chris-mueller

As extensively reported per its 13F filings, Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B) has a stake in Apple Inc. (NASDAQ:AAPL), representing over 40% of his conglomerate’s public fairness holdings.

After foolishly promoting out my shares of AAPL following the demise of founder Steve Jobs, I initiated a brand new place in our household portfolio in March 2017. What’s good for Mr. Buffett is nice for us. Nonetheless, not like the Oracle of Omaha, I observe an equal weighting portfolio technique to keep away from making an attempt to foretell which shares will outperform in the long term.

On this up to date main ticker analysis report, I put Apple and its widespread shares by my market-beating, data-driven funding analysis guidelines of the worth proposition, shareholder yields, fundamentals, valuation, and draw back threat.

The ensuing funding thesis:

Below Steve Jobs’ improvements, Tim Cook dinner’s management, and Warren Buffett’s assured possession stake, Apple is a purchase and maintain without end enduring masterful enterprise. The inventory worth, nonetheless, seems to be at the moment buying and selling at a premium.

My total score: Maintain, based mostly on a bullish view of the corporate and a impartial view of the inventory.

A extra in-depth model of this report, together with metric targets, was first shared with subscribers to my High quality + Worth Methods service on the Looking for Alpha Market on August 22.

Until famous, all information introduced is sourced from Looking for Alpha and YCharts as of the intraday market on August 24, 2022; and meant for illustration solely.

The Reigning King of {Hardware} and Providers

AAPL is a dividend-paying large-cap inventory within the info expertise sector’s {hardware}, storage and peripherals trade.

Apple, Inc. designs, manufactures, and markets smartphones, private computer systems, tablets, wearables, and equipment worldwide. It additionally sells varied associated companies. Apple was integrated in 1977 and is headquartered in Cupertino, California, USA.

My worth proposition elevator pitch for Apple:

The reigning king of productiveness {hardware} and companies whether or not enterprise or private, cell, wearables, tv, or desktop.

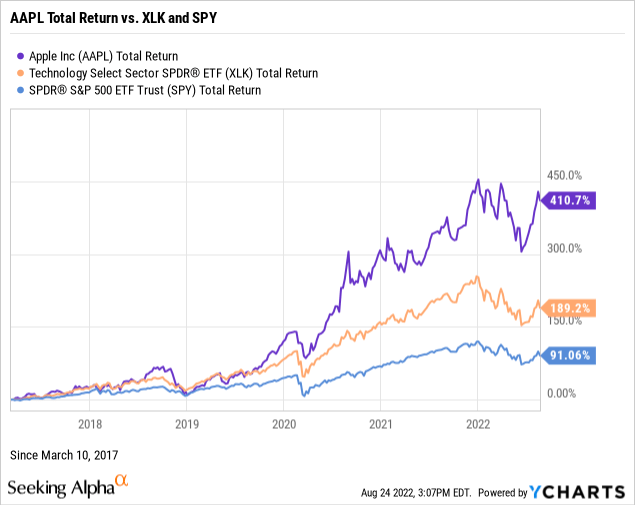

The chart under illustrates the inventory’s efficiency towards the Expertise Choose Sector SPDR Fund ETF (NYSE:XLK) and the SPDR S&P 500 ETF Belief (NYSE:SPY) since including the shares to our household portfolio on March 10, 2017.

Finally, investing in particular person widespread shares ought to goal to beat the benchmark indices over time. For instance, AAPL has greater than doubled the returns of its sector and was a four-bagger towards the market throughout the previous five-plus years.

My worth proposition score for AAPL: Bullish.

Shareholder Yields on Price Beat the 10-12 months

As a part of my due diligence, I common the entire shareholder yields on earnings, free money move, and dividends to measure how a focused inventory compares to the prevailing yield on the 10-year Treasury benchmark observe. In different phrases, what’s the fairness bond fee of the widespread shares?

