anouchka

Introduction

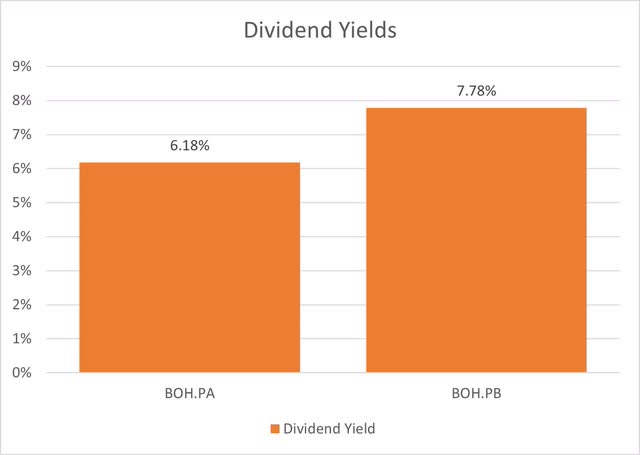

Financial institution of Hawaii (NYSE:BOH) is a regional financial institution and serves as Hawaii’s second oldest financial institution. The financial institution does have a presence exterior of the island state with branches within the American southwest. Financial institution of Hawaii additionally had a single most well-liked share (BOH.PA) that provided an uninspiring yield of simply over 6%. Not too long ago, the financial institution introduced the issuance of a second most well-liked share (BOH.PB) with an 8% dividend. Since its IPO, the shares have traded at a premium, however I imagine the brand new most well-liked shares are nonetheless enticing with a 7.8% yield.

Microsoft Excel API

Financial institution of Hawaii Monetary Outcomes

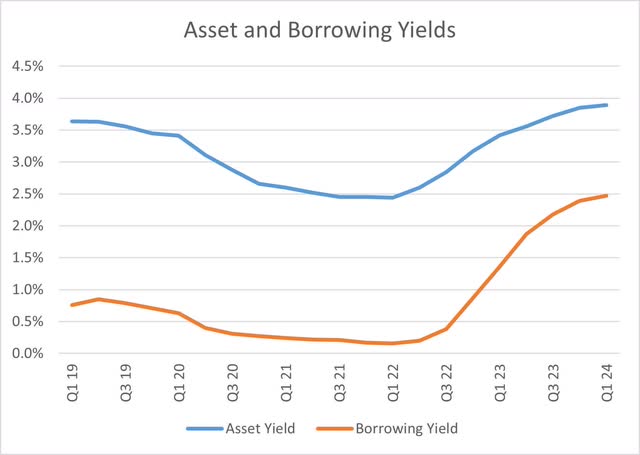

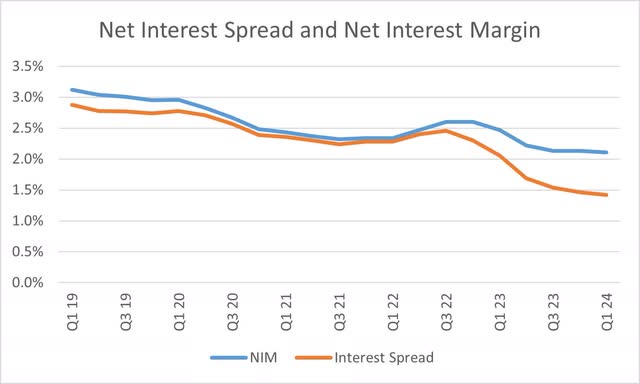

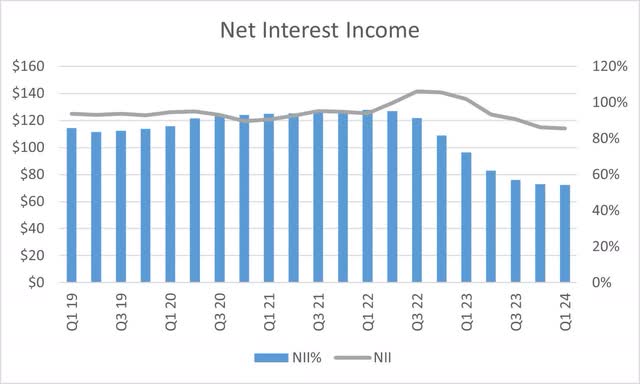

The latest rise in rates of interest led to regional banks attempting to keep up their earnings with the altering charge setting and Financial institution of Hawaii was no completely different. As charges rose, the financial institution’s asset yields rose, however borrowing prices rose at a quicker tempo. The squeeze has led to a drop within the internet curiosity unfold. Whereas some banks have managed to effectively allocate capital and stabilize their internet curiosity margins, Financial institution of Hawaii continues to be seeing a internet curiosity margin decline, albeit a lot slower in latest quarters.

