What do the next three dates have in widespread with one another?

1975.

January 1, 1994.

December 11, 2001.

Suppose for a second.

Surrender?

Every of these three dates is one protectionists routinely determine — both explicitly or by implication — as marking a big flip for the more severe in Individuals’ financial fortunes resulting from worldwide commerce.

1975 is the final 12 months through which America ran an annual commerce surplus. That 12 months was the final to see the greenback worth of Individuals’ exports of products and providers exceed the greenback worth of Individuals’ imports of products and providers. Yearly since then — 2025 is on observe to be the fiftieth — america has run annual commerce deficits.

January 1, 1994, is the date that the North American Free Commerce Settlement (NAFTA) took impact. Regardless of some minor modifications and a reputation change (to United States-Mexico-Canada Settlement, or USMCA) in 2020, this commerce settlement remained in impact till just some weeks in the past when Pres. Trump unilaterally moved the US into violation of it.

December 11, 2001, is the date on which China gained membership within the World Commerce Group (WTO), thus additional rising that nation’s commerce with many different nations, together with the US.

In the event you take note of pronouncements, discussions, and debates within the US over commerce you’ll commonly encounter laments about America’s “continual commerce deficits” (implying that new financial troubles started as 1975 ended), complaints concerning the depredations visited on Individuals by NAFTA (suggesting that Individuals’ financial fortunes started to worsen as 1994 dawned), and, after all, dire warnings of the alleged financial risks that we Individuals encounter by buying and selling with the Chinese language (implying that America’s financial well being solely took one other flip for the more severe as 2001 was coming to an in depth).

Happily, a substantial amount of comparatively simple financial information permits us to place these widespread claims to the check. As is true of any financial information — which, in any case, are drawn from an extremely advanced, dynamic, and ever-changing real-world financial system — the information that I current under are incapable of proving something.

Counterfactuals can at all times be provided, and questions on classifications, excluded variables, lacking information, measurement strategies, and errors, are by no means off the desk. However, even imperfect information could be sufficiently correct to be revealing. At any price, when used truthfully such information are sometimes an vital half — though by no means the unique half — of any sound evaluation or argument about financial coverage.

So listed below are six financial phenomena the developments through which are helpful to seek the advice of to check the claims about commerce described above:

- staff’ actual earnings

- US industrial manufacturing

- US industrial capability

- US capital inventory

- US manufacturing employment as a share of whole employment

- inflation-adjusted common family web price

These six phenomena on no account exhaust the potential information which can be helpful for judging the controversy between protectionists and free merchants, however they’re an excellent begin.

Employees’ Actual Earnings

Among the many most meticulous and knowledgeable students who analysis financial developments is the American Enterprise Institute’s Scott Winship. His 2024 examine Understanding Tendencies in Employee Pay over the Previous 50 Years (PDF) is properly price a full and cautious learn. Amongst different achievements, it reveals the various sloppy makes use of of statistics by pundits who argue that odd Individuals are immediately no higher off economically than had been odd Individuals when the White Home was occupied by Gerald Ford. However for our functions, what Winship reveals in his Determine 6 suffices: At the moment, common inflation-adjusted whole compensation (wages and fringe advantages) for staff within the nonfarm enterprise sector is about 250 % greater than it was in 1975, one hundred pc greater than within the 12 months NAFTA took impact (1994), and about 40 % greater than when China joined the WTO (2001).

US Industrial Manufacturing

US industrial manufacturing is immediately (February 2025) at an all-time excessive. Its earlier all-time excessive was in September 2018, after which it leveled off — maybe resulting from Trump’s first spherical of tariffs — after which fell (after all) throughout COVID. From the tip of COVID till now it’s been largely flat and just under its September 2018 stage till lastly eking out a brand new all-time excessive in February of this 12 months.

One believable wrongdoer for this leveling-off is the barrage of tariffs that started in early-to-mid-2018 and had been largely retained throughout the Biden years. As a result of greater than half of American imports are inputs utilized in home manufacturing, these commerce restrictions dampen the productiveness of American producers.

Opposite to claims too quite a few to depend, the American financial system has not been deindustrialized. Individuals immediately (January 2025) produce 153 % extra industrial output than in 1975, 55 % greater than in January 1994, and 18 % greater than in December 2001.

US Industrial Capability

Nor has the American financial system’s capability to provide industrial output been, as is commonly asserted, “hollowed out.” America immediately has an industrial capability that’s 146 % bigger than it was in 1975, 64 % bigger than in January 1994, and 12 % bigger than in December 2001. This actuality is particularly notable on condition that as we Individuals develop richer, we spend extra on providers relative to what we spend on items.

US Capital Inventory

In 2019 (the final 12 months for which these information can be found), the inflation-adjusted dimension of the US capital inventory was 178 % bigger than it was in 1975, 66 % bigger than in 1994, and 36 % bigger than in 2001.