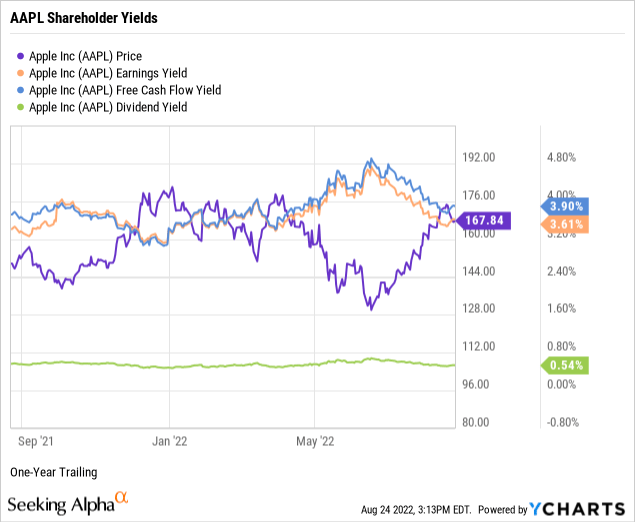

As demonstrated within the under chart, AAPL’s earnings yield was buying and selling at 3.61%, and its free money move yield was 3.90%.

Apple affords a modest dividend yield of 0.54%. Nonetheless, its tremendous conservative 14.69% payout ratio signifies a protected, well-covered dividend with loads of room for annual raises. Additional, AAPL was yielding 2.81% on our household portfolio’s split- and dividend-adjusted price foundation of $32.72 per share, or 227 foundation factors above the ahead yield. Yet one more reminder that purchase and maintain high quality worth investing works.

Subsequent, let’s take the common of the three shareholder yields to measure how the inventory compares to the prevailing yield of three.11% on the 10-12 months Treasury benchmark observe. For instance, the common shareholder yield for AAPL was 2.68%. Nonetheless, the common yield was 3.44%, utilizing the inventory’s dividend yield on our price foundation. Arguably, equities are deemed riskier than U.S. bonds. Thus, securities resembling AAPL that reward long-term shareholders with yields larger than the federal government benchmark favor proudly owning the inventory as a substitute of the bond.

Do not forget that earnings and free money move yields are inverse valuation multiples, suggesting that AAPL trades at a premium. I will additional discover valuation later on this report.

My shareholder yields score for AAPL: Impartial, based mostly on the ahead dividend yield.

ROE and ROIC Embarrass the Tech Sector

Let’s discover the basics of Apple, uncovering the efficiency energy of the corporate’s senior administration.

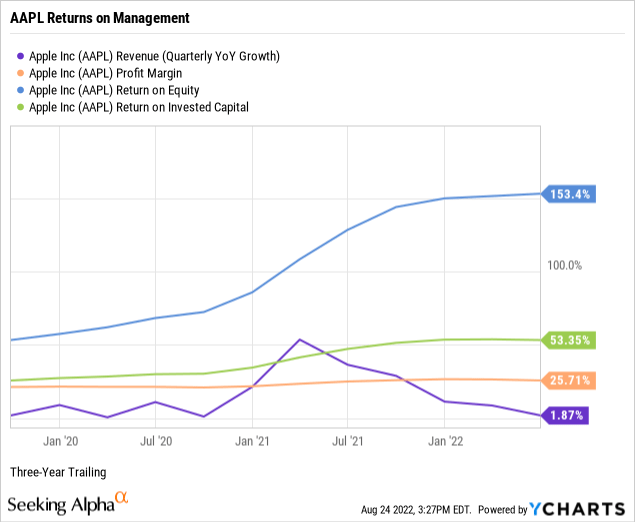

Per the under chart, Apple had three-year income progress of 1.87%, underperforming the 6.16% median progress for the knowledge expertise sector. Quite the opposite, the corporate had a superior trailing three-year pre-tax web revenue margin of 25.71%, far outperforming the sector’s median web margin of 4.25%.

Apple was producing a trailing three-year return on fairness tor ROE at an astounding 153.40% towards a median ROE of simply 7.28% for the sector. Arguably, the escalating fairness returns replicate the board’s inventory repurchases, a great signal for shareholders.

At 53.35%, Apple’s return on invested capital or ROIC additionally embarrasses the sector’s median ROIC of simply 3.98%, indicating that Apple’s senior executives are spectacular capital allocators.

ROIC must exceed the weighted common price of capital or WACC by a snug margin, giving administration’s potential to outperform its capital prices. For instance, Apple’s ROIC far exceeds its trailing WACC of 10.48% (Supply: GuruFocus).

The constant, though slowing income progress, phenomenal web revenue margin, and tremendous excessive returns on fairness and capital point out world-class administration efficiency in Cupertino.

My fundamentals score for AAPL: Bullish.