Financial institution Financials

Financial institution Financials

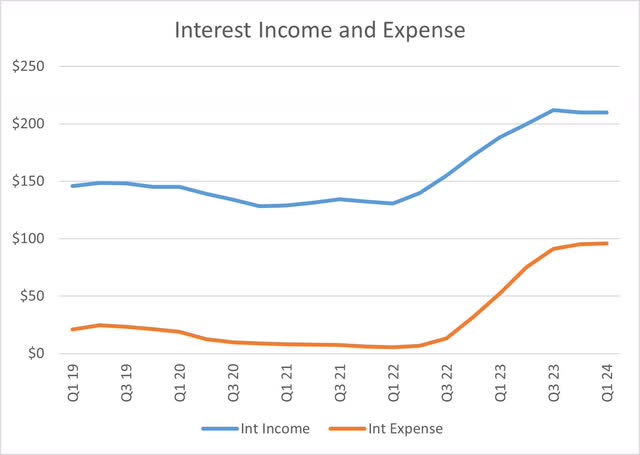

In the case of total earnings, the financial institution is seeing the resistance on the yield aspect is clearly bleeding by way of. During the last couple of quarters, the financial institution’s curiosity revenue development has stalled even with greater rates of interest. This mixed with greater curiosity expense, has led to 5 consecutive quarters of internet curiosity revenue (curiosity revenue much less curiosity expense) declines. Whereas many regional banks have generated internet curiosity revenue above their pandemic or pre-pandemic ranges, Financial institution of Hawaii shouldn’t be a kind of banks.

Financial institution Financials

Financial institution Financials

Loans and Deposits- A Signal of Conservative Capital Administration

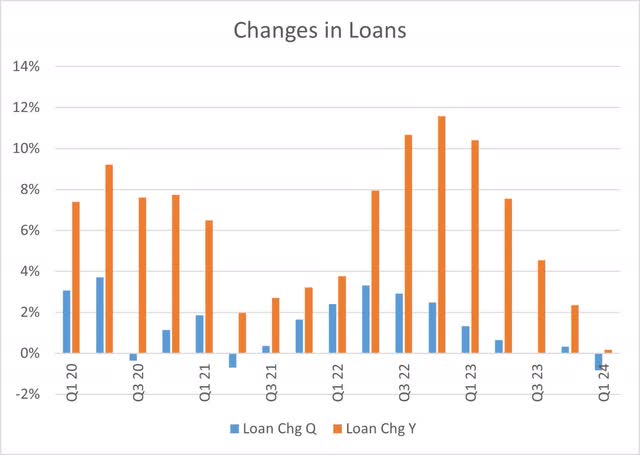

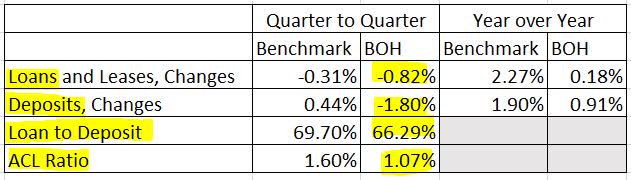

With respect to the well being of the financial institution, I discover the administration of the financial institution’s lending and deposit development to be a optimistic growth. Through the pandemic, many financial institution steadiness sheets grew north of 20%, which made issues tougher when the struggle for deposits began in late 2022. Fortuitously, Financial institution of Hawaii’s lending development has been conservative over the previous few years and is at the moment flat on a yr over yr foundation.

Financial institution Financials

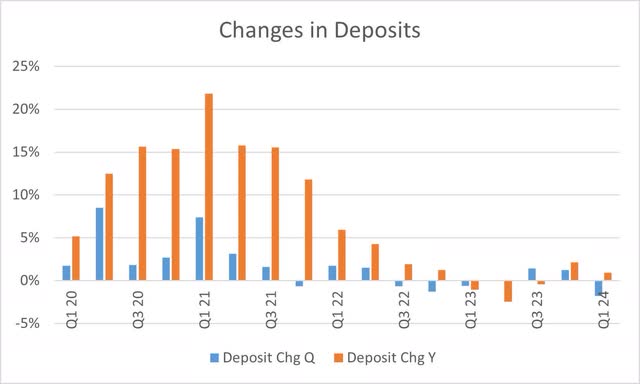

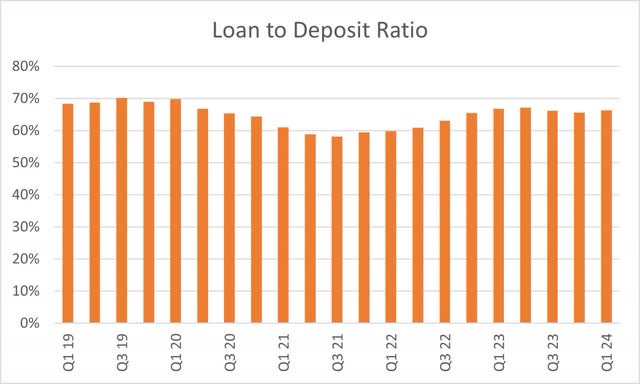

On the deposit aspect, the Financial institution of Hawaii has not been resistant to the challenges of retaining depositors within the regional banking house. Deposits dropped within the first quarter and have declined in 4 out of the final seven quarters. The tame development in each loans and deposits continues to assist the financial institution’s modest mortgage to deposit ratio, which sits underneath 70% and underneath the common for all industrial banks. The benefit to a conservative mortgage to deposit ratio is that the financial institution shouldn’t be depending on exterior financing and may develop its lending sooner or later with out essentially rising its deposits.

