alexsl/iStock Unreleased through Getty Photographs

Thesis

The inventory market is infamous for fully ignoring enterprise fundamentals at each the greed and really feel excessive, as illustrated by the present circumstances of Alibaba (NYSE:BABA) and Amazon (NASDAQ:AMZN). The distinction between these two shares is so stark that it not solely serves to point out a selected funding alternative but in addition serves as a basic instance of market psychology. Admittedly, these two shares aren’t completely comparable and there are actually variations. Among the uncertainties and dangers confronted by BABA aren’t shared by AMZN.

And my thesis right here is that the present market valuation has already priced in all of the dangers surrounding BABA. Extra particularly,

- BABA’s inventory value has just lately change into dominated by market sentiment and disconnected from fundamentals. Its inventory costs simply fluctuated 10%-plus in just a few days or perhaps a single day just lately in response to information and sentiments that will or could not have direct relevance to its enterprise fundamentals. However, AMZN’s inventory value gave the impression to be immune from information and fundamentals. It has been buying and selling sideways in a slender vary (and at an elevated valuation) regardless of its mounting money circulation points and all of the geopolitical and macroeconomic dangers.

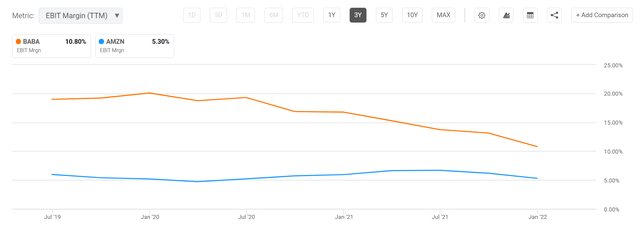

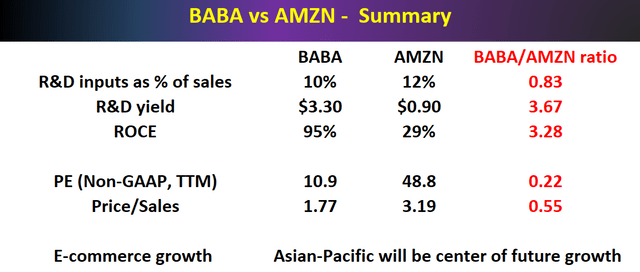

- As proven within the subsequent chart, each BABA and AMZN are valued at about 1.8x and three.2x value to gross sales ratio, respectively, a reduction by nearly an element of 2x (1.8x to be precise). As we glance deeper subsequent, the low cost turns into even bigger than on the floor. The second chart compares the revenue margin between BABA and Amazon. BABA’s EBIT revenue margin is nearly twice that of Amazon – not solely reveals BABA’s superior profitability (and AMZN’s regarding and deteriorating profitability) but in addition additional highlights the valuation hole. The gross sales of BABA needs to be value about 2x as helpful as that of AMZN due to the upper margin, however the present valuation is the other. And as you have been seeing the rest of this text, BABA additionally enjoys superior fundamentals in different keys features, reminiscent of R&D output, return on capital employed, and development potential.

- Lastly, other than their drastically completely different valuations, there are various comparable features between these two e-commerce giants. And a comparability between them might additionally present insights into the evolving e-commerce panorama. Evaluating what they’re researching and creating offers us a peek on the future funding route on this area.

Looking for Alpha Looking for Alpha

Each R&D aggressively however BABA enjoys means higher yield

As talked about in our earlier writings, we don’t spend money on a given tech inventory as a result of we have now excessive confidence in a sure product that they’re creating within the pipeline. As an alternative, we’re extra centered on A) the recurring sources accessible to fund new R&D efforts sustainably, and B) the general effectivity of the R&D course of.

