Sproetniek/E+ via Getty Images

Maintaining Rating

We initiated coverage of Blade Air Mobility, Inc. (NASDAQ:BLDE) on August 24, 2022 with a “BUY” rating. Since then, the performance has been poor, as the stock lost 20% of its market capitalization while the index only lost ~1% around that time frame. Despite this short-term underperformance, we remain bullish on BLDE stock in the long-term as Q3 2022 earnings showed continued financial growth and valuation has the capacity to expand in the long-term.

Company Recap

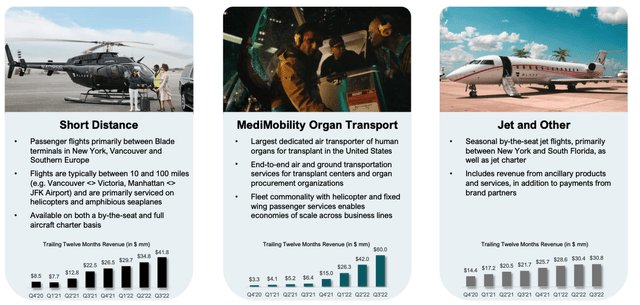

BLADE is an “Urban Air Mobility” company that offers transportation services among various cities in the United States. Most notably, BLADE provides 5-minute-long helicopter transportation services between Manhattan and JFK Airport for around ~$200 and offers other shuttle services as well. BLADE also offers other services such as MediMobility Organ Transport and jet charter services. Each business segment as shown robust quarter-over-quarter growth in the last year.

BLADE Q3 2022 Earnings Presentation

Q3 2022 Financial Performance

Improving Metrics

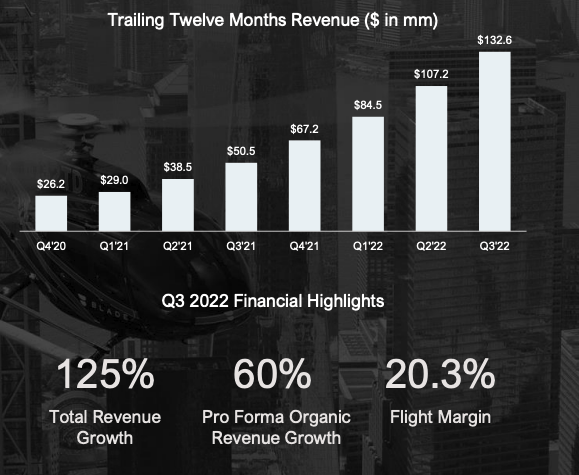

As a high-growth company with potential in the Urban Air Mobility space, we were satisfied with the Q3 performance. The company’s TTM revenue grew from $107.2 million in Q2 2022 to $132.6 million in Q3 2022. On a year-over-year basis, the company’s total revenue grew 125% largely as a result of its acquisition last year, with a pro forma organic revenue growth of 60%. The top line numbers are strong and the company now trades at 2.5x TTM revenue multiple, which is far below the ~3x multiple cited in our initial coverage. In sum, the company showed strong financial growth and the valuation has gotten cheaper.

Q3 2022 Earnings Presentation

Well Capitalized

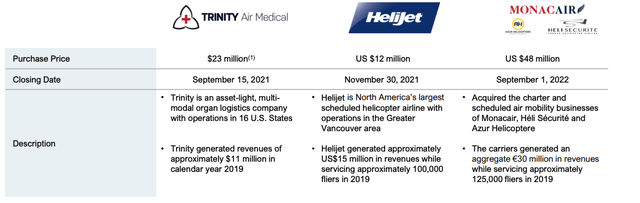

Despite the unprofitability, the company’s balance sheet remains strong, with the company’s cash balance at $202 million, which is roughly ~66% of the company’s market cap. We believe this cash balance gives us a good runway for the company to continue to grow its operations and find new opportunities. Flight margin has also increased on a quarter-over-quarter basis from 14.3% to 20.3%. The improving profitability metric in a key business segment lends us additional confidence that the company is geared to improve profitability and reduce cash burn. Recent acquisitions appear to have been good additions and generating cash flow that can help the company maintain and grow its operations.

Q3 2022 Earnings Presentation

Other Growth Opportunities

We also believe the company has positioned itself to be the main Urban Air Mobility provider across the globe. Though in its early stages, the company has presence in three continents, with presence in the United States, Canada, Europe, and India. For a company with a market capitalization of $300 million and relatively new, the international opportunities are exciting despite the regulatory challenges that are in their way. We believe that with a broad adoption of Urban Air Mobility platforms, Blade will have a good start in international markets due to its brand name and current presence.

Conclusion

Q3 2022 earnings have had little to add to our view and therefore we reiterate our “BUY” rating. The company’s top line growth remains strong and its fundamentals are solid. We still view this company as a good asymmetric risk/reward opportunity and relies on the execution of a long-term strategy that could transform the transportation landscape. Though major regulatory and adoption risks remain, we believe at this current valuation, the upside is substantial if the company continues to increase its presence and turn to profitability as part of its long-term strategy.