Justin Sullivan

Agilent Technologies (NYSE:A) is a global leader in Life Sciences Tools and Services industry. It is well known for its industry-leading laboratory workflow solutions. Agilent continues to acquire companies which aid continued growth on its top line. In fact, A recently acquired Avida Biomed which aims to enhance the company’s NGS offerings. However, despite this expansion effort, A’s revenue y/y growth trend appears to be declining over time, which put A’s valuation to be unattractive as of this writing. A’s catalysts regarding its build and buy strategy, on the other hand, may potentially improve its top line, making it an attractive long pullback candidate.

Company Overview

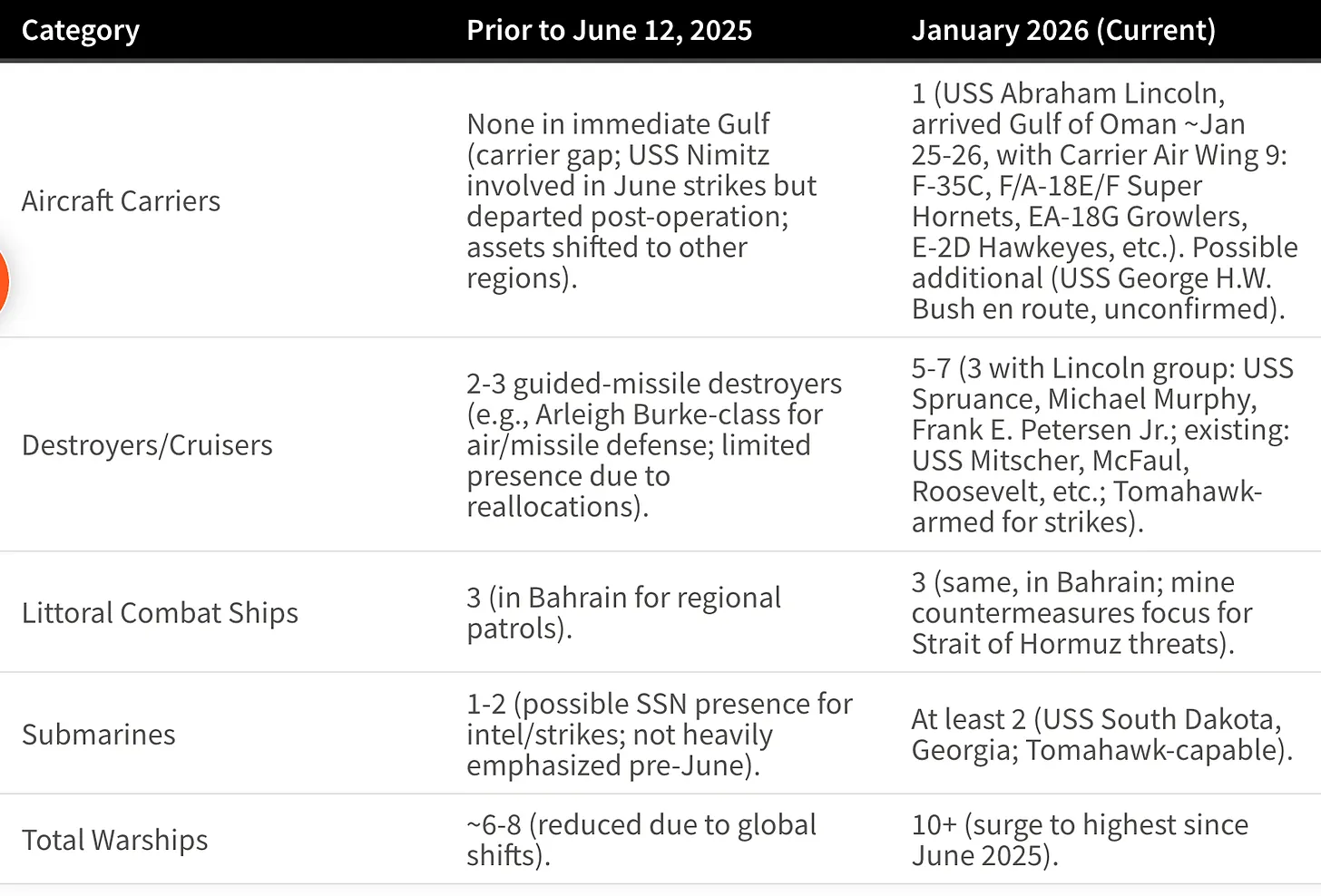

A: Growing Core Revenue (Source: Q4 ’22 Report )

Agilent Technologies finished FY ’22 with 12% year-over-year increase in core revenue on a constant basis, which was higher than the 11% year-over-year growth achieved in FY ’21 and higher than the 6% reported in FY ’20. However, management’s outlook appears to be unsettling, with reduced core revenue growth in FY ’23, as cited below.

Core growth is expected to be in the range of 5% to 6.5%, in line with our long-range goals. Currency will negatively affect reported growth by 430 basis points or roughly $295 million during the year based on fiscal year-end rates. Source: Q4 ’22 Earnings Call Transcript

This has the potential to disrupt the Agilent’s core revenue growth trend as mentioned earlier.