Financial institution Financials

Financial institution Financials

Financial institution Financials & Federal Reserve Weekly Industrial Financial institution Information

Dangers to Financial institution of Hawaii

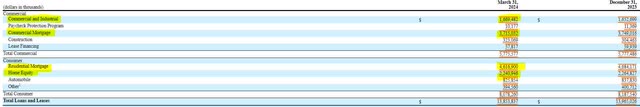

For Financial institution of Hawaii, I imagine that traders want to look at the financial institution’s mortgage focus fastidiously. Because it stands, the residential actual property market is the financial institution’s largest publicity with roughly half of the financial institution’s loans tied into residential mortgage and residential fairness loans. The subsequent largest mortgage focus is industrial actual property mortgages which account for $3.7 billion of the $13.8 billion mortgage portfolio. Whereas the industrial actual property market is dealing with self-explanatory headwinds, adjustments within the labor market and broader economic system can create challenges within the efficiency of the financial institution’s residential actual property mortgages.

SEC 10-Q

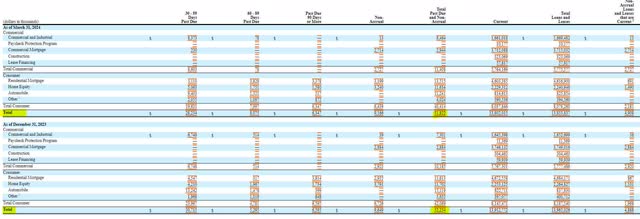

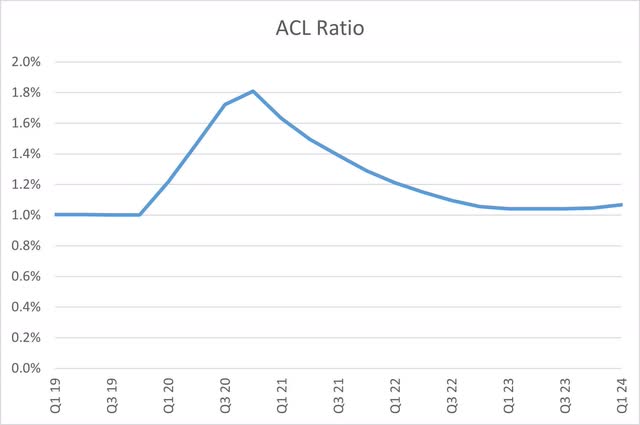

Fortuitously, the Financial institution of Hawaii’s mortgage efficiency is at the moment very sturdy. Within the first quarter, the financial institution recognized $52 million in loans as both delinquent or on nonaccrual standing, which is lower than 0.5% of complete loans. Regardless of the energy of the financial institution’s mortgage efficiency, traders must be conscious of the truth that the financial institution’s allowance for credit score losses is sitting at round 1% of gross loans, which is nicely under the 1.6% trade common. Ought to mortgage efficiency start to slide, there’s little buffer between mortgage efficiency and earnings.

SEC 10-Q

Financial institution Financials

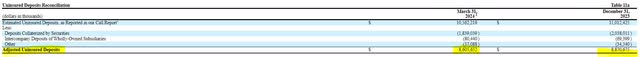

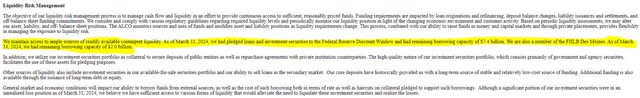

One other threat dealing with the Financial institution of Hawaii is the variety of uninsured deposits. Regardless of declining by greater than $250 million within the first quarter, the financial institution continues to be carrying greater than $8.6 billion in uninsured deposits, which accounts for greater than 40 % of the financial institution’s complete deposits. Fortuitously, the financial institution has enough liquidity to cowl their uninsured deposits with $9.4 billion in borrowing capability between the Federal Reserve and FHLB. However traders must be reminded that if liquidity is required, it will undermine earnings.

SEC 10-Q

SEC 10-Q

Conclusion

The Financial institution of Hawaii’s low internet curiosity margin mixed with its mushy buffer for mortgage losses are the first causes I’m not advocating an funding within the financial institution’s frequent shares. Traders searching for worth ought to take discover that Financial institution of Hawaii’s frequent shares are buying and selling at 16 instances earnings, which is dear contemplating JPMorgan Chase is buying and selling at 12 instances earnings. The Collection A most well-liked shares provide a dividend yield under many of the financial institution’s friends. The Collection B most well-liked shares provide a horny 7.8% yield with a name date that’s 5 years away and are the best choice for revenue traders.