Premium-Priced Inventory of a Legacy Enterprise

I depend on simply 4 valuation multiples to estimate the intrinsic worth of a focused high quality enterprise’s inventory worth.

At 7.13 instances, AAPL’s price-to-sales ratio or P/S exceeded 2.91 instances gross sales for the knowledge expertise sector and a pair of.52 P/S for the S&P 500. Thus, the weighted trade plus market sentiment suggests an overvalued inventory worth relative to Apple’s topline.

AAPL had a price-to-earnings a number of or P/E of 27.72 instances towards a sector P/E of 24.53, indicating investor sentiment pretty costs the inventory relative to earnings per share. Additional, AAPL was buying and selling at a better a number of than the S&P 500’s current total P/E of 23.18. (Supply of S&P 500 P/E: Barron’s).

At 23.38 instances, AAPL was buying and selling at a price-to-operating money move a number of within the neighborhood of the sector’s median of 20.07, indicating the market costs the inventory at a good worth relative to present money flows.

In opposition to the broader sector median of 19.75 instances, AAPL was buying and selling at 22.90 instances enterprise worth to working earnings or EV/EBIT, signaling the inventory was overbought or undersold by the market.

Weighting the popular valuation multiples suggests the market pretty values Apple’s inventory worth to gross sales, earnings, money move, and enterprise worth. Due to this fact, based mostly on the basics and valuation metrics uncovered on this report, dangers and potential catalysts however, I’d name AAPL a premium-priced inventory of a legacy A-rated expertise enterprise.

My valuation score for AAPL: Impartial.

Slender Moat-Rated However Vast Moat Outcomes

When assessing the draw back dangers of an organization and its widespread shares, I give attention to 5 metrics that, in my expertise as a person investor and market observer, typically predict the potential threat/reward of the funding. Therefore, I assign a draw back risk-weighted score of above common, common, under common, or low, biased towards under common and low-risk profiles.

Alpha-rich buyers goal firms with clear aggressive benefits from their services or products. An investor or analyst can streamline the worth proposition of an enterprise with an financial moat task of broad, slim, or none. The main moat analyst, Morningstar, assigns Apple a slim moat score.

A favourite of the legendary worth investor Benjamin Graham, long-term debt protection demonstrates stability sheet liquidity or an organization’s capability to pay down debt in a disaster. For instance, as reported on its June 2022 quarterly monetary statements, Apple’s long-term debt protection was 1.19 instances.

In idea, the corporate may repay 100% of its longer-term debt obligations in a disaster utilizing its liquid property resembling money and equivalents, short-term investments, accounts receivables, and stock.

Quite the opposite, Apple’s short-term debt protection or present ratio was 0.86 instances. Thus, its stability sheet offers lower than adequate liquid property to pay down 100% of its present liabilities, together with accounts payable, accrued bills, short-term borrowings, and earnings taxes.

AAPL’s 60-month trailing beta was 1.24. Its shorter-term 24-month beta was about equal at 1.21. With worth volatility buying and selling considerably above the S&P 500 commonplace of 1.00, AAPL presents as a market perform-type core holding.

The brief curiosity proportion of the float for AAPL was a bear paws-off of simply 0.67%, signaling the near-sighted brief merchants view the inventory as a protected expertise staple supported by a loyal buyer and investor base.

Apple is a essentially stable, slim moat firm with wide-moat outcomes and an interesting threat profile.

My draw back threat score for AAPL: Beneath Common.

Lengthy Apple Stays a Good Concept

Catalysts confirming or contradicting my total maintain funding thesis on Apple Inc. and its widespread shares embody, however will not be restricted to:

- Confirmations: Between new gross sales in rising markets and repeat gross sales to present prospects, Apple has loads of alternatives for the continued progress of its services. Plus, its superior iOS working system bodes nicely for long-term buyer retention. Thus, Apple stays an innovator with stable branding and buyer loyalty producing legendary money flows.

- Contradictions: Apple’s premium pricing technique may restrict gross sales progress in a chronic recession. The corporate might must catch as much as Google (GOOG) (GOOGL) and Amazon (AMZN) in synthetic intelligence to keep up premium customer support. As extensively reported, its board is shopping for again extra shares utilizing bond gross sales to finance the repurchases, which additionally means extra debt.

Because the title of my earlier Apple article prompt over 5 years in the past, Apple stays a good suggestion for long-term buyers. Each time the value is true, purchase and maintain without end and ever. Amen.