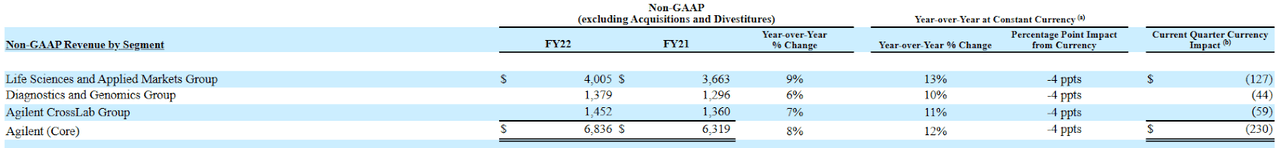

A: Trailing Revenue Growth (Source: Data from SeekingAlpha. Prepared by the Author)

In fact, looking at the A’s GAAP data, as displayed in the image above, we can see that growth is decreasing, which makes it unappealing, especially today’s bearish macro environment. This is especially true considering its higher valuation than its peers, Danaher Corporation (NYSE:DHR), and Thermo Fisher Scientific Inc. (NYSE:TMO)

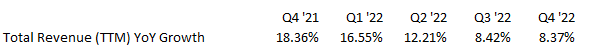

A: Growth in $65B Market (Source: Q4 ’22 Earnings Call Presentation)

Despite today’s challenging operating environment, A is still growing in all of its end markets, as shown in the image above. In fact, the company has explicitly said that they remain focused on their expansion strategy, as quoted below.

Through its deep understanding and insights into lab operations, the ACG team continues to build strategic partnerships and long-term relationships that maximize customer value and provide ongoing demand for services and support. Source: Q4 ’22 Earnings Call Transcript

On top of its recent acquisition, A recently ramped-up its capital expenditure spending in FY ’23 amounting to $300 million for the purpose of continued scale-up of Nucleic Acid Solutions Division (NASD) expansion. Additionally, the company is benefiting from its investment in digitization, which is bringing efficiency to its selling and marketing expenditures, resulting in an improving operating margin, as seen in the image below.

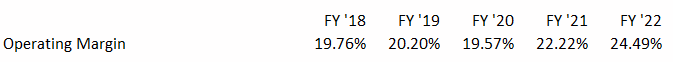

A: Improving Operating Margin (Source: Data from SeekingAlpha. Prepared by the Author)

In fact, management expects earnings per share to improve to $5.61 to $5.69, with a midpoint of $5.65, up from $5.22 in FY ’22.

