The “good ship Transitory,” regardless of an ominous report, seems able to sail once more for the Federal Reserve.

Financial projections the central financial institution launched Wednesday point out that whereas officers see inflation shifting up this 12 months extra quickly than beforehand anticipated, additionally they anticipate the development to be short-lived. The outlook spurred discuss once more about “transitory” inflation that triggered a significant coverage headache for the Fed.

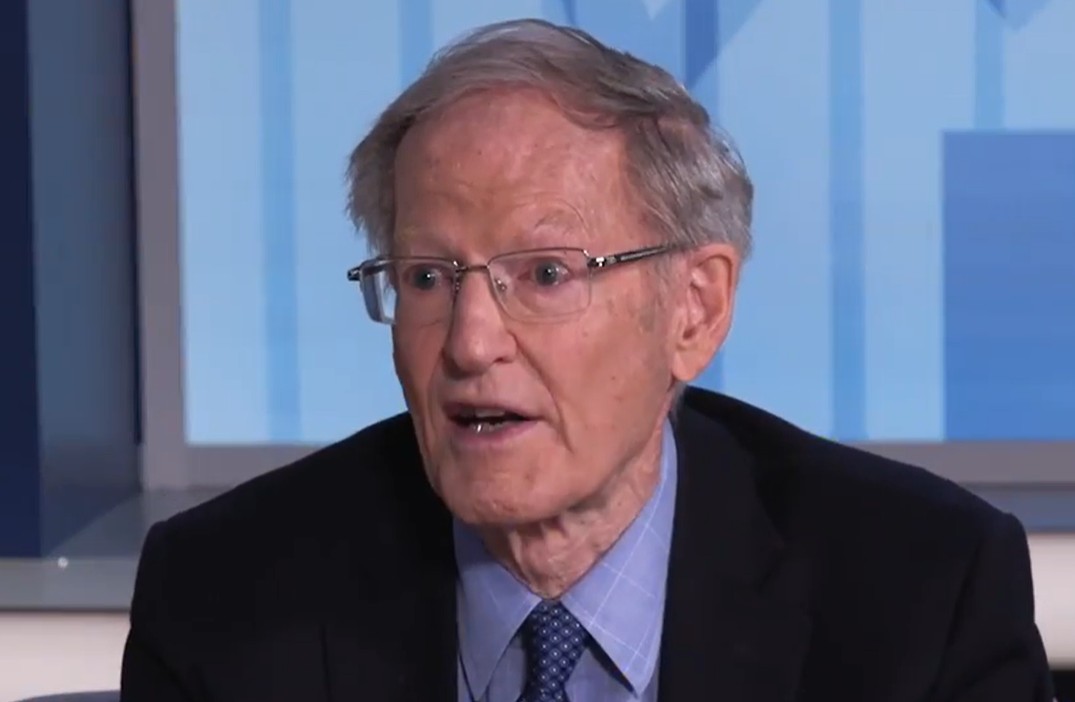

At his post-meeting information convention, Chair Jerome Powell mentioned the present outlook is that any value jumps from tariffs possible will likely be short-lived.

Requested if the Fed is “again at transitory once more,” the central financial institution chief responded, “So I feel that is sort of the bottom case. However as I mentioned, we actually cannot know that. We’ll must see how issues really work out.”

Nevertheless, the Federal Open Market Committee outlook, with inflation hitting 2.8% in 2025 however rapidly receding again to 2.2% then 2% within the succeeding years, signifies that officers don’t anticipate a long-lasting burden from the tariffs.

“It may be the case that it is acceptable generally to look by inflation, if it will go away rapidly, with out motion by us, if it is transitory,” Powell mentioned. “That may be the case within the case of tariff inflation. I feel that will rely upon the tariff inflation shifting by pretty rapidly and, critically, as effectively on inflation expectations being effectively anchored.”

Powell added that whereas sentiment surveys present some short-term inflation indicators have risen, market-based measures for longer-run expectations are well-anchored.

Worries over tariffs

The place is important with markets involved that President Donald Trump’s tariffs might spark a broader international commerce battle that once more would make inflation an issue for the U.S. economic system. Inflation had gave the impression to be on the run heading into this 12 months, however the outlook is much less sure now.

Again in 2021, when inflation first rose previous the Fed’s 2% goal, Powell and his colleagues repeatedly mentioned they anticipated the transfer to be transitory, introduced on by Covid-specific elements impacting provide and demand that finally would fade. Nevertheless, inflation stored rising, finally hitting 9% as measured by the patron value index, and the Fed was pressured to reply with a collection of aggressive rate of interest hikes not seen because the early Nineteen Eighties.

In a speech final August on the Fed’s annual Jackson Gap summit, Powell even joked that “the nice ship Transitory was a crowded one,” and he advised attendees that “I feel I see some former shipmates on the market right this moment.”

The room chuckled at Powell’s remarks, and the market Wednesday did not appear to thoughts the transitory discuss. Shares jumped as Powell spoke, and the Dow Jones Industrial Common closed up 383 factors to 41,964, a reversal of fortune for a market in decline these days.

“‘Transitory’ is again, or a minimum of that was the insinuation,” mentioned Elyse Ausenbaugh, head of funding technique at J.P. Morgan Wealth Administration. “The market response, to me, says that traders are prepared to consider that tariffs and different insurance policies will not create lasting inflationary pressures and that the Fed can keep in management.”

The Fed voted to maintain its benchmark rate of interest on maintain because it weighs the affect of tariffs and monetary coverage from Trump. As well as, Federal Open Market Committee officers indicated that two extra quarter share level charge cuts might be on the way in which this 12 months, although Powell cautioned once more that coverage shouldn’t be locked in, neither is the transitory inflation view on tariffs.

“We will likely be watching all of it very, very fastidiously. We don’t take something with no consideration,” he mentioned.