Banks are growing increasingly concerned about competition from technology and e-commerce disruptors, with firms like Google, Facebook and Microsoft being now perceived among their biggest competitors in the next five years, a new study conducted by Economist Impact and commissioned by Swiss enterprise software provider Temenos found.

The survey, which polled 300 executives in retail, commercial and private banking from all around the world, found that banks are feeling the heat of competition from tech giants. These players were cited by 40% of respondents as their biggest rivals during the next five years, up 6 points from 34% in 2020.

Historical data show that bigtechs’ influence and threat have increased sharply over the past years as the focus on one-stop-shop solutions for online purchases becomes a key battleground between traditional banks and non-financial companies entering the market.

This shift is being attributed to these players’ ability to provide convenient financial solutions and innovative payment methods that better suit consumers’ changing preferences. This includes extensive digital ecosystems with wide ranges of products and services accessible through a single platform, an offering that’s particularly appealing to new generations of consumers who look for seamless and comprehensive experiences when purchasing online.

Additionally, tech giants are known for their advanced technology and user-friendly interfaces, which enhance the overall user experience, the report notes. Their products are also often designed with a focus on personalization and customization, allowing consumers to tailor the products to their specific needs and preferences.

Besides tech giants, a similar trend is also being observed among peer-to-peer (P2P) lenders and alternative finance providers, neobanks, wealthtech providers and non-financial services firms, where this year’s survey results are revealing increased influence and threat from these new players.

26% of the banks polled in 2023 said that they perceived alternative finance providers as their biggest competitors in the next five years, up 10 points from 2020. 25% named neobanks, up 5 points, and 23% named digital wealth managers, up 9 points.

While tech firms, alternative lenders, neobanks, wealthtech companies and non-financial services firms are putting increased pressure on traditional banks, global payments players such as PayPal, Alipay and Apple Pay, on the other hand, are seeing their influence decrease.

In 2020, 50% of the banks polled cited payment firms as their biggest rivals, a figure that declined 9 points this year to 41%. Despite the fall, payment firms remained banks’ top competitors in 2023, surpassing all other categories.

Which non-traditional entrants to the banking industry will be your company’s biggest competitors in the next five years?

Deepening engagement with fintech companies

To fence off competition, banks indicated in this year’s survey that they were looking to deepen their collaboration with fintech companies.

