AerialPerspective Works

U.S.-Listed Technology Stocks Have Fallen Sharply Amid the General Bearish Sentiment

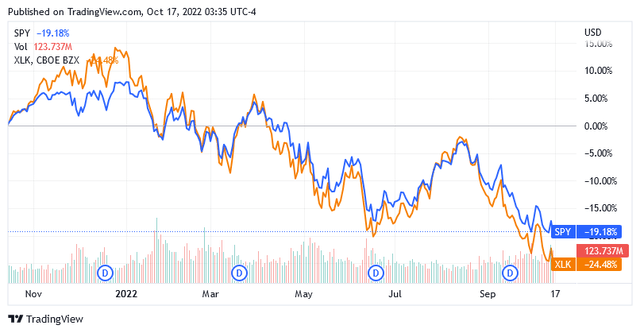

The bear market that has been going on for several months has caused the price of shares listed in the USA to fall sharply.

The SPDR S&P 500 Trust ETF (SPY) provides a valid benchmark to assess the damage suffered by investors who, in just 12 months, have seen their portfolios lose an average of nearly 20% in value as of this writing.

Seeking Alpha

One of the hardest-hit sectors so far is technology, which fell more than 24% over the same period, as can be seen in the chart above. To date, it’s really difficult to predict when investors will smile again, as the factors fueling this bearish sentiment are strong geopolitical tensions, adding elements of escalation every day.

Aviat Networks, Inc. Has the Potential to Come Back Strong

It might be good to stay away from tech stocks for the time being, given the continued strong downside risks. But that doesn’t mean stocks can’t get special attention today, provided they have very strong comeback potential. These are stocks that could quickly eclipse this negative market streak once the general trend changes, i.e., when investors are again willing to accept the higher investment risk associated with equities.

Aviat Networks, Inc. (NASDAQ:AVNW) is one of those stocks to consider when preparing the next strategy for a return to bullish sentiment in the market.

Aviat Networks, Inc.’s Role in the Communications Equipment Industry and Its Long-Term Profitability Targets

Based in Austin, Texas, Aviat Networks, Inc. is a provider of various microwave network technologies that enable wireless communications. These solutions, which include software, are sold by Aviat Networks, Inc. in North America, Europe and overseas.

The company’s customers include communications service providers and private network operators, including government organizations and agencies, covering various areas of public interest such as energy and utility companies and public safety agencies.

It markets its products through direct channels but also indirectly through distributors, resellers and sales agents, and sells its technologies online.

Until the stock market is in good shape again, the company will continue to pursue its long-term goals, which essentially consist of increasing its profitability year after year.

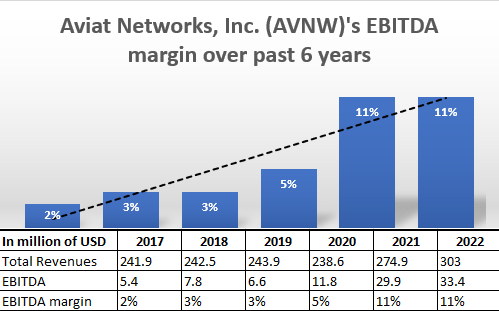

Past trends point to continued improvements in revenue and EBITDA, which could fuel the potential for a strong share price rally to be triggered when the stock market turns bullish.

The chart below shows that the company’s EBITDA margin has increased over the past 6 years as every dollar of revenue has incrementally generated more profit.

Seeking Alpha

For the most recent full fiscal year 2022 ended June 30, 2022, total revenue increased 10.2% year-over-year to $303 million.

The North American segment, which accounts for the largest share of total sales at about 66%, saw a 9% improvement over fiscal 2021, while the overseas segment, which accounts for the remaining 34%, grew more than 12%.

Bookings have performed extremely well in the last quarter of fiscal 2022, which is very encouraging. According to the company, bookings reached record highs for the North American market and for the multi-band segment in EMEA (Europe, Middle East and Africa), while the management software solutions category benefited for the first time from the sale of its Software as a Service-Based Health Assurance software product to an entity within the US state government.

On an adjusted basis, the company also reported the following year-over-year improvements: Operating expenses of $75.8 million were flat, driving operating income up 29.3% to $33.9 million and net income up over 45% to nearly $32 million, or $2.76 per share.

While the gross profit margin this time fell 130 basis points to 36.2% of total sales, the financial profitability indicator is still above the 5-year average of 34.68%. But the company needs to work a little harder on gross profit margin as it still lags behind most of its peers in the industry.

Analysts Expect Aviat Networks to Be Part of a Bright Outlook for the Global Wireless Infrastructure Market

According to a 2021 report by fortunebusinessinsights.com, the global wireless infrastructure market is expected to grow at more than 11% annually over the next few years, from an estimated size of $202.4 billion in 2022 to an estimated size of $427.4 billion in 2029.

The main driver of this market will be the need to make ever faster and more efficient connections available in the commercial communications industry as technologies such as cell phones and other portable or wearable devices become more popular. But the progressive adoption of satellite-supported connection technologies by the armed forces will also provide significant impetus to the market.

