cagkansayin/iStock through Getty Photographs

The PIMCO Energetic Bond Alternate-Traded Fund (NYSEARCA:BOND) is an actively-managed, leveraged, diversified bond fund. BOND’s funding managers constantly choose bonds with above-average yields and returns, however with out materially increased danger or volatility. BOND’s diversified, high-quality holdings, above-average 3.0% yield, and above-average returns, make the fund a purchase.

BOND’s high-quality holdings are notably acceptable for extra risk-averse earnings traders and retirees. Extra aggressive, yield-seeking traders ought to think about higher-yielding alternate options. PIMCO has a collection of unbelievable high-yield CEFs, all of which yield considerably greater than BOND, however are considerably riskier as nicely. Of those, the PIMCO Dynamic Revenue Alternatives Fund (PDO) is wanting notably low-cost, with a 9.7% low cost to NAV.

BOND – Fundamentals

- Sponsor: PIMCO

- Dividend Yield: 2.99%

- Expense Ratio: 0.55%

- Whole Returns CAGR (Inception): 2.96%

BOND – Funding Thesis

BOND’s funding thesis is sort of easy, and rests on the fund’s diversified, high-quality holdings, above-average yield, and above-average returns. These mix to create a robust, high-quality fund, acceptable for extra conservative earnings traders and retirees. Let’s take a look at every of those factors.

Diversified Excessive-High quality Holdings

BOND is an actively-managed bond fund, administered by PIMCO, essentially the most profitable and well-known fixed-income funding managers on this planet. In Looking for Alpha retirement circles, PIMCO is best-known for its assortment of high-yield leveraged CEFs, however the firm does produce other completely different choices, together with BOND.

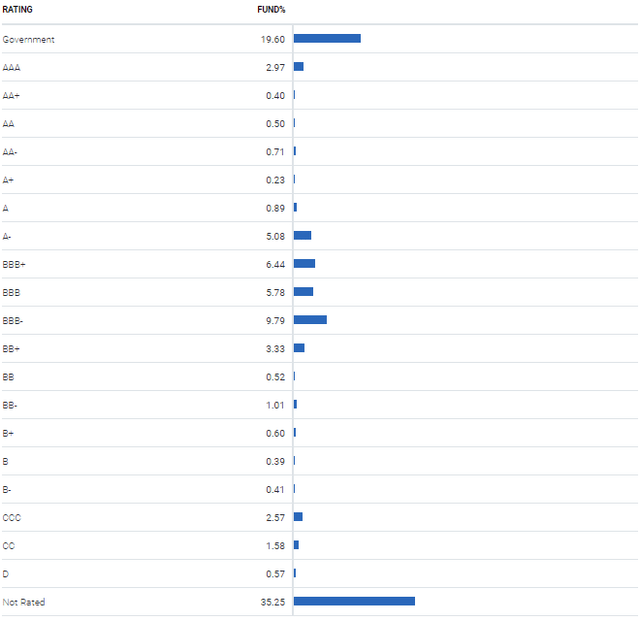

BOND itself invests in a diversified portfolio of bonds, specializing in high-quality securities like treasuries, investment-grade company bonds, and mortgage-backed securities. BOND additionally invests in some riskier bonds, together with high-yield company bonds, however in a lot decrease portions.

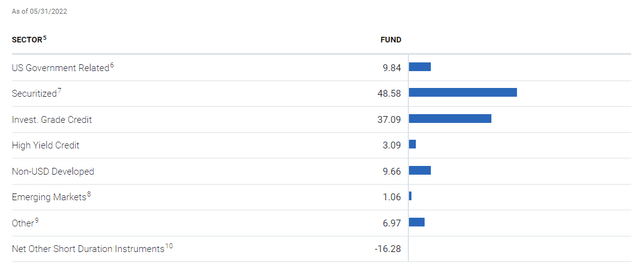

As talked about beforehand, BOND is an actively-managed fund, so asset allocations and safety choice are each considerably depending on the fund’s funding administration crew. From what I’ve seen, the fund is at the moment considerably underweight treasuries, doubtless as a consequence of issues about rising rates of interest. Treasuries have underperformed these previous few months, so being underweight stated asset class appears to have been the precise name, to this point at the least.

Asset allocations and credit score weights are as follows.

