Now that we’re into the second half of 2022, with the Independence Day vacation behind us, we are able to take inventory of the adjustments that the final six months have introduced. And people adjustments have been dramatic. As this 12 months received began, the S&P 500 was coming off of a 27% annual achieve. At this time, the index is down 20%, placing it right into a bear market.

The losses have been broad-based, and have left many in any other case sound equities languishing at low costs. It’s a circumstance that has a number of sad traders questioning what the choices are – nevertheless it has additionally opened alternatives for anybody prepared to shoulder some added danger in a tough investing setting.

With this in thoughts, we have used the TipRanks database to pinpoint three shares which have proven hefty losses this 12 months, on the order of fifty% to 75%, however every additionally incorporates a Sturdy Purchase analyst consensus score and a strong upside potential. Let’s take a deeper dive in.

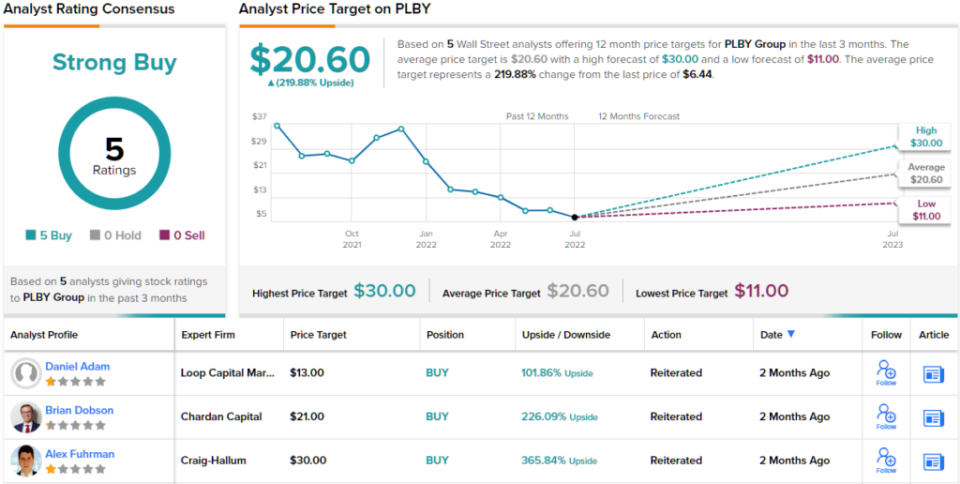

PLBY Group (PLBY)

The primary inventory, the PLBY Group, defines itself, with out irony, as a ‘pleasure and leisure’ firm. Based by Hugh Hefner in 1953, the PLBY Group owns Playboy, one of many world’s most distinctive and recognizable manufacturers. Whereas the journal is the corporate’s most instantly recognizable product, Playboy additionally boasts over 1 million energetic digital clients, greater than 50 million world social media followers, and actions in over 180 nations. The corporate’s merchandise embody fashion and attire, gaming and way of life, and sweetness and grooming merchandise.

The corporate’s robust model helps its rising income stream. Playboy reported 63% year-over-year income progress in its latest 1Q22 report, with $69.4 million on the high line. This was pushed by a 125% enhance in direct-to-consumer income, which hit $49.6 million. On the backside line, the corporate reported a 12 cent revenue per share, a pointy turnaround from the 15-cent per-share loss reported in 1Q21.

Regardless of strong outcomes, PLBY noticed its shares fall 76% for the reason that begin of the 12 months. Within the final 12 months, the corporate has been making strikes to develop, buying new subsidiaries and transferring into the Chinese language and Indian markets. Playboy already boasts a $1 billion e-commerce spend in China, as a part of its transfer into that nation, and the corporate has been working to place a digital model of the legendary Playboy Mansion on-line within the Metaverse.

What this implies, within the eyes of Craig-Hallum analyst Alex Fuhrman, is a transparent alternative for traders in search of a ground-floor entrance.

“PLBY is undervalued and the corporate continues to carry out properly. Q1 income was forward of our estimate and adj. EBITDA was inside a couple of hundred thousand {dollars} of our estimate – a powerful consequence at a time when many different e-commerce retailers are lacking estimates and/or decreasing steering,” Fuhrman opined.

“Regardless of robust efficiency and proudly owning one of the vital acknowledged manufacturers on the earth, PLBY trades at a significant low cost to friends. Given the years-long alternative for the Playboy model to catch up from years of poor administration and under-monetization, we view this low cost as a horny shopping for alternative,” the analyst added.

