Ian is putting all his attention into the new American AI Wealth Summit today and then taking some well-deserved time off to welcome his new baby!

(Welcome to the team Baby King! You can sign our card for him here if you want!)

This week, I’m happy to take the lead because I have an amazing new investing opportunity for you. It’s an emerging tech market with huge profit potential.

And it’s all thanks to the continued advancements of artificial intelligence.

We’re watching this mega trend very closely: automated machine learning.

Mega-cap tech companies like Microsoft, Google and Amazon’s Web Services are already partnering with (or scooping up) these specialized AI companies.

This technology is proving to cut operations costs, increase productivity and give businesses the competitive edge over their peers.

I’m even recommending an exchange-traded fund (ETF) you can invest in today in this space.

So, are you ready? Find out more about this mega trend in today’s video…

(Or read the transcript here.)

Hot Topics in Today’s Video:

- Survey Says: A big thanks for everyone who voted on last week’s “AI Ian” survey in The Banyan Edge. Find out which AI-generated Ian won! [0:25]

- Mega Trend: Automated machine learning is an amazing facet of AI tech. And it’s helping businesses streamline their costs while improving production. [1:00]

- Investing Opportunity: This ETF tracks the BlueStar Quantum Computing and Machine Learning Index. Companies in this sector have products or services that develop quantum computing and machine learning tech. [5:00]

- Stock Pick: There’s one technology powering America’s AI revolution — microchips. And right now, we’re in a war over these chips. Ian details the full story and the investment opportunity here.

Until next time,

Amber Lancaster

Director of Investment Research, Strategic Fortunes

Warren Buffett likes to keep things simple.

Despite being one of the wealthiest people in human history, this is a man who drives a car he bought in 2014, and who’s lived in the same house in Omaha for decades.

He also keeps his market valuation models simple.

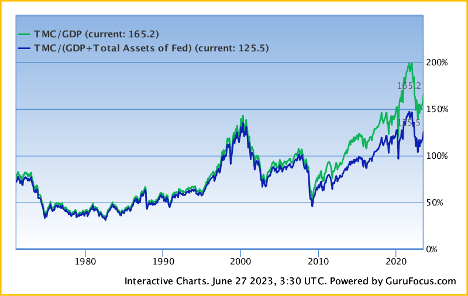

The “Buffett indicator” is a quick and dirty snapshot of market valuations that compares the value of the stock market to the size of the economy (GDP).

The ratio steadily rose throughout the “easy money” period of 2009 to 2019. Then it exploded higher in 2020 and 2021, during the Fed-fueled pandemic market frenzy.

The indicator came down again during last year’s bear market, but remains wildly expensive.

Just for kicks, the quants at GuruFocus made an adjustment to Buffett’s indicator. They compared the total value of the stock market to the combination of GDP and the size of the Fed’s balance sheet. The idea is to account for the outsized influence that the Fed’s tinkering has had in recent years.

Interestingly, after taking the Fed’s gargantuan balance sheet into account, this modified Buffett indicator looks a little bit better. But it’s still trading at levels seen after the 1990’s tech bubble burst.

What Does This Mean for Us?

Valuation metrics like these won’t tell you what the market is doing today or tomorrow.

They’re not designed for market timing.

But they will give you a decent idea of what to expect over the next several years. By GuruFocus estimates, the market is pricing in expected returns of about 2.4% per year over the next decade, and that includes dividends.

Estimates are estimates. Take them with a grain of salt. But I think it’s fair to assume that broad market returns will be muted over the next several years.

But this doesn’t mean we can’t still make money in this market … if we look in the right places.

We can’t buy an index fund and expect to generate strong returns in the years ahead. But we can focus on the trends that are literally poised to change the world.

Today, Amber brought us automated machine learning. Ian King has also been focused on microchips — the technology powering the advancements in AI.

Eighty-five percent of the world’s leading-edge microchips are in our smartphones, smart cars, computers, medical devices and even our power grid. These are all American inventions … all while China struggles to compete.

Ian’s latest report breaks down the modern “Cold War” between China and U.S., with the microchip industry at the center of it all. Go here to start watching his free webinar.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge