DenGuy/E+ via Getty Images

Thesis

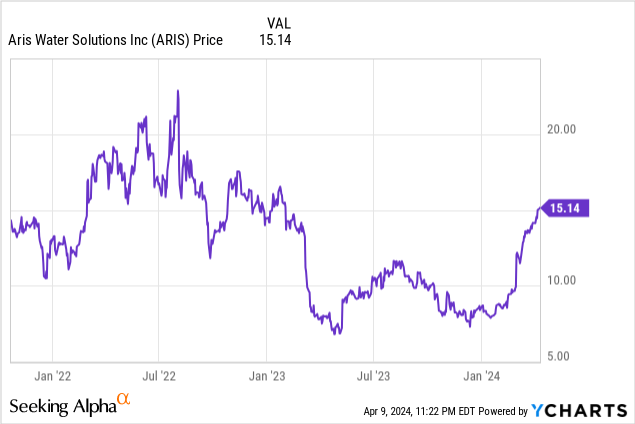

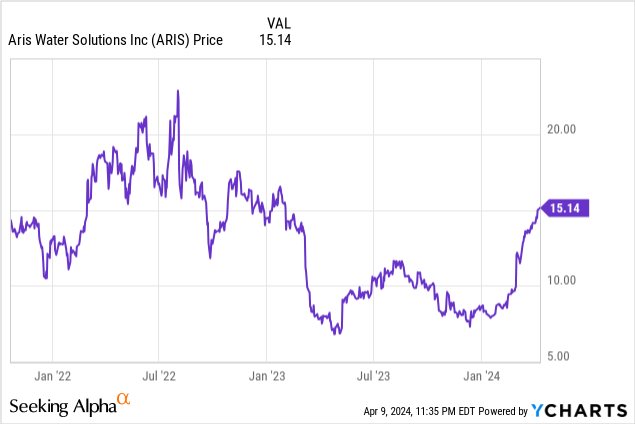

Shares of Aris Water Solutions, Inc. (NYSE:ARIS) nearly doubled in the past three months. They grew from $7.74 on January 19 to $15.15 on April 9.

However, we need to take those numbers in context, because the shares had been at more than $20 in the summer of 2022, and then lost roughly two-thirds of their value:

Still, that decline should not be surprising because Aris provides environmental water solutions to energy companies in the Permian Basin and its chart roughly reflects a chart of crude oil prices over the same period.

Looking ahead, there is a reasonable likelihood the company will continue to produce results that boost the stock price. I consider Aris slightly undervalued and have a one-year price target of $18.00 and a Buy recommendation.

About Aris

Specifically, Aris helps oil and gas companies reduce their water and carbon footprints. As it points out in the 10-K for 2023, it offers what it calls “full-cycle water handling and recycling solutions”.

Its major customers and affiliates include ConocoPhillips (COP), Chevron Corporation (CVX), and privately held Mewbourne Oil Company, Inc. ConocoPhillips also owns part of Aris, one of 18 Class B shareholders who control 48% of Aris’ voting power.

Class B holders comprise legacy owners of Solaris LLP, a company that was partially converted into Aris. While it is the sole managing member of Solaris, Aris owned only 52% of that firm at the end of 2023, while legacy owners had a 48% interest.

The relationship with Solaris dates back to October 2021 when Aris completed an IPO of Class A common shares. With net proceeds of $246.4 million, it bought into Solaris, and held a roughly 38% interest at that time.

Investors also should know it is categorized as an “emerging growth company”, a federal designation that allows it an extended transition period to meet new or revised accounting standards.

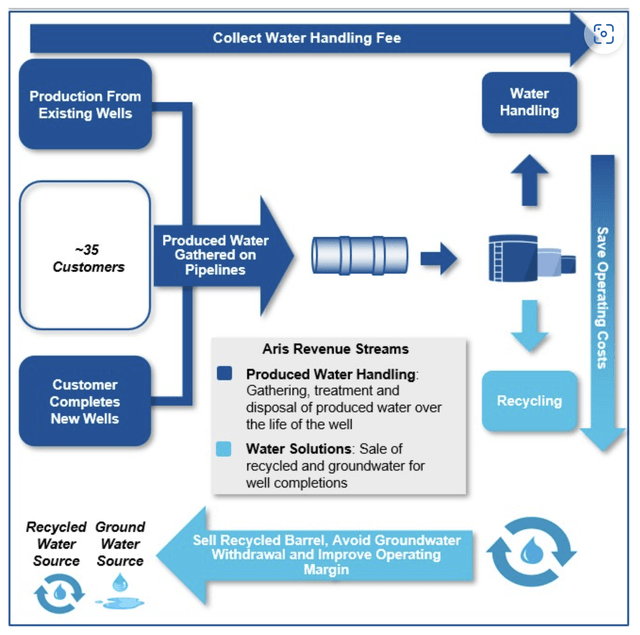

Operationally, Aris has integrated pipelines, related infrastructure, and water treatment methods. The following flowchart shows its “produced water” process and revenue generation:

ARIS Flowchart of Produced Water (ARIS 10-K)

At the end of 2023, it had 745 miles of installed pipelines, 66 water handling facilities and nearly 1.8 million barrels per day of capacity.

It published its Q4 and full-year 2023 earnings results on February 28. Highlights included:

- Total water volumes were up 16% for the year.

- Recycled produced water volume was up 8% annually.

- While increasing its volumes, it achieved sustainable, annualized savings of $7.5 million.

- Total revenue was $104.13 million, compared to $82.87 million in 2022.

- Total cost of revenue was $64.49 million, compared with $55.94 million in 2022.

- Net income attributable to Aris (excluding the other interests in Solaris) was $5.40 million, compared to $1.83 million for 2022.

- Basic and diluted EPS was $0.17, up from $0.06 for 2022.

- Weighted average shares, basic and diluted, for 2023 was 30.13 million versus 27.95 million in 2022.

Competition and competitive advantages

Aris reported in the 10-K that it competes with public and private water infrastructure companies and operators developing in-house systems. While it does not list pricing at the top of its list of competitive criteria, a highly competitive market suggests margins may be constrained (more on this below).

According to an October 2023 article in The American Oil & Gas Reporter, a number of companies compete in the Permian area, including, Select Water Solutions, Inc. (WTTR), Gravity Water Midstream, formerly part of Gravity, Co., Ltd. (GRVY), and the following private firms: WaterBridge NDB LLC, Renovo Resources LLC, and Permian Oilfield Partners. Again, the number of names raises concerns about margins and profitability.

Select Water has a market cap of $1.13 billion, compared to Aris’ $876.00 million at the close on Tuesday, April 9, 2024.

Its competitive advantages include permits for roughly 220 miles of pipeline and 35 water-produced water handling facilities, representing 1.2 million barrels per day of handling capacity. This allows it to respond quickly to customer demand.

Aris is in a growing market, according to the article in The American Oil & Gas Reporter, which observed that independent providers are quickly growing their share of total water management activity. They are buying systems from operators and other midstream companies to achieve economies of scale.

Aris is part of this expansion by virtue of its capital allocation strategy, which is described as seizing opportunities while making strategic acquisitions and divestitures, and bolt-on customer connections.

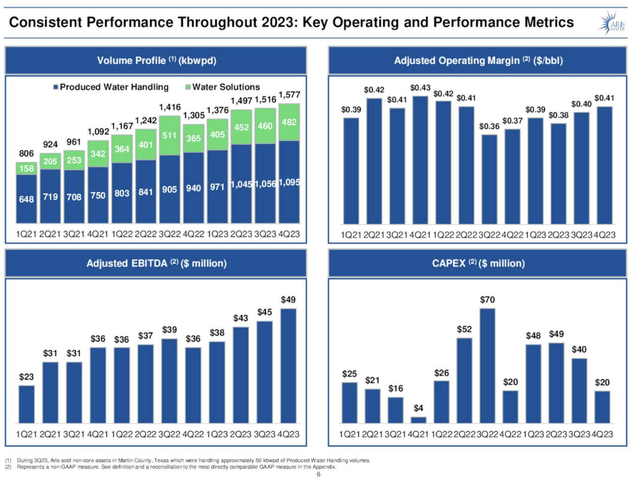

The Q4 earnings presentation also pointed out the company expects to grow its volumes, adjusted operating margin, and adjusted EBITDA while bringing down its capital expenditures:

ARIS Key metrics charts (ARIS Presentation)

That’s in part due to its continuous improvement initiative, which aims to optimize its existing assets and grow its rates of return on invested capital. In 2023, electrification and other cost reduction measures allowed it to recognize $7.5 million per year in sustainable, annualized savings. Companies that successfully implement continuous improvement initiatives can systematically bring down their costs while profitably growing.

