

That is only some decimal factors away from the beta of the small-cap index, which is 1.47.

This reveals that Nifty Junior has been as unstable because the small-cap index over the previous yr. Therefore, the following time you hear large-caps are comparatively higher positioned, you’ll want to ask which and what sort of large-caps.

In any case it does seem, the Nifty 50 and Nifty Junior are as totally different as chalk and cheese.

Traders shouldn’t depend on large-caps solely for his or her measurement; deciding on the correct shares stays essential even on this section. Valuations are paramount.

Many of the shares talked about earlier have been buying and selling at valuations that have been unsustainable.

Therefore, acquired punished large time when the market entered a correction section, with the large-cap tag offering no cushion.