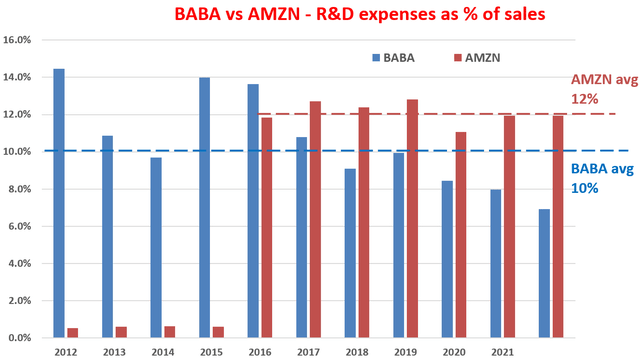

So let’s first see how properly and sustainably BABA and AMZN can fund their new R&D efforts. The quick reply is: Extraordinarily properly. The subsequent chart reveals the R&D bills of BABA and AMZN over the previous decade. As seen, each have been constantly investing closely in R&D lately. AMZN did not spend meaningfully on R&D earlier than 2016. However since 2016, AMZN on common has been spending about 12% of its whole income on R&D efforts. And BABA spends a bit much less, on common 10%. Each ranges are in line with the common of different overachievers within the tech area, such because the FAAMG group.

Creator primarily based on Looking for Alpha knowledge

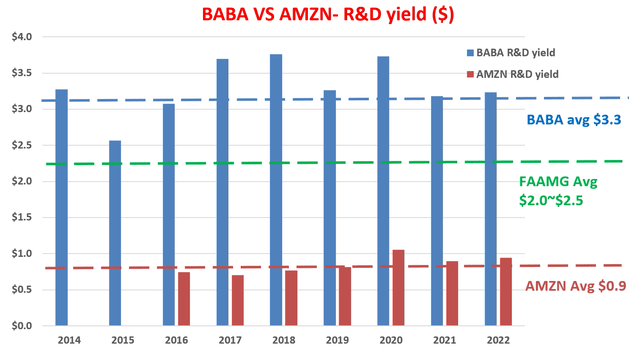

Then the subsequent query is, how efficient is their R&D course of? That is the place the distinction kicks in as proven within the subsequent chart. The chart reveals a variation of Buffett’s $1 check on R&D bills. Suggested by Buffett, we don’t solely take heed to CEOs’ pitches on their good new concepts that can shake the earth (once more). We additionally study the financials to see if their phrases are corroborated by the numbers. And in BABA and AMZN’s instances, their numbers are proven right here. The evaluation technique is detailed in our earlier writings and in abstract:

- The aim of any company R&D is clearly to generate revenue. Due to this fact, this evaluation quantifies the yield by taking the ratio between revenue and R&D expenditures. We used the working money circulation because the measure for revenue.

- Additionally, most R&D investments don’t produce any end in the identical 12 months. They sometimes have a lifetime of some years. Due to this fact, this evaluation assumes a three-year common funding cycle for R&D. And because of this, we used the three-year shifting common of working money circulation to characterize this three-year cycle.

As you may see, the R&D yield for each has been remarkably constant though at completely different ranges. In BABA’s case, its R&D yield has been regular round a median of $3.3 lately. This degree of R&D yield could be very aggressive even among the many overachieving FAAMG group. The FAAMG group boasts a median R&D yield of round $2 to $2.5 lately. And the one one which generates a considerably excessive R&D yield on this group is Apple (AAPL), which generates an R&D yield of $4.7 of revenue output from each $1 of R&D bills.

AMZN’s R&D yield of $0.9, alternatively, is considerably decrease than BABA’s and can be the bottom among the many FAAMG group. And observe that since AMZN did not spend meaningfully on R&D earlier than 2016, we solely began reporting its R&D yield beginning in 2016.

Subsequent, we are going to study their profitability to gasoline their R&D efforts sustainably and likewise dive into a few of the particular R&D efforts they’re enterprise.

Creator

BABA enjoys far superior profitability

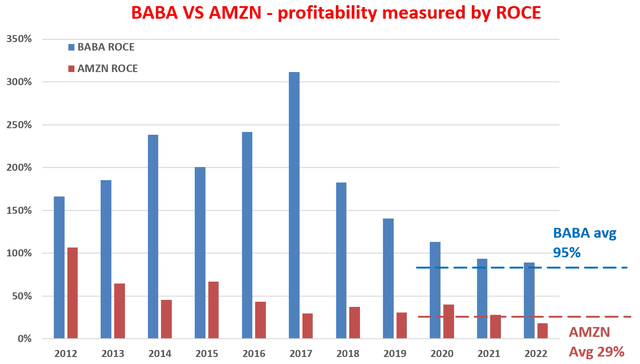

As defined in our earlier writings, to us, crucial profitability measure is ROCE (return on capital employed) as a result of:

ROCE considers the return of capital ACTUALLY employed and due to this fact gives perception into how a lot extra capital a enterprise wants to take a position in an effort to earn a given additional quantity of revenue – a key to estimating the long-term development fee. As a result of once we suppose as long-term enterprise house owners, the expansion fee is “merely” the product of ROCE and reinvestment fee, i.e.,

Lengthy-Time period Development Charge = ROCE * Reinvestment Charge

The ROCE of each shares has been detailed in our earlier articles and I’ll simply straight quote the outcomes under. On this evaluation, I think about the next gadgets capital really employed A) Working capital (together with payables, receivables, stock), B) Gross Property, Plant, and Tools, and C) Analysis and improvement bills are additionally capitalized. As you may see, BABA was in a position to keep a remarkably excessive ROCE over the previous decade. It has been astronomical within the early a part of the last decade exceeding 150%. It has declined because of all of the drama lately that you’re acquainted with (China’s tightened rules, excessive tax charges, slow-down of the general financial development in China, et al). However nonetheless, its ROCE is on common about 95% lately.

AMZN’s ROCE has proven the same sample. It too has loved a a lot larger ROCE within the early a part of the last decade. And it too has witnessed a gentle decline over time. Lately, its ROCE has been comparatively low, with a median of round 29%. A ROCE of 29% continues to be a wholesome degree (my estimate of the ROCE for the general economic system is about 20%). Nonetheless, it is not corresponding to BABA or different overachievers within the FAANG pack.

Subsequent, we are going to study their key segments and initiatives to kind a projection of their future profitability and development drivers.

Creator

Development prospects and remaining verdict

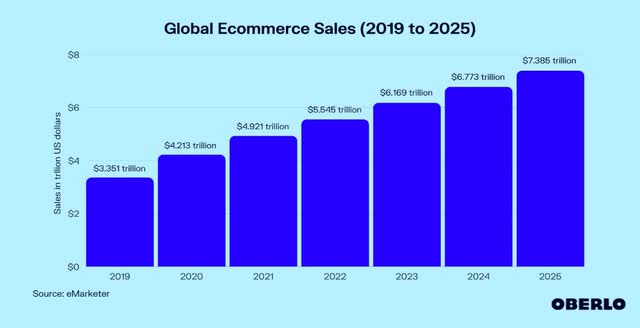

Trying ahead, I see each as properly poised to learn from the secular development of e-commerce penetration. After we are so used to the American means of on-line buying, it is easy to kind the impression that e-commerce has already saturated. The truth is that the worldwide e-commerce penetration continues to be ONLY at about 20% at present. Which means 80% of the commerce continues to be at present performed offline. By way of absolute quantity, as you may see from the next chart, world retail e-commerce gross sales have reached $4.2 trillion in 2020. And it is projected to nearly double by 2026, reaching $7.4 trillion of revenues within the retail e-commerce enterprise. The e-commerce motion is simply getting began and the majority of the expansion alternative is but to come back. And leaders like BABA and AMZN are each greatest poised to capitalize on this secular development.

OBERLO knowledge

I additionally see each get pleasure from super development alternatives in different areas apart from e-commerce. Each are leaders within the cloud computing area, particularly in their very own geographical areas. This phase has super development potential because the world shifts to the pure “pay per use” mannequin, and the expansion is simply beginning as start-ups, enterprises, authorities companies, and tutorial establishments shift their computing must this new mannequin. In BABA’s case, its cloud computing, worldwide avenues, and home platform growth are all having fun with momentum. These segments all present promise for profitability and development within the close to future to keep up their excessive R&D yield and excessive ROCE. Equally, AMZN’s AWS unit is anticipated to develop considerably within the close to future to assist raise the underside line. It has just lately introduced choices reminiscent of Cloud WAN, a managed large space community, and Amplify Studio, a brand new visible improvement surroundings. Furthermore, AMZN’s additionally introduced the deliberate $8.45 billion buy of MGM Film Studios, and I am optimistic in regards to the synergies with its streaming companies.