These feedback again up the analyst’s Purchase score, and quantified by his $30 value goal, which signifies his confidence in a whopping 366% upside for the subsequent 12 months. (To observe Fuhrman’s observe file, click on right here)

Typically, an organization’s product impressed unanimity from the Avenue’s analysts – PLBY does simply that. All 5 of the latest analyst opinions are optimistic, making the Sturdy Purchase consensus score unanimous. The common value goal of $20.60 suggests ~220% upside from the present buying and selling value of $6.44. (See PLBY inventory forecast on TipRanks)

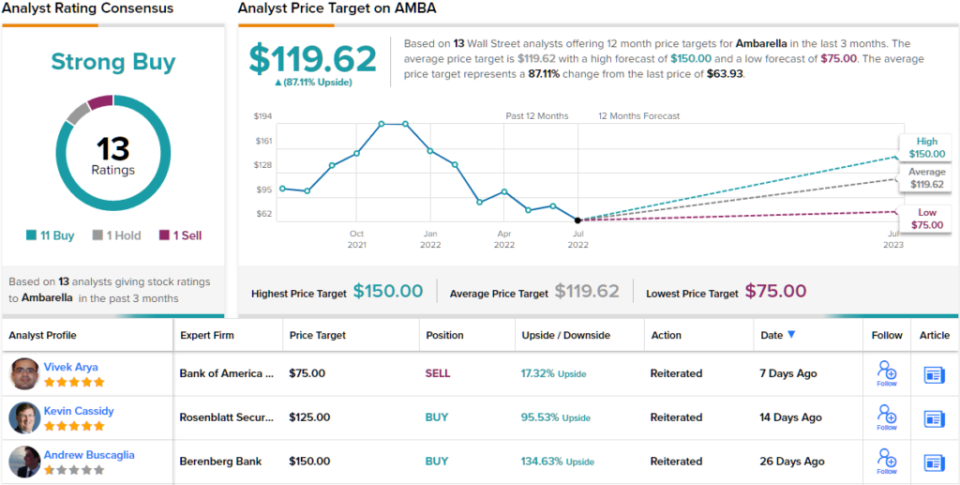

Ambarella (AMBA)

The following beaten-down inventory we’ll at is Ambarella, a semiconductor chip maker. The corporate operates within the fabless area of interest, which means the corporate designs, promotes, markets, and sells its chip merchandise, and produces small numbers of prototypes for testing functions, however contracts with the big chip foundries for full-scale manufacturing orders. Ambarella’s chips are designed for video functions, and are specialised for superior picture processing and high-resolution video compression. The chipsets have discovered utility in a variety of small digital camera programs, together with wearable cameras, car dashboard cams, pocket video cameras, and even drones. The frequent denominator right here is low-power, high-definition video.

Up to now this 12 months, Ambarella’s shares have fallen roughly 68%. A big a part of that drop, some 31%, got here on the finish of February, when the corporate reported income steering of $88.5 million to $91.5 million; on the midpoint of $90 million, this got here in under the ~$91 million forecast. Administration predicted decrease margins by the remainder of the calendar 12 months, which didn’t assist issues.

The corporate is dealing with headwinds from the final market setting, but additionally from the semiconductor chip scarcity. As a fabless firm, Ambarella relies on its foundries, and they’re closely backlogged.

Ambarella did meet its steering, nonetheless, when it launched its Q1 report for fiscal 2023, the quarter ending on April 30. The corporate reported $90.3 million on the high line, or a 29% year-over-year achieve. On the backside line, non-GAAP EPS got here in at 44 cents per diluted share, nearly double the 23 cents reported within the year-ago quarter.

On a optimistic be aware for the corporate, Ambarella introduced in June a brand new partnership with Inceptio, a pioneer in autonomous trucking. Below the settlement, Ambarella will present chips for an automotive grade central computing platform able to concurrently processing no fewer than seven 8MP cameras for encompass notion and collision avoidance.

This chip firm and its automotive functions has attracted consideration from 5-star analyst Gary Mobley of Wells Fargo, who writes: “We view AMBA as one of many purest methods within the chip sector to play the AI/ML pc imaginative and prescient on the edge, and among the best methods to play rising L2+ ADAS/AV capabilities within the automotive market (e.g., pc imaginative and prescient processing and sensor fusion). We view AMBA as a strategically essential asset for automotive OEMs wishing to assist L2+ ADAS/AV in addition to incumbent auto chip suppliers centered on MCUs and sensor know-how (e.g. picture & radar).”

