New information from the Bureau of Financial Evaluation verify that inflation remained low in Could. The Private Consumption Expenditures Value Index (PCEPI), which is the Federal Reserve’s most popular measure of inflation, grew at an annualized fee of 1.6 p.c final month. It has averaged 1.1 p.c during the last three months and a couple of.3 p.c during the last 12 months.

Core inflation, which excludes risky meals and vitality costs but in addition locations extra weight on housing companies costs, was a bit greater. Based on the BEA, core PCEPI grew 2.2 p.c in Could. It has averaged 1.7 p.c during the last three months and a couple of.7 p.c during the last 12 months.

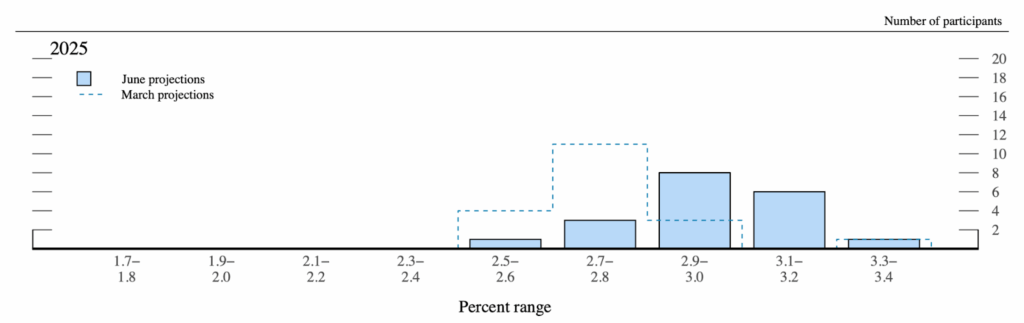

Inflation is operating nicely under the newest projections submitted by Fed officers. In June, the median Federal Open Market Committee member projected 3.0 p.c PCEPI inflation for 2025, with projections starting from 2.5 to three.3 p.c. PCEPI inflation has averaged simply 2.6 p.c year-to-date, which is above the projections submitted by eighteen of 19 FOMC members.

The truth is, inflation has been operating a lot nearer to the projections Fed officers submitted again in March. Three months in the past, the median FOMC member projected 2.7 p.c inflation for 2025. At the moment, projections ranged from 2.5 to three.4 p.c, however the central tendency (i.e., excluding the three highest and three lowest projections) was 2.6 to 2.9 p.c. In March, just one member projected inflation would exceed 3.0 p.c this 12 months. In June, seven members projected inflation above 3.0 p.c.

What modified? Quickly after submitting their projections in March, Fed officers discovered how excessive and widespread President Trump’s meant tariff charges could be. Ongoing negotiations, court docket orders, and Congressional push again now counsel these tariff charges will probably be decrease — and, in some circumstances, a lot decrease — than these introduced in April. Nonetheless, the tariff charges seem to stay greater than Fed officers anticipated they might be again in March.

Broadly talking, there are two methods the inflation information would possibly evolve within the months forward. Within the first situation, the pass-through from tariffs will trigger costs to rise significantly over the again half of this 12 months. Given year-to-date information, inflation must common 3.3 p.c over the rest of 2025 to hit the median FOMC member’s projection. That’s greater than double the inflation fee realized in Could, and seventy foundation factors above the typical inflation fee realized during the last 12 months. Within the second situation, the place passthrough from tariffs is way decrease than most Fed officers count on, inflation will proceed falling, stay regular, or rise barely.

In concept, the passthrough from tariffs to the worth stage should not have any impact on financial coverage. The tariffs are a adverse provide shock, which the Fed is unable to mitigate. The most effective the Fed can do (with or with out the adverse provide shock) is stabilize demand — that’s, to maintain nominal spending on a secure trajectory.

The latest projections seem in keeping with this look-through-supply-shocks method. Whereas the median projection for inflation rose significantly from March to June, the implied median projection for nominal spending — which will be constructed by including the median projections for inflation and actual GDP progress — remained unchanged at 4.4 p.c.

Financial coverage is extra sophisticated in follow, nevertheless. The general public won’t react to the passthrough from tariffs the way in which the rational brokers in an financial mannequin do. Particularly, the general public would possibly mistake the momentary improve in inflation brought on by an hostile provide shock as a everlasting improve in inflation, and revise their inflation expectations accordingly. Fed officers would then want to fulfill these greater expectations with quicker nominal spending progress, thereby delivering the completely greater inflation anticipated; or, depart nominal spending progress unchanged and threat a recession.

On the post-meeting press convention final week, Fed Chair Jerome Powell acknowledged the chance that tariffs will push inflation expectations greater:

The consequences on inflation might be short-lived, reflecting a one-time shift within the worth stage. It’s additionally attainable that the inflationary results might as a substitute be extra persistent. Avoiding that end result will depend upon the scale of the tariff results, on how lengthy it takes for them to move via absolutely into costs, and finally on conserving long run inflation expectations nicely anchored. Our obligation is to maintain long run inflation expectations nicely anchored and to stop a one-time improve within the worth stage from changing into an ongoing inflation downside.

In different phrases, the Fed would possibly have to maintain coverage tighter than could be best as a way to reassure the general public that the supply-driven inflation will probably be momentary.

If financial coverage have been near impartial at present, holding the federal funds fee goal barely above impartial as a way to maintain inflation expectations well-anchored would have little adverse impact on near-term financial exercise and a impartial to constructive impact on long run financial exercise. If financial coverage is already excessively tight, nevertheless, the Fed’s hesitancy to chop the federal funds fee goal in response to lower-than-expected nominal spending progress might considerably scale back financial exercise within the close to time period, exacerbating the actual results of upper tariffs. Simply because the Fed’s hesitancy to boost charges in 2021 and early 2022 allowed inflation to rise, its hesitancy to chop charges within the months forward would threat inflicting a recession.