janiecbros/E+ through Getty Photos

With biotech again momentarily in vogue this month, buyers would possibly discover it worthwhile to re-acquaint themselves with Karuna Therapeutics (NASDAQ:KRTX). This clinical-stage biopharmaceutical firm was the perfect first-year IPO performer of 2019 (admittedly, a yr now misplaced to some collective pre-pandemic haze). KRTX’s worth was pushed sky-high by a torrent of analyst enthusiasm over a optimistic Part 2 consequence.

Minimize to 2022: KRTX is predicted to drop Part 3 outcomes later this quarter. To say that the information might be “destiny-changing” for the corporate is an understatement.

What makes this launch so vital? KRTX has an experimental remedy that might overcome the challenges of conventional psychiatric drug improvement. It’s pursuing a mechanism of motion clearly differentiated from all present requirements of care in schizophrenia and dementia-related psychosis.

Present antipsychotic remedies inhibit D2 dopamine receptors. A brand new strategy did emerge within the Nineties, which labored to stimulate the muscarinic receptors within the central nervous system, however sadly the strategy created nasty cholinergic uncomfortable side effects (as a result of stimulation of muscarinic receptors in peripheral tissues).

Karuna’s lead drug candidate KarXT (Karuna-xanomeline-trospium) is exclusive in that it avoids the normal blockade of dopamine or serotonin receptors and mediates through muscarinic cholinergic receptors, however its trospium element particularly operates as an efficient muscarinic receptor antagonist. By combining examined and authorised muscarinic-agonist xanomeline with muscarinic-antagonist trospium chloride, the detrimental impact to peripheral tissues is curbed.

Schizophrenia impacts almost 3 million sufferers respectively within the U.S., and greater than 24 million globally, based on the WHO. It is without doubt one of the most disabling ailments that afflicts humankind, and it impacts about .45% of all folks worldwide. Likewise, dementia-related psychosis is sort of widespread; it plagues about 2 million People and that quantity is estimated to develop steadily with the demographic growing older of our inhabitants.

With a novel mechanism and powerful knowledge, Karuna might seize a large market alternative. Prior medicine on this class have attained peak gross sales starting from $3 billion to over $9 billion. By decreasing the opposed occasions related to xanomeline, it has the potential to supply a protected, differentiated remedy to handle the destructive signs of schizophrenia. KarXT might be a blockbuster.

Part 2 Success And Efficacy:

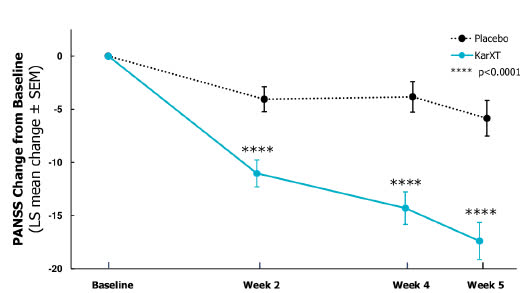

Launched in November 2019, KarXT’s Part 2 knowledge have been spectacular. Its research to be used to deal with acute psychosis in sufferers with schizophrenia demonstrated strong efficacy, assembly the first endpoint, with an 11.6-point imply discount in complete Constructive and Destructive Syndrome Scales core in comparison with placebo.

Karuna Therapeutics

On the time, Jeffrey Lieberman, M.D., a member of Karuna Therapeutics’ scientific advisory board, had this to say concerning the outcomes:

The outcomes of the Part 2 trial are spectacular and inspiring as a result of they point out that KarXT, if authorised, might signify a game-changing therapeutic advance within the remedy of sufferers with schizophrenia. Along with its novel mechanism of motion, KarXT might be a brand new therapeutic choice that has the potential to supply strong efficacy devoid of weight acquire, metabolic results and extrapyramidal uncomfortable side effects.

Printed within the prestigious New England Journal of Drugs, these outcomes catapulted the inventory from 17 to 85 inside days, making it probably the most profitable IPO of 2019. The ticker -despite a momentary dip to 62 in March 2022, has stayed at a plateau ranging between 98 and 155 over the previous 18 months.

