Shares of AT&T (T) – Get AT&T Inc. Report are greater on Monday, eventually verify about 8% up, after the corporate accomplished its merger with Discovery on Friday.

The break up leaves the pure-play AT&T enterprise underneath AT&T (and the T ticker image, whereas its WarnerMedia enterprise (together with HBO) merged into Discovery — therefore the WBD ticker image.

(Adjusted for the switch of media property to Warner Bros. Discovery, legacy AT&T is buying and selling decrease from Friday.)

One might make an argument that AT&T is now undervalued vs. Verizon (VZ) – Get Verizon Communications Inc. Report and that Discovery is undervalued vs. different streaming giants, like Netflix (NFLX) – Get Netflix, Inc. Report and Disney (DIS) – Get Walt Disney Firm Report.

At the very least, that is the bulls’ hope.

Buying and selling T Inventory

I’d put up a chart of Discovery, however with simply sooner or later of value motion, there isn’t a lot for technical merchants to go on. That leaves us with AT&T, which by the best way, yields simply over 5% with its dividend.

Scroll to Proceed

Two analysts have come out with new value targets already, with Deutsche Financial institution assigning a $24 goal and JPMorgan assigning a $22 goal.

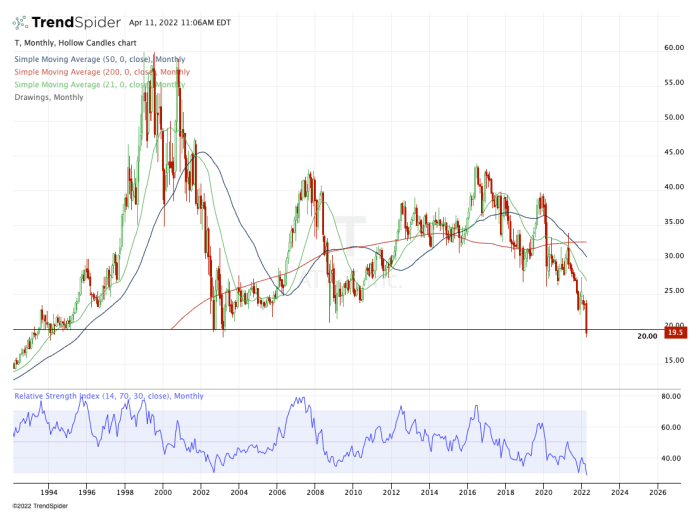

Bulls are actually seeking to see wAT&T inventory can reclaim the important thing $20 degree. As for why it is a key degree, you’ll be able to see the way it has been a notable help degree for roughly 20 years by trying on the month-to-month chart under.

If it might probably clear $20, then the JPMorgan analysts could have an affordable value goal of $22. That will get AT&T inventory again to the prior low when it bottomed at $22.02 in December.

From there, the inventory can start to fill the hole again as much as $23.54 — virtually again to Deutsche Financial institution’s goal.

If we see the latter motion play out and AT&T start to fill the hole, control the short-term transferring averages, just like the 10-day and 21-day. These might act as resistance amid the rally.

As for the draw back, right now’s low of $18.85 is an efficient reference level to bear in mind. Under that opens the door all the way down to the 161.8% draw back extension at $18.65, which AT&T inventory practically hit right now (and a few merchants want it did).