Mobley doesn’t cease with upbeat feedback, he additionally provides AMBA inventory an Obese (i.e. Purchase) score, together with a $110 value goal that suggests a 72% one-year upside potential. (To observe Mobley’s observe file, click on right here)

Wall Avenue is clearly on this inventory, and has given it 13 latest analyst opinions. These break all the way down to 11 Buys, 1 Maintain, and 1 Promote, for a Sturdy Purchase consensus score. The shares are promoting for $63.93 and their $119.62 common value goal suggests an 87% achieve this 12 months. (See Ambarella inventory forecast on TipRanks)

Ichor Holdings (ICHR)

Final on our record, Ichor Holdings, has a steady of subsidiaries within the discipline of important programs engineering and manufacturing. Ichor operates within the semiconductor, manufacturing, and built-in options niches, the place it gives gear and processes as diverse as fuel modules and chemical course of subsystems. The corporate’s merchandise are additionally discovered within the manufacturing technique of alt power sources, biomedical gear, and LED shows.

A large ranging, extremely diverse enterprise is a bonus for producer, particularly relating to the manufacture of specialty merchandise. Ichor has seen its revenues usually develop over the previous two years, and the newest print, for 1Q22, got here in at simply over $293 million. This was up 11% year-over-year, and the perfect results of the previous 9 quarter. Non-GAAP EPS, nonetheless, was reported at 70 cents, down from 1Q21’s 76 cents, and properly under the 90-cent forecast.

The disappointing earnings put traders on edge, with shares slipping 52% year-to-date.

The weak spot within the latest earnings report hasn’t bothered DA Davidson analyst Thomas Diffely, who wrote of the inventory: “Regardless of a difficult working setting, market demand stays strong, in reality the corporate elevated funding in direct labor and manufacturing capability. Additional, ICHR is as soon as once more set to outpace 2022 WFE progress (~15%) because of its leverage to key device segments (etch and dep). As such, our bullish thesis on ICHR stays intact.”

To this finish, the 5-star analyst charges ICHR shares a Purchase whereas setting a $60 value goal to counsel a powerful potential one-year achieve of 171%. (To observe Diffely’s observe file, click on right here)

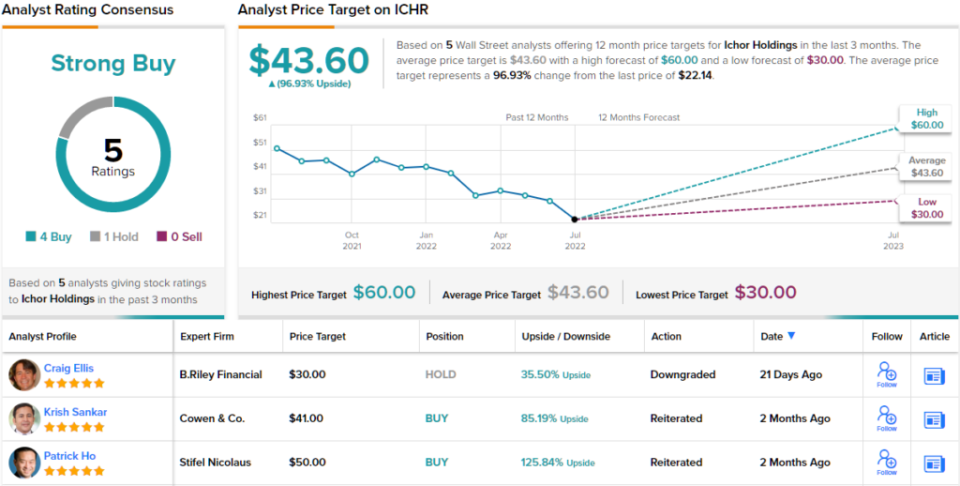

All in all, out of 5 analyst opinions on file for ICHR, 4 charge it a Purchase, giving the inventory a Sturdy Purchase analyst consensus. The shares are buying and selling for $22.14 and their $43.60 common value goal implies an upside of ~97% over the approaching 12 months. (See Ichor inventory forecast on TipRanks)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.