Technicals: A New Momentum Cycle?

Karuna’s market capitalization is presently $3.60 billion with 31.26 million shares excellent, greater than 90% held by establishments and companies. It has a moderately tight public float and a beta of two.04.

KRTX’s weekly chart over the previous two years, you may see that the early Nov 2021 prime of $155 was not confirmed by the MACD and that, in actual fact, the momentum indicated by KRTX’s MACD topped out in Feb. 2021 and eventually absolutely troughed solely in March 2022. That worth drop under 100 in late March discovered a “W leg” in early June, however I might argue that the “increased low” of the MACD means that we’re in a brand new cycle.

inventory charts.com

The next chart additionally suggests there was a noticeable bifurcation from sector efficiency since mid-March:

Part 3: The Particulars

What has saved the ticker this elevated? What has buyers revving up? Fairly merely: Part 3. Topline knowledge from the Part 3 EMERGENT-2 trial is predicted within the third quarter (and EMERGENT-3 within the first quarter of 2023.)

As Part 3, 5-week, randomized, double-blind, parallel-group, placebo-controlled, multicenter inpatient trials, each EMERGENT-2 and EMERGENT-3 will look at the efficacy and security of KarXT in about 246 grownup topics every. These are people who’re “acutely psychotic” -designated with a DSM-5 analysis of schizophrenia. The first goal of the research is to evaluate the efficacy of KarXT versus a placebo in decreasing PANSS complete scores in grownup inpatients with a DSM-5 analysis of schizophrenia. The secondary goals of the research are to judge enchancment in illness severity and signs, security and tolerability in grownup inpatients with the precise DSM-5 analysis of schizophrenia.

Constructive outcomes from these five-week trials, plus some extra security knowledge, should be sufficient to help a New Drug Software submitting. If authorised, KarXT might get 7.5 years of regulatory exclusivity within the U.S. with the potential for a 6-month pediatric extension.

Relating to the Chinese language market, Karuna has already inked a cope with Zai Labs. Underneath the phrases of the settlement, inked in November 2021, it’s going to obtain a $35 million upfront cost and is eligible to obtain as much as a further $80 million in improvement and regulatory milestones. It is usually eligible to obtain as much as $72 million in gross sales milestones and low-double-digit to high-teens tiered royalties based mostly on annual web gross sales of KarXT on the mainland.

Success would ship the fill up properly, most likely to above $160 inside hours of a optimistic Part 3 consequence (breaking by an “upward ascending triangle” arguably established by the November nineteenth 2019 intraday excessive).

Success would additionally make the corporate a takeover goal.

Clear And Current Risks

As analyst Edmund Ingham has thoughtfully written, remedies for schizophrenia – a really advanced disease–are plagued with a excessive late-stage trial failure price, with solely 51% of CNS remedies progressing from a Part 3 trial to approval (in actual fact, the bottom price amongst all therapeutic areas apart from oncology).

The present remedies for the illness, together with generics, aren’t going away and there are different biotech companies at work on new efforts. Final summer season, Cerevel Therapeutics unveiled optimistic outcomes of a trial of its drug CVL-231 in grownup schizophrenia sufferers, setting off a shake-up amongst shares of biotechs targeted on the dysfunction. Sure, it was a tiny Part 1b trial. However because it confirmed “clinically significant antipsychotic exercise,” the (CERE) research means that Karuna’s aggressive panorama is ever-evolving.

In KRTX’s just lately reported quarter, R&D bills have been up 117% yr over yr (to $43.8 million) attributable to elevated scientific program prices. Normal and administrative bills additionally jumped 51.3% from 2020 to $14.8 million attributable to increased employee-related prices.

On the finish of 1Q-2022, Karuna had a money stability of $443.19 million, a ten% drop from the prior quarter. Is that this ample to help all points of operation, together with the a number of milestones wanted following a possible NDA submission of KarXT in schizophrenia? Karuna believes it’s.

At current, Karuna Therapeutics is a extremely speculative name choice on a possible blockbuster. Part 3 is for all of the marbles.