kynny/iStock via Getty Images

Introduction

ACM Research Inc (NASDAQ:ACMR) is a small-cap stock that can be used to play the capital equipment dynamics of the global semi-conductor industry. Whilst this company’s corporate office is in California, its business operations are primarily carried out in China, through its sub- ACM Shanghai, in which it has an 82.5% stake.

A Few Encouraging Sub-Plots

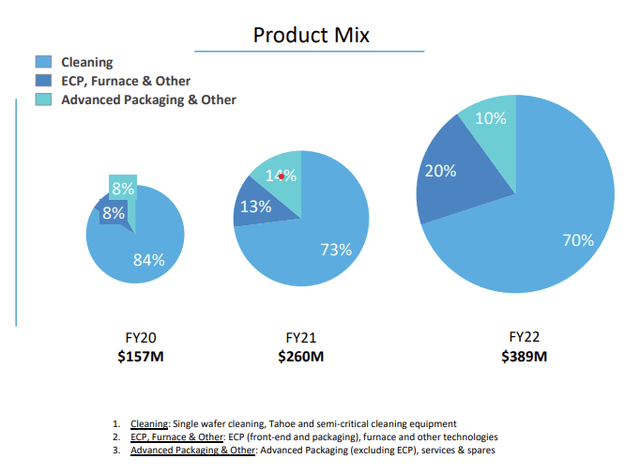

August 2023 Presentation

Even though ACMR has done well to grow its portfolio beyond wet-cleaning technology, that segment still accounts for the largest chunk of business. Note that ACMR’s wet-cleaning expertise is relied on by foundry, logic, and memory chip makers who repeatedly come back to the firm. For context, over the last 14 years, the company has delivered close to 380 wet-cleaning and other front-end processing tools, yet around 76% of these are repeat orders, giving you a sense of the stickiness of this business.

So why is ACM Research’s proposition so seductive for clients?

Well what investors need to note is that ACM’s single wafer, wet-cleaning equipment can be very pivotal in improving product yield at the front-end, even for highly advanced process nodes of less than 22nm. The goal here is to remove any blemishes or defects on the wafer surface without causing any damage.

Other competing cleaning tech such as jet spray wafer-cleaning or megasonic wafer-cleaning processes have their own set of flaws, such as an inability to remove particles at low node sizes without damage to the wafers, or an inability to maintain uniform energy doses across these wafers. Processing speeds too are generally a lot slower than the wet cleaning tech that ACMR is known for.

Investors should also note that ACM is also in the midst of expanding its client base beyond just the Asian front-end fab customers, particularly those based in China (Just three Chinese based foundries and chip companies account for 44% of group revenue) and is targeting clients in regions such as North America and Western Europe.

Last year, they delivered a tool for evaluation to a US lab for a global semiconductor capital equipment vendor, and in Q2, management sounded optimistic that it would pass qualification by the end of this year. Similarly, in Q1 this year, ACMR also announced another order from a European based entity for qualification, and they are currently building a local service team and looking to deliver it by Q4.

This broad pivot beyond mainland China should help derisk the operating model over time, although it must also be said that the current strong exposure to China, should not necessarily be seen as an outright drawback, as the country is desperately trying to intensify its domestic mature node infrastructure (which has picked up due to US-led suppression), to keep up with the surging demand there, particularly on account of the burgeoning EV penetration. ACM is believed to cover 90% of all cleaning process steps, and its expertise will likely only be relied on with greater fervor.

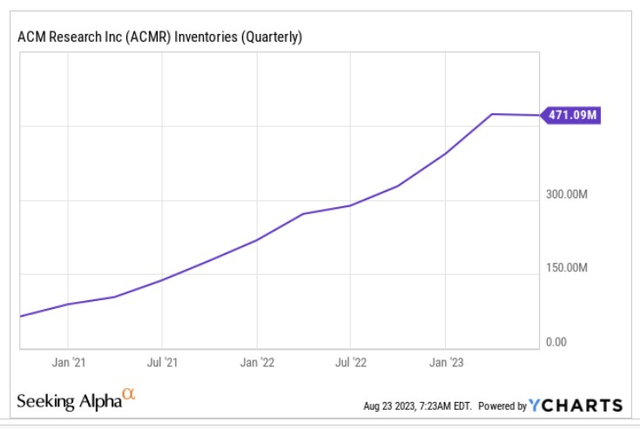

Then, over the last three years, on an annual basis, ACM has failed to generate any positive operating cash flow (let alone FCF); the lack of sustainable cash flow is not ideal and will likely keep it out of reach from a lot of institutional screeners. However, recently in Q2, the company managed to eke out positive operating cash flow of $6m, despite maintaining relatively high inventory levels (of over $470m) for the second straight quarter.

