Olemedia/E+ through Getty Pictures

Thesis

Kingsoft Cloud (NASDAQ:KC) is down roughly 85% from ATH. Whereas the corporate has definitely traded at wealthy valuations up to now, the corporate now seems very low cost at x0.71 P/B and x0.8 P/S. Such low multiples will not be justified, in my view, as the corporate is properly positioned to profit from structural tailwinds in China’s accelerating cloud market-a market anticipated to develop at a 25% CAGR for the following 5 years. That stated, I’m bullish on the corporate and assign a Purchase advice. My base-case goal worth is $6.37/share.

About Kingsoft Cloud

Kingsoft Cloud is a number one cloud service supplier in China, and the nation’s greatest cloud-only participant. Kingsoft Cloud was based in 2012 as a spin-off from Kingsoft Corp and has grown to supply a complete portfolio of PaaS and IaaS, offering prospects with cloud infrastructure and cloud merchandise corresponding to knowledge storage and computing. Furthermore, in response to the corporate, lots of Kingsoft Cloud’s product options combine with AI, massive knowledge, IoT, blockchain, edge computing, and AR/VR applied sciences.

As of Q1 2022, roughly 35% of the corporate’s enterprise operations, as measured by whole gross sales, are attributable to enterprise cloud companies, and roughly 65% to public cloud. Within the public cloud market, Kingsoft has a powerful give attention to video, schooling and gaming. In my view, traders ought to respect this focus as this can be a actually engaging market in China.

Kingsoft’s Alternative

Kingsoft is poised to profit from the structural growth-trend in China’s Cloud market and the big addressable market. As of early 2022, China is the world’s second largest cloud market, however ultimately poised to overhaul the US-given China’s unmatched inhabitants and variety of linked sensible units and different web purposes.

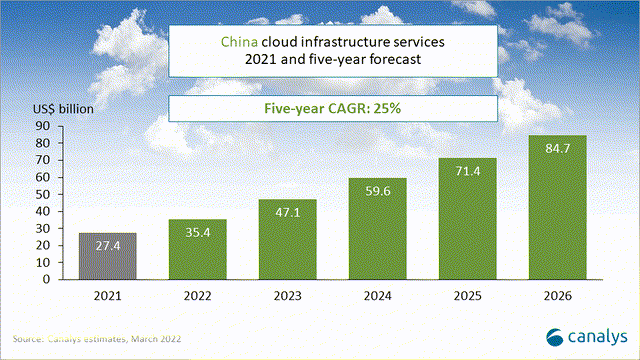

Regardless of macro-economic challenges in China, the nation’s cloud market delivered a powerful efficiency, rising roughly 45% year-over-year to virtually $30 billion in 2021. The market’s energy was definitely supported by post-pandemic developments corresponding to digitalization of schooling, e-commerce and distant working. However the structural tailwind for the business will probably be sustained. The truth is, China’s marketplace for cloud infrastructure is anticipated to achieve roughly $85 billion by 2026-implying a 5-year CAGR of 25% as in comparison with 2021.

Canalys

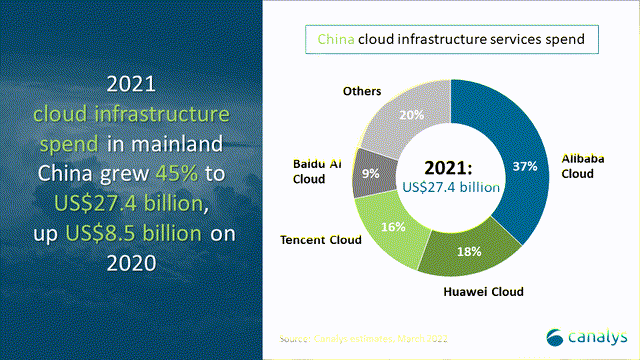

Kingsoft Cloud is China’s largest impartial cloud-player, that means that the corporate has no different enterprise operations which may create potential conflicts of curiosity for the corporate’s shoppers. That stated, the corporate may have a novel positioning to seize market share from massive tech giants corresponding to Alibaba, Tencent, Baidu, JD and Huawei. Most notably, as of 2021 these 5 tech giants accounted for roughly 80% of the nation’s cloud market share.

