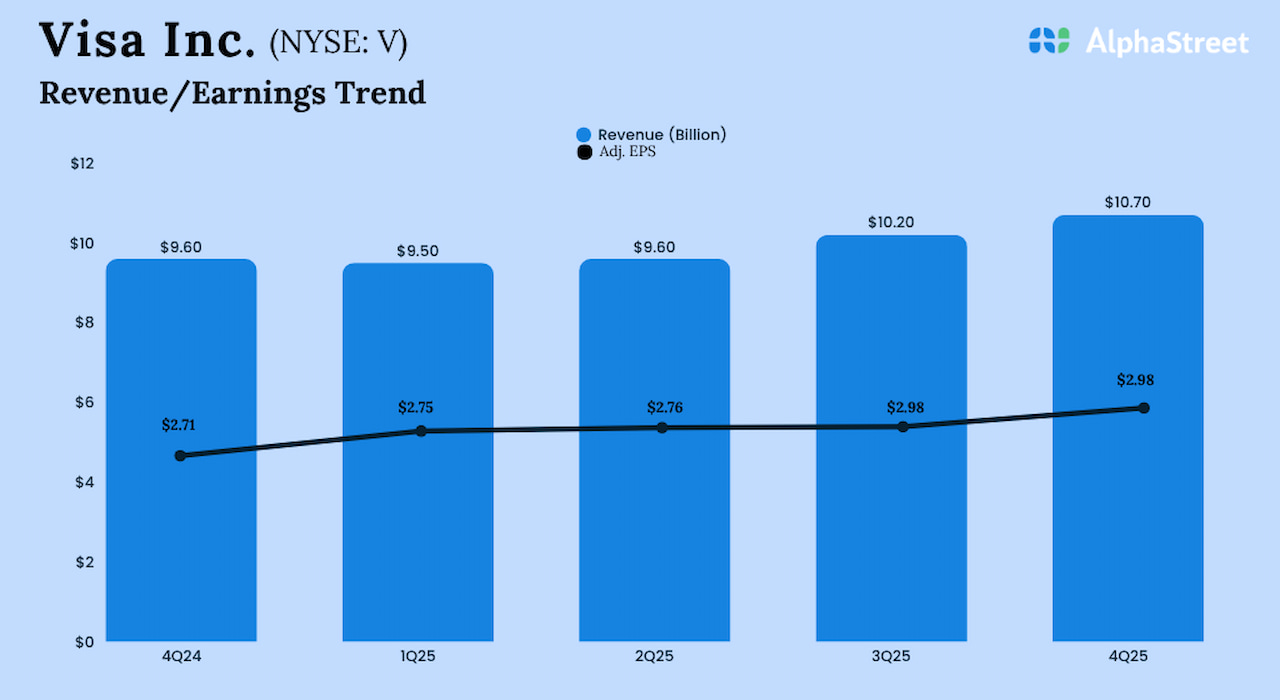

Visa, Inc. (NYSE: V) on Tuesday reported a rise in revenues for the fourth quarter of fiscal 2025, which translated into a ten% development in adjusted earnings.

Fourth-quarter income grew 12% yearly to $10.7 billion, aided by a rise in cost quantity amid continued wholesome client spending. The highest-line beat analysts’ estimates.

In consequence, adjusted earnings rose to $2.98 per share in This autumn from $2.71 per share final 12 months, exceeding expectations. On a reported foundation, web revenue was $5.1 billion or $2.62 per share, vs. $5.3 billion or $2.65 per share reported in This autumn 2024.

“We continued to spend money on our Visa as a Service stack to function a hyperscaler throughout the funds ecosystem. As applied sciences like AI-driven commerce, real-time cash motion, tokenization, and stablecoins converge to reshape commerce, our give attention to innovation and product growth positions Visa to guide this transformation,” mentioned Ryan McInerney, Chief Govt Officer, Visa.

In the course of the quarter, the corporate repurchased round 14 million shares of its frequent inventory at a mean price of $349.77 per share for $4.9 billion.