Margins

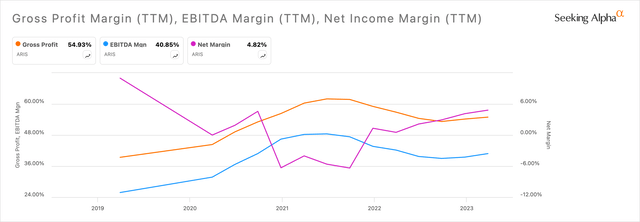

Aris’ profit margins look promising at the top, but fade as you work your way down the income statement:

- Gross margin: 54.93% compared to the Industrials median of 30.94%.

- EBITDA margin: 40.85% versus 13.60% for the sector.

- Net income margin: 4.82% compared to 5.91% for the sector median.

However, the net margin is improving, and has risen in all but one of the last six quarters:

ARIS Margins (SeekingAlpha)

Going forward, the net margin might expand more because of supply and demand. Founder and Executive Chairman Bill Zartler said on the Q4 earnings call, “There is greater demand for water infrastructure in the Northern Delaware Basin than there are existing assets, and we have the opportunity to participate in further growth at attractive rates of return.”

He also noted that the firm focused on fundamental execution in 2023 and was able to recapture some of the margins that were eroded by inflation and costs driven by rapid growth in 2022.

With demand exceeding supply, Aris should be able to raise or at least maintain its prices. As indicated earlier, it expects to have good control over its expenses. Combine those two issues with an ability to claw back expense growth due to inflation, and you have a good formula for better margins on the bottom line.

Growth

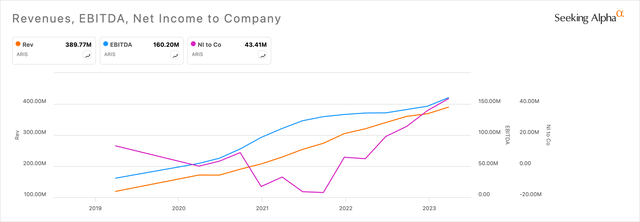

The following chart shows how revenue and EBITDA have grown quite consistently over the past five years, while net income has surged over the past year and a half:

ARIS Revenue, EBITDA, Net Income (SeekingAlpha )

In its outlook for 2024, management wrote in the Q4 and full-year earnings report that this year would be focused on cash generation. More specifically, it pointed to “significant” free cash flow growth because of more asset efficiency, a better cost structure, and lower capital reinvestment.

In other words, it’s expecting higher FCF thanks to more revenue from existing assets while maintaining a lid on its cost structure and lower capex. The decision to proceed with lower capex, for the second year in a row, is a bold move. Apparently, the board and management are confident they can raise the top and bottom lines without reinvesting more into the business.

President and CEO Amanda Brock said on the earnings call, “sustainable volume growth, our anticipated continued expansion of operating margins and significantly reduced capital spending, sets up 2024 as a pivotal year for Aris as we anticipate sustained positive free cash flow.”

The Wall Street analysts who follow Aris are also bullish, expecting earnings to grow 16.43% this year over last year, and have even more ambitious targets for the three years after that:

ARIS EPS Estimates table (SeekingAlpha )

Revenue also is expected to keep growing, but at a slower rate than earnings. That’s a good sign because it means the company is becoming more efficient at turning revenue into net income and EPS.

Management and strategy

CEO Brock has been with Aris and Solaris Water Midstream since 2017, and prior to that was CEO of Water Standard, President of the Americas for Azurix, and President of Enron Joint Venture Management. She has been named one of the Top 10 Women in Energy by the Houston Chronicle and was inducted into the Houston Woman’s Business Hall of Fame.

Stephan Tompsett holds the CFO’s chair at Aris, and prior to that held the same positions at Limetree Bay Energy and EagleClaw Midstream Ventures. He has more than 20 years of senior financial experience.

Both leaders have the expertise and experience needed to maintain growth, based on their achievements over the past several years.

The company has a four-point strategy, as articulated in the discussion of its capital allocation framework, in the Q4 earnings presentation:

- Maintain leverage in a target range of 2.50X to 3.50X (Q4-2023’s leverage was 2.4X).

- To generate “High-Return Organic Growth,” it will not pursue any new opportunities but will focus instead on opportunities to grow with its customers using incremental capital.

- Acquisitions and divestitures: Opportunistically divest itself of non-core assets and make disciplined acquisitions if they are a strategic fit, have the right technology and expertise, provide strong financial returns, and have quality customers.