Canalys

How analysts see it

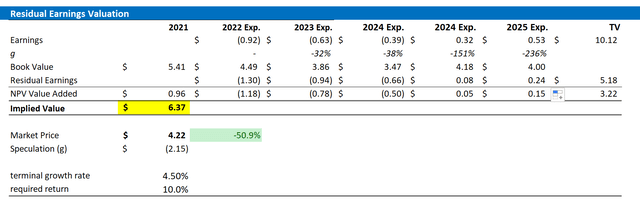

Analysts are very bullish on KC, with a mean consensus goal worth of $12.78/share (considerably >100% upside). Out of the eleven analysts that cowl the inventory, 5 analysts have a STRONG BUY ranking, three have a BUY ranking and three analysts a HOLD ranking. In response to the Bloomberg Terminal, as of June 2022, analysts see KC’s revenues in 2022, 2023, 2024 and 2025 at $1.48 billion, $1.86 billion, $2.15 billion and $2.24 billion. This might equal a 3-year CAGR of roughly 20% from 2022 to 2025. Respectively, EPS are estimated at $0.92, -$0.63, -$0.39 and $0.32 for a similar interval.

In search of Alpha

Residual earnings valuation

To worth KC, I suggest to make use of a residual earnings valuation and anchor on the next assumptions:

- I base my EPS estimates on the analyst consensus till 2024. In response to the Bloomberg Terminal, as of June 2022, consensus signifies earnings per share for 2022, 2023, 2024, 2025 and 2026 of -$0.92, -$0.63, -$0.39, $0.32 and $0.53.

- I exploit a WACC of 10%.

- For the terminal progress price, I apply anticipated nominal GDP progress at 3.5% plus one share level to replicate the gaming business’s potential (thus, 4.5% in sum).

Primarily based on the above assumptions, my calculation returns a base-case goal worth for KC $6.37/share, implying 50% upside potential.

Analyst Consensus; Creator’s Calculation

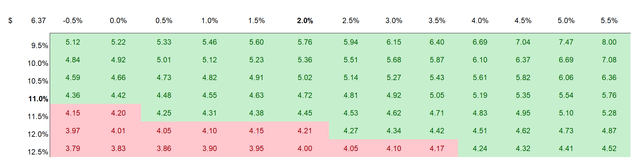

Traders might need completely different assumptions close to KC’s required return and terminal enterprise progress. Thus, I additionally enclose a sensitivity desk to check various assumptions. For reference, red-cells suggest an overvaluation as in comparison with the present market worth, and green-cells suggest an undervaluation.

Analyst Consensus; Creator’s Calculation

Dangers

I wish to spotlight a number of dangers which will trigger KC inventory to considerably deviate from my goal worth of $6.37:

First, KC’s enterprise actions are strongly linked to the well being of the Chinese language economic system. A major financial slowdown in China, attributable to COVID lockdowns, the actual property disaster and inflation, may considerably affect enterprise investments in digitalization–and thus KC’s enterprise monetization alternatives.

Second, traders are well-advised to not underestimate aggressive pressures in China’s cloud market. KC is competing with the nation’s main tech giants, together with Tencent and Alibaba. That stated, traders would possibly wish to carefully monitor Kingsoft Cloud’s topline progress and bottom-line margins.

Third, a lot of KC’s share worth is presently pushed by investor sentiment in the direction of danger belongings, ADRs, and China equities. Thus, traders ought to carefully monitor the market sentiment when taking shopping for/promoting choices for the inventory.

Conclusion

I’m very bullish on the financial and monetary potential of China’s cloud market, given the nation’s massive addressable market and accelerating digitalization. That stated, I see Kingsoft Cloud as a gorgeous danger/reward alternative to achieve publicity to this market. I worth Kingsoft Cloud primarily based on a residual earnings framework and calculate a good base-case goal worth equal to $6.37/share, implying 50% upside potential.