For Superior Micro Gadgets, Inc. (NASDAQ: AMD), 2025 has been a pivotal yr marked by sturdy income progress and strategic partnerships in AI and enterprise computing. Continued progress in information heart deployments and regular features within the consumer phase have bolstered the chipmaker’s edge within the quickly evolving semiconductor panorama. Traders might be carefully watching the corporate’s upcoming earnings report as it’s anticipated to replace on the latest OpenAI deal.

Q3 Report Due

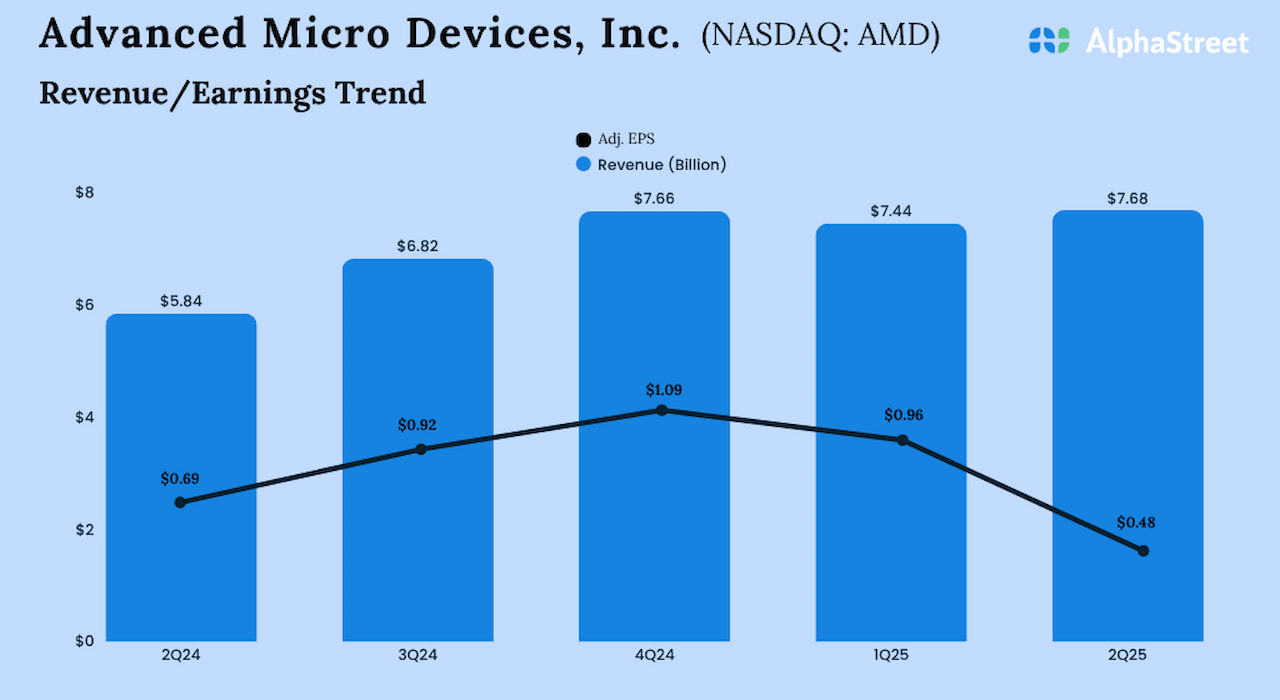

AMD is getting ready to report its September-quarter outcomes on November 4, after the closing bell. Analysts anticipate a powerful year-over-year rise in income and adjusted earnings, pushed by continued momentum in its information heart and AI segments. The consensus earnings estimate is $1.17 per share, which represents a marked enchancment from the prior-year quarter when the corporate earned $0.92 per share. The bullish forecast displays an estimated 28.3% progress in Q3 revenues to $8.75 billion.

AMD shares set a brand new file of $264.33 this week, extending the upswing that adopted the corporate’s multi-year strategic partnership with OpenAI, introduced in early October. AMD has grown a whopping 58% up to now 30 days alone. Notably, the common inventory value for the final 52 weeks is $137.52. The worth has greater than doubled up to now 4 months, outperforming the broader market.

Income Beats

Within the second quarter, earnings, on an adjusted foundation, declined to $0.48 per share from $0.69 per share in the identical interval of 2024. Unadjusted web earnings was $872 million or $0.54 per share in Q2, in comparison with $265 million or $0.16 per share a yr earlier. The corporate reported revenues of $7.7 billion for the June quarter, vs. $5.83 billion within the prior-year interval. Earnings matched estimates whereas revenues exceeded expectations.

“To speed up our growth, we’ve got invested considerably to develop our AI software program and {hardware} capabilities, each organically and inorganically, with numerous acquisitions and strategic investments. We strengthened our software program stack final quarter with the addition of the Brium and Lamini groups, constructing on our acquisitions of Nod.ai, Mipsology, and Silo AI. On the {hardware} aspect, we added a world-class rack and information heart scale design workforce within the second quarter with our acquisition of ZT Programs,” AMD CEO Lisa Su mentioned within the Q2 earnings name.

Street Forward

Lately, AMD entered right into a partnership with OpenAI for large-scale deployments of its expertise, beginning with the AMD Intuition MI450 sequence and rack-scale AI options. With its aggressive information heart technique targeted on AI, the corporate is consistently difficult Nvidia’s dominance in that space. The event of AMD’s next-generation MI400 sequence is progressing, and it’s deliberate for launch in 2026. In accordance with the corporate, it’s the most superior GPU it has ever constructed. Extra lately, AMD and the US Division of Vitality introduced the event of two supercomputers — Lux AI and Discovery — designed to drive breakthroughs in science, vitality, and nationwide safety.

Reversing the latest uptrend, AMD shares traded barely decrease throughout Friday’s session. The final closing value is up 78% from the degrees seen a yr in the past.