YCharts

On the Q2 call, management noted that around 36% of these inventories came from finished tools that are currently being evaluated by clients and will likely be drawn down. Besides ACM had resorted to significant inventory buildup in recent periods on account of supply chain challenges across the industry, and they believe this is less of an issue now, and thus inventory position is likely to be less of a drag on the working capital. On account of this, it is quite possible that positive operating cash flow persists beyond just Q2, and we may close the FY on a positive note.

Forward Financial Outlook And Valuation Commentary

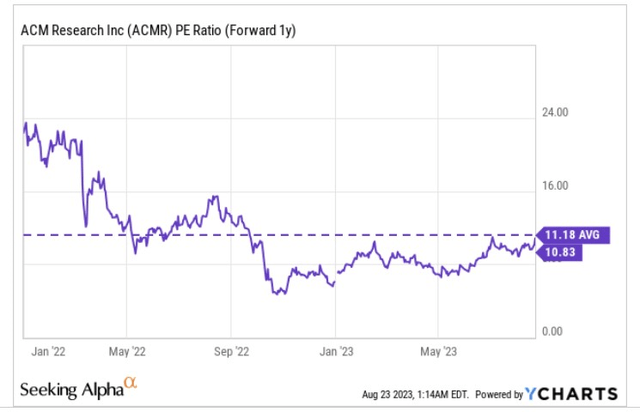

ACM is not a particularly expensive stock to own; based on its expected FY24 EPS, the stock is in fact priced at a marginal 3% forward P/E discount relative to its long-term average of 11.18x.

YCharts

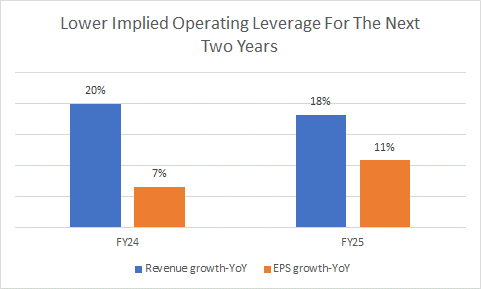

The slight discount is understandable when you consider the likely slower pace of growth and weaker operating leverage one will get, going forward.

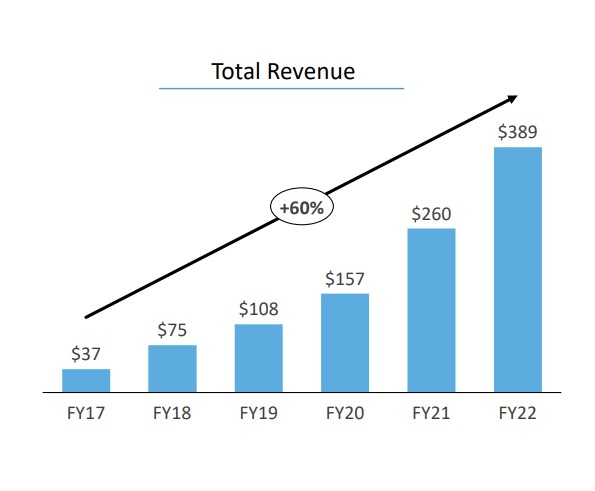

August 2023 Presentation

As highlighted in the image above, traditionally, ACM’s business has been growing at 60% over the last five years or so. In recent periods that pace has slowed, and despite a fairly commendable H1, where the topline grew by 49%, management chose not to lift their FY topline guidance of $515m to $585m. Consensus currently has a FY figure that is slightly above the mid-point of that range at $551m; this would translate to growth of 42% for the year.

Granted, 42% annual topline growth in FY23 should be applauded when Gartner believes that ACMR’s focus market equipment segment as a whole will likely contract by -20% this year. Yet still, after a robust H1, the implied growth in H2 for ACMR will likely only come in at around a lower figure of 35%. Besides, in the years ahead, consensus shows expected topline growth to come in at much lower levels of 19% p.a. on average.

It isn’t just the topline. To successfully service and close deals in the international markets, ACM will also likely witness a step-up in SG&A, which was instrumental in driving OPEX costs up by 63% YoY in Q2. All in all, in FY24 and FY25, consensus positioning suggests that ACM won’t witness adequate operating leverage, with bottomline growth lagging topline growth by 1300bps, and 700bps respectively.

YCharts

Closing Thoughts – Technical Considerations

On the charts, we are not overzealous about the current risk-reward on offer, but we certainly don’t think it’s poor either. The image below helps ascertain if ACMR could work as a potential mean-reversion play within the small-cap growth universe. In retrospect, this could have been a great trade in Q4 last year, but note that the relative strength ratio has since doubled, and whilst there’s still a bit more scope for mean-reversion to the mid-point of the trading range, the gap isn’t too large at this juncture.

Stockcharts

Then on ACM’s standalone weekly chart note that since the gap down in October last year, the stock has recovered and closed the gap, trending up in the shape of a rather consistent ascending channel. If one were to stage a long position at this juncture, using the two boundaries as guideposts, it’s fair to say that the risk-reward looks fair.

Investing

All things considered, we feel a HOLD rating seems fitting for ACM.