US Manufacturing Employment as a Share of Complete Nonfarm Employment

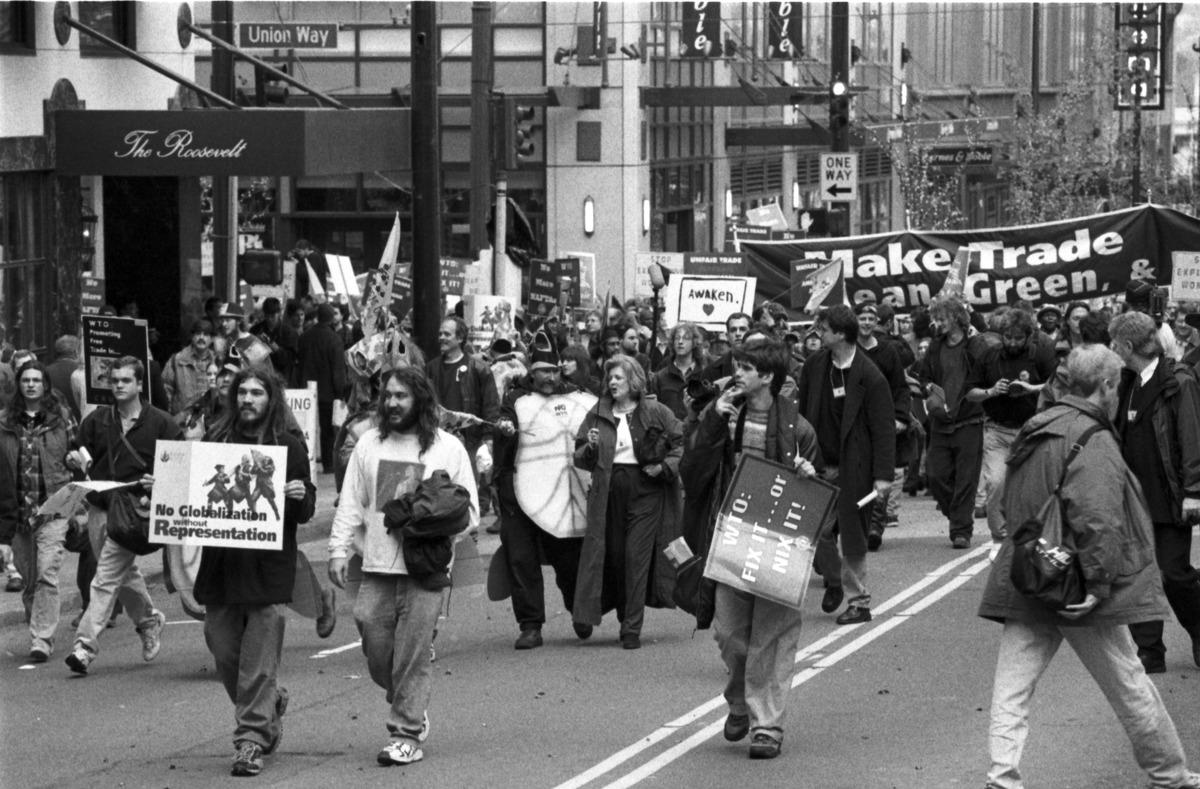

The accompanying graph reveals, from January 1939 by way of February 2025, manufacturing employment as a share of whole nonfarm employment within the US.

I constructed this graph from two completely different information sources obtainable on the St. Louis Fed’s FRED information website. As you may see, protectionists are appropriate once they word that manufacturing employment as a share of whole employment has fallen since 1975, has continued to fall since 1994, and has fallen additional nonetheless since 2001. However as you may also see, this pattern dates again lengthy earlier than 1975. Excluding the wartime (November 1943) peak, manufacturing staff as a share of all nonfarm staff began falling slightly steadily in 1954, 22 years earlier than America started its still-unbroken run of annual commerce deficits, 40 years earlier than NAFTA, and 47 years earlier than the WTO accepted China as a member.

It’s true that the typical month-to-month price of decline within the share of staff employed in manufacturing has been very barely quicker from 1976 by way of immediately (February 2025), at 0.171 %, than it was from 1954 by way of 1975, at 0.134 %. But it surely’s additionally true that the typical month-to-month price of decline within the share of producing staff has slowed since China joined the WTO. From January 1976 by way of November 2001, the share of producing staff fell at a mean month-to-month price of 0.192 %; from December 2001 by way of February 2025, that price dropped to 0.146 %.

Manufacturing employment as a share of whole employment is falling not due to commerce however due to enhancements in labor-saving applied sciences, mixed with Individuals’ rising demand for providers relative to the demand for items.

Inflation-adjusted Common Family Internet Price

If protectionists are appropriate that US commerce deficits both push Individuals additional into debt to foreigners or end result from Individuals promoting too many property to foreigners, the online price of American households would have fallen over the previous half-century, as these years noticed an unbroken string of annual US commerce deficits. However the reverse has occurred. As I clarify on this quick weblog put up at Café Hayek, the typical inflation-adjusted web price of a US family immediately (2024) is 232 % greater than it was in 1975, 140 % greater than in 1994, and 78 % greater than in 2001. In brief, we Individuals have gotten richer as we’ve run commerce deficits and since NAFTA took impact in addition to since China joined the WTO.

Once more, none of those six developments within the information proves that protectionists are mistaken to argue that freer commerce and commerce deficits have harmed America economically. However taken collectively they need to not less than put the burden of proof squarely and closely the place it belongs — particularly, on protectionists. It’s they, and never free merchants, who advocate government-imposed restrictions on Individuals’ financial liberties.