Market Pressure Persists

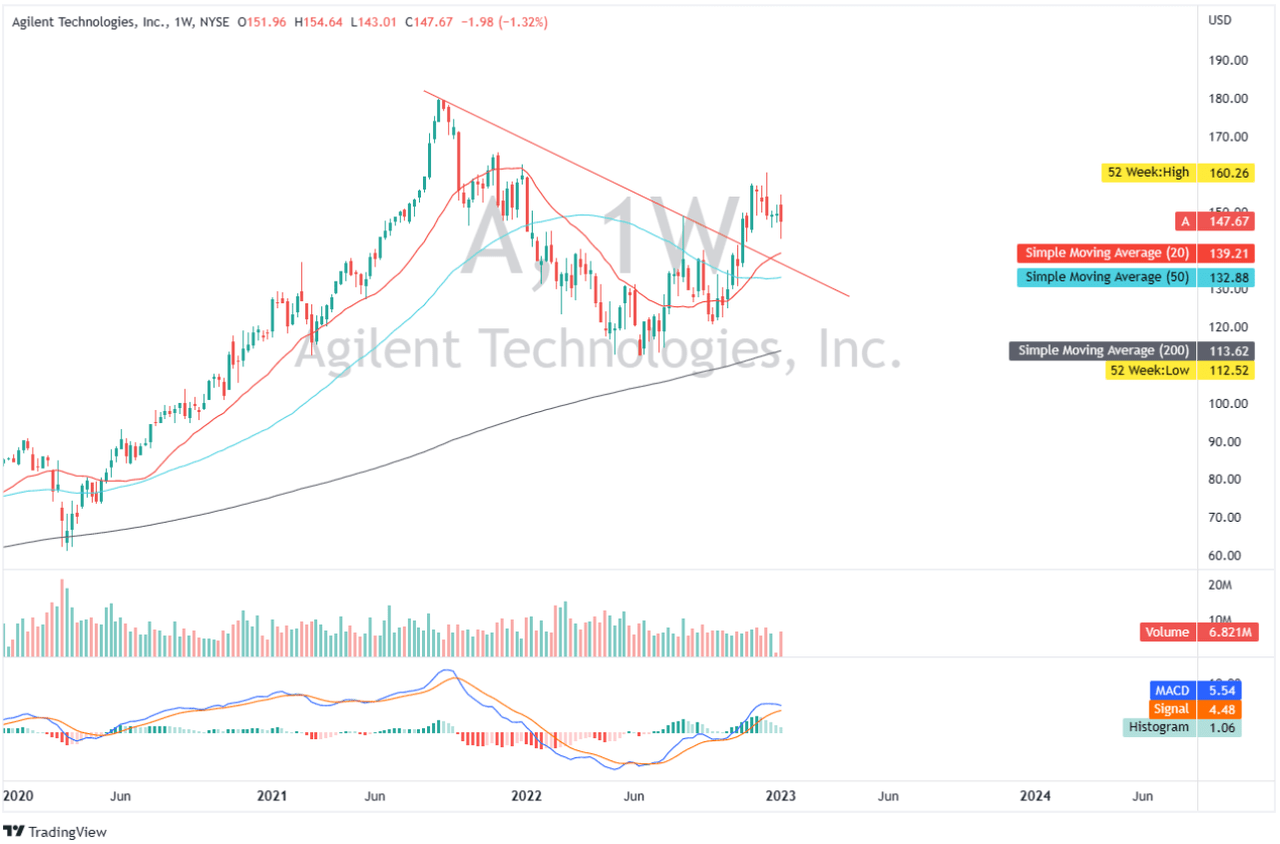

A: Weekly Chart (Source: Author’s TradingView Account)

Agilent has seen a bullish breakout, as illustrated in the chart above. A bullish crossover of its 20- and 50-day simple moving averages supports this bullish breakout. Additionally, the market exerted pressure on A and rejected the $160 level; this swing high may be a major resistance level to watch. Price action weakness persists, particularly in light of its MACD indicator, which is now creating a probable bearish crossover that might result in a price drop. If you were looking for a safer entry point, I would look on its next support zone around $140 to $130.

Fairly Valued

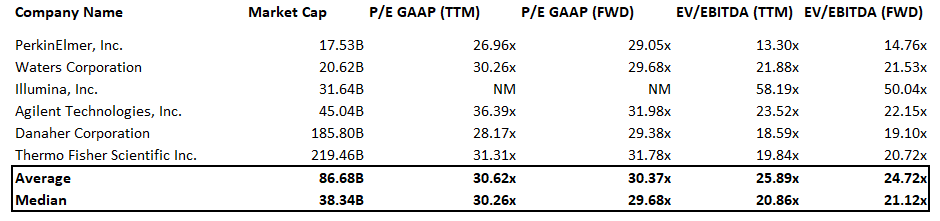

A: Relative Valuation (Source: Data from SeekingAlpha. Prepared by the Author)

PerkinElmer, Inc. (NYSE:PKI), Waters Corporation (NYSE:WAT), Illumina, Inc. (NASDAQ:ILMN)

When we compare A’s trailing P/E of 36.39x to its peers’ average of 30.62x, we can immediately conclude that A is rather expensive. However, its forward P/E of 31.98x is close to its peer average of 30.37x. Moving forward, A’s trailing EV/EBITDA of 23.52x represents a discount to its peer average. It also has a cheaper forward EV/EBITDA ratio of 22.15x than its peers’ average of 24.72x.

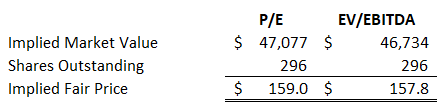

A: Relative Valuation (Source: Prepared by the Author)

To quantify our valuation, we may arrive at an average blended fair price of $158.4 using an implied P/E of 30.37x, selected EV/EBITDA of 24.72x, a discount rate of 8%, analyst EPS estimate of $5.66, and an anticipated EBITDA of $2,117 million in FY ’23. Hence, it does not provide a margin of safety, making it unappealing at its current level.

But There Is Potential Growth

However, I believe this assumption remains conservative, especially considering the rumors on the potential M&A transaction with Guardant Health (NASDAQ:GH). This acquisition may help advance Agilent’s growth in the global liquid biopsy market. In fact, Agilent Resolution ctDx First has already been approved by the FDA as a liquid biopsy companion diagnostic test to Mirati Therapeutics’ (NASDAQ:MRTX) Krazati for the treatment of certain patients with non-small cell lung cancer (NSCLC) and has received positive feedback from cancer patients, as quoted below.

Agilent added that the test uses a propriety technology to detect genomic alterations in circulating tumor DNA (ctDNA) from plasma. This minimally invasive approach is preferred by 90% of patients with cancer compared to more invasive tissue biopsy tests, according to the company. Source: Here

Despite GH’s disappointing test results from its Guardant SHIELD study, colorectal cancer blood test, I believe there is still opportunity for improvement, and in my opinion, there is a potential operational synergy given both companies’ experience in the industry. With this catalyst in place, I would not be surprised if A releases other life changing innovations in the future.

Conclusive Thoughts

Despite today’s slowing top line growth trend outlook and A’s high multiples, A has interesting growth catalysts which may potentially boost both its top line and margins. Furthermore, A reveals a healthy debt to equity ratio of 0.52x and has a favorable cash flow from operations outlook from management of $1.4 billion to $1.5 billion in FY ’23, up from $1,312.0 million in FY ’22. Hence, I believe A remains liquid and attractive in its potential pullback.

Thank you for reading everyone and cheers!