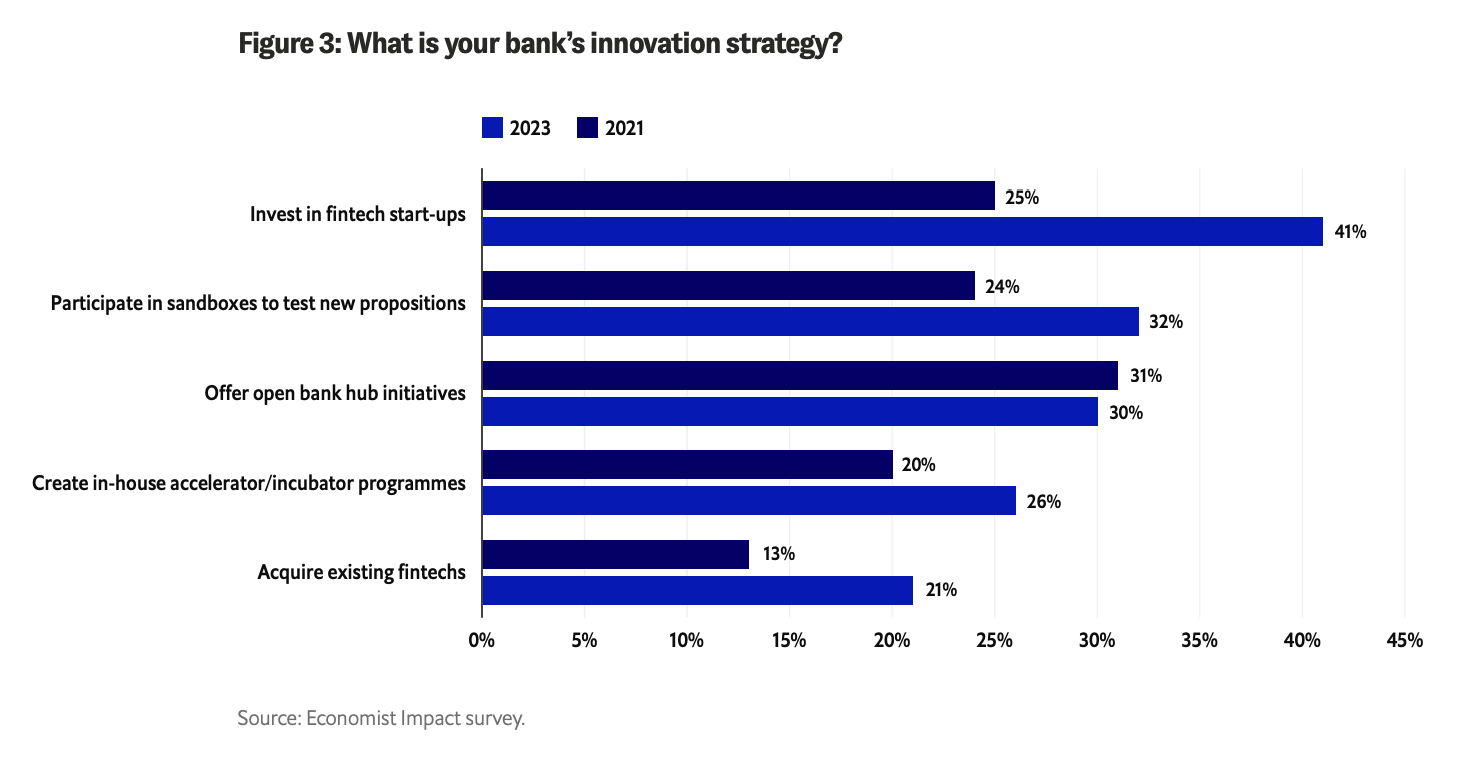

Since the 2021 survey, increasing engagement with fintech firms has become a much more important innovation strategy for banks. In 2023, 41% of respondents said they were looking to invest in fintech startups, up 16 points from 2021’s 25%. Similarly, 32% said they planned to participate in sandboxes with fintech companies and other technology providers to test new propositions, up 8 points from 2021’s 24%.

Findings from the study also revealed that banks are looking to tap into the challenging macroeconomic environment and the funding crunch to snap up existing fintech companies at a discount, with 21% of respondents stating they were looking to acquire fintech companies, up 8 points from 13% in 2021.

Banks view strategic acquisitions as a way to consolidate their positions, increase access to technology, and create comprehensive product offerings with compelling payment solutions.

What is your bank’s innovation strategy?, Source: Byte-sized banking: Can banks create a true ecosystem with embedded finance?, Economist Impact/Temenos, Sep 2023

Over the next one to three years, banking executives foresee relationships within the fintech industry evolve further, with as many as 44% of survey respondents believing that banks will acquire majority stakes in fintech companies and 32% believing that there will be market consolidation among challenger banks in the next one to three years. These were lower in 2021, at 41% and 23% respectively.

The need to embrace technology

The Economist Impact/Temenos document, titled “Byte-sized banking: Can banks create a true ecosystem with embedded finance?”, released on September 28, discusses the need for banks to adapt to emerging technologies and create their own digital ecosystems in order to remain relevant in the face of disruption from new players.

In particular, the report emphasizes the importance of generative artificial intelligence (AI) in the banking industry and highlights the need for collaboration with fintech companies and technology providers.

75% of respondents to this year’s survey said they believed that the banking sector will be significantly impacted by generative AI and 71% agreed that unlocking value from AI will be the key differentiator between winners and losers.

Respondents cited improved user experience and personalization (21%), digital marketing (19%) and customer fraud detection (13%) as the top three most valuable use cases of AI for banks in the next one to three years.

