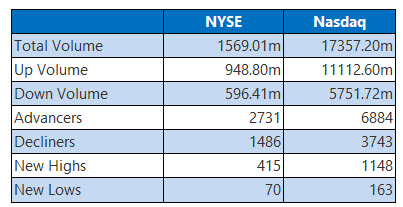

Shares completed the primary half of the 12 months on a excessive notice, with each the S&P 500 and Nasdaq notching document highs. The latter additionally marked a sixth-straight acquire, whereas the Dow jumped 275 factors for its third consecutive win, breaking above the psychologically important 44,000 stage for the primary time since February.

All three main indexes completed increased for the month and quarter as properly. Notably, the Dow logged its greatest month since January, the S&P 500 scored its largest quarterly proportion acquire since December 2023, and the Nasdaq secured its largest quarterly win since June 2020.

Proceed studying for extra on at this time’s market, together with:

5 Issues to Know Right now

-

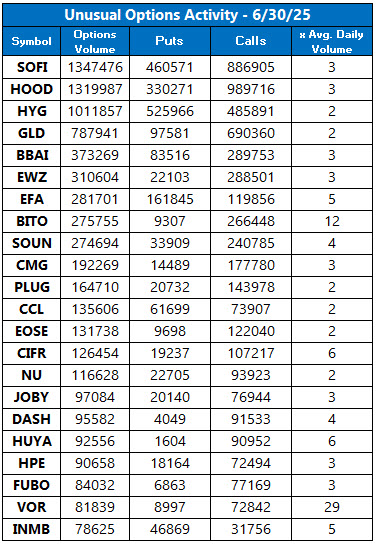

Robinhood (HOOD) inventory hit document highs after the buying and selling platform launched U.S. inventory and ETF tokens for patrons within the European Union (EU). (MarketWatch)

- Indian officers will prolong their keep in Washington to succeed in a commerce settlement. (Reuters)

- Two tech shares surging after DoJ lawsuit is put to relaxation.

- Walt Disney inventory jumped to two-year highs after an improve.

- Software program identify marked a contemporary all-time excessive amid cloud deal.

There have been no earnings of notice at this time.

Gold Rises for 2nd Quarter

Oil costs slipped on Monday, contemporary off their worst weekly pullback since March 2023. August-dated West Texas Intermediate (WTI) crude dropped 41 cents, or 0.63%, to settle at $65.11 a barrel. Oil completed June with a 3.2% month-to-month rise, however dropped round 8% for the quarter.

On the again of a weakening U.S. greenback, gold futures had been final seen 0.9% increased at $3,317,60. Bullion slipped 2.5% within the month of June, however nonetheless posted a second consecutive quarterly rise, up 5.1%.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.