The corporate has undertaken accelerated write-offs to wash up the mortgage guide, which has resulted in larger credit score prices. The state of affairs is predicted to normalise from the December quarter.

Given the corporate’s plan to open 200 branches within the present fiscal 12 months and receding strain on asset high quality, the credit score progress is predicted to be larger within the second half of the present fiscal 12 months.

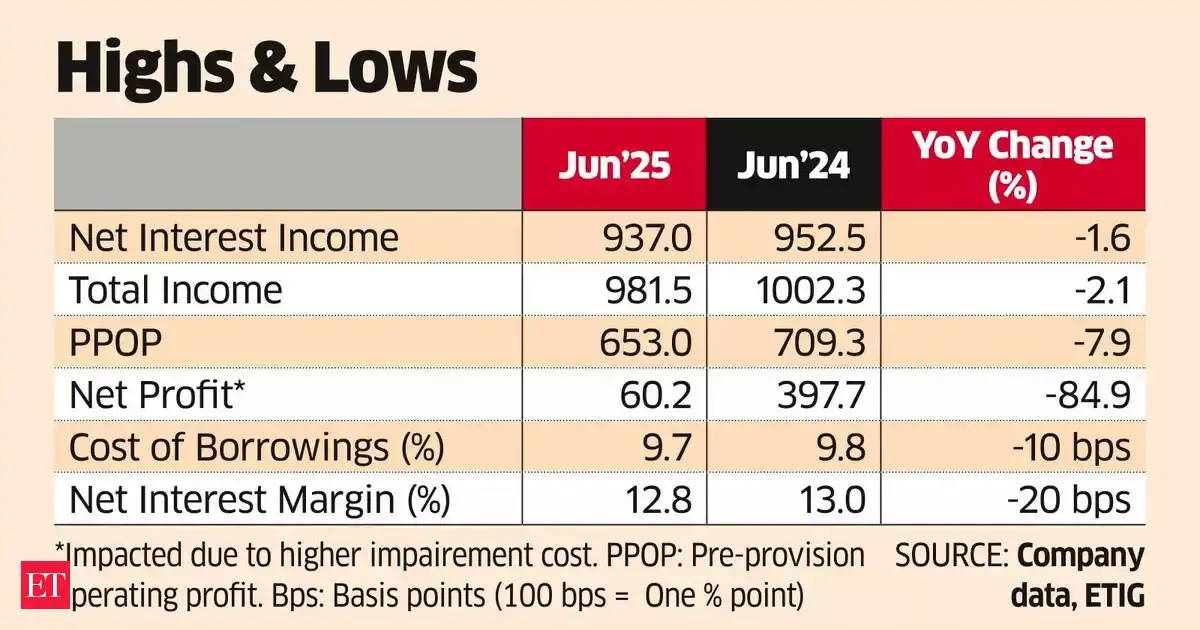

Dwindling credit score high quality within the microfinance section over the previous few quarters has affected the efficiency of CreditAccess. For its general portfolio, 90-day PAR (portfolio in danger ratio) shot as much as 3.3% from 1.1% within the year-ago quarter. The corporate has suffered a better asset high quality stress in Karnataka, which accounts for practically one-third of its mortgage guide. The PAR ratio for Karnataka within the 90 days and above class elevated to five.1% within the June quarter from 2.4% within the earlier quarter.

Based on the corporate administration, Karnataka has began exhibiting stabilisation in PAR within the present quarter. As well as, the implementation of stricter norms for mortgage disbursement has diminished the proportion of extremely leveraged debtors (which have borrowed from three or extra lenders) to 11.4% in June from 25.3% final August.

The credit score price elevated to ₹571.9 crore within the June quarter from ₹420.1 crore within the September 2024 quarter. This was largely as a result of accelerated write-offs because the proportion of recent PAR accretion within the credit score price fell to 61% from 90% through the interval. This raises hope that credit score prices might ease within the second half of the present fiscal 12 months.

Aside from asset cleanup, the corporate has additionally elevated give attention to retail financing, which is prone to type 12-15% of the mortgage guide by FY28. The section contributed 7% to the gross loans within the June quarter in contrast with 3% within the year-ago quarter.

Axis Securities expects annual progress in mortgage guide and internet revenue at 18% and over 50% between FY25 and FY28. It has raised goal value to ₹1,485 from earlier ₹1,350, implying FY27 anticipated price-book a number of of two.5. Inventory was final traded at ₹1,351 on Tuesday on the BSE.