What do you believe will be the most valuable use of artificial intelligence for banks in the next 1-3 years?, Source: Byte-sized banking: Can banks create a true ecosystem with embedded finance?, Economist Impact/Temenos, Sep 2023

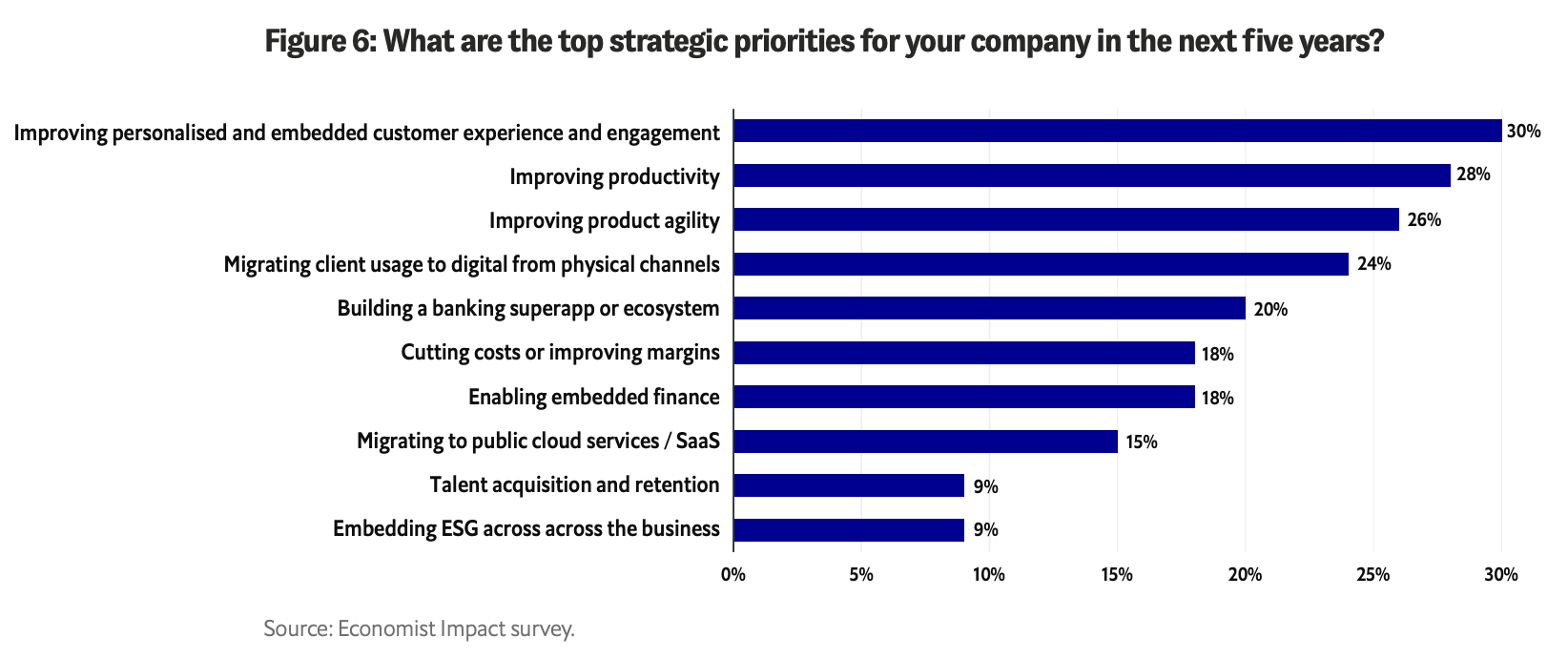

The document also mentions the evolution of banks’ business models, stressing the rise to prominence of banking ecosystems. Results from the study show that banks are aiming to evolve into true digital ecosystems, with one-fifth prioritizing the development of a banking super-app. The strategy involves leveraging technology and data to better understand consumers and more effectively deliver real-time, personalized experiences, and building cross-industrial platforms.

What are the top strategic priorities for your company in the next five years?, Source: Byte-sized banking: Can banks create a true ecosystem with embedded finance?, Economist Impact/Temenos, Sep 2023