- Return capital to shareholders through dividends and share buybacks.

In the fourth quarter, it repurchased 107,746 shares at an average price of $9.67, which is well below the April 8 closing price of $15.08.

Its dividend yield at the close on April 9 was 2.39% and the annual payout is $0.36. The payout ratio is 40.91%.

Aris thinks of itself as a growth company; the components of this strategy all fit with that and complement each other.

Valuation

The Seeking Alpha Quant system gives Aris an A- valuation grade, recognizing that its key metrics compare favorably with the Industrials medians:

- P/E Non-GAAP [FWD]: 14.72 versus 19.01 for the sector.

- P/E GAAP [FWD]: 16.53 compared to 21.71 for the sector.

- PEG Non-GAAP [FWD]: 1.23, well below the sector median of 1.76.

- EV/EBITDA [FWD] 6.60 versus 11.62 for the sector.

- Price/Sales [FWD]: 1.13 compared to 1.49.

These metrics suggest that Aris is modestly undervalued when compared to the sector, and we get the same impression from a price chart:

Between mid-2022 and late January of this year, the stock stumbled badly, then recovered somewhat before falling again. Over the last three months, the price has been hot, roughly doubling; there have been no news releases or changes in analyst coverage that might have stimulated the spike.

When share prices go up as rapidly as they have done in the past few months, it’s tempting to think they could fall back again at any time. However, I think the current push is a reversion to the mean or similar phenomenon, and that it could go up to the $20 level at some point in the near future.

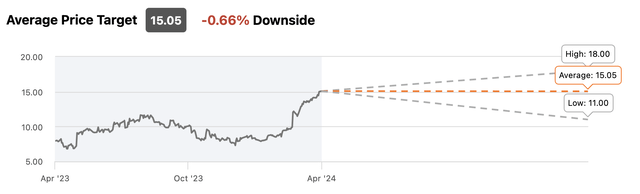

Wall Street analysts apparently think the bullish run is over. Their average price target is nearly flat, despite the bullish EPS estimates:

ARIS Price Targets (SeekingAlpha )

Personally, I like the high target better. 2024’s earnings are expected to be 16.43% above 2023’s and if we add 16.43% to the April 9 closing price of $15.15, we get a one-year price target of $17.64, which is not far off of $18.00. Those are different end dates by a quarter, but they provide an indication of what’s ahead.

The higher target also is consistent with management’s expectations of higher volumes, expanding margins, and lower capex. As Chairman Zartler noted, there is currently a supply-demand imbalance that favors sellers.

The Quant system has a Hold rating, Wall Street analysts have six Strong Buys, four Buys, and one Hold (despite their flat target price). There have been no other Seeking Alpha ratings in the past 90 days.

Here’s an interesting question when considering valuation: Can an environmentally friendly company working for the oil & gas industry be recognized as a green stock? I don’t have an answer to that question so far, but a positive answer would add upward pressure on the price.

Summing up, I believe the stock is slightly undervalued despite the recent increases and that it will get to around $18.00 in the next year.

Risk factors

The first and most obvious risk for me is that Aris moves a lot of contaminated water before it is recycled. Any break or leakage in its pipelines or facilities could be problematic and expensive.

Second, its fortunes are tied to capital spending by oil and gas companies, and as we know spending can be cut back dramatically in a short time. In turn, producer spending is driven by events, economic cycles, and other factors that are under no one’s control.

Aris depends heavily on just a few major customers; in 2023, its three largest customers accounted for 62% of revenues. That’s especially true of ConocoPhillips, which provided about 33% of last year’s revenue. To some extent, the COP risk is offset by the fact that it owns about 47% of its Class B common shares.

Aris operates in an asset-heavy industry, requiring it to use debt to finance its growth. If it is unable to borrow money, or borrow at reasonable rates, it could face financial constraints. To some extent, that should be offset this year by higher expected free cash flow.

Aris does not do any fracking, but many of its customers do, so the company is exposed to potential legislation or regulations. Any new measures that constrain fracking could hurt both its top and bottom lines.

Conclusion

Aris Water Solutions serves oil and gas producing companies and is therefore subject to the ups and downs of that industry. It is working to improve its fortunes, though, by controlling its costs, getting more out of its existing assets while reducing capex, and only taking on growth that offers above-average profitability.

As a result, I expect its share price to continue growing, and have a target price of $18.00 along with a Buy recommendation.