Because of the rapid rate of innovation in telecommunications technology, coupled with the continued expansion of global connectivity for geopolitical strategic reasons, the number of growth opportunities for Aviat Networks, Inc. and other communications equipment providers is virtually unlimited.

The microwave-based infrastructure is being built through the contribution of an impressive array of components, including the products and services of Aviat Networks, Inc., and other specialists in wireless transport solutions.

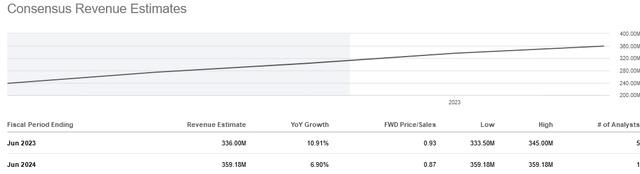

In the near future, the company is expected to contribute to global wireless infrastructure growth with the following improvement in revenue and net profit.

Analysts estimate total revenue will increase 10.91% year-on-year to $336 million in 2023 and 6.90% year-on-year to $359.18 million in 2024.

Seeking Alpha

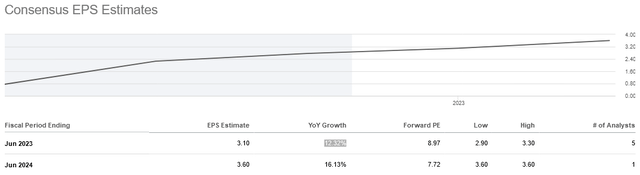

Analysts estimate that total net earnings per share will increase by 12.32% year-on-year to $3.10 in 2023 and by 16.13% year-on-year to $3.60 in 2024.

Seeking Alpha

Solid Balance Sheet to Support Growth

As of June 30, 2022, Aviat Networks, Inc.’s balance sheet had $48 million in cash against zero outstanding debt, indicating a solid foundation in support of growth projects.

Aviat Networks recently signed a collaboration agreement with a U.S. semiconductor supplier, MaxLinear, Inc. (MXL), for the deployment of a next-generation chip solution. MaxLinear’s chip will enable Aviat Networks to increase the capacity of its wireless transport technology while reducing overall costs notably.

Aviat Networks’ more innovative and efficient wireless transport solution will support the significant volume of data expected with 5G deployment. Wireless transport should play a major role in the growth of the global wireless infrastructure market over the next few years.

Wall Street Recommendation Ratings and Price Target

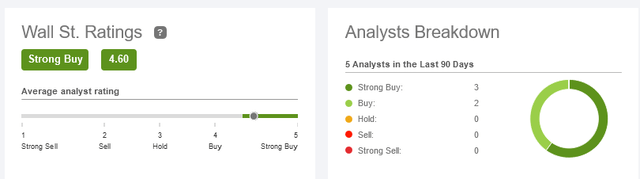

On Wall Street, the stock has three strong buy ratings and two buy ratings for an average strong buy rating.

Seeking Alpha

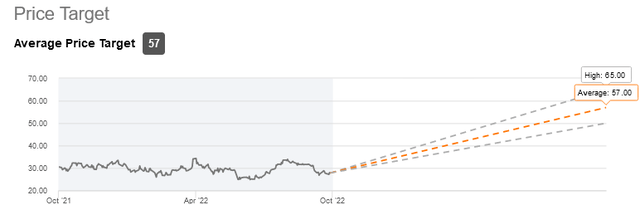

The stock has a median price target of $57, which is up 105% from current levels.

Seeking Alpha

The Share Price Could Face Further Downsides

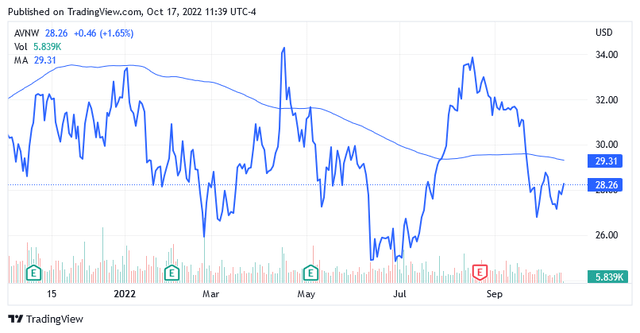

The stock was trading at $28.26 per share as of this writing for a market cap of $311.43 million and a 52-week range of $24.13 to $35.18.

Seeking Alpha

The share price is trading below the middle point of $29.66 of the 52-week range and below the long-term trend of the 200-day simple moving average of $29.31.

The non-GAAP (TTM) P/E is 10.22 versus the industry median of 15.22 and the price-to-sales (TTM) ratio is 1.02 versus the industry median of 2.40. All these metrics give an indication of a low stock price.

The stock is a very interesting investment opportunity because it has growth potential that it can unleash in the form of price increases over the next few years. However, given the pressure of the current market headwinds, the share price could still fall, putting off a buy decision for now.

Conclusion – This Stock Has Significant Growth Potential, but the Share Price Could Trade Lower

Aviat Networks, Inc. stock continues to strive to improve its long-term profitability targets. It succeeds in doing so, while the share price falls under the pressure of strong headwinds in the market.

There is strong upside potential ahead that can be unleashed as the stock market becomes more bullish.