BOND Company Web site BOND Company Web site

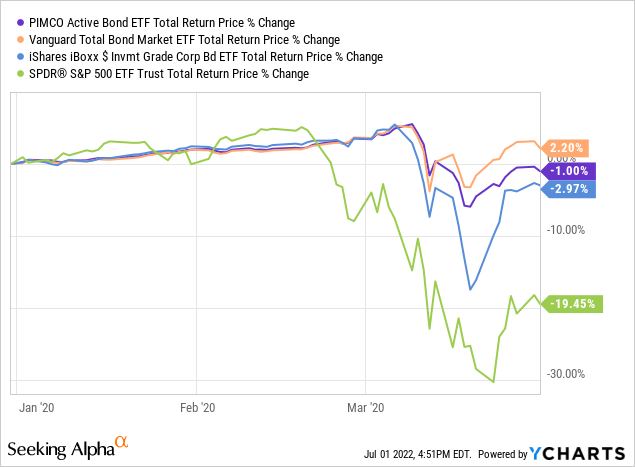

BOND’s diversified, high-quality holdings considerably scale back portfolio danger, volatility, and losses throughout downturns. For example, the fund suffered losses of 1.0% throughout 1Q2020, the onset of the coronavirus pandemic. Losses have been extraordinarily low, as anticipated. Losses have been considerably decrease than these skilled by most broad-based fairness indexes, and someplace between these of broad-based bond indexes and investment-grade company bond indexes.

As must be clear from the above, BOND is a typically protected, high-quality fund, which ought to virtually definitely expertise few, if any, losses throughout any future downturn or recession.

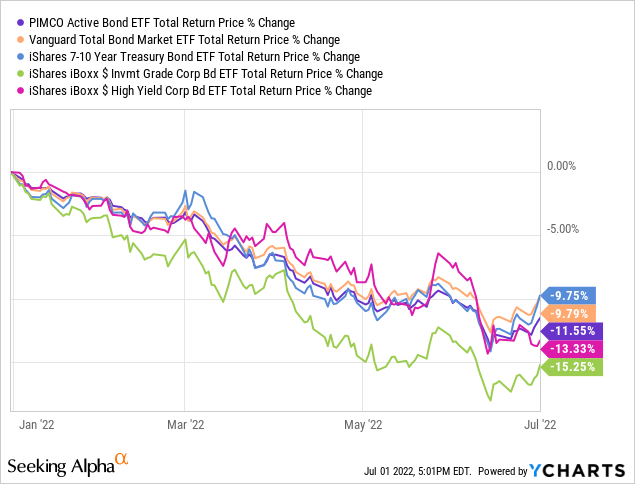

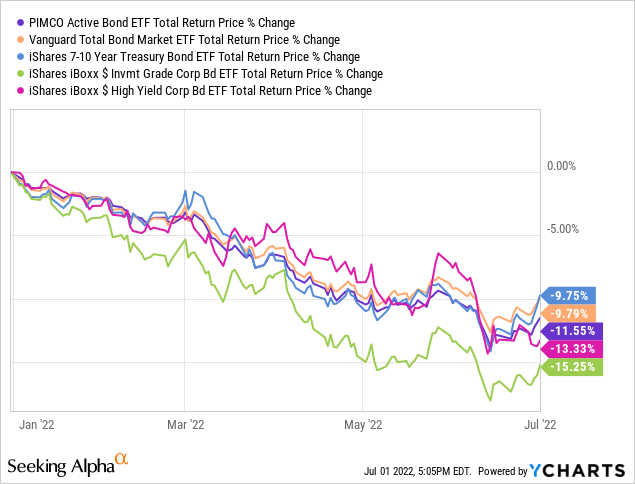

BOND’s underlying holdings sport a median period of 6.2 years, indicating average/common rate of interest danger. Count on, nicely, average/common losses when rates of interest rise, as has been the case YTD. BOND’s losses are in the midst of its friends, fairly actually so.

BOND’s common period and rate of interest danger just isn’t a damaging per se, it is a crucial truth for traders to think about. Different bond funds try to scale back rate of interest danger, to scale back losses in periods of rising rates of interest. BOND largely does not do that, so traders searching for low-duration funds ought to look elsewhere.

As an apart, BOND is a leveraged fund, sporting a 1.52x leverage ratio. Leverage virtually all the time will increase portfolio danger, volatility, and losses throughout downturns, however the state of affairs appears considerably completely different for BOND. From what I’ve seen, a number of the fund’s leverage is canceled out by quick positions, and a few is used for swaps and different derivatives which could not essentially improve potential dangers. BOND’s leverage has not led to elevated losses throughout prior downturns, and it won’t result in elevated losses throughout future downturns both. As such, I don’t assume that BOND’s leverage detracts from the general high quality and security of its holdings: the fund stays a protected alternative, acceptable for extra conservative earnings traders and retirees.

