After a federal vacation final Monday, the S&P 500 rallied for the week, and included two outlier days of +2.45% and +3.06%. As a reminder, an outlier day is any single buying and selling day past +/-1.50%. As we wrote final week, “By way of the primary 6 months of 2022, you’ll anticipate see about 6 outlier days past +/-1.50% [based on bell curve math during a normal, efficient market environment].”

The variety of outliers in 2022 is now as much as 43 outlier days. Once more, in a traditional market surroundings, you’ll anticipate to have 6 days. The S&P 500 has had seven instances as what was anticipated. That is reflective of a extremely unstable bear market surroundings.

Bear markets, like we’re seeing right now, will characteristic massive rallies. Final week’s outliers have been two very massive “up” days, however that doesn’t imply we’re seeing a shift in market environments. Actually, volatility goes up, not down. The Canterbury Volatility Index (CVI) is now at a 2-year excessive. Excessive volatility is the first attribute of a bear market. To be able to for the bear market to alter to a bullish or transitional Market State, two issues would wish to happen.

To vary from a bear to a bull/transitional market surroundings:

- Volatility wants to say no by at the least 20-30%. Proper now, volatility is at CVI 146. Typically talking, a volatility lower than CVI 75 is taken into account low and steady.

- We have to see a sequence of upper highs and better lows. Bull markets are characterised by a gentle and gradual, upward climb the place the markets put in a excessive, after which pullback and put in a low, adopted by a rally to a better excessive and pullback to a better low. Proper now, we’ve got solely seen decrease highs and decrease lows. It should take time for this course of to play out.

Some Charts to Watch

Throughout the board, each international fairness ETF in our universe (which is about 150 ETFs) is in a Bearish Market States. Understand that there are a number of ETFs in our “options to international equities” class which are in Bullish Market States, most of that are inverse ETFs. That being stated, we’re paying particular consideration to risk-adjusted relative power in few totally different areas, a few of that are highlighted under.

Vitality

The power sector has been the perfect performing S&P 500 sector in 2022. Not too long ago, the sector has skilled a big pullback. Proper now, it seems to be sitting on assist. The perfect state of affairs is for the group of power shares to bounce upward off this assist stage.

Canterbury Funding Administration. Chart created utilizing Optuma Technical Evaluation Software program

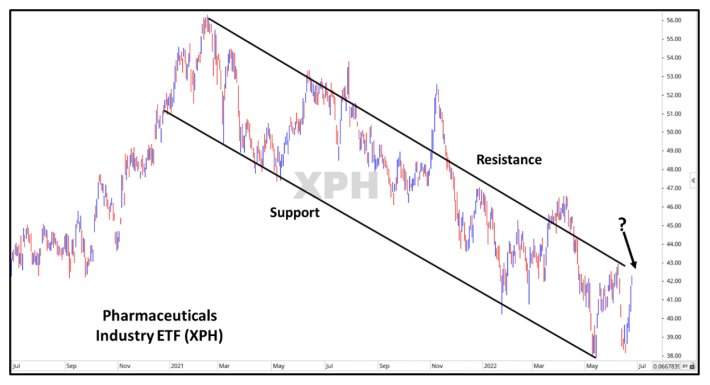

Prescription drugs

One of many greatest movers in Volatility-Adjusted-Relative-Energy (VWRS) rankings has been the prescription drugs business. Apparently, prescription drugs final put in a excessive again in February 2021, and had since fallen greater than -30% from that prime. Not too long ago, nonetheless, it climbed up in rating on our every day stories after a rally skilled during the last two weeks. Trying on the chart under, you may see it has been buying and selling in a “channel,” which options falling assist and resistance strains that the safety tends to fluctuate between. The business is now on the higher finish of its vary. Will it comply with the possible pattern and decline again to assist, or will its rally proceed, break above resistance and start a brand new pattern?

Notice that the assist and resistance strains being drawn are pretty arbitrary and needs to be drawn with a “thick” pen. There have been just a few instances the place the ETF has damaged above resistance for a brief interval earlier than declining under it. Ideally, a break above resistance could be adopted by a pullback to the resistance line earlier than bouncing off of it and confirming the road as new assist.

Canterbury Funding Administration. Chart created utilizing Optuma Technical Evaluation Software program

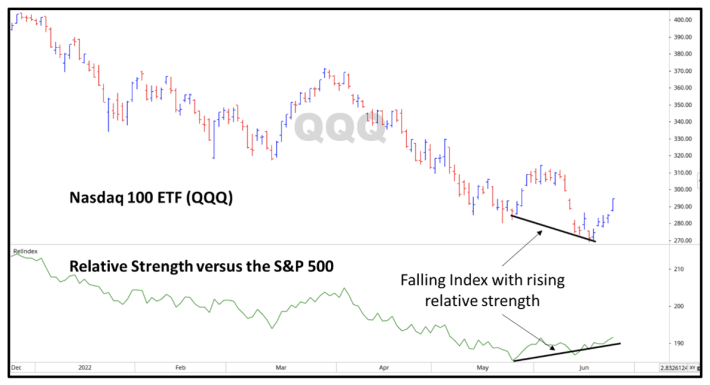

Expertise Shares

Expertise-related shares are by far the biggest part of the broad, U.S. markets. In different phrases, if expertise shares wrestle, they are going to have a tendency to drag market indexes down with them. That’s what has occurred in 2022. On the flip aspect, any rally in technology-related shares ought to pull the markets larger. Not too long ago, we’ve got seen the relative power of the Nasdaq (a technology-based index) versus the S&P 500 tick larger. This rotation has not occurred lengthy sufficient to point a confirmed shift in momentum in the direction of tech shares, however we’re maintaining an in depth eye on it.

Canterbury Funding Administration. Chart created utilizing Optuma Technical Evaluation Software program

Backside Line

Even with the big up days and rally seen final week, the markets are nonetheless about 85% oversold. This might result in the expectation of an extra “bear market rally” within the days forward. That stated, we might proceed to anticipate decrease costs sooner or later.

The target is to not name the course of the market and the size of time it can take the indexes to get again to a traditional market surroundings. Our goal is to effectively diversify the mix of securities within the portfolio with a purpose to preserve low and constant volatility, whatever the general market surroundings.

To perform the discuss of sustaining stability, the portfolio would require a mixture of each lengthy and inverse ETFs. By sustaining a extra steady portfolio with low volatility, the portfolio can profit from the market’s volatility, moderately than being punished by it, by limiting portfolio declines and coming off a bigger greenback base worth with every subsequent rally.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.