lerbank/iStock via Getty Images

Bitcoin (BTC-USD) is set to end the week 1.3% lower, in line with broader investor sentiment that soured after major central banks’ increasingly hawkish tone signaled a potential recession next year.

Investors in the space were also spooked after French auditor Mazars reportedly halted its proof of reserves reporting for cryptocurrency clients, citing lack of confidence in the reports it published so far.

The firm earlier released reports for crypto exchanges Binance, Crypto.com and KuCoin. According to CNBC, Mazars’ report for Binance is no longer available on the firm’s website.

Accounting firm Armanino is also reportedly ending its crypto audit practice. The company was recently named in a lawsuit as it failed to find irregularities at FTX.US during its audit last year.

The crypto industry has been reeling since the FTX (FTT-USD) collapse, with investors reportedly pulling 91,363 bitcoin (BTC-USD) – amounting to ~$1.5B – from Binance, Kraken and Coinbase last month.

The SEC and the CFTC each filed charges against FTX (FTT-USD) founder Sam Bankman-Fried, essentially providing a blueprint on how regulators can police offshore crypto exchanges.

“Though the FTX fallout may slow the growth of the crypto economy, it is unlikely to derail the path of evolution these new technologies offer. Just as the hedge fund industry survived Bernie Madoff and emerged stronger, the crypto industry is likely to enter a more professional and regulated phase,” said SA contributor Franklin Templeton Investments.

The global cryptocurrency market cap stands at $806.06B, down 4.7% over Thursday, according to CoinMarketCap.

The Biden administration said Congress enact legislation to regulate the spot market for crypto assets that are not securities and recommended steps to “address regulatory arbitrage”.

U.S. Senators Elizabeth Warren (D-MA) and Roger Marshall (R-KS) unveiled a bipartisan legislation Tuesday to combat money laundering and terrorist financing through digital assets.

Billionaire venture capitalist David Rubenstein predicts U.S. lawmakers will take about a year to pass legislation after the FTX scandal.

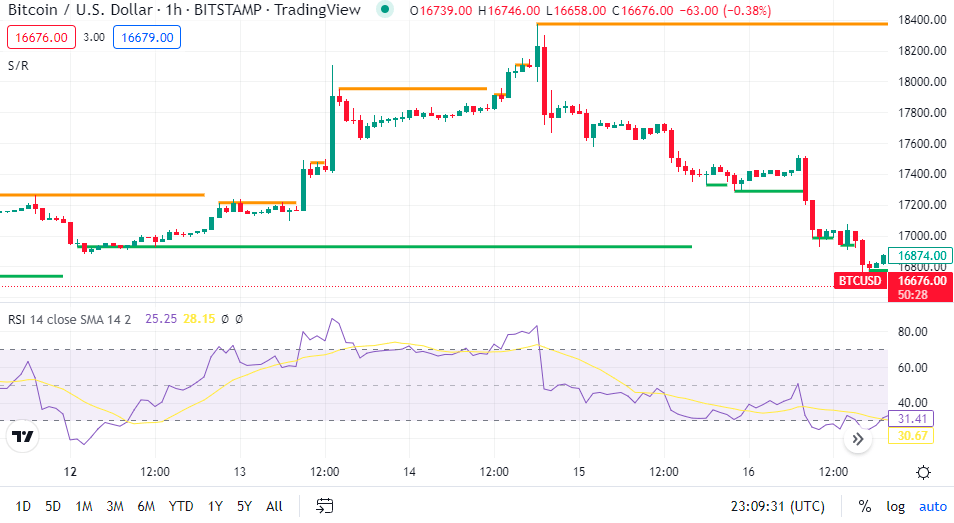

Bitcoin price

Bitcoin (BTC-USD) dropped 4.3% to $16.6K at 6.16 pm ET, while ether (ETH-USD) fell 7.7% to $1.17K.

Bitcoin (BTC-USD) has been struggling to remain above $17K this week. SA contributor VanEck expects the coin to test $10K-$12K in Q1 amid a wave of miner bankruptcies and rise to $30K in H2 2023.

Crypto-related stocks that ended in the red on Friday include: Marathon Digital (MARA) -10.6%, Riot Blockchain (RIOT) -5.5%, Coinbase (COIN) -3.6%, Silvergate Capital (SI) -2%, Bit Digital (BTBT) -1.5%.