Additionally, I do see some uneven development alternatives for BABA. As aforementioned, each shares are greatest poised to capitalize on the world’s unstoppable shift towards e-commerce. Nonetheless, the remaining shift shall be inconsistently distributed and the Asian-Pacific area would be the middle of the momentum. As proven within the chart above, world retail e-commerce gross sales are anticipated to exceed $7.3 trillion by 2025. The twist is that the Asian-Pacific area shall be the place a lot of the development shall be. By 2023, the Western continents will contribute 16% of the full B2B e-commerce quantity, whereas the remaining 84% would come from the non-Western world. And BABA is greatest poised to learn with its scale and attain, authorities assist, and cultural and geographic proximity.

Lastly, the next desk summarizes all the important thing metrics mentioned above. As talked about early on, my thesis is that the dangers surrounding BABA have been absolutely priced in already. Even when we put apart the problem of valuations and dangers, there are various comparable features between these two e-commerce giants (in all probability greater than their variations). Evaluating and contrasting their R&D efforts, profitability, and future development areas not solely elucidate their very own funding prospects but in addition present perception into different e-commerce funding alternatives.

Creator

Dangers

I don’t suppose there’s a must repeat BABA’s dangers anymore. Different SA authors have supplied glorious protection already. And we ourselves have additionally assessed these dangers primarily based on a Kelly evaluation.

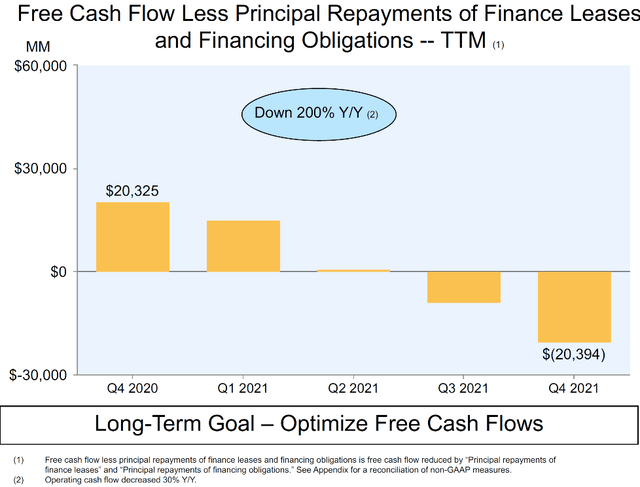

For AMZN, a key difficulty I like to recommend buyers to maintain an in depth on within the upcoming earnings launch is the leasing accounting. We now have cautioned readers earlier than the 2021 This fall earnings launch in regards to the function of its lease accounting and the potential of its free money circulation (“FCF”) deterioration after being adjusted for leasing accounting. And as you may see from the next chart, sadly, its FCF has certainly suffered a dramatic deterioration to a unfavourable $20B in 2021 This fall. Within the incoming 2022 Q1 launch, this can be a key merchandise that I’d be watching.

AMZN 2021 This fall earnings launch

Abstract and remaining ideas

The inventory market is infamous for fully ignoring enterprise fundamentals each on the greed excessive and on the worry excessive. The stark distinction between BABA and AMZN serves as a basic instance of such market psychology so buyers might establish mispricing alternatives.

The thesis is that BABA is now within the excessive worry finish of the spectrum and its inventory value has just lately change into disconnected from fundamentals. Specifically,

- The present market valuation has already priced in all of the dangers surrounding BABA. BABA’s value to gross sales ratio is discounted by nearly half relative to AMZN regardless of its larger margin and profitability.

- Each shares pursue new alternatives aggressively with 10% to 12% of their whole gross sales spent on R&D efforts, however BABA enjoys a much better yield.

- I additionally see each properly poised to learn from the secular development of worldwide e-commerce penetration and likewise from the alternatives in different areas reminiscent of cloud computing. Nonetheless, I do see some asymmetries right here. For instance, the remaining e-commerce shift shall be inconsistently distributed and the Asian-Pacific area would be the middle of the momentum, the place BABA is healthier positioned to learn from its authorities assist and cultural/geographic proximity.