Above-Common Yield

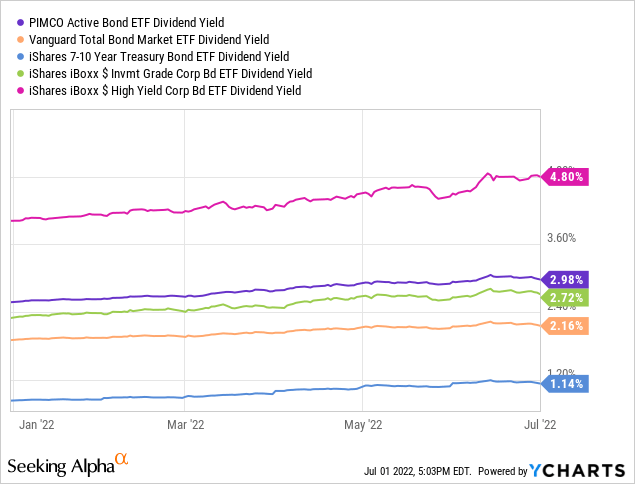

BOND at the moment yields 3.0%. Though the fund’s yield just isn’t notably excessive on an absolute foundation, it is increased than that of its closest friends, broad-based bond indexes, and investment-grade company bond indexes. BOND’s yield is sort of good for a diversified, high-quality bond fund, a profit for the fund and its shareholders. The fund does yield fairly a bit lower than high-yield company bond funds, however these are materially riskier funds too.

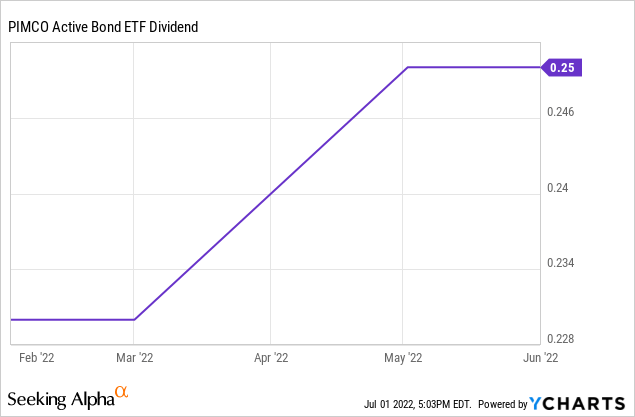

BOND’s dividend will doubtless see some development within the coming months, because the Federal Reserve is climbing charges to fight rising inflation. BOND’s dividend has already elevated twice up to now few months, and is up 8.7% YTD. Additional development is probably going, because the fund sports activities a 30-day SEC yield, a short-term yield metric, of three.8%, and a yield to maturity, a forwards-based measure of anticipated returns, of 5.7%.

BOND’s 3.0% yield is considerably above-average for a diversified, high-quality bond fund, and can doubtless see robust, constant development within the coming months, benefitting the fund and its shareholders.

Above-Common Returns

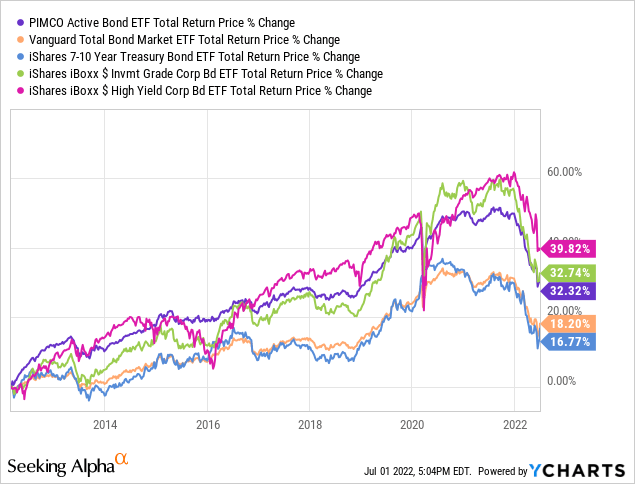

BOND’s above-average dividend yield typically ends in above-average return for shareholders, at the least relative to the fund’s stage of danger. BOND has achieved annual returns of about 2.9% since inception, vastly outpacing treasuries and bonds normally, matching the efficiency of investment-grade company bonds, however underperforming relative to the high-yield company bonds.

BOND’s returns are above-average for a fund of its kind and stage of danger. For example, the fund outperformed relative to investment-grade company bonds throughout 1Q2020, a recession, and YTD, a interval of rising rates of interest.

In easy phrases, BOND offers traders with the returns of an investment-grade company bond fund, the extent of danger of a diversified bond fund, and a better yield than each, a stable mixture. Generally phrases, the fund is superior to most comparable alternate options on most metrics, though not considerably so. It’s a good fund, and higher than the index, however nothing too spectacular.

Conclusion

BOND’s diversified, high-quality holdings, above-average 3.0% yield, and above-average returns, make the fund a purchase.